Quit Claim Deed From Llc To Individual Form

Description

How to fill out Quit Claim Deed From Llc To Individual Form?

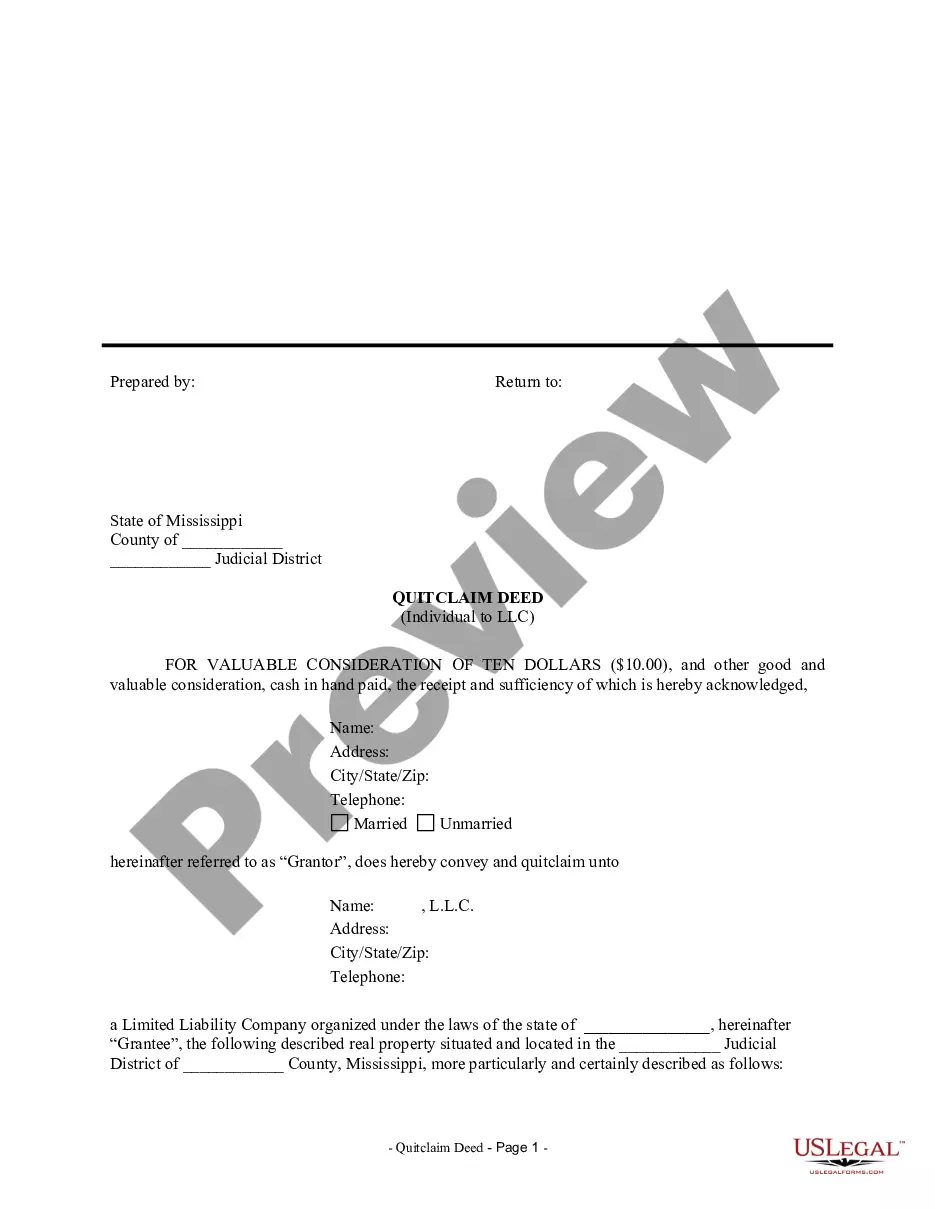

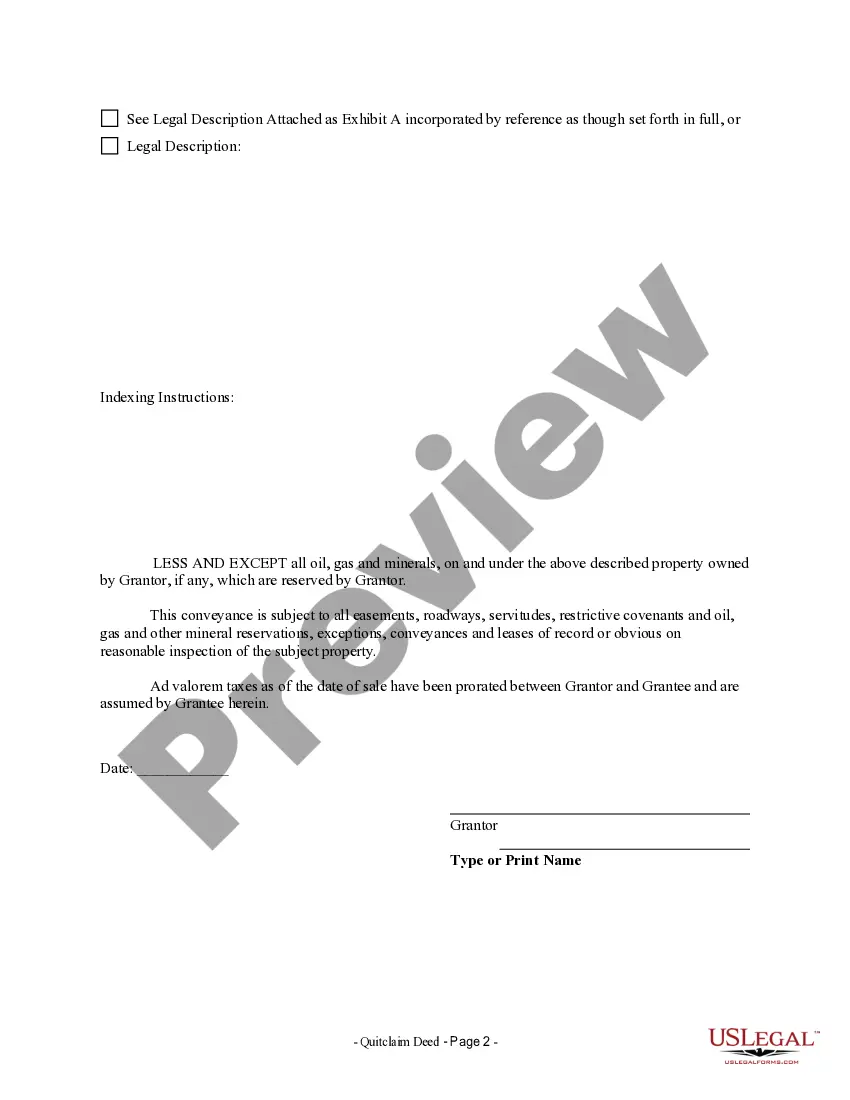

When you need to finalize a Quit Claim Deed from LLC to Individual Form in line with your local state's statutes and regulations, there can be various selections to choose from.

There's no necessity to review every document to ensure it satisfies all the legal requirements if you are a subscriber of US Legal Forms.

It is a reliable source that can assist you in acquiring a reusable and current template on any topic.

Make use of the Preview mode and inspect the form description if present.

- US Legal Forms is the most comprehensive online archive with a compilation of more than 85k ready-to-use documents for business and personal legal situations.

- All templates are verified to adhere to each state's regulations and laws.

- For this reason, when retrieving the Quit Claim Deed from LLC to Individual Form from our platform, you can be assured that you maintain a legitimate and current document.

- Obtaining the necessary sample from our platform is exceptionally simple.

- If you already possess an account, simply Log In to the system, verify that your subscription is active, and save the preferred file.

- Later, you can access the My documents tab in your profile and retrieve the Quit Claim Deed from LLC to Individual Form at any moment.

- If this is your inaugural experience with our website, please follow the instructions below.

- Browse the recommended page and examine it for adherence to your specifications.

Form popularity

FAQ

To avoid LLC tax in California, businesses should understand the specific tax obligations and explore any applicable deductions. Utilizing structures like the quit claim deed from llc to individual form for property transfers can be advantageous in some situations. Engaging with an experienced accountant can also help identify strategic ways to minimize tax liabilities. Strategic planning is crucial to maintain financial health.

An LLC can avoid property tax reassessment in California by ensuring the transfer of property is structured appropriately. Utilizing a quit claim deed from llc to individual form, under certain scenarios, can help maintain the current assessment. It’s crucial to consult with a tax professional to navigate this process effectively and qualify for any available exemptions. Proper planning is key to managing potential tax liabilities.

