Missouri Disclosure Statement For Divorce

Description

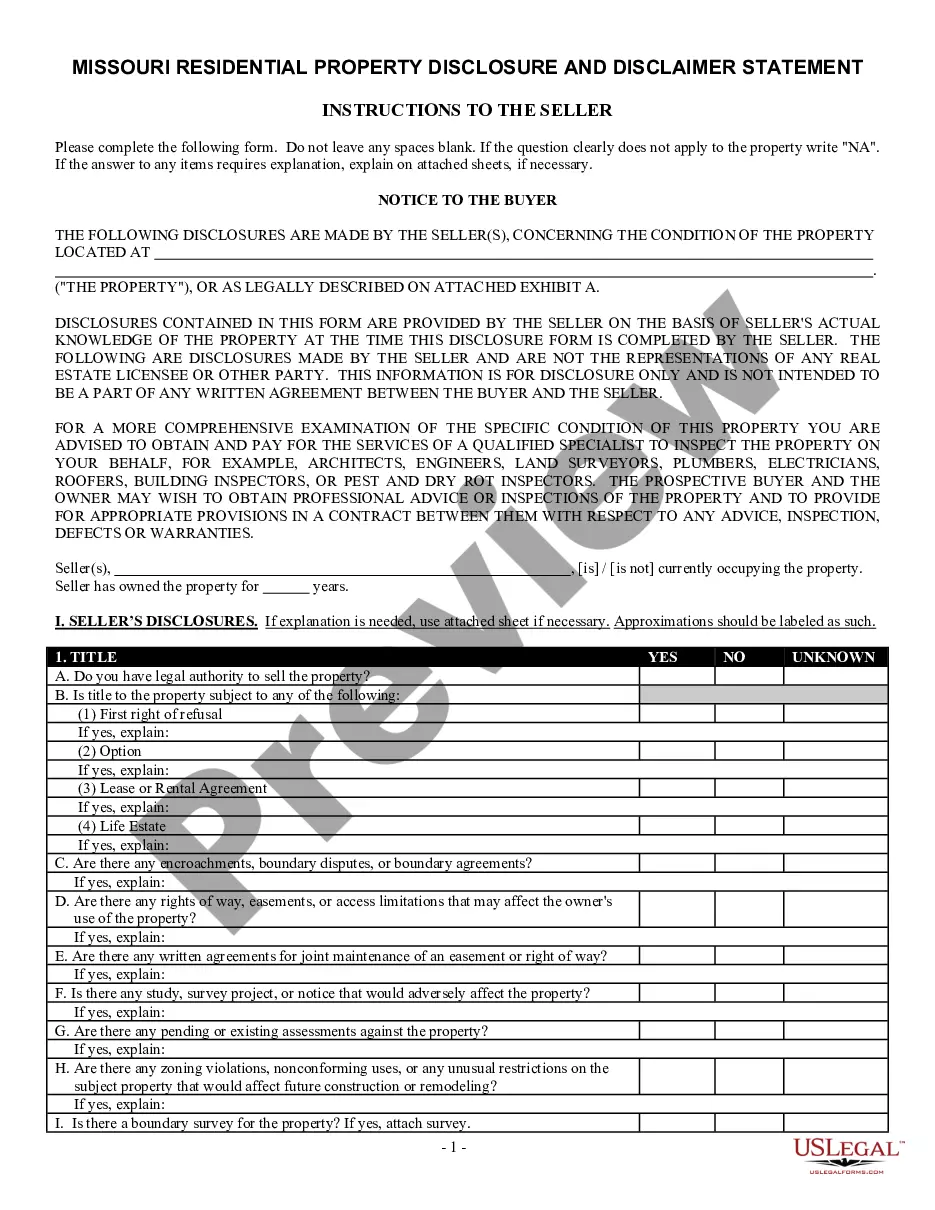

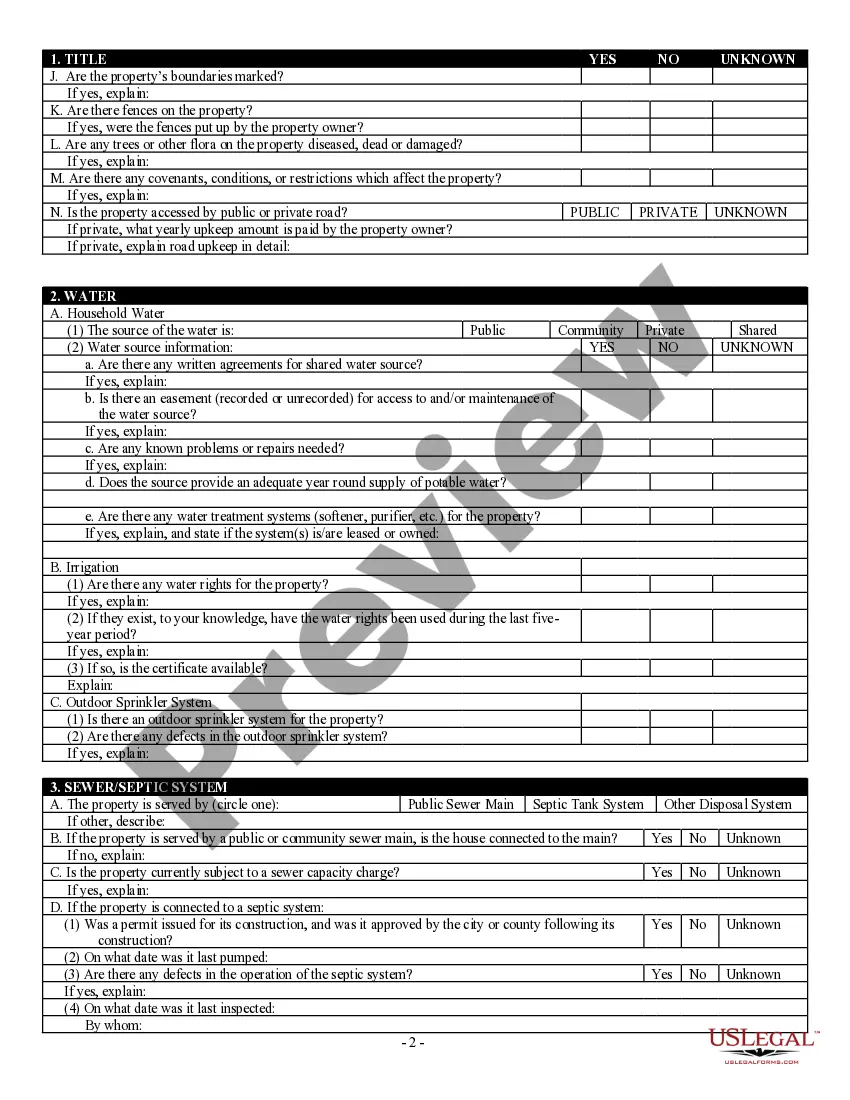

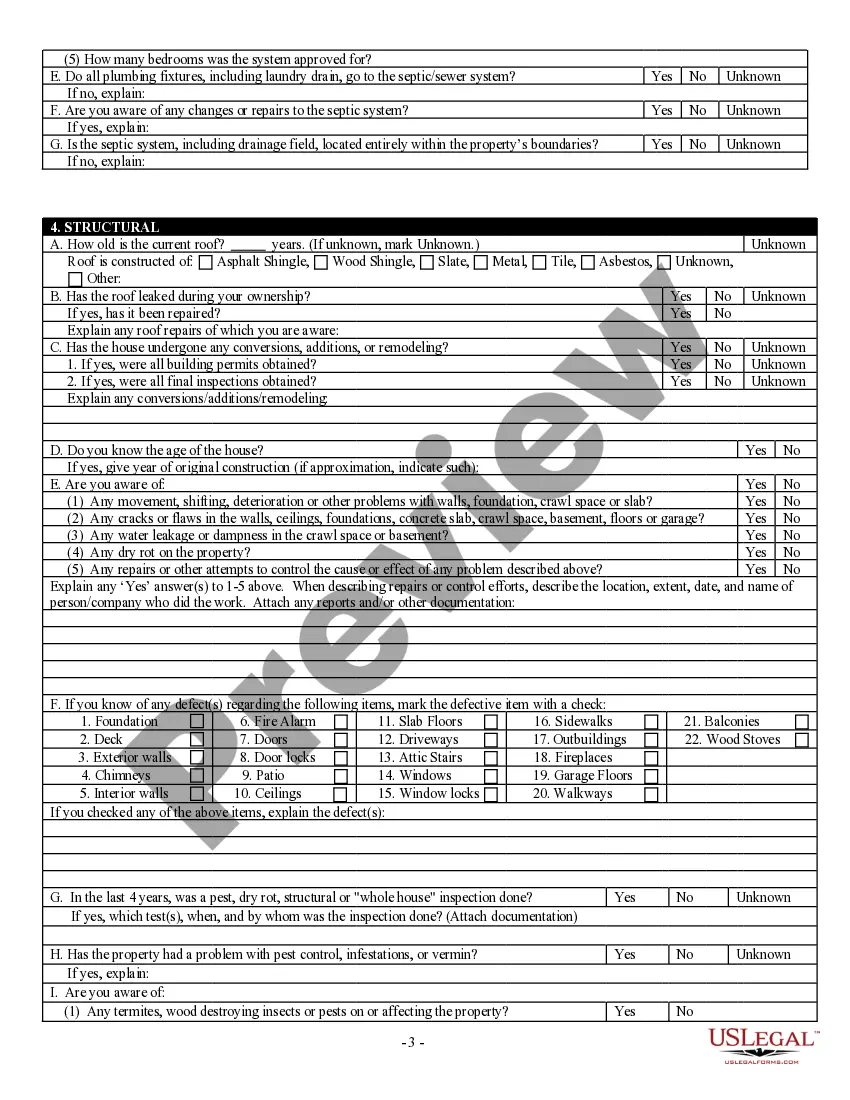

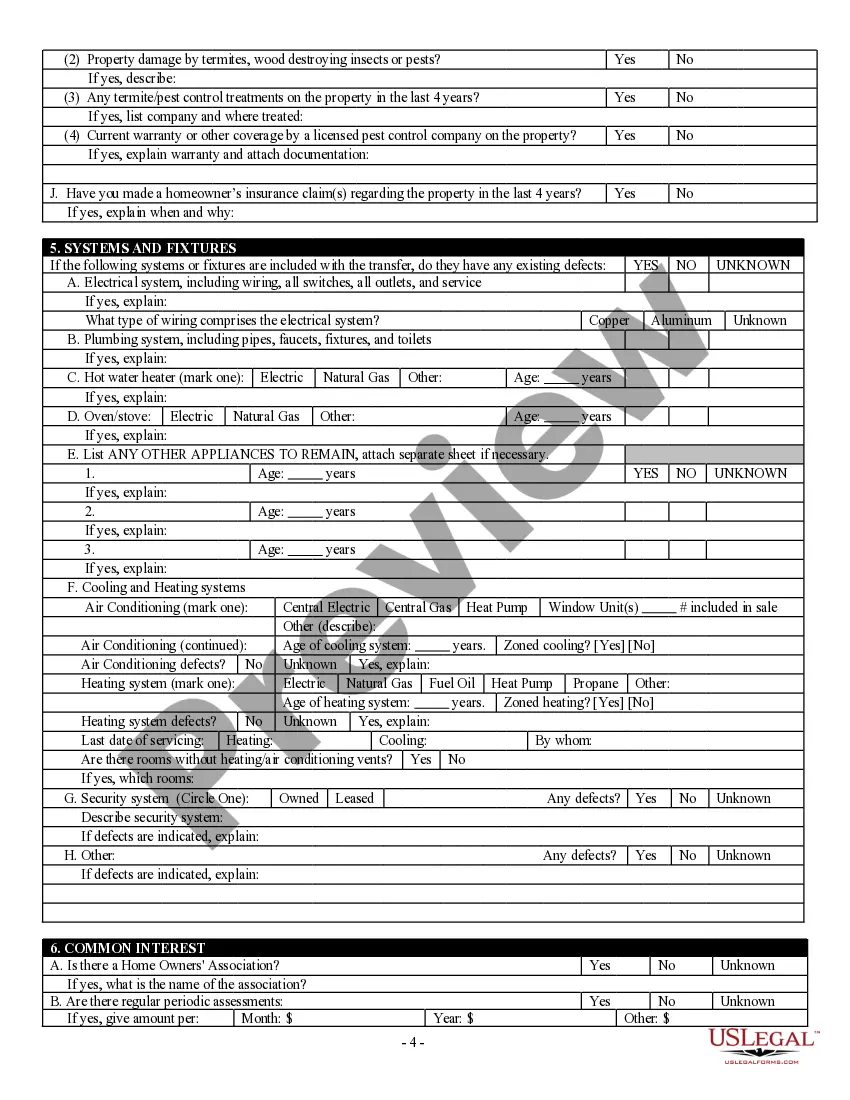

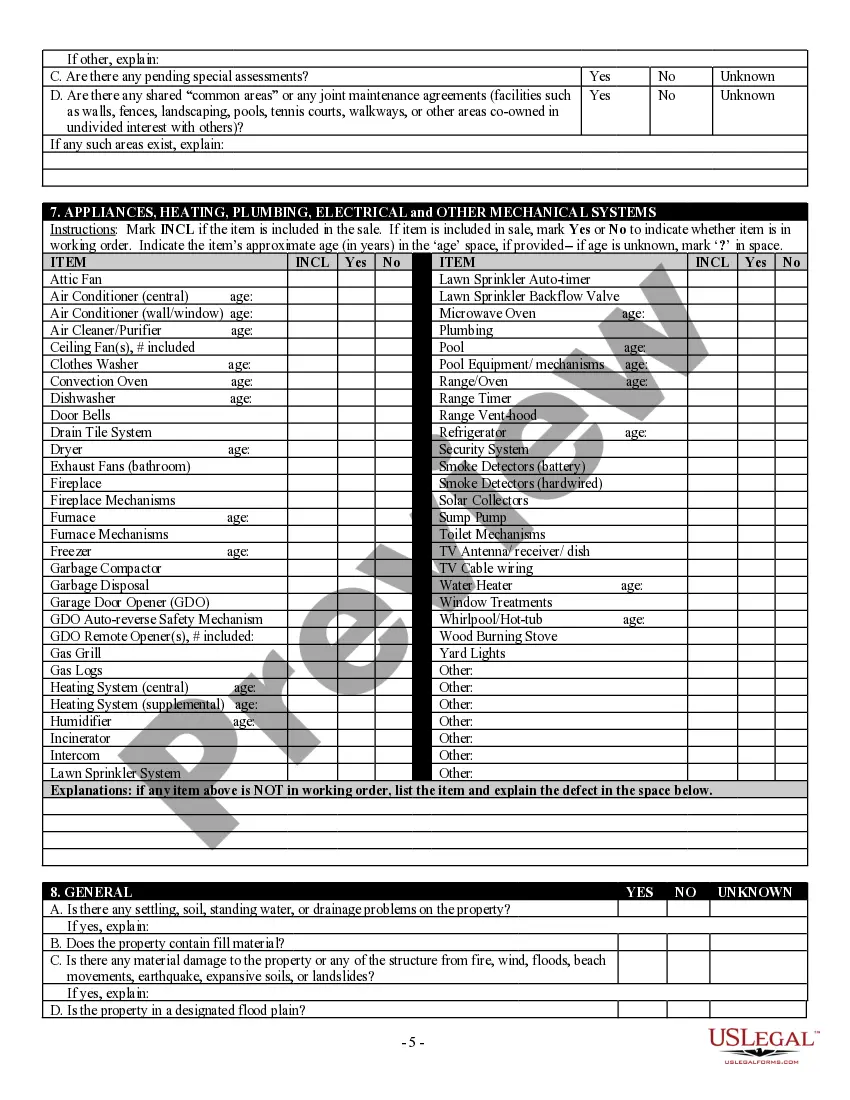

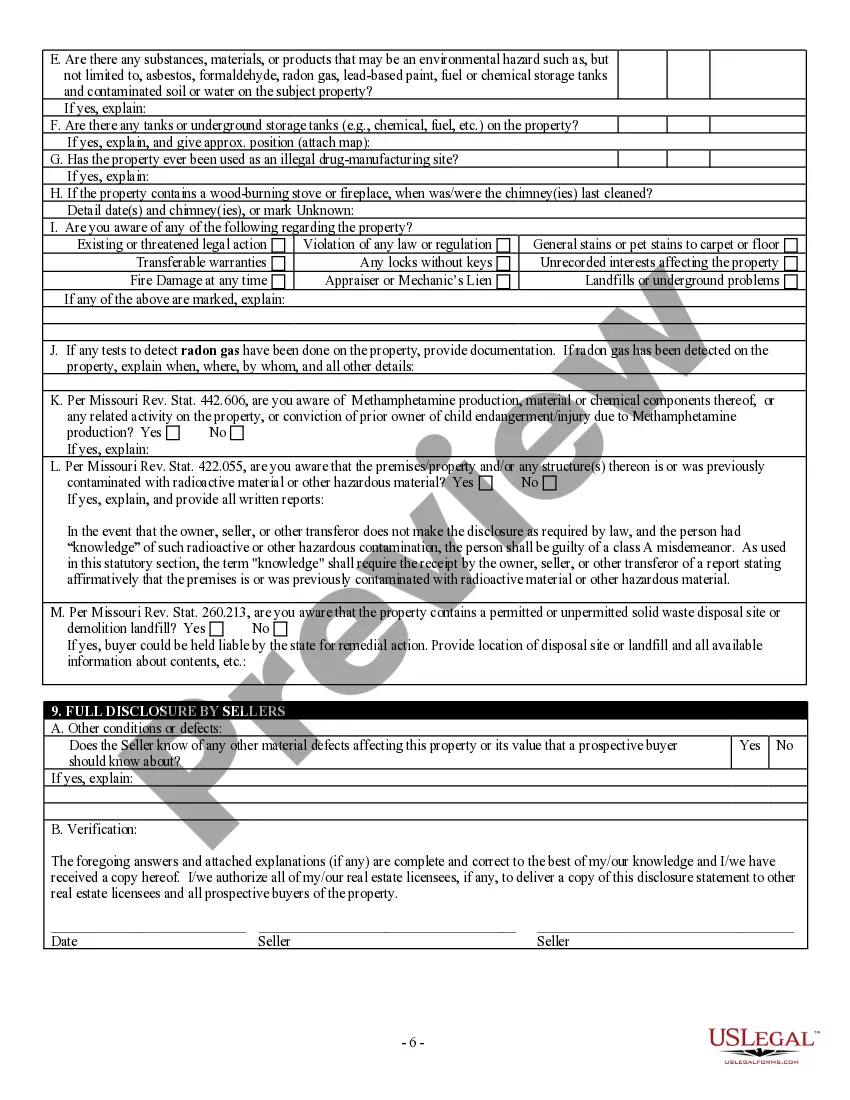

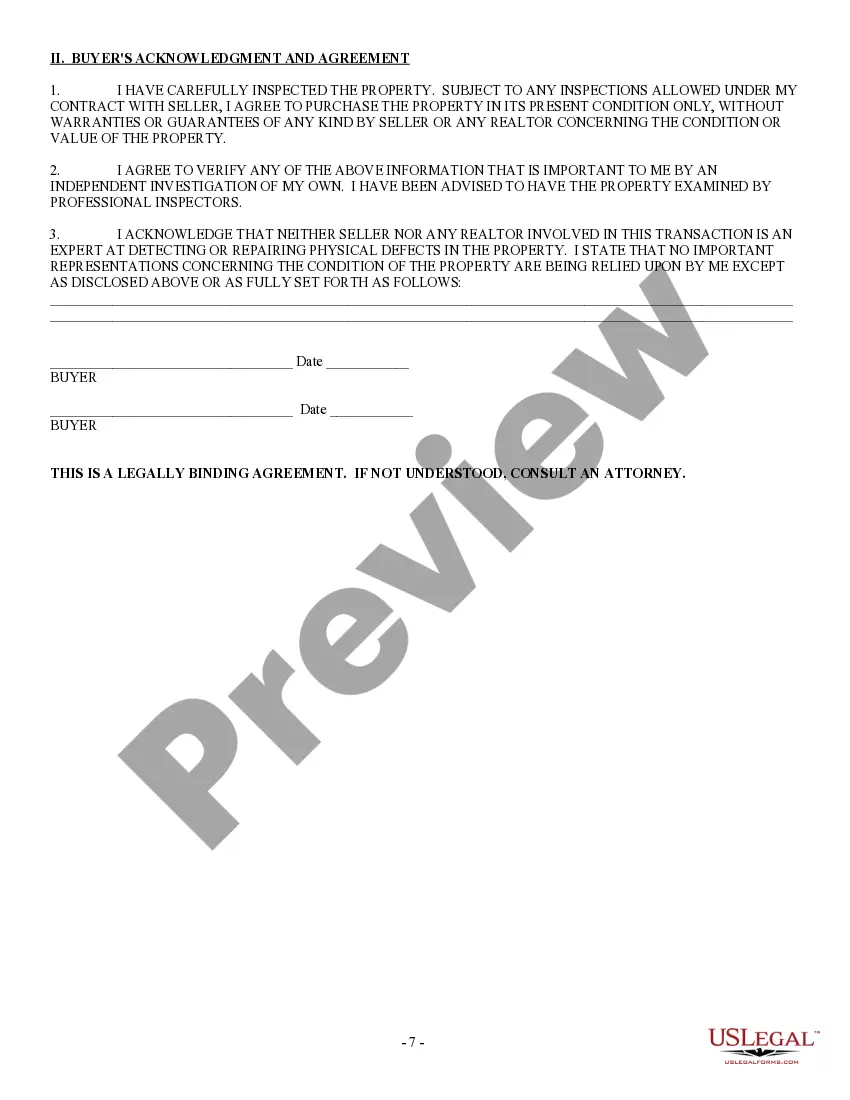

How to fill out Missouri Residential Real Estate Sales Disclosure Statement?

The Missouri Disclosure Statement For Divorce displayed on this page is a reusable official template created by qualified attorneys in alignment with national and local laws.

