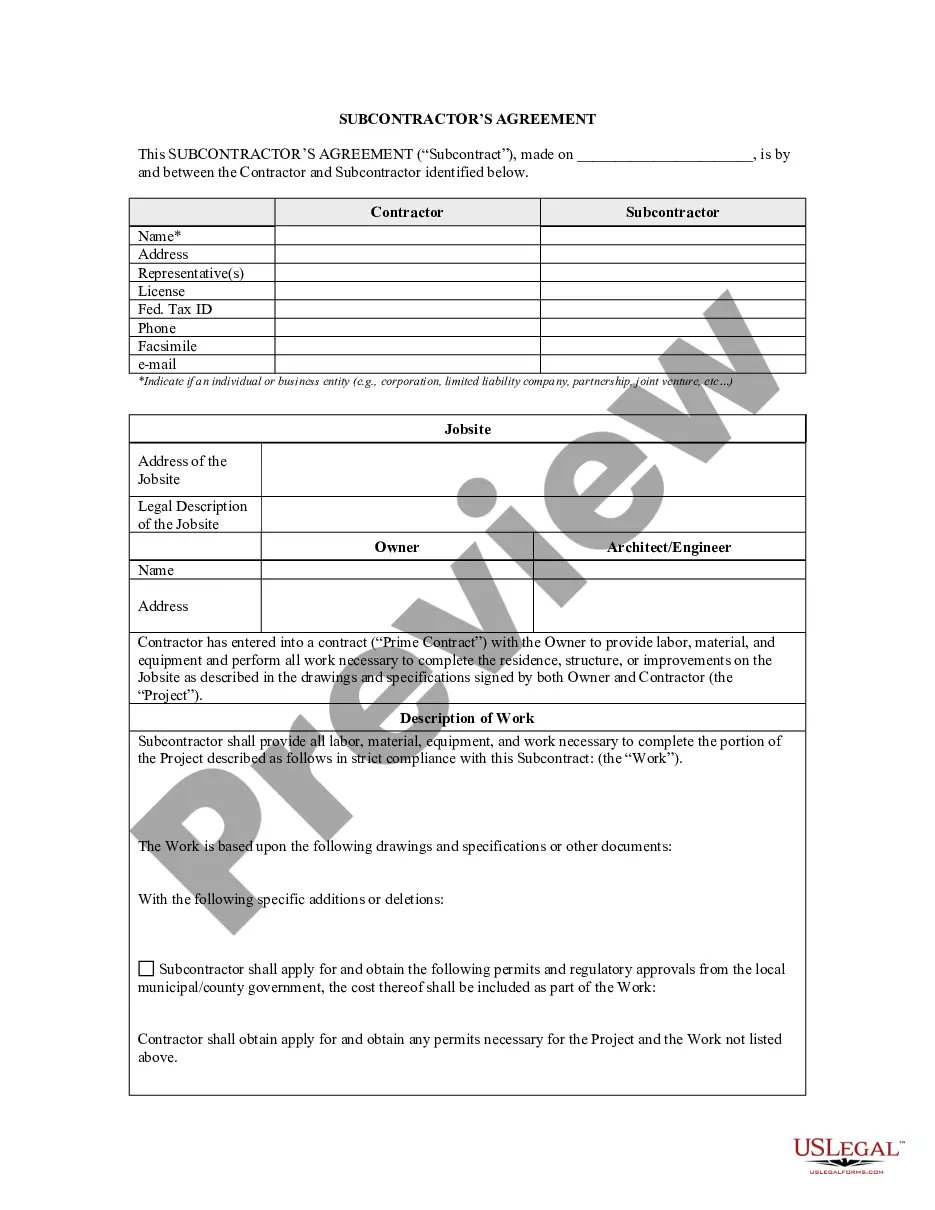

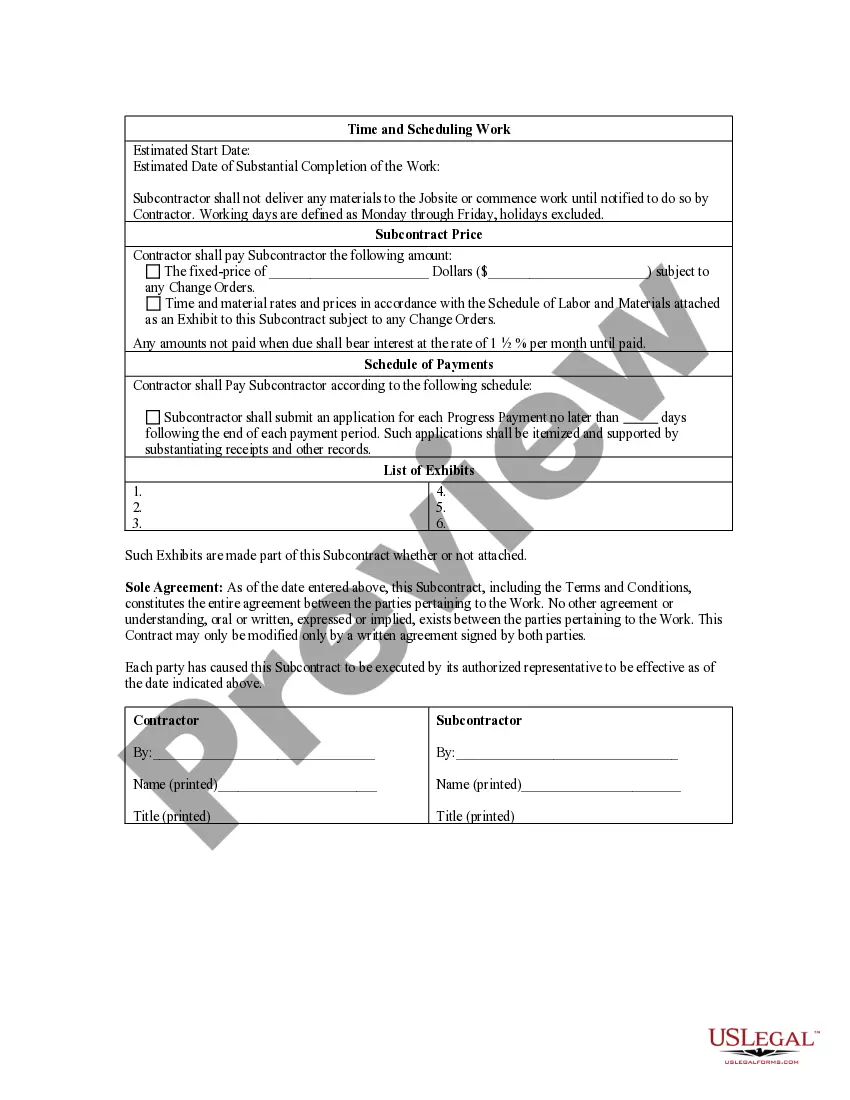

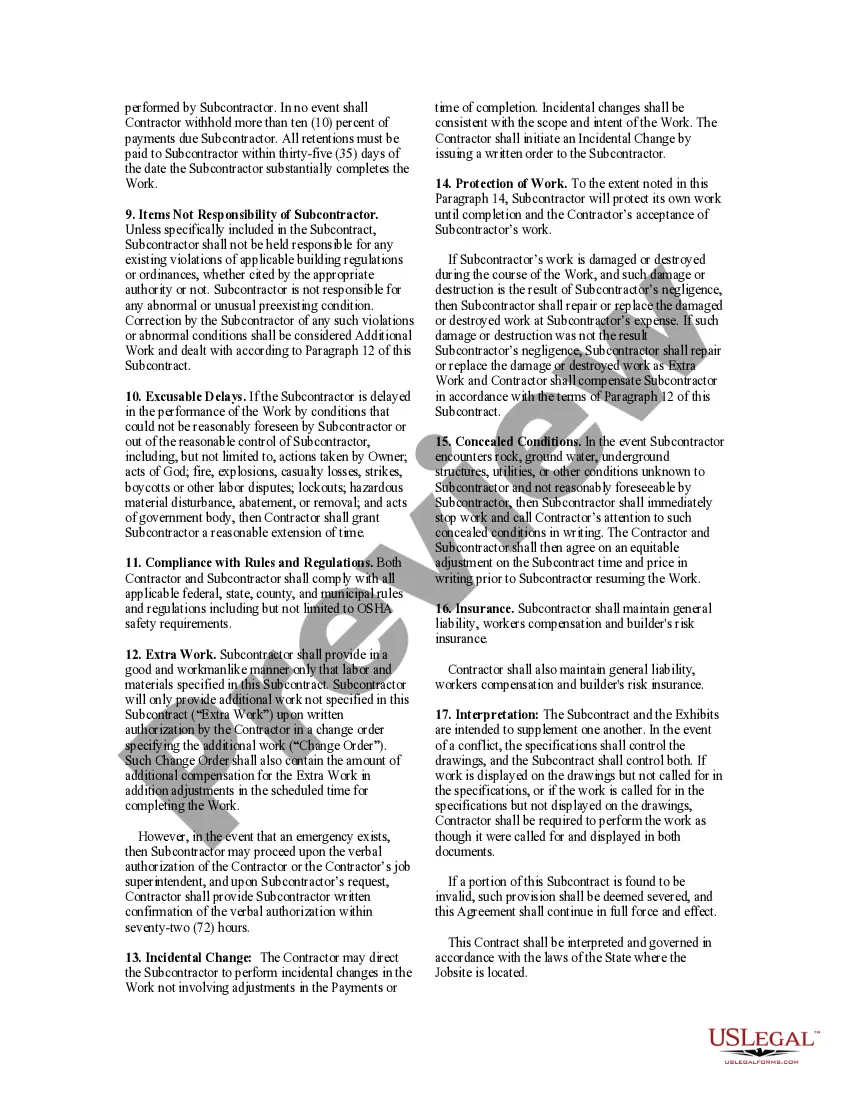

Subcontractor Form

Description

How to fill out Subcontractor Form?

Individuals often link legal documents with complexity that solely a professional can handle.

In a certain respect, this is accurate, as creating a Subcontractor Form requires considerable knowledge of subject matter, including state and local laws.

However, with US Legal Forms, everything has become simpler: pre-prepared legal templates for various personal and business circumstances specific to state regulations are gathered in one online archive and are now accessible to all.

All templates in our collection are reusable: once obtained, they remain saved in your account. You can access them whenever necessary through the My documents tab. Discover all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- Review the page content thoroughly to confirm it meets your requirements.

