Heirship Affidavit Mississippi Withholding Tax

Description

How to fill out Mississippi Heirship Affidavit - Descent?

Handling legal documentation can be daunting, even for the most proficient individuals.

When you seek a Heirship Affidavit Mississippi Withholding Tax and lack the opportunity to invest time in locating the suitable and current version, the tasks can become overwhelming.

If you hold a subscription, Log Into your US Legal Forms account, find the necessary form, and obtain it.

Visit My documents tab to view the documents you previously downloaded and manage your folders to your liking.

Leverage the US Legal Forms online library, supported by 25 years of expertise and reliability. Transform your daily document management into a seamless and user-friendly process today.

- Confirm it is the correct document by previewing it and reviewing its description.

- Ensure that the template is authorized in your state or county.

- Click Buy Now when you are prepared.

- Select a subscription option.

- Choose the file format you desire, and Download, complete, eSign, print, and submit your documents.

- Utilize advanced tools to complete and manage your Heirship Affidavit Mississippi Withholding Tax.

- Access a valuable knowledge base of articles, guides, and resources pertinent to your situation and requirements.

- Save time and effort searching for the documents you need, and use US Legal Forms’ sophisticated search and Review feature to obtain Heirship Affidavit Mississippi Withholding Tax.

Form popularity

FAQ

Heirship laws in Mississippi dictate how a deceased person's estate is distributed among heirs when there is no will. Generally, these laws follow a hierarchy, giving priority to spouses, children, and further relatives. Understanding these laws is crucial for establishing rightful claims, especially when preparing an heirship affidavit Mississippi withholding tax. It's advisable to consult legal resources or professionals to navigate these laws effectively.

To obtain an affidavit of heirship in Mississippi, you typically need to gather relevant information about the deceased and their family. You may draft the affidavit yourself or use legal forms available from platforms like US Legal Forms. Make sure to have the affidavit signed by witnesses who can confirm the relationships. This process is essential for addressing the heirship affidavit Mississippi withholding tax accurately.

An affidavit of heirship serves as a legal document that identifies the rightful heirs of a deceased person's estate. This document can help avoid the lengthy probate process, as it provides clear evidence of who inherits the assets. By including an heirship affidavit Mississippi withholding tax, you ensure that the tax implications are correctly managed. This affidavit is often used to transfer property titles and manage estate assets.

To petition for a determination of heirship in Mississippi, you must file a petition in the appropriate probate court. This petition typically includes information about the deceased, the potential heirs, and the relationship between them. Once filed, the court will schedule a hearing where interested parties can present their case. Utilizing an heirship affidavit Mississippi withholding tax can simplify this process, by clearly establishing the heirs.

To fill out the Mississippi employee's withholding exemption certificate, start by entering your personal information, including your name, address, and Social Security number. Then, indicate your filing status and the number of exemptions you are claiming. Make sure to review the instructions carefully to ensure compliance with Mississippi withholding tax regulations. If you need assistance, US Legal Forms offers templates and guidance to help you accurately complete this form.

In Mississippi, the threshold for inheriting property without incurring taxes can vary based on the relationship to the deceased. Generally, there is no inheritance tax in Mississippi, allowing heirs to inherit without owing taxes. However, federal estate tax may apply if the estate exceeds a certain value, so it is crucial to understand the distinctions. For clarity on potential tax implications, including Mississippi withholding tax, consult with a tax professional or use resources from US Legal Forms.

To create an affidavit of heirship in Mississippi, you need to meet several requirements. First, you must identify all potential heirs of the deceased, including their relationship to the decedent. You must also gather supporting documentation, such as birth certificates and marriage licenses, to verify these relationships. Utilizing US Legal Forms can streamline your application and ensure you meet all necessary requirements to avoid any issues related to Mississippi withholding tax.

An heirship affidavit in Mississippi is a legal document that establishes the rightful heirs to a deceased person's estate. This document is particularly useful when there is no will present, as it allows heirs to claim their inheritance without going through probate. By filing an heirship affidavit, individuals can simplify the process of transferring property and assets, without the burden of Mississippi withholding tax complications. Using US Legal Forms can help you create a compliant affidavit tailored to your needs.

