Missouri Promissory Note Without Interest Tax Implications

Description

How to fill out Missouri Unsecured Installment Payment Promissory Note For Fixed Rate?

Steering through the red tape of official papers and forms can be demanding, particularly when one is not engaged in such tasks professionally.

Even locating the appropriate template for the Missouri Promissory Note Without Interest Tax Implications will be labor-intensive, as it must be accurate down to the last detail.

Nonetheless, you will spend significantly less time selecting a fitting template if it originates from a dependable source.

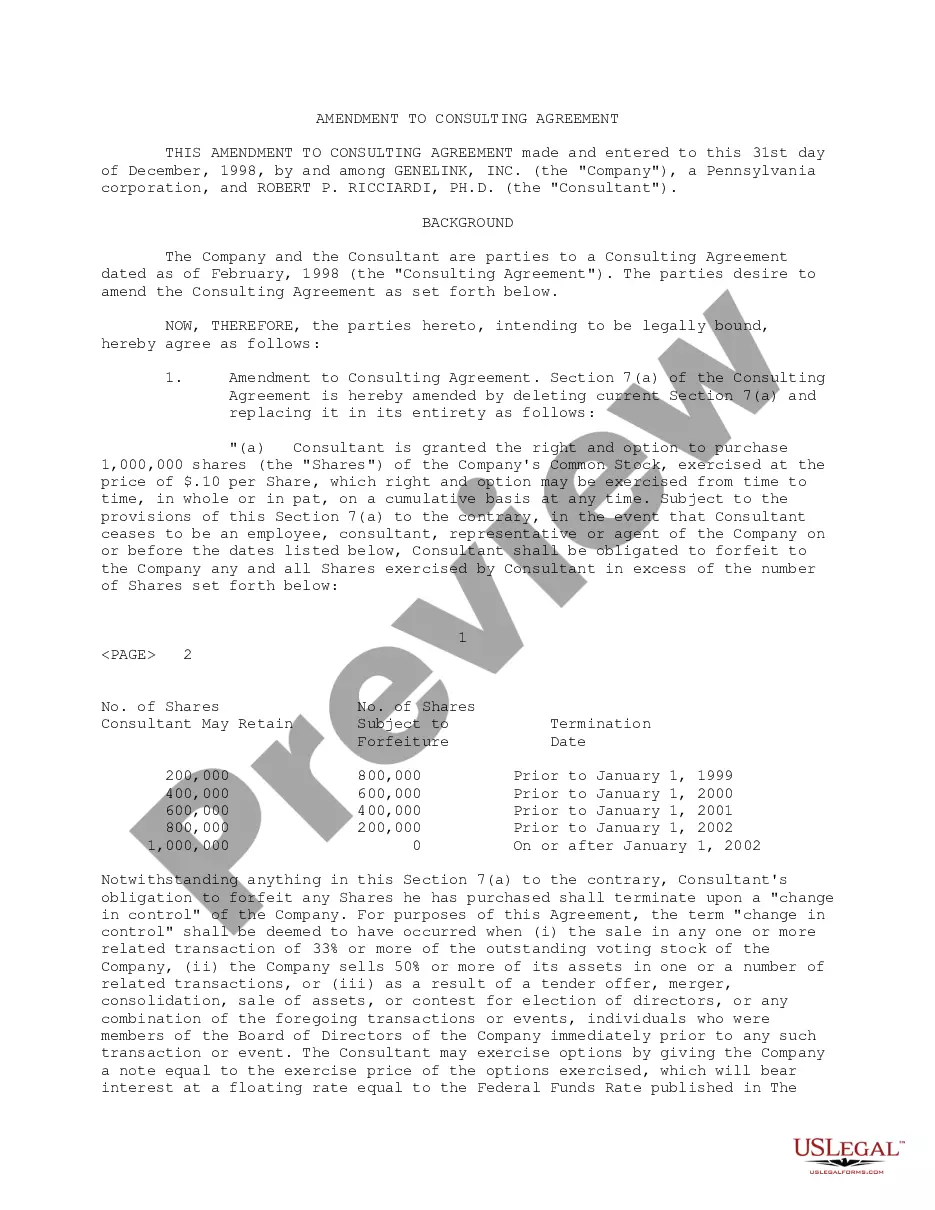

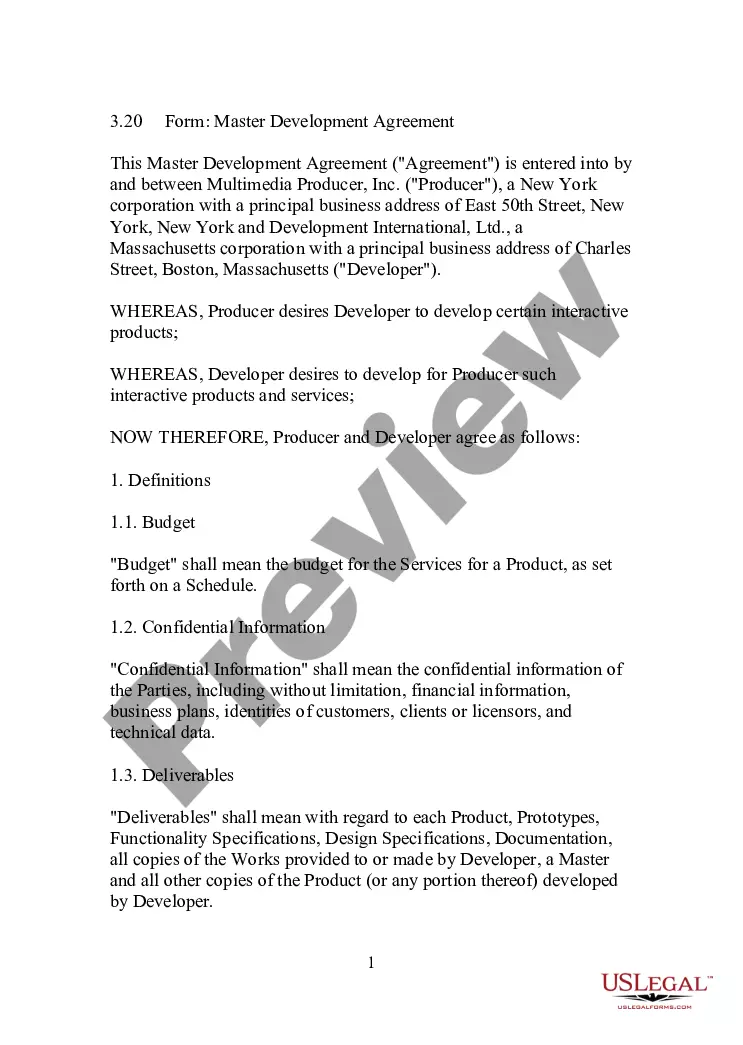

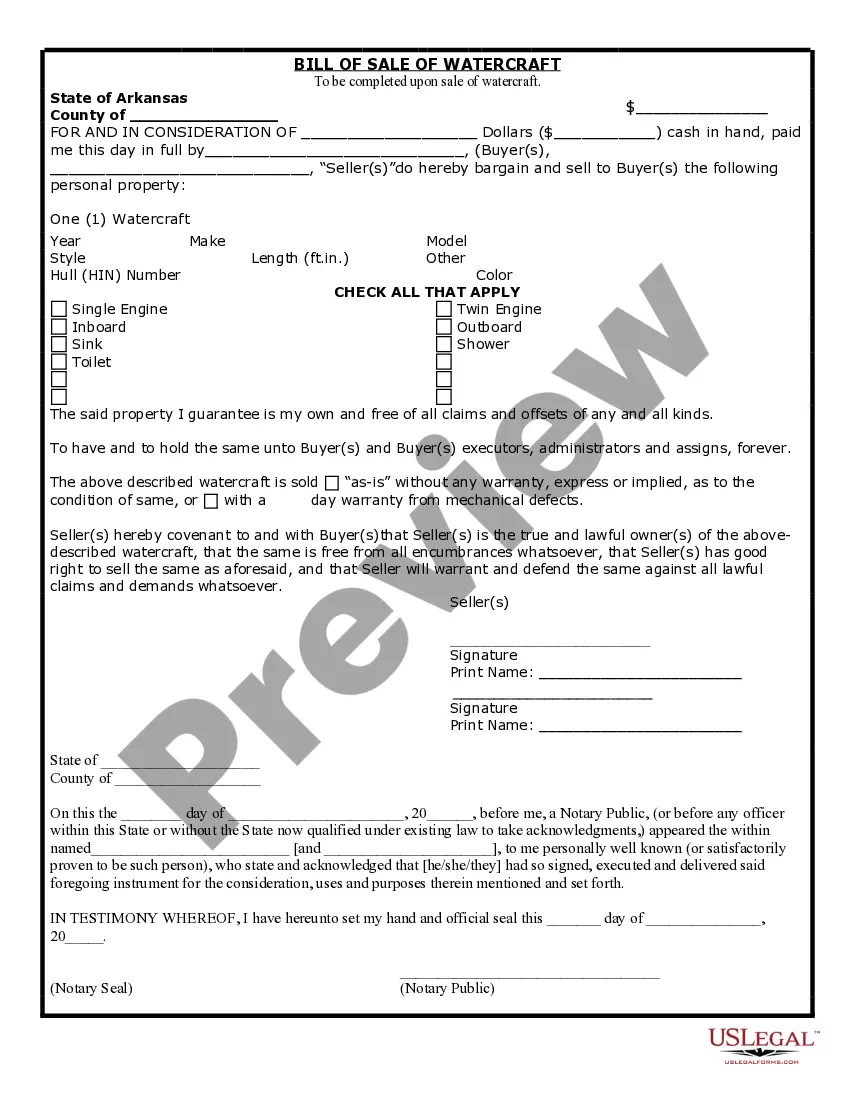

Obtain the appropriate form in a few straightforward steps: Enter the document name in the search box. Select the right Missouri Promissory Note Without Interest Tax Implications from the results. Review the description of the sample or view its preview. When the template meets your requirements, click Buy Now. Choose your subscription plan. Use your email and set a security password to create an account at US Legal Forms. Select a credit