Missouri Foreign Llc Registration For Revenue

Description

How to fill out Missouri Registration Of Foreign Corporation?

Whether for corporate reasons or for personal issues, everyone must confront legal matters at some point in their life.

Completing legal documents necessitates meticulous attention, starting with selecting the appropriate form template.

With an extensive US Legal Forms catalog available, you will never have to waste time searching for the correct template online. Use the library’s straightforward navigation to find the right template for any occasion.

- For instance, if you select an incorrect version of the Missouri Foreign Llc Registration For Revenue, it will be rejected upon submission.

- Thus, it is crucial to have a reliable source for legal documents like US Legal Forms.

- If you wish to acquire a Missouri Foreign Llc Registration For Revenue template, follow these simple steps.

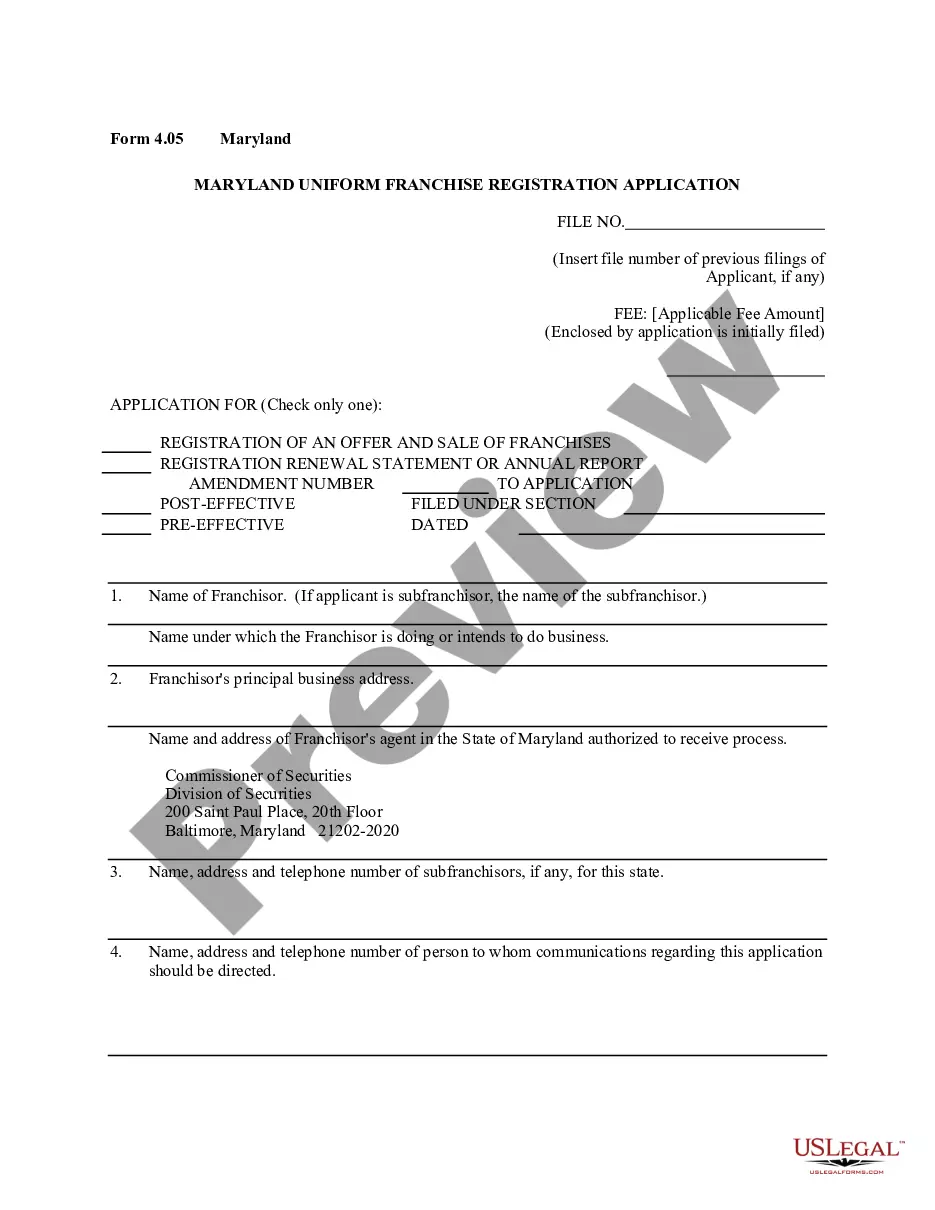

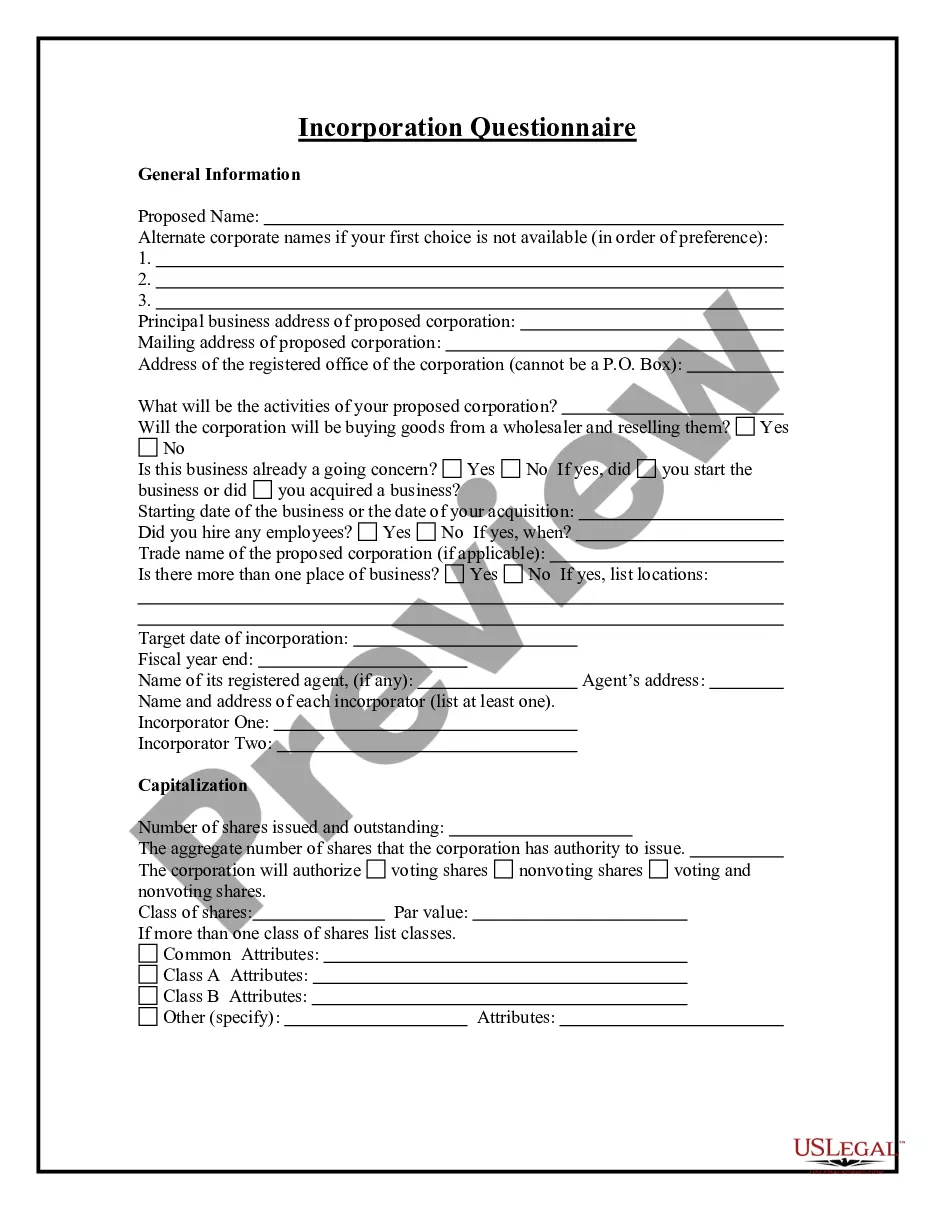

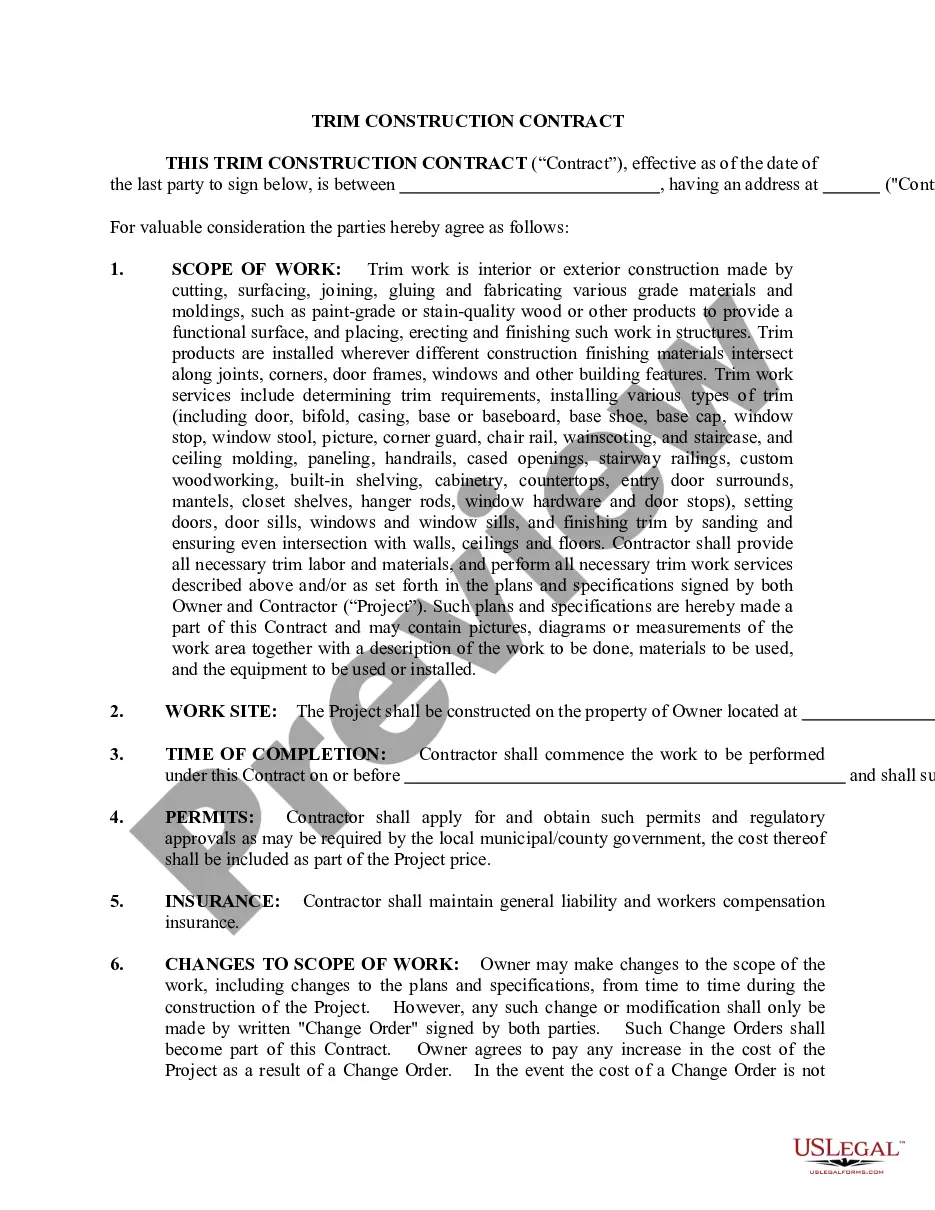

- Locate the template you require by using the search bar or catalog navigation.

