Mn Attorney Minnesota Withholding

Description

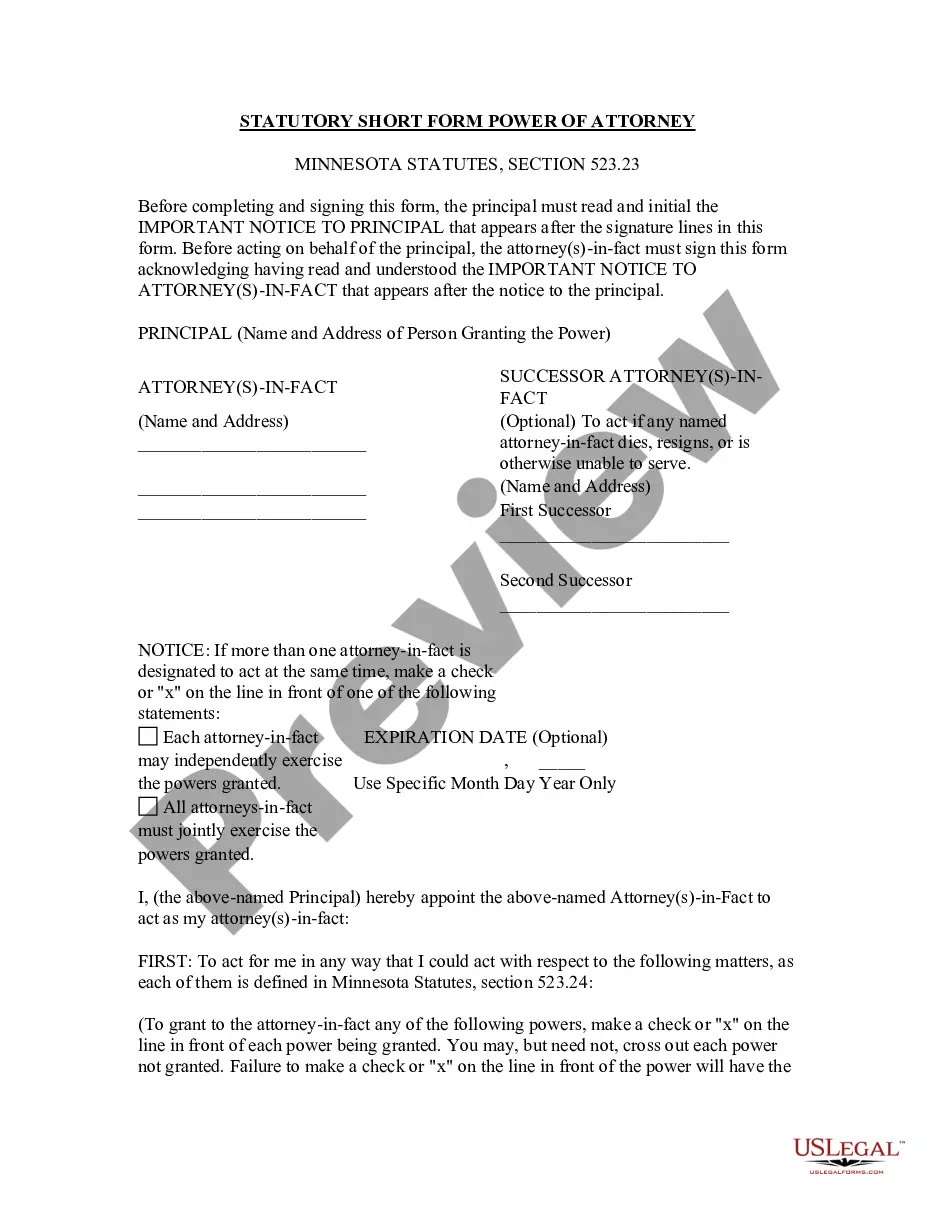

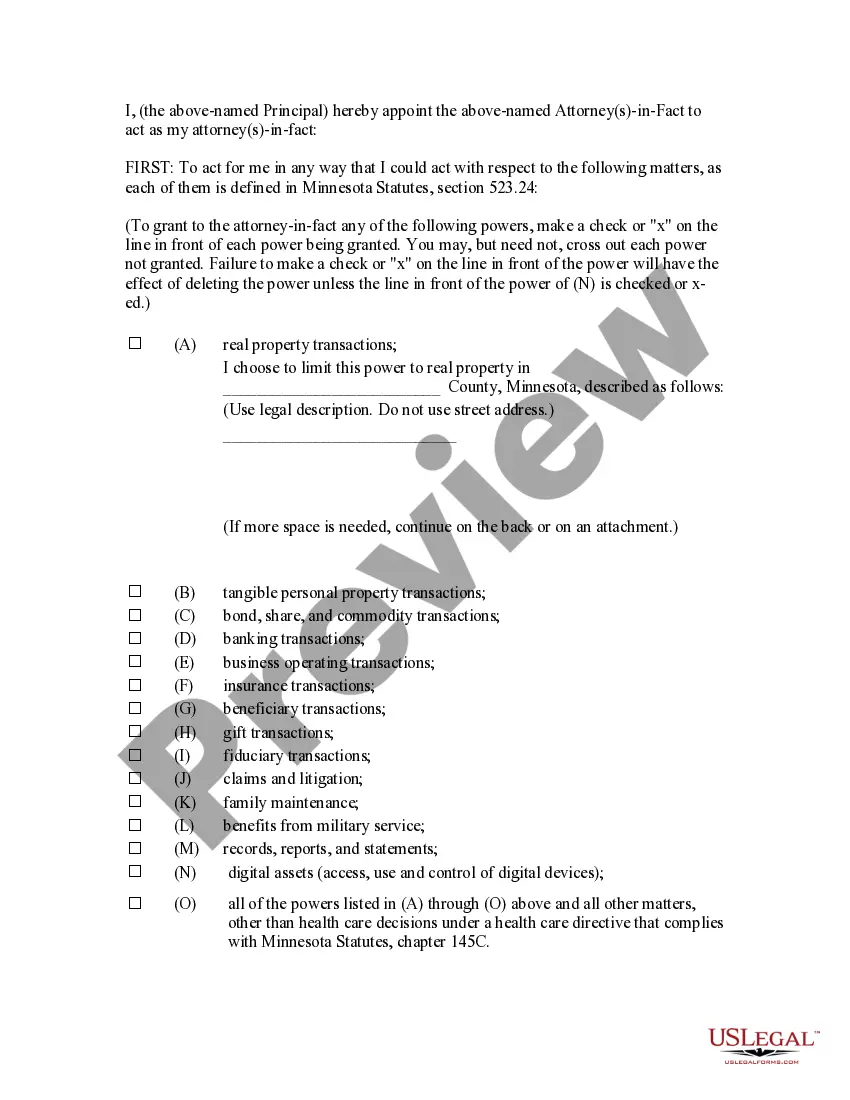

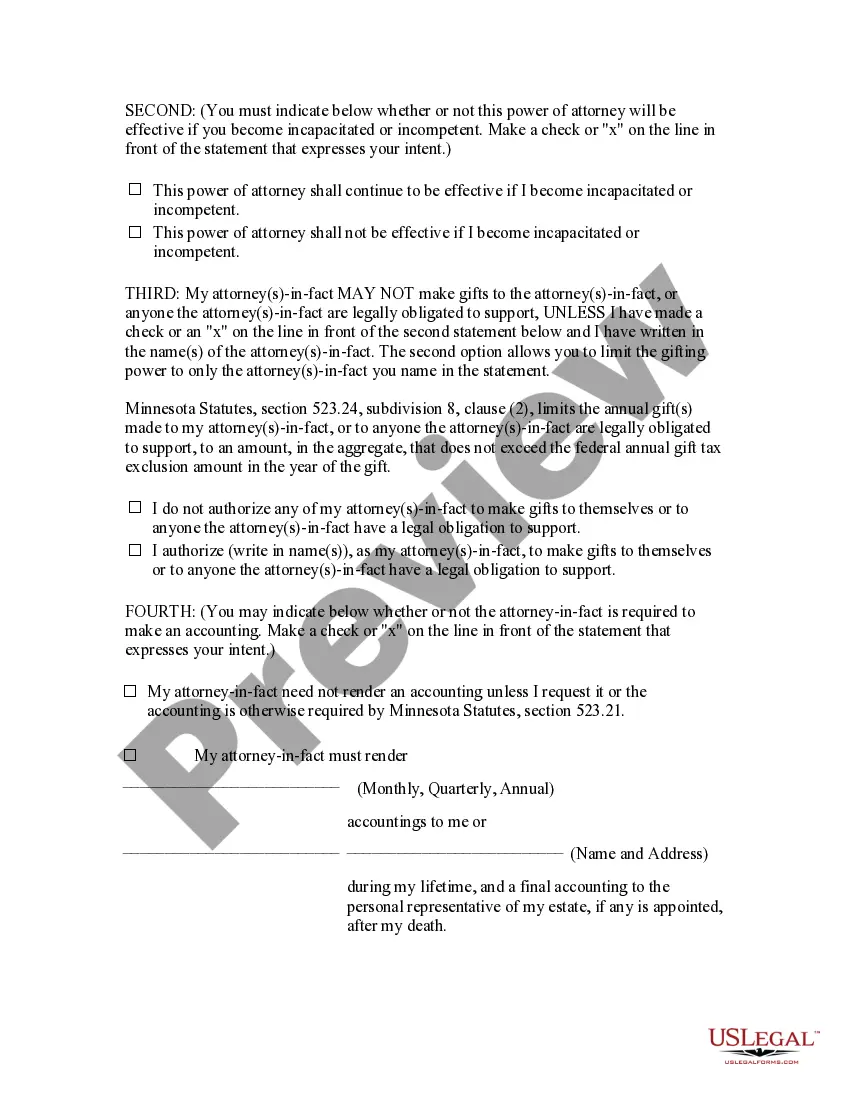

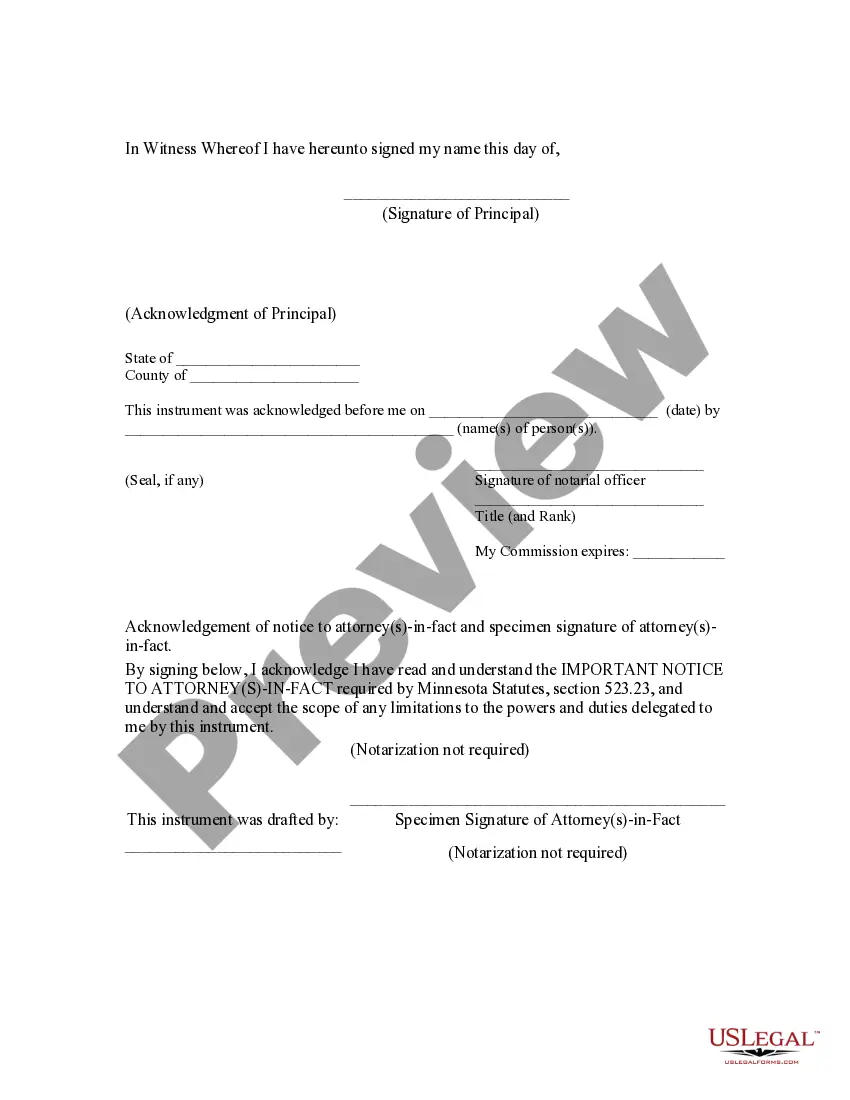

How to fill out Minnesota Statutory General Power Of Attorney With Durable Provisions?

Utilizing legal document examples that comply with federal and local regulations is essential, and the web provides numerous alternatives to choose from.

However, what is the benefit of spending time looking for the suitable Mn Attorney Minnesota Withholding template online when the US Legal Forms digital library has already compiled such documents in one place.

US Legal Forms is the most extensive online legal repository featuring over 85,000 fillable documents prepared by attorneys for various business and personal situations.

Evaluate the template using the Preview option or via the text description to guarantee it meets your requirements.

- They are easy to navigate with all forms organized by state and intended use.

- Our experts stay updated with legal changes, ensuring that your form is current and compliant when obtaining a Mn Attorney Minnesota Withholding from our site.

- Acquiring a Mn Attorney Minnesota Withholding is straightforward and swift for both existing and new users.

- If you have an account with an active subscription, Log In and download the document sample you need in your desired format.

- If you are new to our website, follow the steps below.

Form popularity

FAQ

Minnesota Withholding Tax is state income tax you as an employer take out of your employees' wages. You then send this money as deposits to the Minnesota Department of Revenue and file withholding tax returns. Withholding tax applies to almost all payments made to employees for services they provide for your business.

Starting January 1, 2024: The MN state tax withholding default will be 6.25%.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

The total number of allowances claimed is important?the more tax allowances claimed, the less income tax will be withheld from a paycheck; the fewer allowances claimed, the more tax will be withheld.

Minnesota Withholding Tax is state income tax you as an employer take out of your employees' wages. You then send this money as deposits to the Minnesota Department of Revenue and file withholding tax returns. Withholding tax applies to almost all payments made to employees for services they provide for your business.