card or PayPal for payment. Download the template file to your device in your preferred format. US Legal Forms will save you considerable time verifying if the form you found online suits your needs. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the search for appropriate forms online.

- US Legal Forms serves as a single hub to locate the latest document samples, understand their usage, and download them for completion.

- It boasts a collection of over 85,000 forms applicable in various fields.

- When searching for a Missouri Promissory Note Without Interest Tax Implications, you need not doubt its relevance as all forms are validated.

- Having an account at US Legal Forms guarantees you access to all necessary samples.

- You can save them in your history or add them to the My documents catalog.

- Access your stored forms from any device by simply clicking Log In at the library site.

- If you do not yet have an account, you can always search again for the required template.

Form popularity

FAQ

A simple promissory note will state the full amount is due on the stated date; you won't need a payment schedule. You can decide whether to charge interest on the loan amount and include the interest in the document if needed.

Nothing in the tax law prevents you from making loans to family members (or unrelated people for that matter). However, unless you charge what the IRS considers an adequate interest rate, the so-called below-market loan rules come into play.

Generally, any income you generate from a promissory note is taxable income and must be reported. The income generated is simply the interest you earned on the note for the tax year in question. If you lent the money personally rather than through your business, report the income on your personal income tax return.

If you are receiving the promissory interest, enter it as if you received form 1099-INT. In the Received from box, you may enter Promissory Note Interest Income and the name and any tax ID, if you have it. Only the amount is required however.

If you are paying the promissory interest and this is a personal loan, you can't deduct the interest. According to the IRS, only a few categories of interest payments are tax-deductible: Interest on home loans (including mortgages and home equity loans) Interest on outstanding student loans.