Missouri Foreign Llc Registration Without Itin

Description

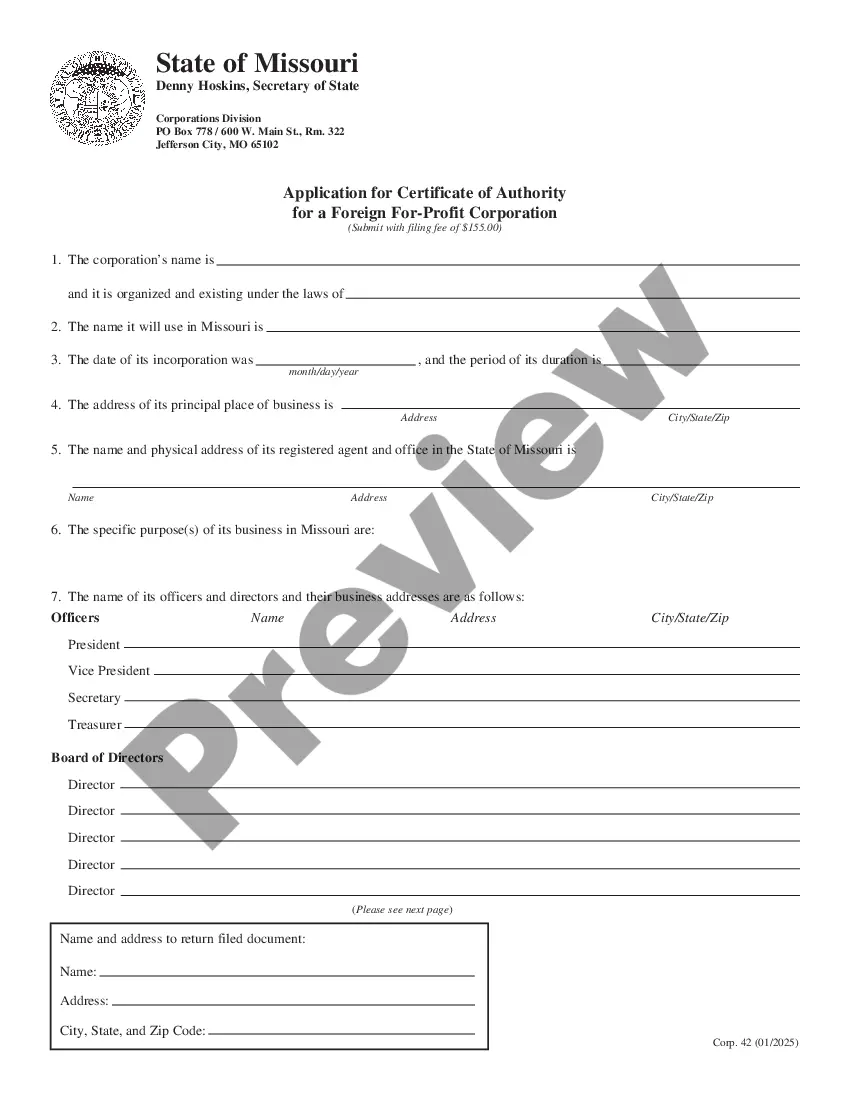

How to fill out Missouri Registration Of Foreign Corporation?

Creating legal documents from the ground up can frequently be daunting. Certain situations may require extensive research and significant financial resources.

If you seek a more straightforward and cost-effective method of producing Missouri Foreign Llc Registration Without Itin or other documents without unnecessary obstacles, US Legal Forms is readily available.

Our online collection of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal matters. With just a few clicks, you can promptly access state- and county-specific templates carefully crafted by our legal professionals.

Utilize our platform whenever you require trustworthy and dependable services to swiftly find and download the Missouri Foreign Llc Registration Without Itin. If you are already familiar with our site and have set up an account with us, simply Log In to your account, choose the template and download it immediately or re-obtain it at any time in the My documents section.

Ensure that the template you choose adheres to the laws and regulations of your state and county. Select the most appropriate subscription option to purchase the Missouri Foreign Llc Registration Without Itin. Download the form, then complete, certify, and print it. US Legal Forms has a solid reputation and more than 25 years of expertise. Join us now and simplify the form completion process into something effortless and efficient!