- Review the form’s description to ensure it aligns with your circumstances, state, and area.

- Click on the form’s preview to examine it.

- If it is the incorrect form, return to the search option to find the Missouri Foreign Llc Registration For Revenue sample you seek.

- Obtain the template when it corresponds to your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- If you have not yet created an account, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Select your payment method: you may use a credit card or PayPal account.

- Choose the document format you prefer and download the Missouri Foreign Llc Registration For Revenue.

- Once downloaded, you can fill out the form using editing software or print it out and complete it manually.

Form popularity

FAQ

Unlike most states, where LLCs have to file an ?Annual Report? (and pay a fee), Missouri LLCs don't have to file an Annual Report and they don't have to pay an annual fee to the Secretary of State. Missouri is one of the few states that doesn't have Annual Report requirements for LLCs.

A limited liability company taxed as a partnership will file a Federal Form 1065 and a Missouri Partnership Return MO-1065. Each member will receive a Federal K-1 and will report their income on their Federal Form 1040 and on a Missouri Individual Income Tax Form 1040.

Missouri does not require LLCs to file an annual report. Taxes. For complete details on state taxes for Missouri LLCs, visit Business Owner's Toolkit or the State of Missouri .

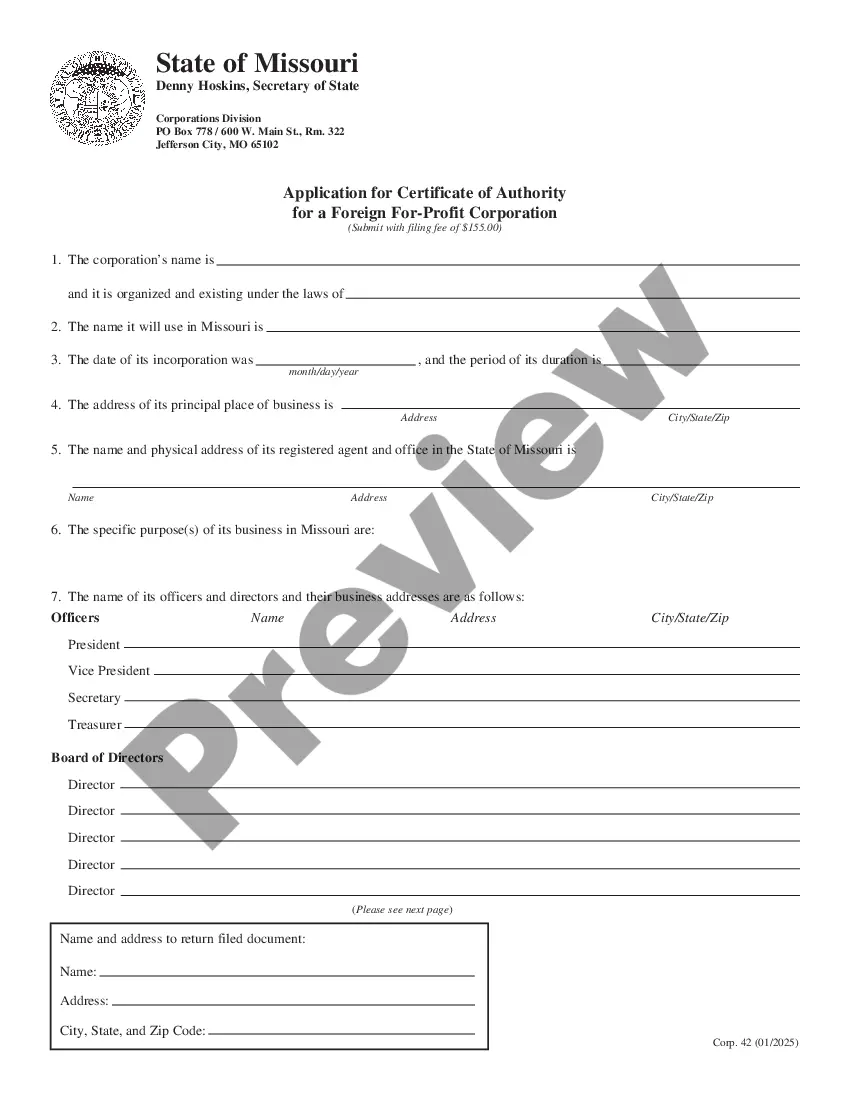

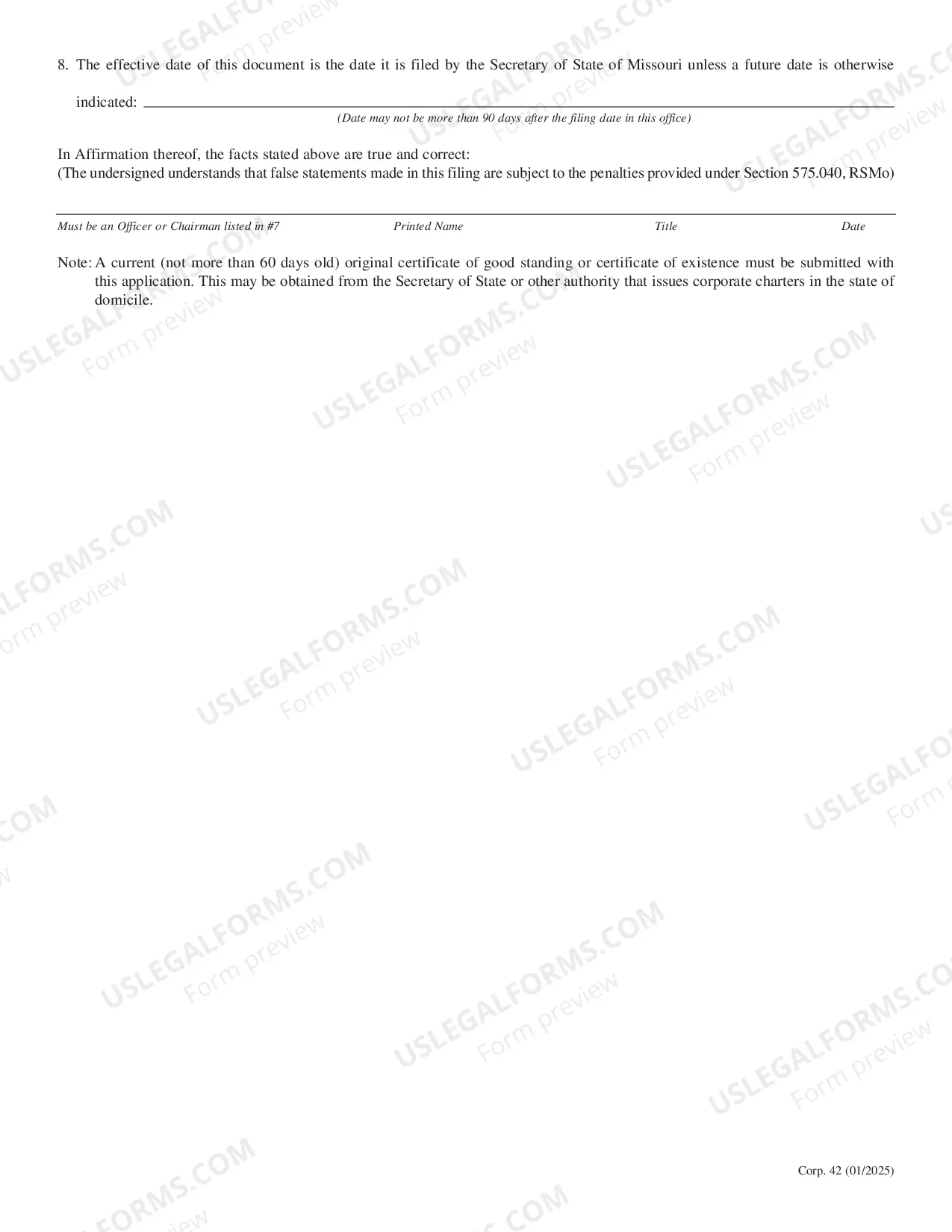

Register a Foreign Corporation in Missouri. To register a foreign corporation in Missouri, you must file a Missouri Application for Certificate of Authority with the Missouri Secretary of State, Corporations Division. You can submit this document online, by mail, or in person.

