Executor Without Will

Description

How to fill out Mississippi Petition To Close Estate And Discharge Executor?

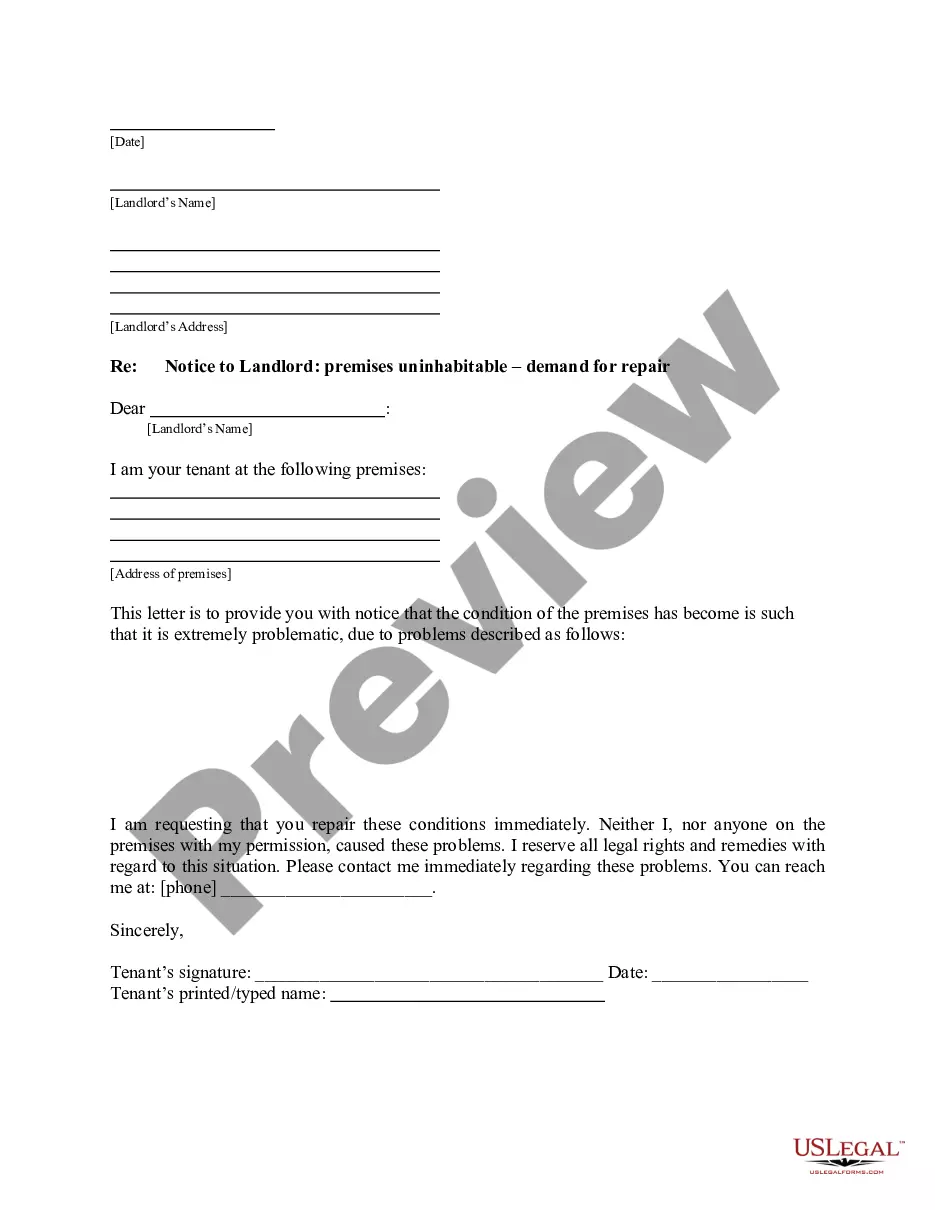

- Log in to your US Legal Forms account if you are a returning user. Ensure your subscription is active to access the necessary templates.

- For new users, start by checking the preview and description of the form that matches your needs and complies with local jurisdiction rules.

- If you find the form does not meet your requirements, utilize the search function to find a more suitable template.

- Select the document and click the 'Buy Now' button to choose your desired subscription plan, which will grant you access to the entire library.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Once your payment is confirmed, download the selected form to your device and access it anytime through the 'My Forms' section of your profile.

In conclusion, US Legal Forms empowers you to efficiently handle legal processes, especially when serving as an executor without a will. With a vast collection of over 85,000 templates and expert assistance available, you can ensure compliance and accuracy in your documentation.

Get started today and simplify your legal needs with US Legal Forms!

Form popularity

FAQ

In Indiana, you must file for probate within three years from the date of the person's death, even if there is no will. If you act as the executor without will, it is crucial to adhere to this timeframe to ensure a smooth transition of assets. Delaying this process can complicate matters and potentially lead to issues with distributing the deceased's property. Utilizing platforms like US Legal Forms can simplify the documentation and filing needed during this important time.

In Indiana, probate is triggered when a person dies leaving behind assets that are solely in their name. This applies particularly if there is no existing will, meaning you will have to navigate the probate process as an executor without will. This process ensures that the deceased's debts are settled and remaining assets are distributed according to Indiana laws. Always consider consulting a legal professional to help guide you through these complexities.

In cases where there is an executor without a will, state laws determine heirs based on familial relationships. Typically, spouses, children, and other close relatives hold primary entitlement to the estate. Understanding these laws can help you navigate the distribution process more smoothly.

An executor without a will does not have discretion over asset distribution. Instead, they must follow the laws of intestacy, which dictate how the estate is divided among heirs. Familiarizing yourself with these laws or consulting platforms like USLegalForms can clarify your responsibilities.

An executor without a will is appointed by the court to manage the estate according to state laws. While an executor can operate without a will, having one can simplify their duties. It's beneficial to utilize resources like USLegalForms to understand the process and fulfill requirements effectively.

As an executor without a will, you should avoid making decisions that could conflict with state probate laws. Do not distribute assets prematurely or act without proper court approval. Always keep accurate records and maintain transparency with beneficiaries to prevent misunderstandings.

The best person to serve as an executor is usually someone reliable, organized, and knowledgeable about estate matters. Ideally, this should be a trusted friend or family member who understands your wishes. It's crucial that they maintain impartiality and can navigate potential disputes. For added insights on selecting an executor without will, explore the resources available at uslegalforms.

To become an executor, you must typically be named in the will or appointed by the court if there is no will. You will need to file the will for probate and submit a petition to the probate court. Having an understanding of the process can be crucial, and platforms like uslegalforms can provide useful information to assist you along the way.

To find out who the executor of an estate is, you can check the probate court records where the deceased lived. This information is usually public and offers insight into the appointed executor. You may also contact family members or close friends for additional information. Effective tools from uslegalforms can guide you through this process if needed.

An executor has considerable power, but their authority is not absolute. They can manage the estate's assets, settle debts, and distribute property according to the will, or state laws if there's no will. However, they must act in the best interest of the beneficiaries, adhering to legal guidelines. It's beneficial to familiarize yourself with the scope of your authority using resources like uslegalforms.