Minnesota A Corporation With No Assets

Description

How to fill out Minnesota A Corporation With No Assets?

Precisely crafted official documentation is one of the essential assurances for preventing issues and lawsuits, but securing it without an attorney's assistance might require time.

Whether you need to swiftly locate an updated Minnesota A Corporation With No Assets or other forms for work, family, or business circumstances, US Legal Forms is consistently available to assist.

The procedure is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you just need to Log In to your account and click the Download button next to the chosen file. Additionally, you can retrieve the Minnesota A Corporation With No Assets at any time, as all documents ever obtained on the platform are accessible within the My documents section of your profile. Save time and money on preparing official documents. Try US Legal Forms today!

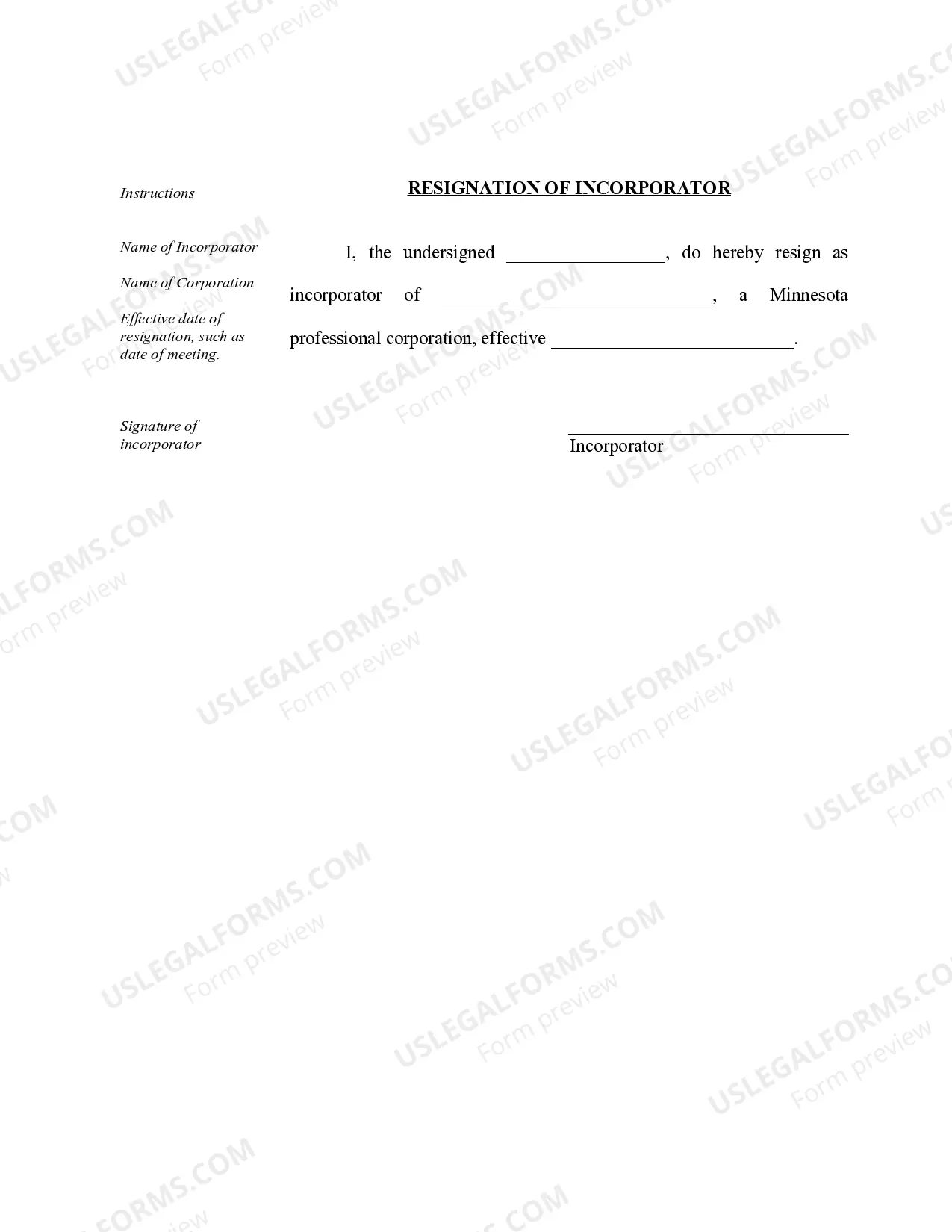

- Ensure that the form is appropriate for your situation and region by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the header of the page.

- Select Buy Now when you find the relevant template.

- Select the pricing plan, Log Into your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Select PDF or DOCX file format for your Minnesota A Corporation With No Assets.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Yes, a corporation is a legal entity that is separate from its owners. This separation grants owners limited liability, protecting their personal assets from business debts and liabilities. However, in the case of a corporation with no assets in Minnesota, this separation may become complicated, making it wise to consult with a professional for guidance on your specific situation.

A corporation is a legal structure for a business that enables it to operate as a separate entity from its owners. This means it can sue or be sued, own assets, and enter contracts independently. In Minnesota, even if a corporation has no assets, understanding its legal status is crucial for liability protection and financial management.

A sole proprietorship is a legal entity that is not separate from the business owner. In this structure, the owner personally holds all responsibilities and liabilities of the business. In contrast, if you form a corporation in Minnesota, you can protect your personal assets, even if the corporation has no assets of its own.

False. A corporation is generally considered a separate entity from its owners, especially in Minnesota. This separation provides protection for the shareholders against personal liability for the corporation's debts. Nevertheless, if a corporation has no assets, this protection may not hold up in every situation.

In Minnesota, a corporation is typically recognized as a separate legal entity, distinct from its owners. This means that it can own property, enter contracts, and incur liabilities independently of its shareholders. However, in practical terms, if a corporation has no assets, it may have limited legal protections for owners. It's essential to understand this distinction when forming a corporation in Minnesota.

Starting an S Corporation in Minnesota involves several steps, including filing articles of incorporation. For a Minnesota a corporation with no assets, the process starts by choosing a corporate name and completing the necessary paperwork with the state. After filing, you'll need to apply for S Corporation status with the IRS. Engaging with uslegalforms can simplify this process by providing the templates and guidance you need for a smooth establishment.

The lowest corporate tax rate in Minnesota is applicable to corporations with lower income thresholds. Notably, a Minnesota a corporation with no assets can still face tax implications depending on income and business operations. It is vital to know the applicable rates, as they can influence your overall financial strategy. Utilize tools or platforms like uslegalforms to stay informed on the latest tax regulations and rates.

Nexus rules in Minnesota determine when a business has sufficient presence in the state to be taxed. For a Minnesota a corporation with no assets, understanding nexus is crucial, as it may apply even without physical assets. Factors such as employees, sales, or other business activities can create a nexus. Therefore, evaluate your activities in the state to ensure compliance with Minnesota tax law.

In Minnesota, the minimum corporate income tax is determined by the level of business activity and income reported. This tax is relevant for any corporation, including a Minnesota a corporation with no assets. Even if your corporation does not hold physical assets, your business may still be subject to this tax based on your income level. Consulting a tax professional or using resources from uslegalforms can guide you through the process effectively.

The minimum corporate tax in Minnesota applies to corporations with net income. If your Minnesota a corporation with no assets generates income, you will need to be aware of the tax structure. It is essential to factor in the minimum tax liabilities even for a corporation that may not have substantial assets. Understanding these requirements can help you avoid unexpected tax obligations.