Second Deed Of Trust With Lien

Description

How to fill out Mississippi Second Deed Of Trust, Security Agreement, And Financing Statement?

What is the most trustworthy service to obtain the Second Deed Of Trust With Lien and other updated versions of legal documents? US Legal Forms is the solution!

It's the largest repository of legal templates for any purpose. Each form is correctly drafted and reviewed for adherence to federal and state regulations. They are organized by region and state, making it easy to find the one you need.

US Legal Forms is an excellent choice for anyone needing to handle legal documentation. Premium users can enjoy additional features such as filling out and signing previously saved documents electronically at any time with the built-in PDF editing tool. Explore it today!

- Experienced users of the platform simply need to Log In to their account, verify the validity of their subscription, and click the Download button next to the Second Deed Of Trust With Lien to obtain it.

- Once saved, the document is accessible for future use within the My documents section of your account.

- If you do not have an account with us yet, follow these steps to create one.

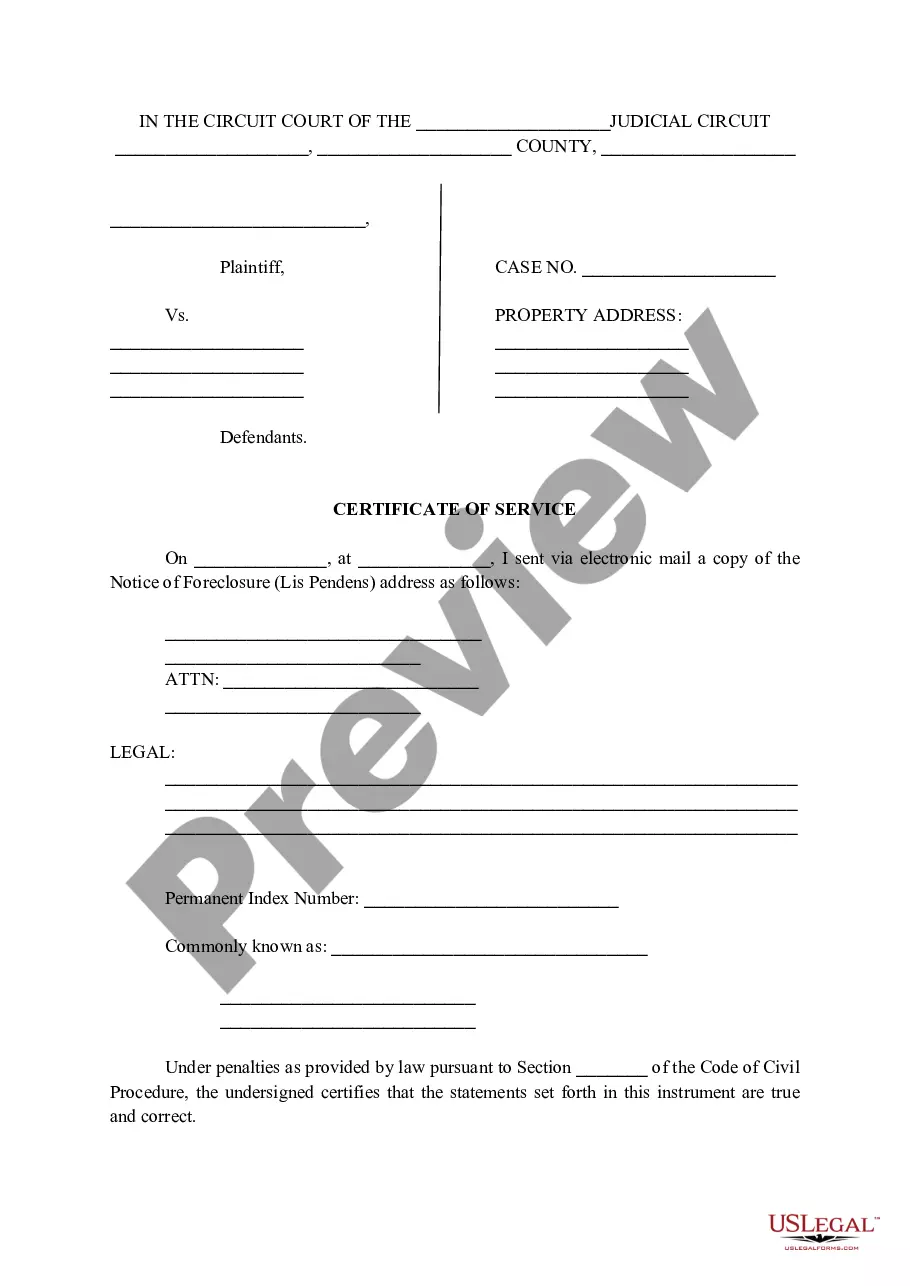

- Form compliance verification. Before you download any document, ensure it meets your requirements and complies with your state's or county's regulations. Review the form description and utilize the Preview if available.

Form popularity

FAQ

Yes, a trust deed can be varied under certain circumstances. When dealing with a second deed of trust with lien, both the lender and the borrower must agree to the changes in writing. This flexibility allows parties to adapt to new situations or terms that may better serve their interests.

Yes, you can have two trust deeds on a property as long as they are properly structured and legally documented. Typically, the first trust deed takes priority over the second deed of trust with lien, creating a hierarchy in repayment. This option allows homeowners to leverage equity and access additional financing for various purposes. Always consult a legal or financial expert to ensure you manage your obligations correctly.

A lien represents a legal right or interest held by a lender in a debtor's property, while a trust is a fiduciary relationship where one party holds property for the benefit of another. In the context of real estate, a second deed of trust with lien establishes the lender's right to the property if the borrower defaults. Understanding this difference is vital for navigating financial obligations and securing appropriate financing.

To release a deed of trust lien, you need to complete a specific form that is widely available online. You can find these forms on legal document sites like US Legal Forms, where they provide resources tailored for your needs. After filling out the form, you'll submit it to the appropriate county recorder's office to officially release the lien. Taking this step is crucial for clearing your property title.