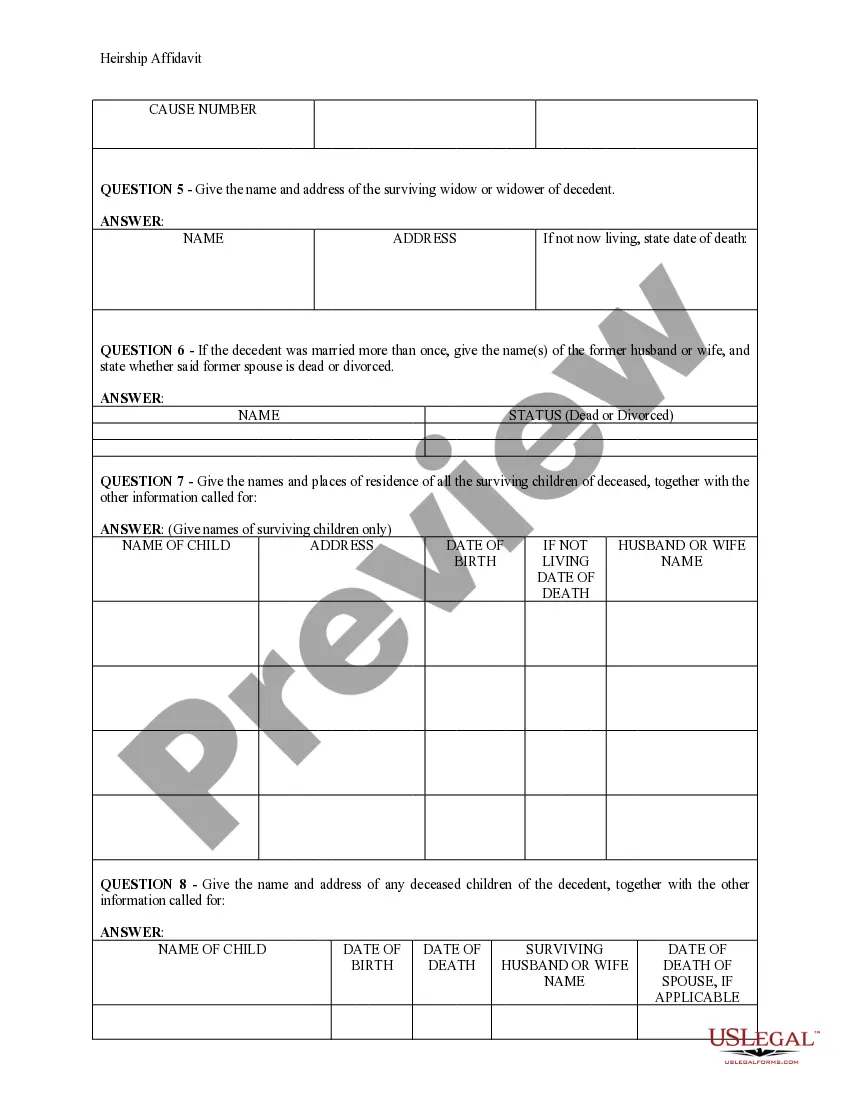

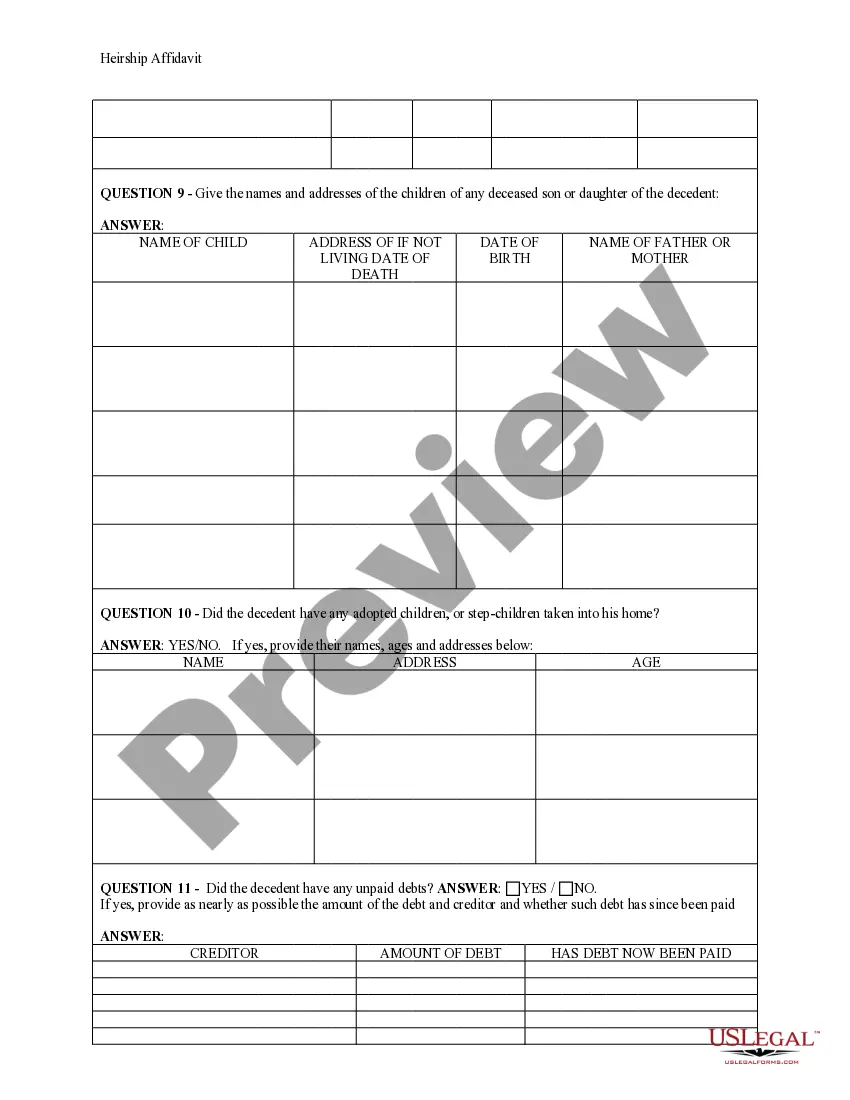

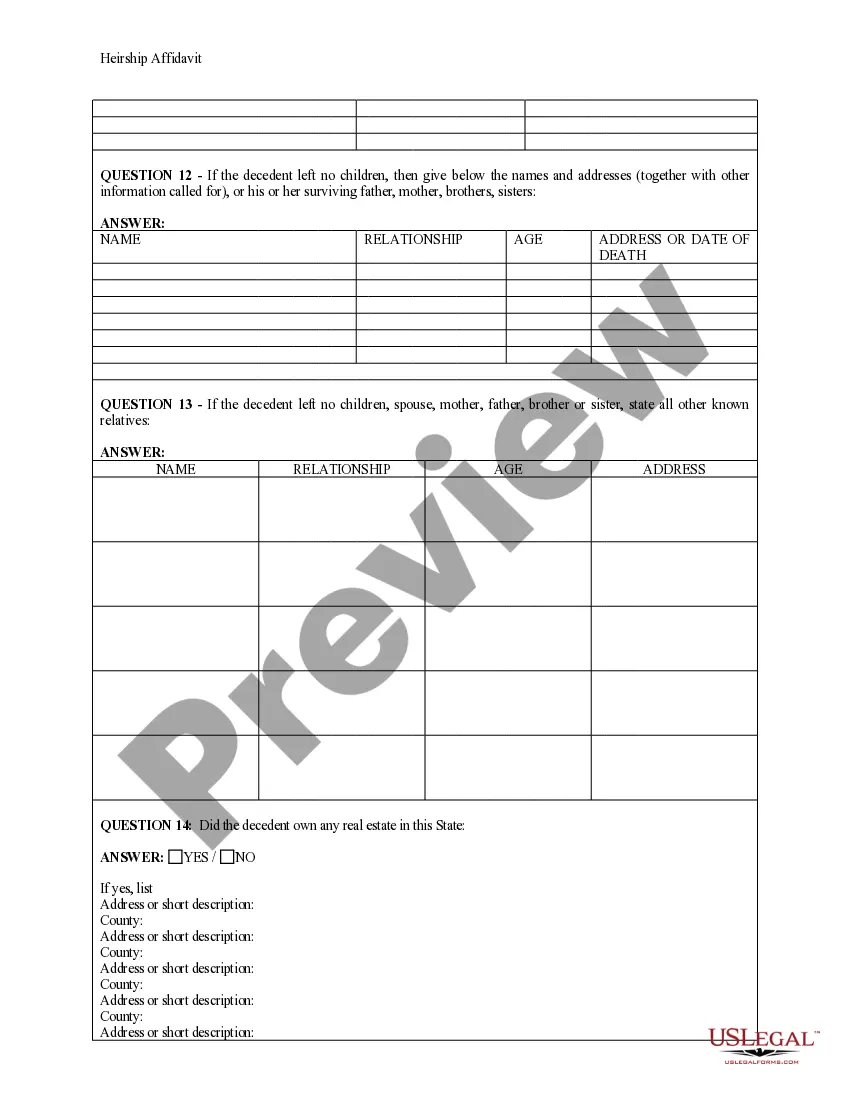

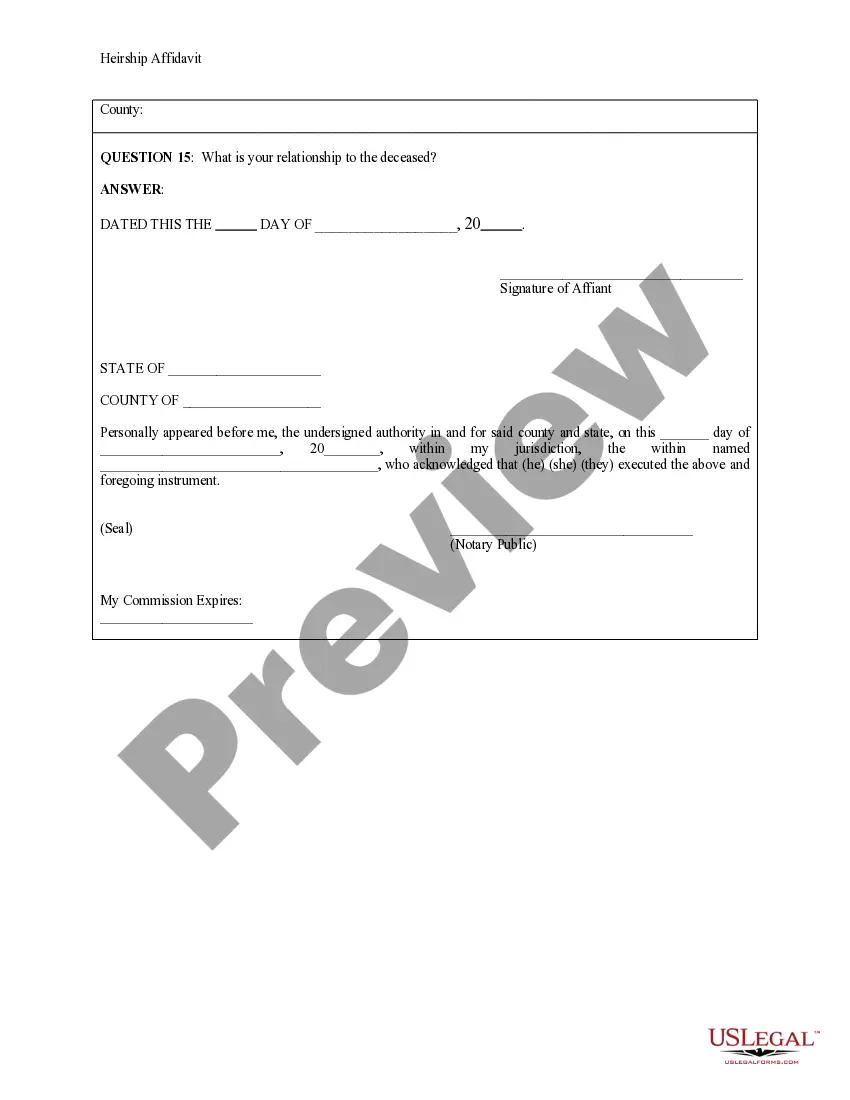

Filling out an affidavit of heirship requires you to provide essential details about the deceased and the heirs. Include the deceased's name, date of birth, date of death, and the relationships of all heirs involved. It is crucial to have this document notarized to make it legally valid. If you need assistance, US Legal Forms can offer you the necessary templates and guidance, especially when addressing issues related to heirship affidavit Mississippi withholding tax.

To fill out an affidavit of death and heirship, start by collecting pertinent details about the deceased, such as their name, date of death, and the names of surviving heirs. Clearly state the relationship of each heir to the deceased. After completing the document, sign it in front of a notary public to ensure its legal standing. For a smooth experience, consider using US Legal Forms, which provides templates for affidavits, including those related to heirship affidavit Mississippi withholding tax.