Mo Personal Representative Form Montana

Description

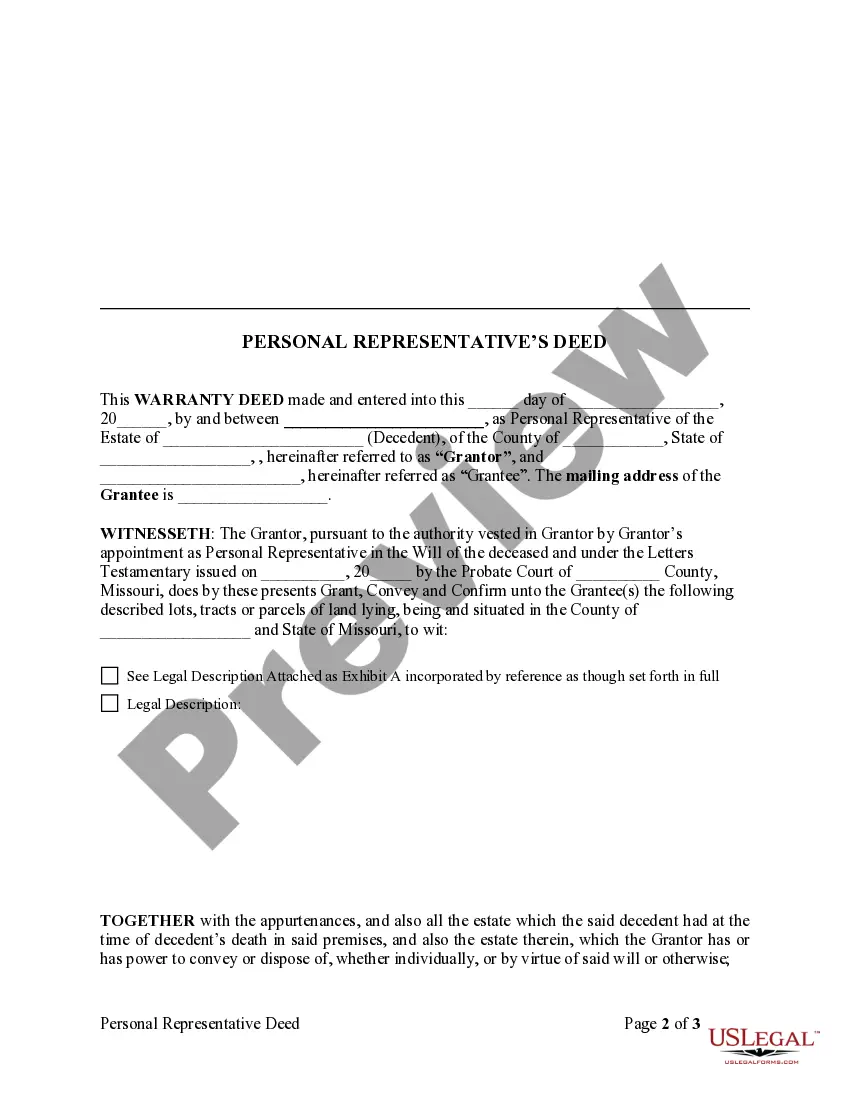

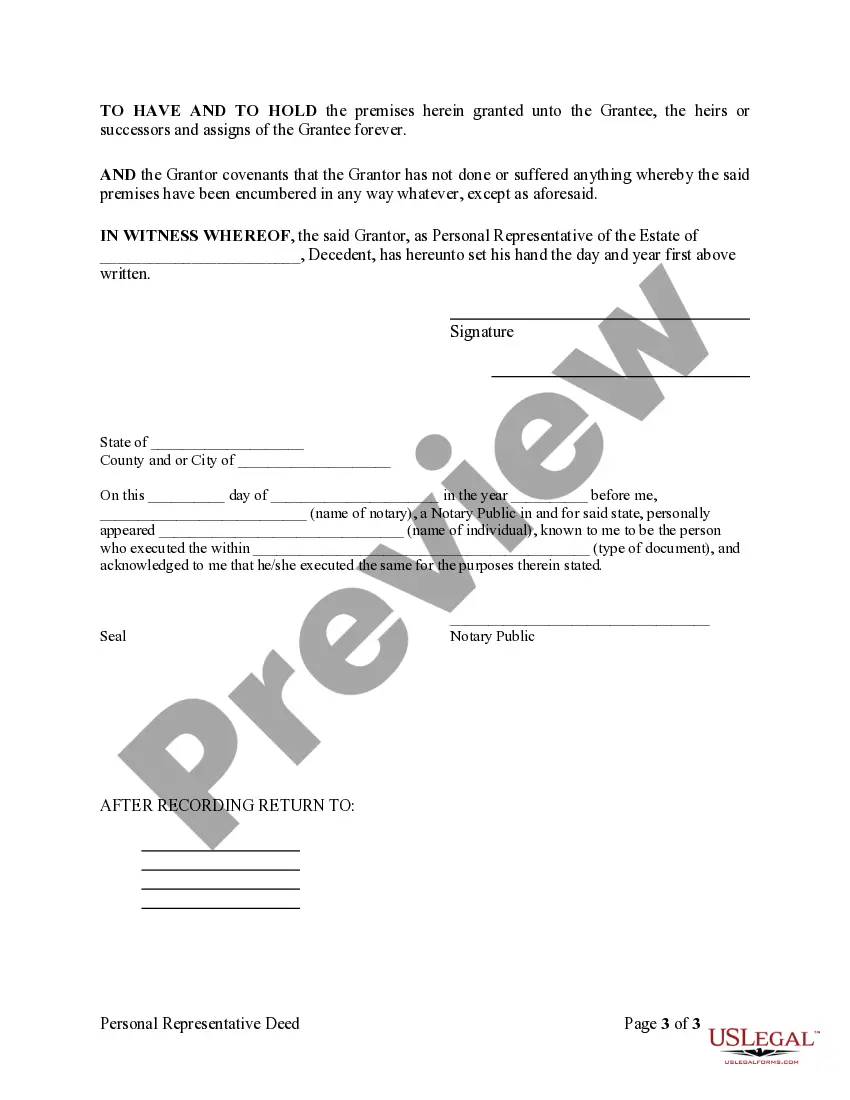

How to fill out Missouri Personal Representative's Deed To Individual?

Legal document management might be overwhelming, even for the most knowledgeable experts. When you are looking for a Mo Personal Representative Form Montana and do not have the time to commit searching for the correct and up-to-date version, the processes may be stress filled. A strong online form library could be a gamechanger for anybody who wants to deal with these situations efficiently. US Legal Forms is a industry leader in web legal forms, with over 85,000 state-specific legal forms available to you whenever you want.

With US Legal Forms, you can:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms covers any demands you might have, from individual to business paperwork, in one place.

- Employ innovative resources to accomplish and manage your Mo Personal Representative Form Montana

- Gain access to a useful resource base of articles, guides and handbooks and materials connected to your situation and needs

Help save effort and time searching for the paperwork you need, and employ US Legal Forms’ advanced search and Review feature to locate Mo Personal Representative Form Montana and acquire it. If you have a monthly subscription, log in to the US Legal Forms profile, look for the form, and acquire it. Take a look at My Forms tab to see the paperwork you previously saved and also to manage your folders as you can see fit.

If it is your first time with US Legal Forms, create an account and get unlimited use of all benefits of the library. Listed below are the steps to consider after downloading the form you want:

- Validate this is the proper form by previewing it and looking at its description.

- Ensure that the sample is recognized in your state or county.