- Examine the form description or view it through the Preview feature.

- Find another example using the Search bar in the header if the previous one doesn't meet your needs.

- Click Buy Now when you discover the correct Subcontractor Form.

- Choose a subscription plan that aligns with your needs and financial situation.

- Create an account or Log In to proceed to the payment section.

- Complete the payment for your subscription via PayPal or with a credit card.

- Select the format for your document and click Download.

- Print your form or import it to an online editor for expedited completion.

Form popularity

FAQ

If you paid someone who is not your employee, such as a subcontractor, attorney or accountant $600 or more for services provided during the year, a Form 1099-NEC needs to be completed, and a copy of 1099-NEC must be provided to the independent contractor by January 31 of the year following payment.

How to file a 1099 formGather the required information.Submit Copy A to the IRS.Submit copy B to the independent contractor.Submit form 1096.Check if you need to submit 1099 forms with your state.

The 1099-NEC requires the business/payor's name, address, phone number, and employer identification number. It also requires the payee's name, address and tax identification number. For nonemployee compensation, the total amount paid for the year goes in box 1 of the 1099-NEC.

Complete Form 1099-MISC with the name, address and tax identification number copied from the IRS Form W-9 for accuracy. Don't complete Form 1099-MISC for any workers hired by the contractor or subcontractor, as these individuals do not receive direct payment from you.

You should have the following on hand to fill out the 1099-MISC form:Payer's (that's you!) name, address, and phone number.Your TIN (Taxpayer Identification Number)Recipient's TIN.Recipient's name and address.Your account number, if applicable.Amount you paid the recipient in the tax year.