Subcontractor Without Utr

Description

How to fill out Subcontractor Without Utr?

There's no longer a requirement to invest countless hours searching for legal documents required by your local state regulations.

US Legal Forms has gathered all of them in a single location and made them easily accessible.

Our platform offers over 85,000 templates for any business and personal legal situations categorized by state and field of use. All forms are properly drafted and verified for accuracy, ensuring you receive an up-to-date Subcontractor Without Utr.

Creating official documents in accordance with federal and state regulations is fast and straightforward with our platform. Try US Legal Forms today to keep your paperwork organized!

- If you are acquainted with our service and already possess an account, ensure your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all previously acquired documents whenever you need to by accessing the My documents tab in your profile.

- If you are new to our service, the procedure will require a few additional steps to finalize.

- Here’s how new users can access the Subcontractor Without Utr in our catalog.

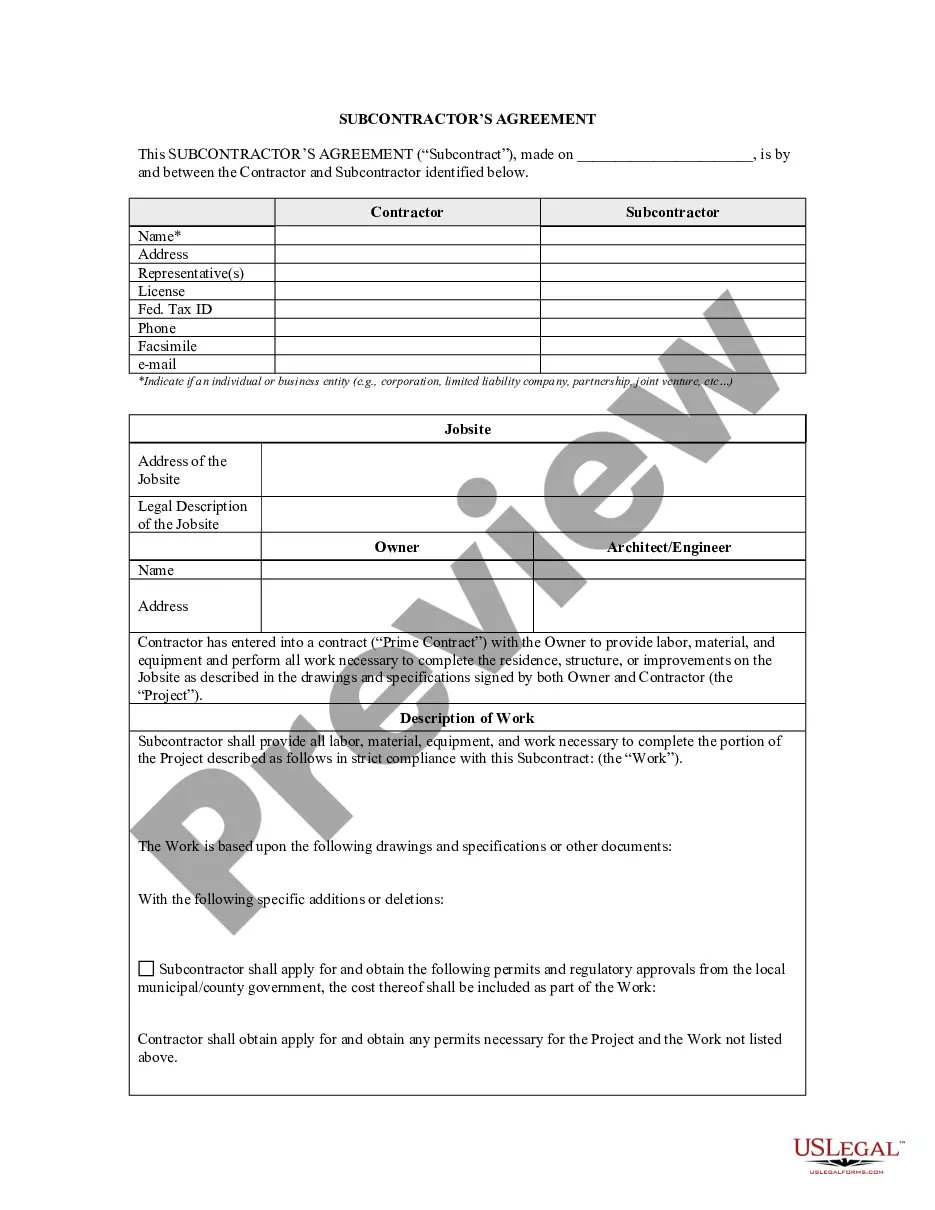

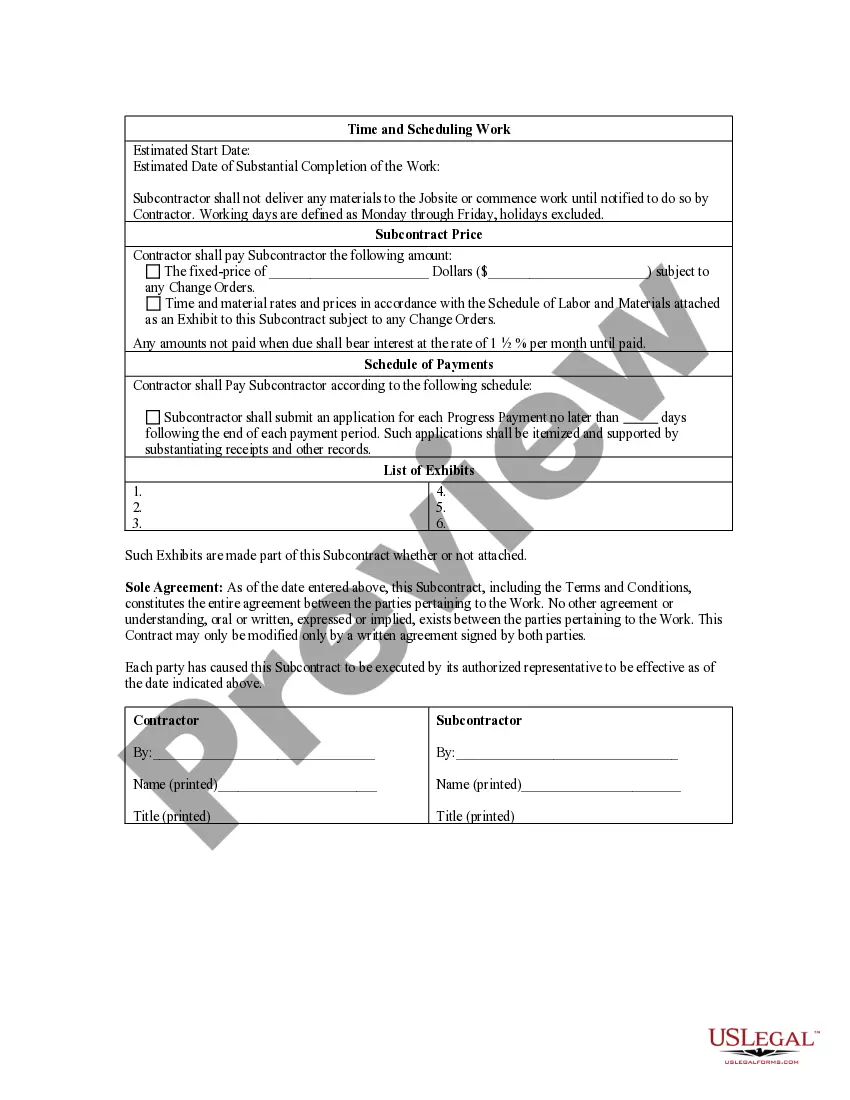

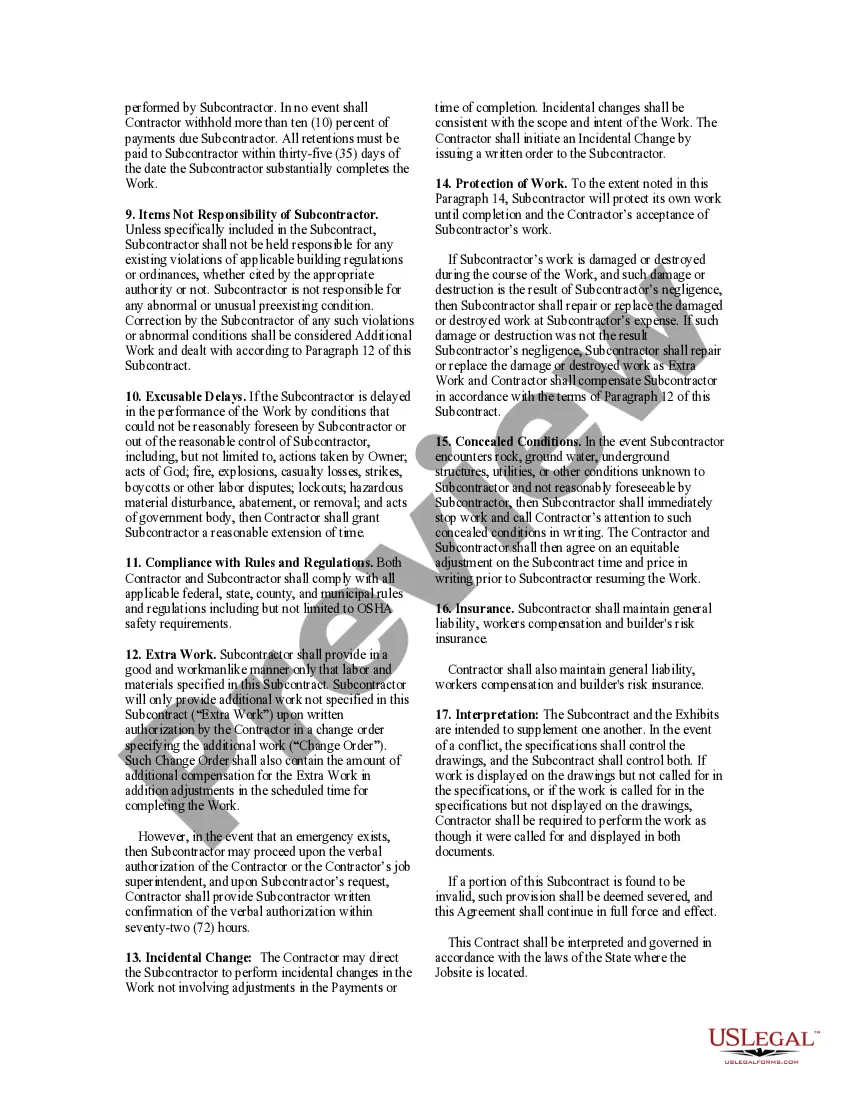

- Carefully review the page content to confirm it includes the sample you require.

- To assist with this, utilize the form description and preview options if available.

- Use the Search field above to look for an alternative sample if the previous one wasn't suitable.

- Click Buy Now next to the template name when you identify the suitable one.

- Choose your preferred subscription plan and sign up for an account or Log In.

- Complete payment for your subscription using a card or PayPal to proceed.

- Select the file format for your Subcontractor Without Utr and download it to your device.

- Print the form to fill it out manually or upload the document if you prefer working with an online editor.

Form popularity

FAQ

Information required to verify a subcontractoruse HMRC's CIS online service.call HMRC's CIS Helpline - 0300 200 3210.use a third-party software package.

The only people who need UTR numbers are those who file Self-Assessment tax returns - that means that they've either set up a limited company or they're self-employed.

Create your personal tax account and sign up for Self Assessment. You'll need your Unique Taxpayer Reference ( UTR ) to do this. You'll get an activation code for your new account in the post within 7 working days (21 if you're abroad). When you get the code, sign in to activate your Self Assessment.

If you cannot find your UTRHMRC will send it to the business address that's registered with Companies House.

Well technically, there is no longer any such thing as a CIS number it was abolished as part of the CIS r of 2007. But in practice your UTR is the first ten digits of your old CIS card number.