Missouri Court Forms Child Custody

Description

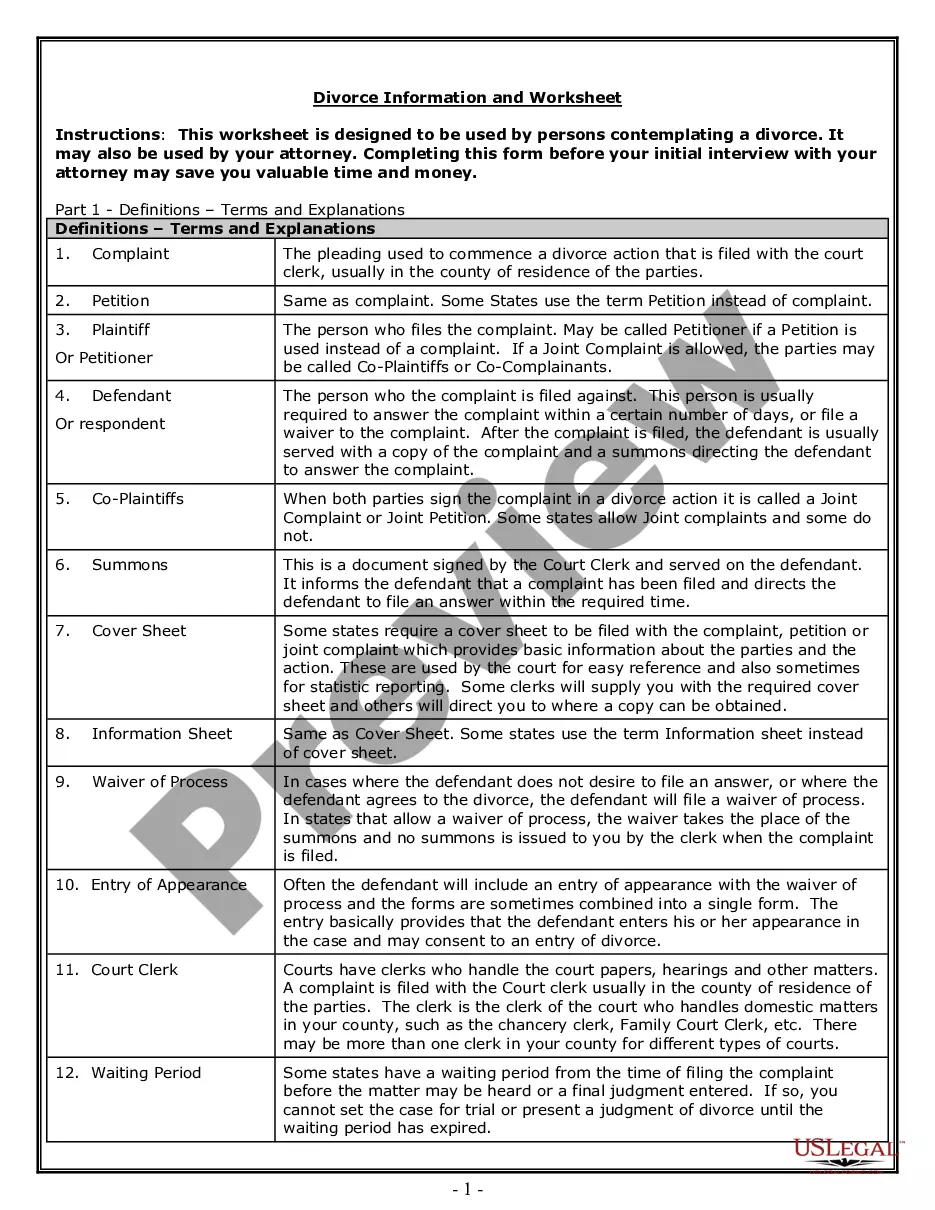

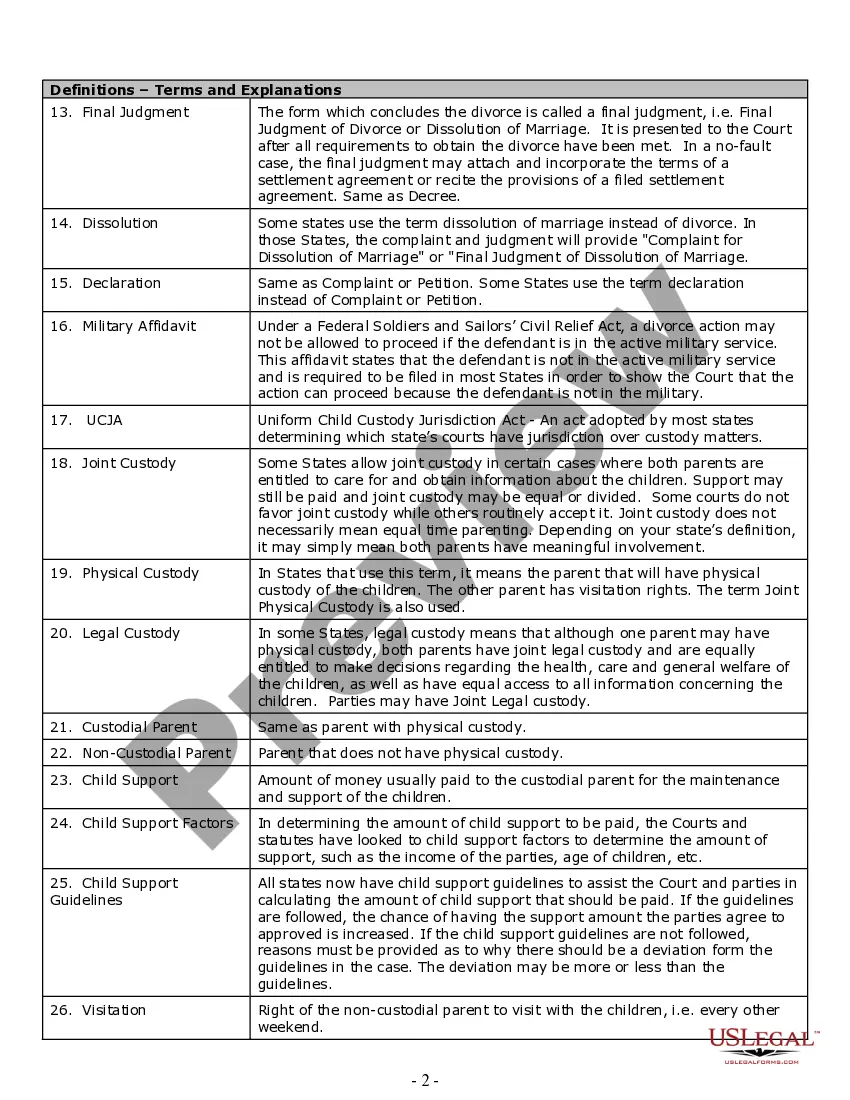

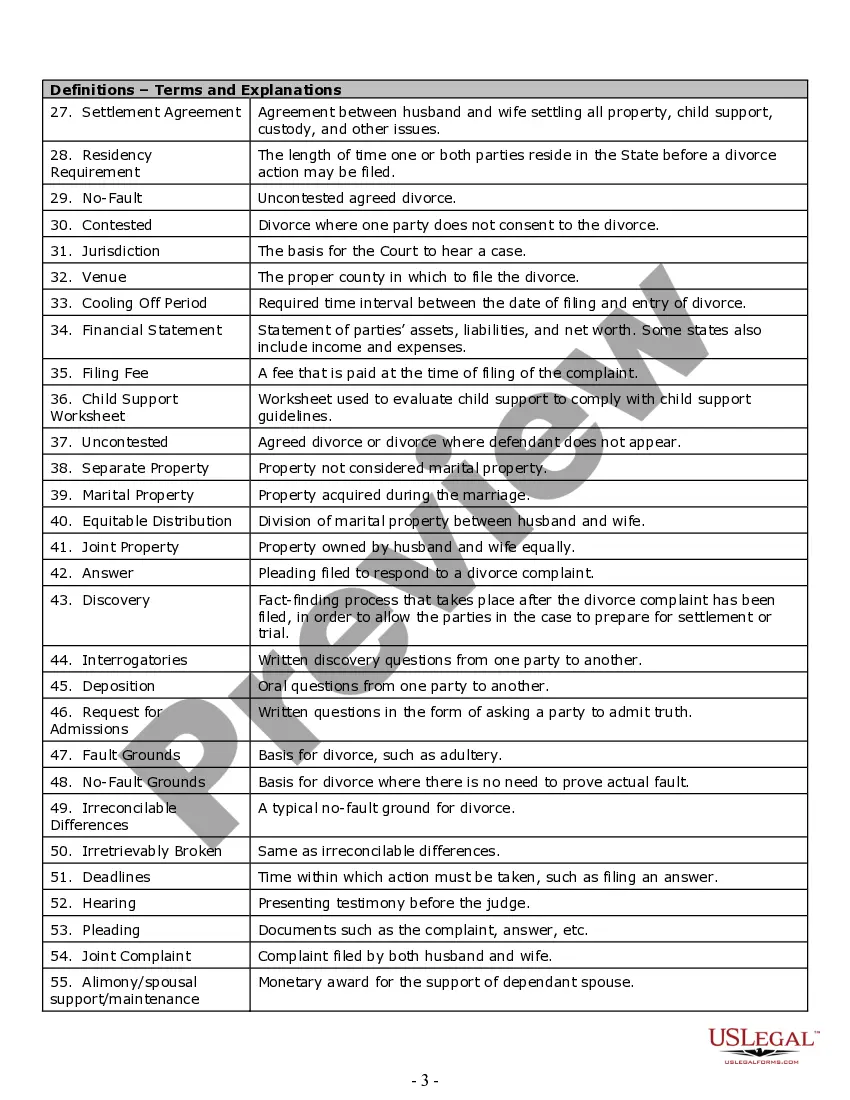

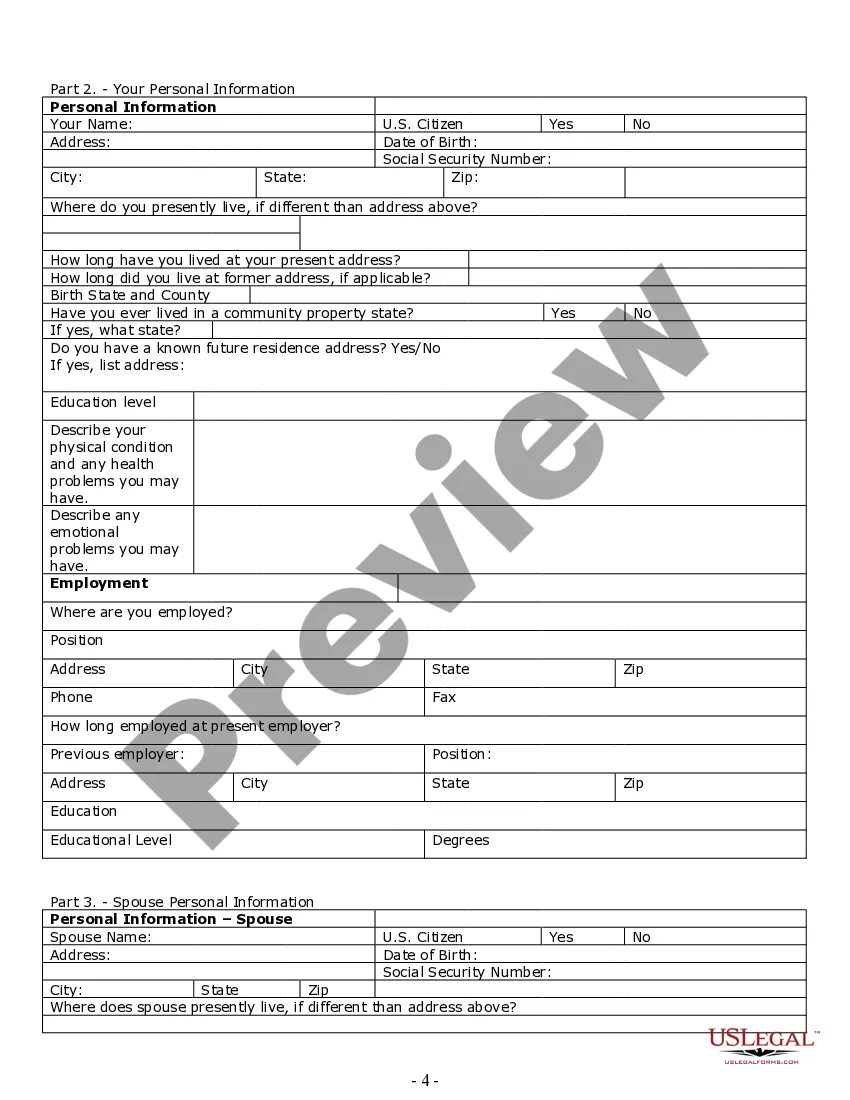

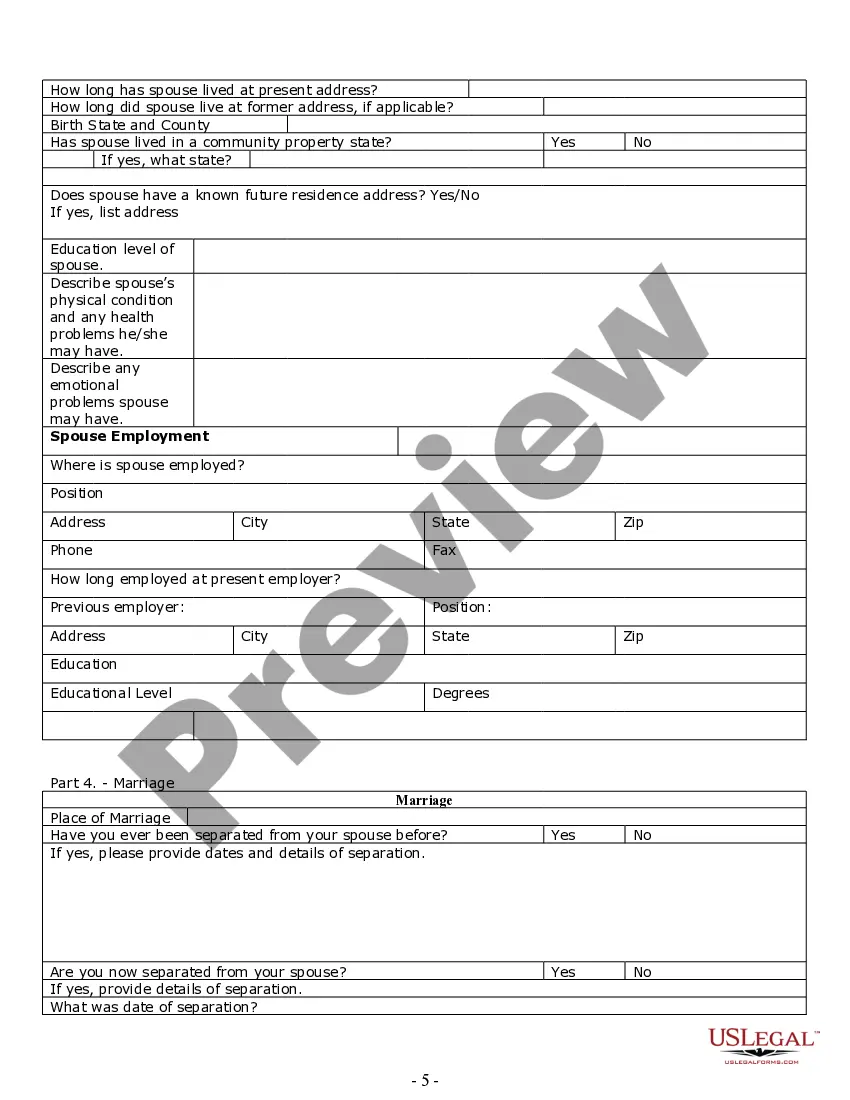

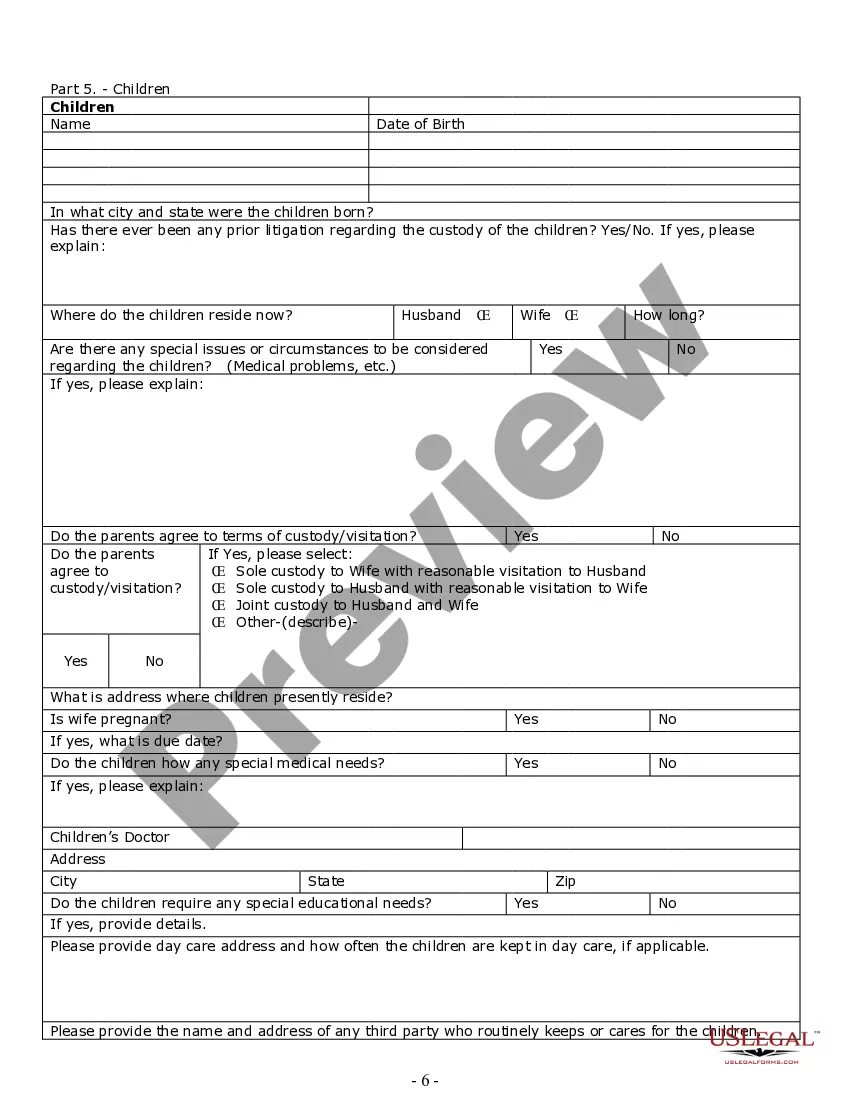

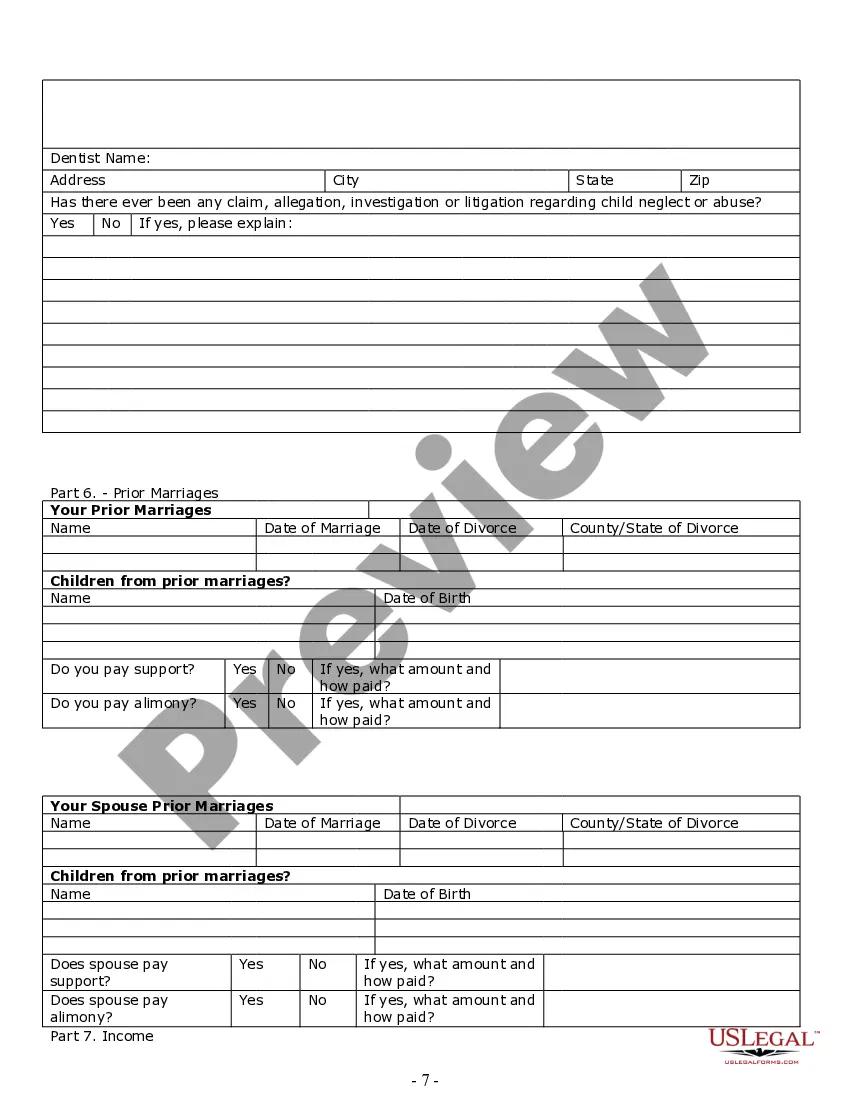

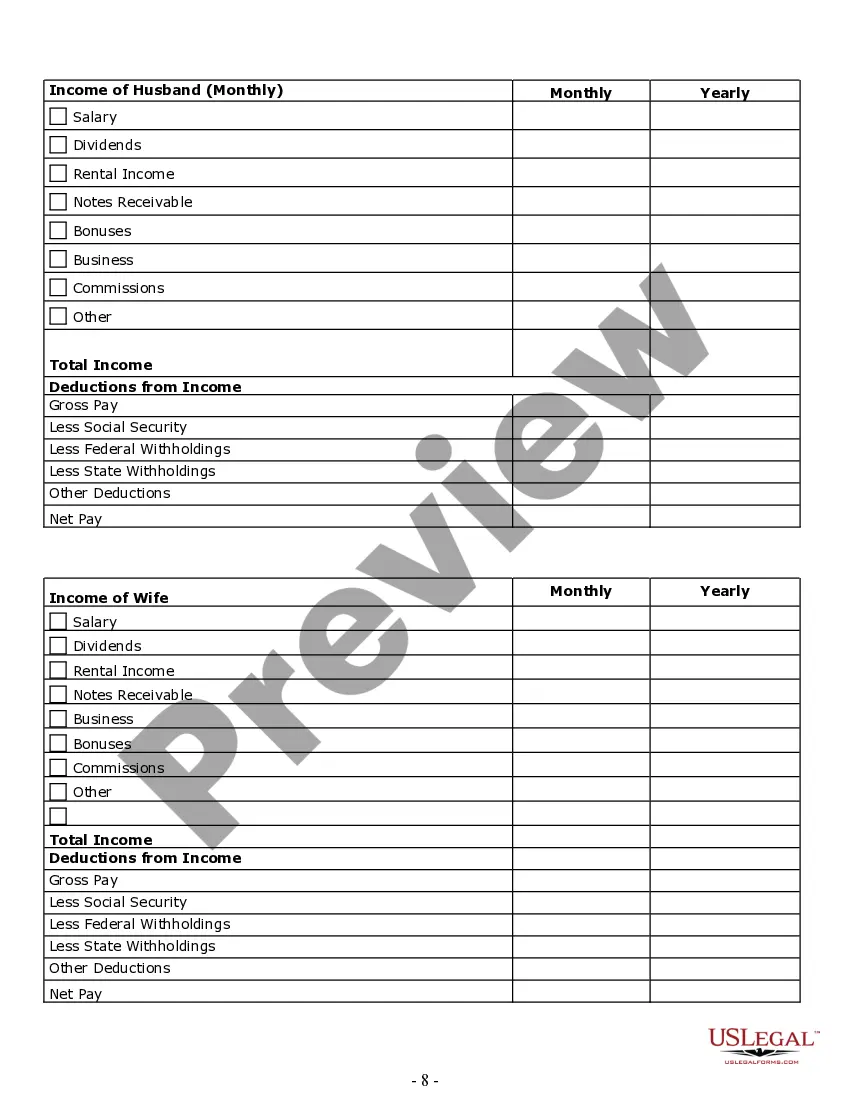

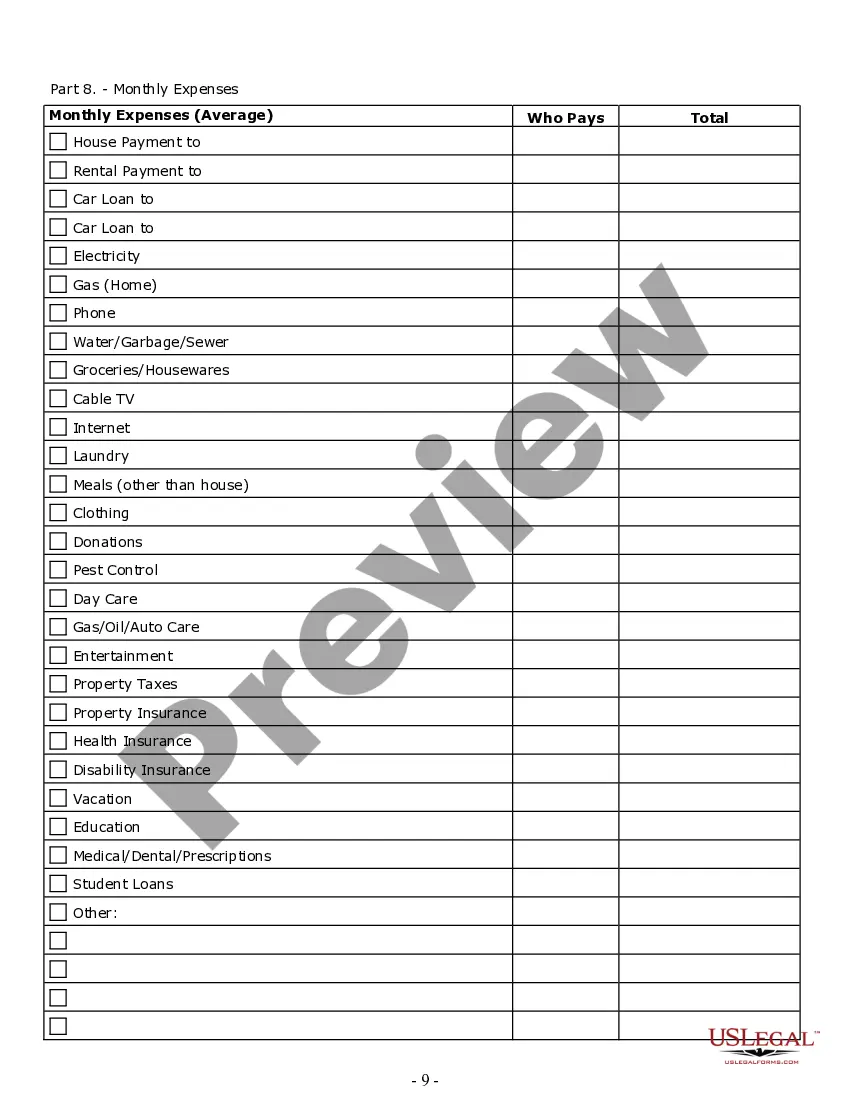

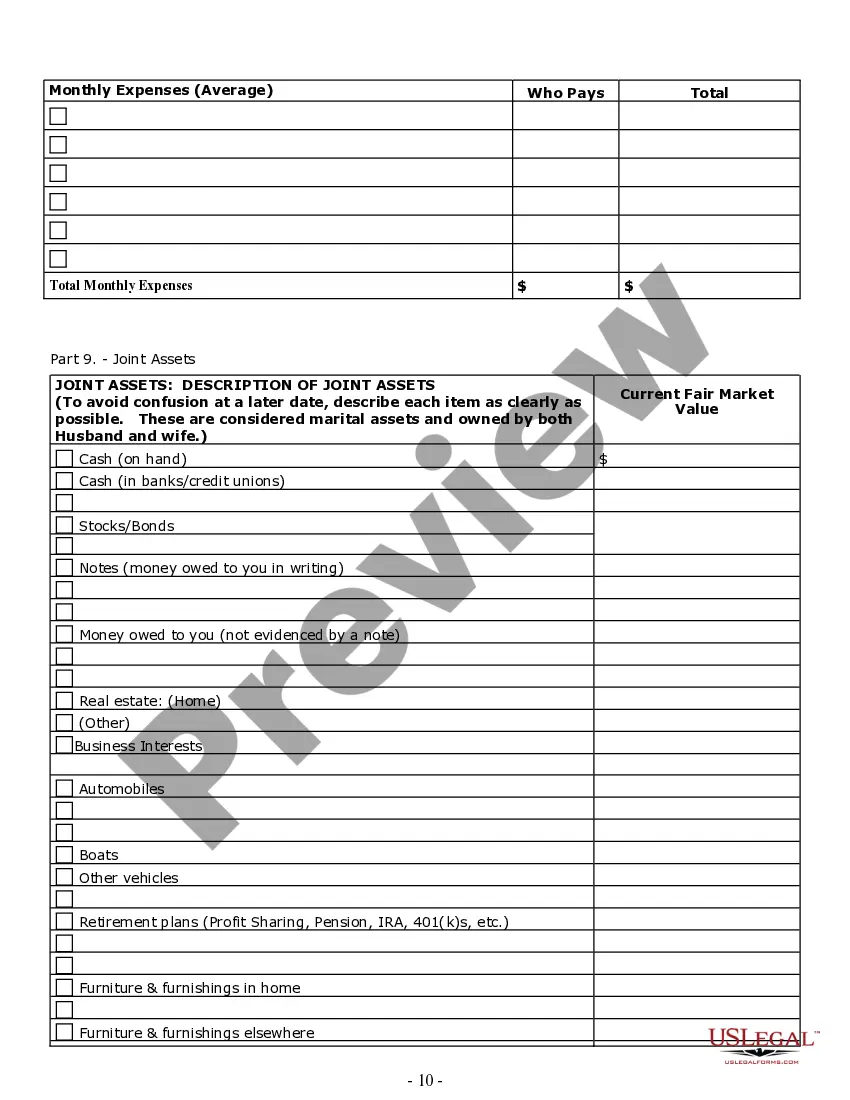

How to fill out Missouri Divorce Worksheet And Law Summary For Contested Or Uncontested Case Of Over 25 Pages - Ideal Client Interview Form?