For over 25 years, US Legal Forms has delivered individuals, businesses, and legal practitioners with over 85,000 authenticated, state-specific documents for any corporate and personal circumstance. It’s the fastest, easiest, and most dependable way to acquire the forms you require, as the service assures the utmost level of data safety and anti-malware safeguards.

Enroll in US Legal Forms to have authenticated legal templates for all of life’s situations readily available.

- Search for the document you require and review it.

- Navigate through the file you searched and preview it or examine the form description to confirm it meets your needs. If it doesn’t, utilize the search tool to find the appropriate one. Click Buy Now once you locate the template you’re looking for.

- Register and sign in.

- Select the pricing option that fits you and set up an account. Use PayPal or a credit card for a quick transaction. If you already possess an account, Log In and review your subscription to proceed.

- Obtain the editable template.

- Select the format you prefer for your Missouri Disclosure Statement For Divorce (PDF, Word, RTF) and download the example onto your device.

- Fill out and sign the documents.

- Print the template to complete it manually. Alternatively, employ an online versatile PDF editor to swiftly and accurately fill out and sign your document with a legally-binding electronic signature.

- Redownload your papers.

- Utilize the same document again whenever necessary. Access the My documents section in your profile to redownload any previously acquired forms.

Form popularity

FAQ

While recording the invoice journal entry, you need to debit the accounts receivable account for the amount due from your customer and credit the sales account for the same amount. You also need to post the cost of goods sold journal entry to update your inventory.

Accounts receivable (AR) are the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. Accounts receivable are listed on the balance sheet as a current asset.

In accrual accounting, your receivable balance is listed in the general ledger under current assets. When invoices are paid, finance credits the appropriate liabilities account and debits accounts receivable to account for the payment.

The golden rule in accounting is that debit means assets (something you own or are due to own) and credit means liabilities (something you owe). On a balance sheet, accounts receivable is always recorded as an asset, hence a debit, because it's money due to you soon that you'll own and benefit from when it arrives.

Majorly, receivables can be divided into three types: trade receivable/accounts receivable (A/R), notes receivable, and other receivables.

Once you have received the payment, you need to give them a payment receipt and also record the payment entry in the system. While recording the payment journal entry, you need to debit the cash to show an increase due to the payment and credit accounts receivable to reduce the amount owed by your customer.

Accounts receivable are an asset account, representing money that your customers owe you. Accounts payable on the other hand are a liability account, representing money that you owe another business.

Three kinds of reports are important for accounts receivable: receivables reports, which list invoices issued and payments due for each customer; aging reports, which show the length of time invoices have been outstanding, which invoices are overdue and by how long they are overdue; and customer payment history reports ...