- Pick Buy Now when you are all set.

- Select a monthly subscription plan.

- Pick the file format you want, and Download, complete, sign, print and send your document.

Take advantage of the US Legal Forms online library, supported with 25 years of experience and stability. Transform your day-to-day document managing in to a smooth and intuitive process right now.

Form popularity

FAQ

Even without a statutory guideline on executor fees in Montana, the common understanding among legal professionals suggests that an executor can expect to receive about 2-5% of the estate's value. However, this percentage can vary based on the specifics of the estate and the executor's duties.

If you make a will, you may name the person to carry out your plan for the settlement of your estate. In Montana, the individual who performs this function is called. a personal representative. Formerly, the terms 'executor' or 'administrator' were used.

If you make a will, you may nominate the person to administer the settlement of your estate. A testator (the person writing a will) only nominates a PR in a will. The clerk of court or the judge makes the appointment. In performing duties, a PR must follow procedures provided in the Montana Uniform Probate Code.

Small Estate Summary Administration ? If it appears from an inventory and appraisal that the value of the entire estate (less liens and encumbrances) does not exceed the homestead allowance of $22,500; exempt property of $15,000; family allowance of $27,000; cost and expenses of administration; reasonable funeral ...

(1) A personal representative is entitled to reasonable compensation for services. The compensation may not exceed 3% of the first $40,000 of the value of the estate as reported for federal estate tax purposes and 2% of the value of the estate in excess of $40,000 as reported for federal estate tax purposes.