Regardless of whether it's for commercial reasons or personal matters, everyone eventually has to deal with legal issues at some point in their lives.

Completing legal paperwork requires meticulous care, beginning with picking the appropriate form template.

With a comprehensive US Legal Forms inventory available, you won’t need to spend time hunting for the correct template on the internet. Utilize the library’s user-friendly navigation to find the right form for any occasion.

- Locate the template you require by utilizing the search bar or catalog browsing.

- Review the form’s description to confirm that it corresponds with your situation, state, and location.

- Click on the form’s preview to inspect it.

- If it turns out to be the wrong document, return to the search tool to find the Missouri Court Forms Child Custody example you need.

- Download the file if it fits your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously saved files in My documents.

- If you do not yet have an account, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile sign-up form.

- Select your payment method: you can use either a credit card or a PayPal account.

- Choose the desired file format and download the Missouri Court Forms Child Custody.

- Once downloaded, you can fill out the form using editing software or print it for manual completion.

Form popularity

FAQ

One of the biggest mistakes in a custody battle is failing to prioritize the child's welfare. Many parents focus on their grievances rather than what truly benefits the child. To avoid this, consider using Missouri court forms child custody, which can assist in presenting a case centered on the child's needs rather than personal conflicts.

A Letter of Testamentary?sometimes called a "Letter of Administration" or "Letter of Representation"?is a document granted by a local court. The document simply states that you are the legal executor for a particular estate and that you have the ability to act as such.

WI Form PR-1806, which may also referred to as Proof Of Heirship (Informal And Formal Administration), is a probate form in Wisconsin. It is used by executors, personal