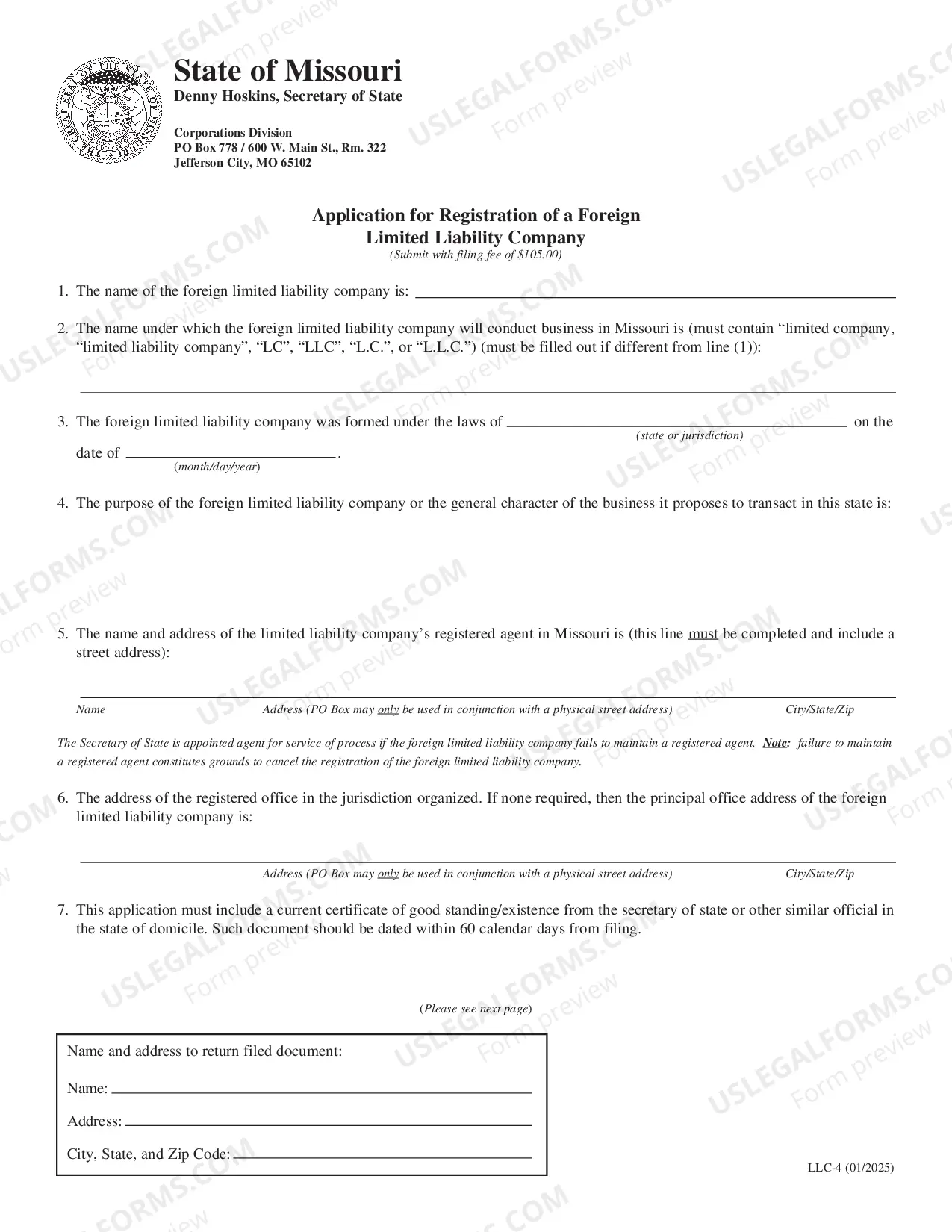

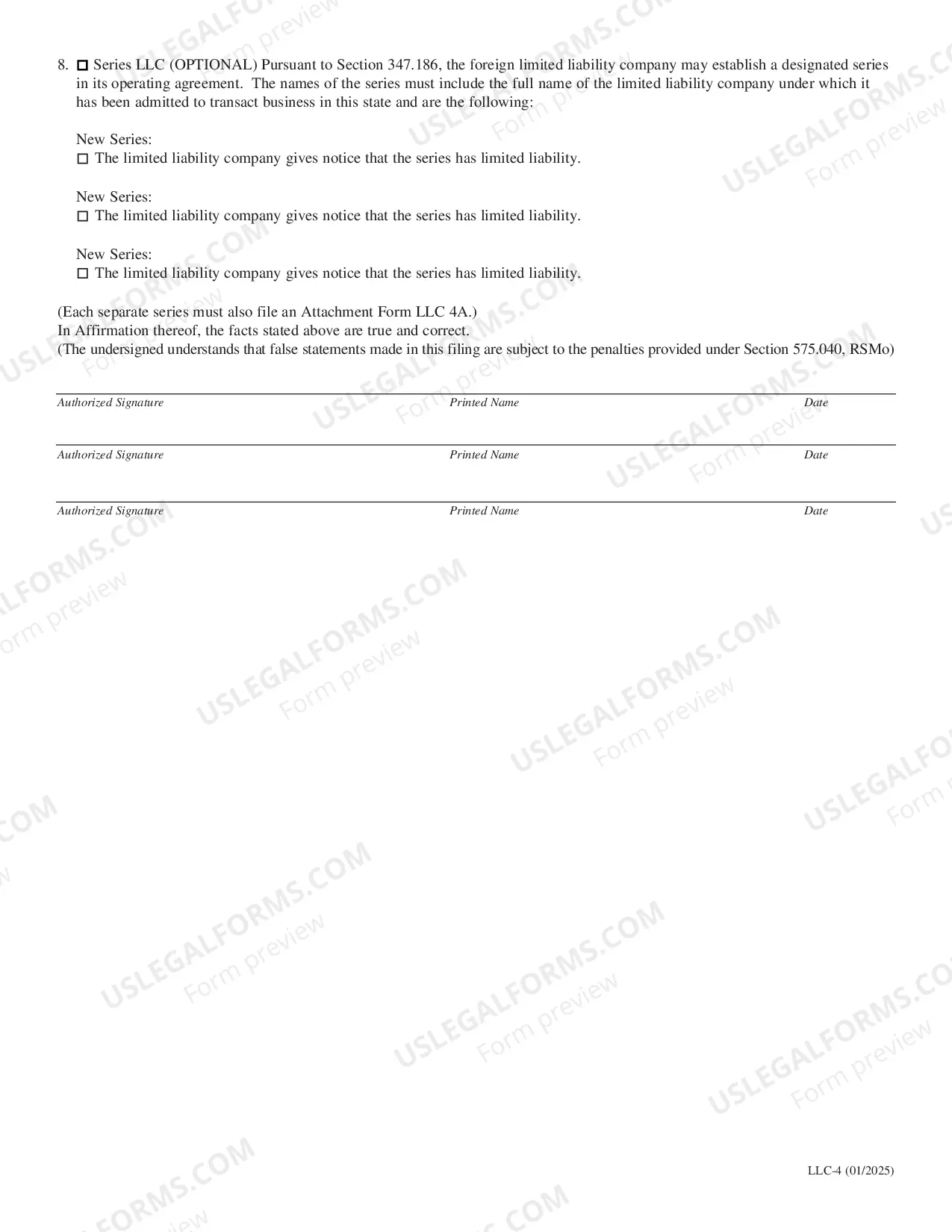

Missouri's statutes don't explicitly define what the state considers to count as doing business, but in general, your LLC will need to register as a foreign LLC in Missouri if it applies for state or county business or occupational licenses, sells or provides retail or other services, has a physical address, storefront ...