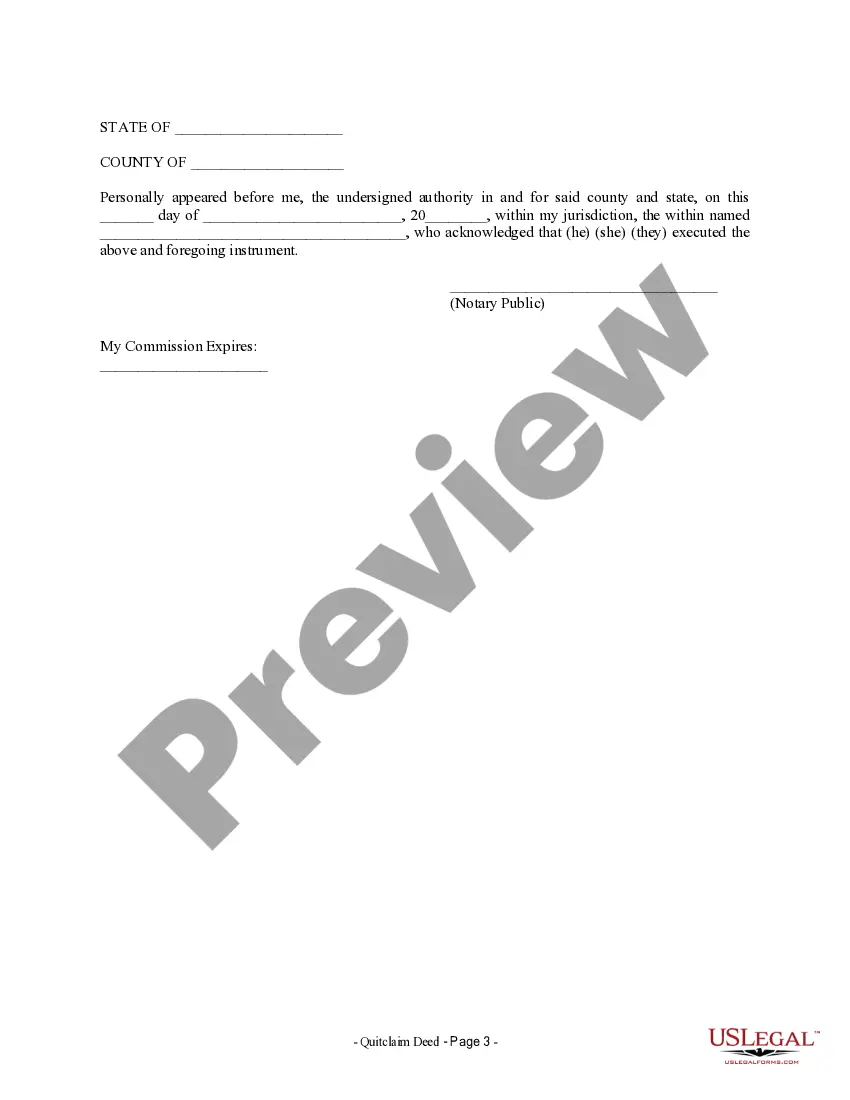

In Ohio, a quit claim deed must include the names of the grantor and grantee, a legal description of the property, and the signature of the grantor. It’s also advisable to have the document notarized to confirm its validity. For those looking to transfer property efficiently, using a quit claim deed from llc to individual form can simplify the process. Always verify local regulations to ensure compliance.

To transfer a property title to an LLC in California, you will need to prepare a quit claim deed from llc to individual form. This deed must be signed and notarized. You should then file it with the county recorder's office to officially update the title. Ensure that you comply with any tax implications or requirements set by the state.

Yes, you can create a quit claim deed from LLC to individual form yourself. However, it is essential to ensure that you follow the correct legal steps and include all necessary details to make it valid. Some people prefer using online platforms like US Legal Forms to easily access templates and guidance, making the process straightforward. Always consider local laws and regulations, as they may vary by state, and ensure that the form is properly signed and notarized.

The best deed to transfer property depends on your specific needs. For maximum protection and assurance, a warranty deed is advisable, as it covers the buyer against future claims. If you prefer a straightforward method of transferring ownership without guarantees, then a quit claim deed from LLC to individual form may suffice, but make sure you understand the trade-offs involved.

Individuals who need a quick transfer of property without the complexities of title examination benefit the most from a quitclaim deed. This can include family members transferring property among themselves or businesses needing to change ownership quickly using a quit claim deed from LLC to individual form. While it is straightforward, both parties should be aware of the lack of guarantees that come with this type of deed.

Quitclaim deeds are often used to transfer property between family members, resolve title issues, or as part of a divorce settlement. When dealing with property transfers, many find a quit claim deed from LLC to individual form a simple and efficient choice. However, it is crucial to understand the potential risks involved, as this type of deed does not provide buyer protections.

In Texas, a quit claim deed generally cannot be reversed once it has been executed and recorded. The nature of a quit claim deed from LLC to individual form implies the transfer of ownership without guarantees, making it challenging to annul. If you need to address disputes following such a transfer, legal assistance may be necessary to explore your options.

A warranty deed provides the greatest protection compared to other types of deeds, including quitclaim deeds. With a warranty deed, the grantor guarantees that they hold clear title to the property and can defend it against claims. In contrast, a quit claim deed from LLC to individual form does not offer these assurances, making it essential to understand the type of protection each deed provides.