- Not signed up yet? No worries.

- It only takes a few minutes to register and browse the library.

- However, before diving straight into downloading Missouri Foreign Llc Registration Without Itin, consider these suggestions.

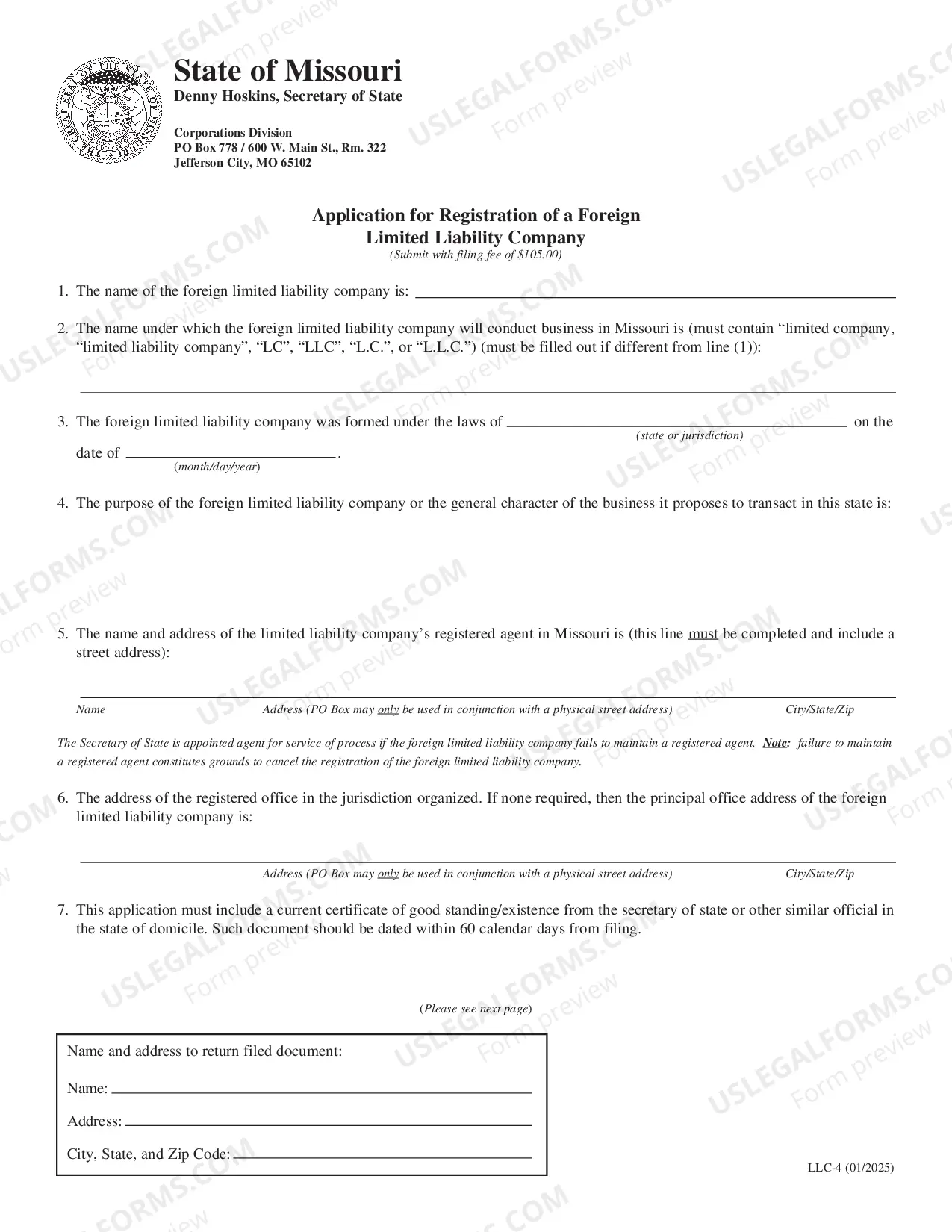

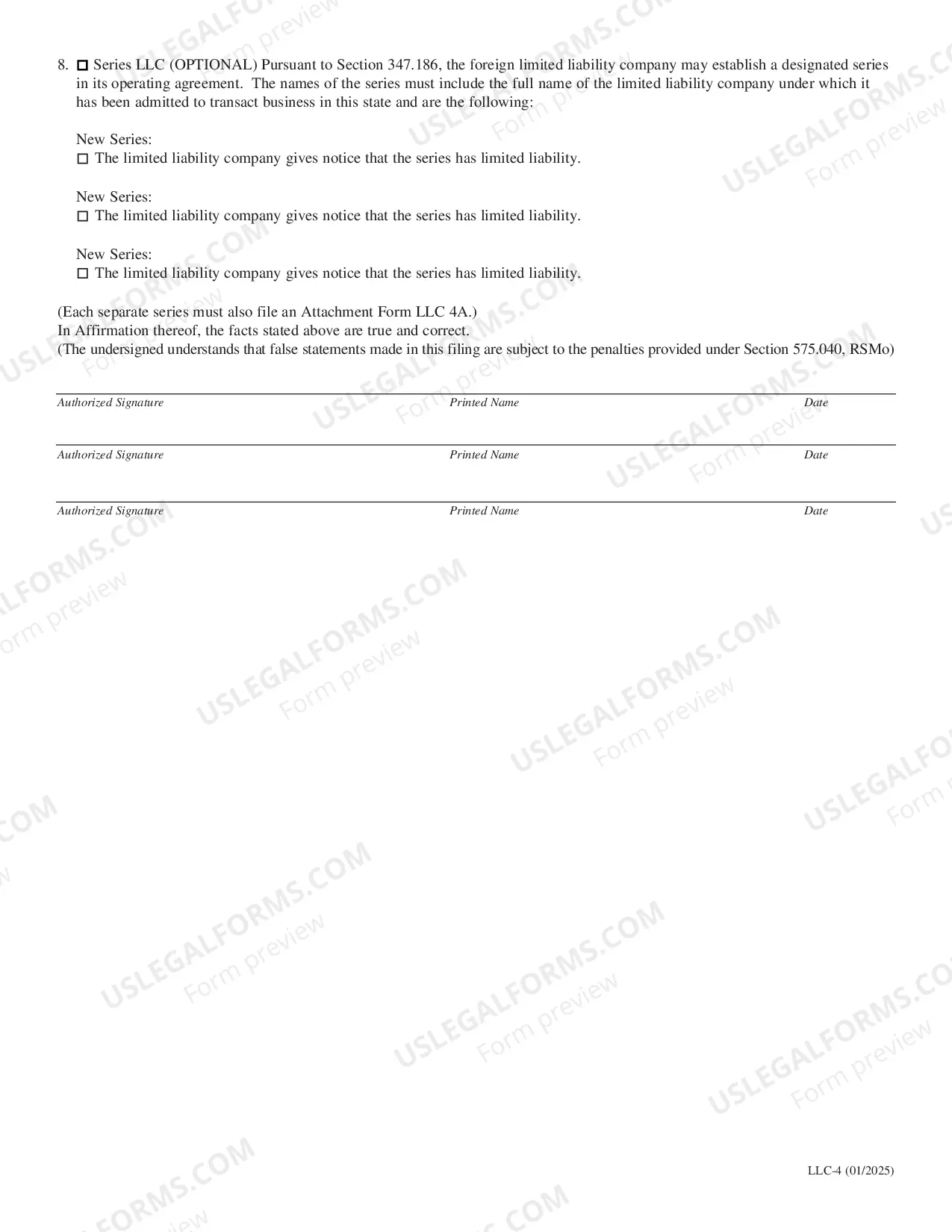

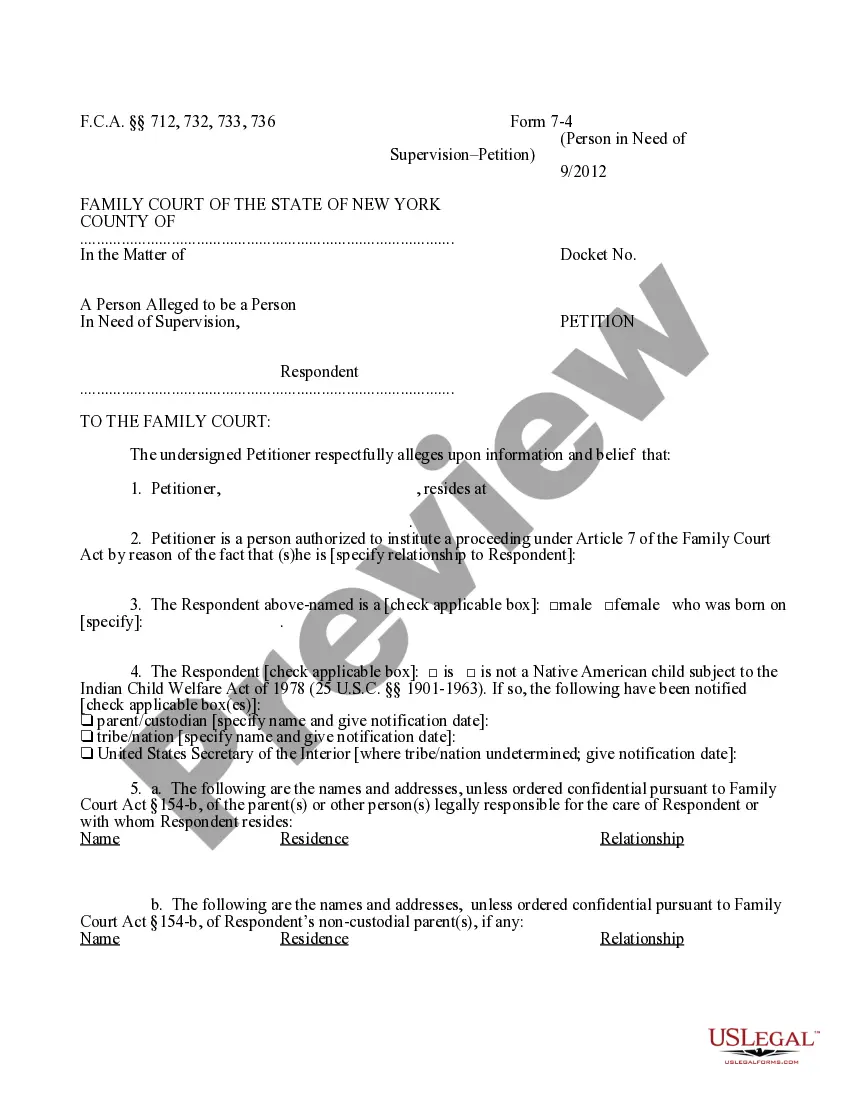

- Examine the document preview and descriptions to confirm that you are accessing the document you need.

Form popularity

FAQ

Regardless of whether your business is in an office building, a home (if the company is run from a residence) or any other physical location, every Missouri LLC must have a designated street address. It can be located outside the State of Missouri, but it cannot be a P.O. Box.

To do business as a foreign LLC in Missouri, you'll need to appoint a local registered agent, file an Application for Registration of a Foreign Limited Liability Company with the Missouri Secretary of State, and pay the state filing fee of $105 (plus a 2.15% added fee if paying by credit card).

For LLCs electing to be taxed as corporations, Form MO-1120 must be filed in Missouri. A single-member LLC that is considered disregarded for federal taxation purposes must report income and expenses accrued by the LLC on the member's tax return. In Missouri, a state tax identification number is required.

Starting an LLC in Missouri will include the following steps: #1: Draft a Business Plan. #2: Research Your Business Structure Options. #3: Register a Business Name. #4: Appoint a Registered Agent. #5: File Articles of Organization. #6: Obtain an Employer Identification Number (EIN) #7: Draft an Operating Agreement.

Missouri's statutes don't explicitly define what the state considers to count as doing business, but in general, your LLC will need to register as a foreign LLC in Missouri if it applies for state or county business or occupational licenses, sells or provides retail or other services, has a physical address, storefront ...