Minnesota Seller Affidavit For Collection Of Personal Property

Description

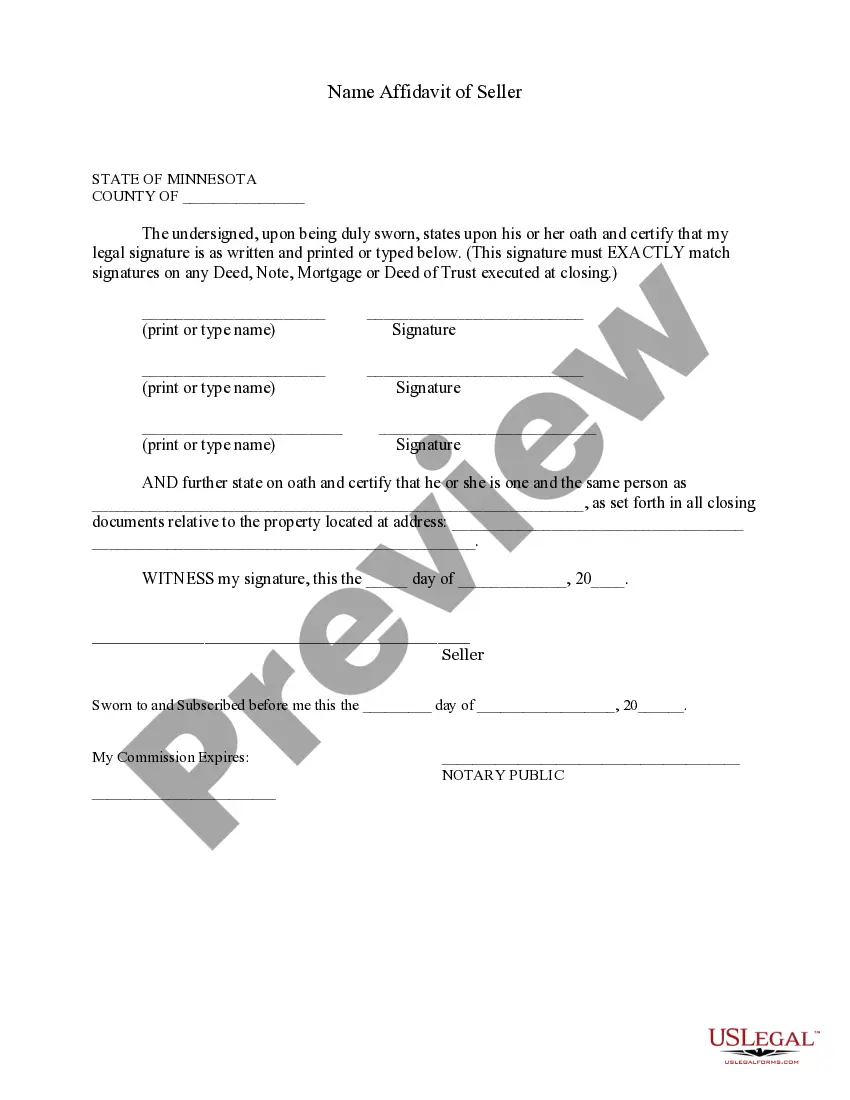

How to fill out Minnesota Name Affidavit Of Seller?

Whether you frequently handle documents or occasionally need to submit a legal paper, it is essential to have a reliable resource where all the examples are pertinent and current.

The first step you must take with a Minnesota Seller Affidavit For Collection Of Personal Property is to ensure that it is indeed its most current version, as this determines its admissibility.

If you wish to streamline your quest for the most recent document examples, search for them on US Legal Forms.

1. Use the search menu to locate the form you desire. 2. Review the preview and outline of the Minnesota Seller Affidavit For Collection Of Personal Property to confirm it is exactly what you are interested in. 3. After verifying the form, click 'Buy Now.' 4. Select a subscription plan that suits you. 5. Create an account or Log In to your existing one. 6. Enter your credit card information or PayPal details to complete the transaction. 7. Choose the file format for download and confirm it. 8. Eliminate confusion when dealing with legal documents. All your templates will be organized and verified with a US Legal Forms account.

- US Legal Forms is a repository of legal forms featuring nearly every document sample you might need.

- Look for the templates you require, review their relevance immediately, and learn more about their applications.

- With US Legal Forms, you can access over 85,000 document templates in a variety of fields.

- Obtain the Minnesota Seller Affidavit For Collection Of Personal Property samples within a few clicks and store them in your profile at any time.

- A US Legal Forms profile will provide you with convenient access to all the samples you need with greater ease and fewer complications.

- Simply click Log In in the header of the website and navigate to the My documents section to have all the forms you need at your fingertips; you won’t have to waste time either searching for the correct template or verifying its authenticity.

- To acquire a form without an account, follow these steps.

Form popularity

FAQ

Steps in estate settlementLocating the will or trust document.Consult an attorney.Secure copies of the death certificate.Inventory assets.Payment of claims and bills.Life insurance.Tax implications.Convert assets to cash.More items...

Step 1 Make a List of Assets. You can do this in a simple spreadsheet.Step 2 Download and Prepare Affidavit. Download Form 3C-E-210 and fill it out.Step 3 Get Affidavit Notarized. When you have completed the affidavit, you must swear to it and sign it before a notary public.Step 4 Collect the Assets.

How to Write(1) Name Of Minnesota Deceased.(2) County Of Minnesota Deceased.(3) Name of Minnesota Petitioner.(4) Address Of Minnesota Petition.(5) Date Of Minnesota Decedent Death.(6) Basis For Minnesota Petitioner Claim.(7) Minnesota Decedent Estate Assets.(8) Signature Date Of Minnesota Petitioner.More items...?

Other states require that the affidavit be filed with the Court. The main requirement before you may use an affidavit is that the value of the personal and/or real property of the estate not exceed a certain value.