representatives, trustees, guardians & other related parties during the probate & estate settlement process.

Form PR-1831 - Transfer By Affidavit ($50,000 And Under) is a probate form in Wisconsin. To transfer decedent's assets not exceeding $50,000 (gross) to an heir, trustee of trust created by decedent, or person who was guardian of the decedent at the time of the decedent's death for distribution.

In Wisconsin, they are called Domiciliary Letters. This document gives the executor the legal authority to administer the deceased person's estate. While the process varies from state to state, the executor must petition the probate court in the county in which the decedent lived.

In Wisconsin, they are called Domiciliary Letters. This document gives the executor the legal authority to administer the deceased person's estate. While the process varies from state to state, the executor must petition the probate court in the county in which the decedent lived.

How to File (5 steps) Gather Information. Prepare Affidavit(s) Notify Department of Health Services. Get All Forms Notarized. Collect the Assets.

Probate is unnecessary if the property solely owned by the decedent totals less than $50,000 in value. Then all that's required to transfer property is completing a "transfer by affidavit" form. Also exempt from probate is property titled in joint ownership, which automatically passes to the surviving owner.

In Wisconsin, you can expect to pay about 4 to 5% of the estate's total value when all is said and done. Attorney fees during the probate process may total half or more of this expense, given the time and complexity involved in settling the estate.