Mo Personal Representative Without A Will

Description

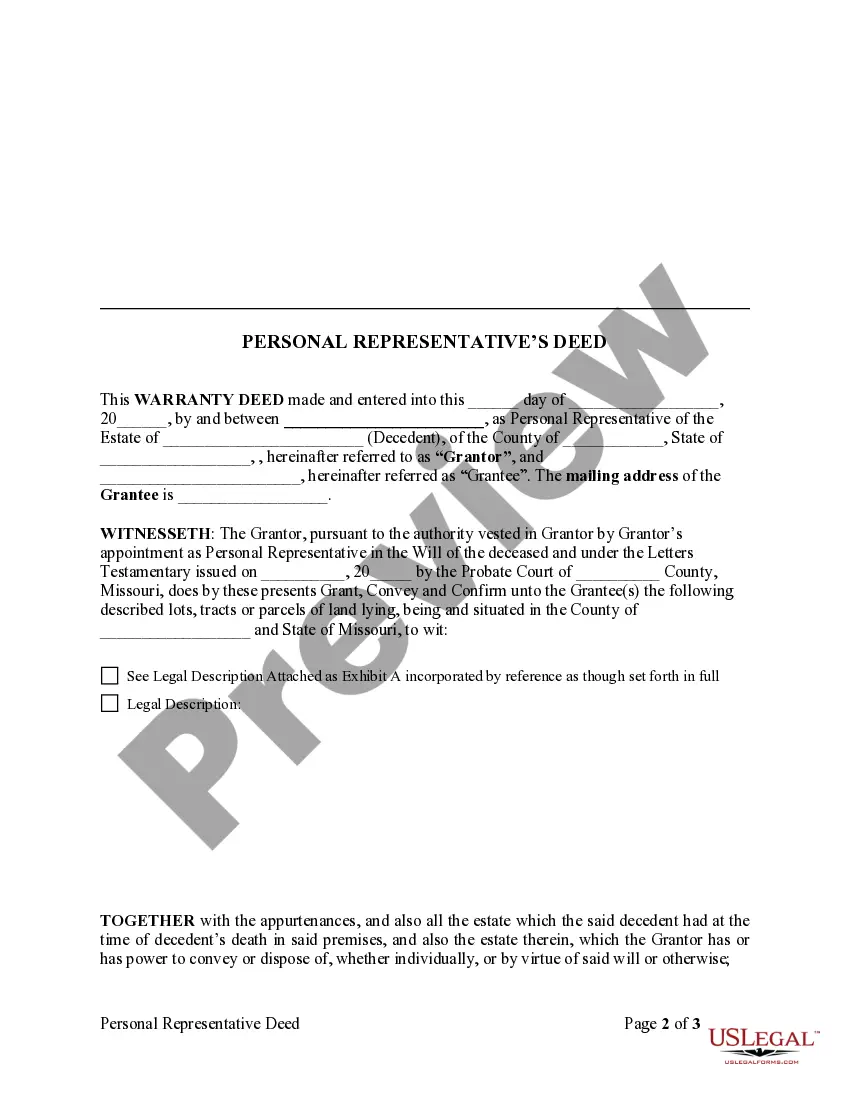

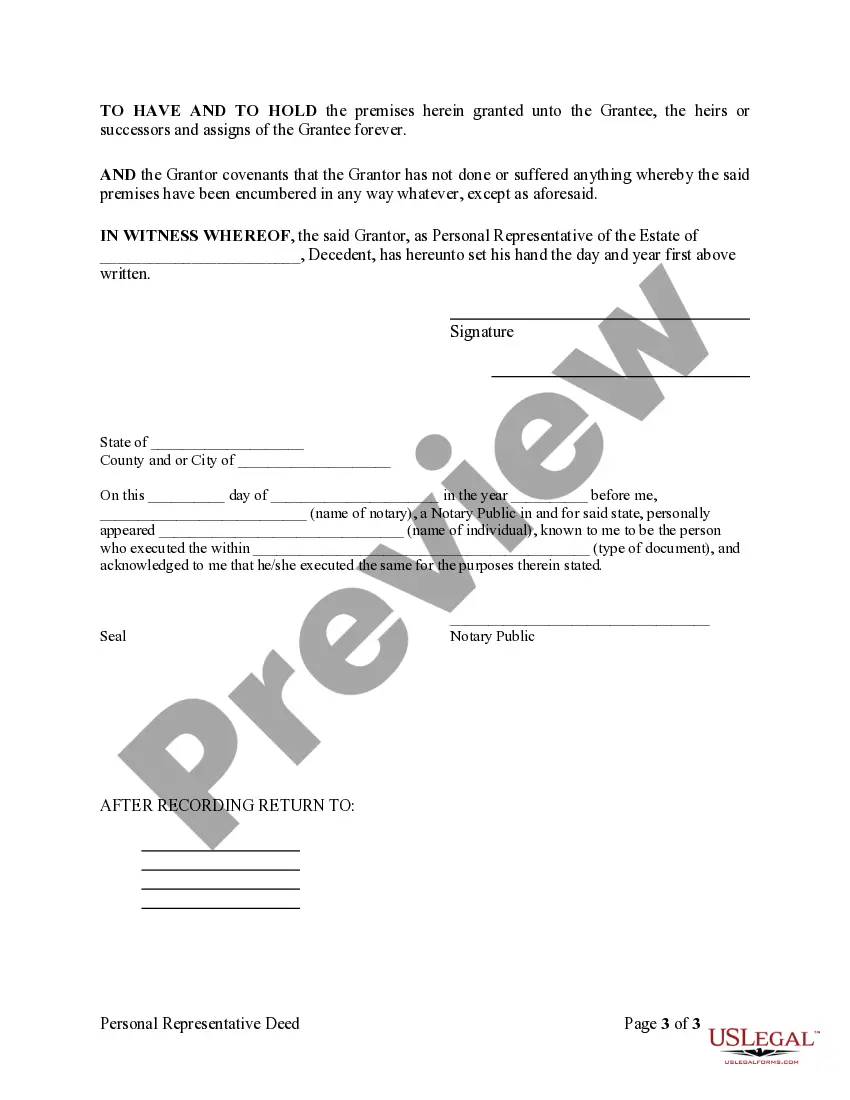

How to fill out Missouri Personal Representative's Deed To Individual?

Whether for business purposes or for individual matters, everybody has to manage legal situations at some point in their life. Filling out legal papers requires careful attention, starting with choosing the proper form sample. For example, when you pick a wrong version of a Mo Personal Representative Without A Will, it will be rejected once you send it. It is therefore important to have a trustworthy source of legal papers like US Legal Forms.

If you need to get a Mo Personal Representative Without A Will sample, stick to these simple steps:

- Get the template you need by using the search field or catalog navigation.

- Look through the form’s information to make sure it suits your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is the incorrect form, return to the search function to locate the Mo Personal Representative Without A Will sample you need.

- Get the file when it matches your needs.

- If you already have a US Legal Forms profile, click Log in to gain access to previously saved files in My Forms.

- In the event you don’t have an account yet, you may download the form by clicking Buy now.

- Choose the correct pricing option.

- Finish the profile registration form.

- Pick your payment method: use a bank card or PayPal account.

- Choose the document format you want and download the Mo Personal Representative Without A Will.

- When it is saved, you can complete the form by using editing applications or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you never have to spend time looking for the right template across the web. Make use of the library’s easy navigation to find the proper form for any occasion.

Form popularity

FAQ

Here in Missouri, somebody who dies without a will is said to have died ?intestate.? Most states, including ours, have very particular procedures on how to handle the assets of anyone who has died intestate. In general, your assets will be passed on to your closest living relatives.

If someone dies without a will, their property will be passed along based on intestate succession. This is the state's way of making a will for an individual who passes away without one, and its purpose is to distribute someone's possessions based on the way that the average person would.

If you die without a will in Missouri, your children will receive an "intestate share" of your property. The size of each child's share depends on how many children you have, whether or not you are married, and whether your spouse is also their parent. (See the table above.)

A personal representative cannot resign without the probate court's consent, and then only when a successor personal representative is appointed.

If you resign from your role as Executor, generally, another Executor will be appointed. If more than one Executor is named in the deceased's Will or a backup Executor, then the responsibility will fall to them. Alternatively, if you have been named as a sole Executor, a suitable replacement will need to be found.