Minnesota Bill Of Sale With Odometer Disclosure

Definition and meaning

A Minnesota Bill of Sale with Odometer Disclosure is a legal document that transfers ownership of a vehicle from the seller to the purchaser. This form not only states the terms of sale, such as the purchase price and personal information of both parties, but also provides details regarding the vehicle's odometer reading at the time of sale. The odometer disclosure is essential to ensure that the buyer is aware of the vehicle's mileage, preventing any fraudulent misrepresentation of the vehicle's condition.

How to complete a form

To complete a Minnesota Bill of Sale with Odometer Disclosure, follow these steps:

- Begin by filling in the date of the transaction at the top of the form.

- Enter the seller’s name and address, followed by the purchaser’s name and address.

- Clearly indicate the total sale price of the vehicle.

- Provide a detailed description of the vehicle, including the make, model, year, and Vehicle Identification Number (VIN).

- Record the current odometer reading.

- Both parties must sign the document, confirming their agreement to the sale.

Ensure that both parties keep a copy of the completed Bill of Sale for their records.

Who should use this form

This form is ideal for anyone involved in the buying or selling of a motor vehicle in Minnesota. It is specifically tailored for individual sellers and buyers who want to document the sale and transfer of ownership. Both private parties engaging in a sale and dealers selling used vehicles are encouraged to use this form to ensure compliance with state laws and protect their interests.

Key components of the form

The Minnesota Bill of Sale with Odometer Disclosure includes several key components:

- Seller and Purchaser Information: Names and addresses.

- Vehicle Information: Make, model, year, VIN, and odometer reading.

- Sale Price: The total amount agreed upon for the sale.

- Signatures: Both the seller and purchaser must sign the document, verifying the transaction.

Inclusion of all these details ensures a clear understanding of the transaction and maintains transparency between the parties involved.

State-specific requirements

In Minnesota, the Bill of Sale with Odometer Disclosure must comply with state regulations that mandate transparency in vehicle transactions. Sellers are required to provide accurate odometer readings to buyers, which helps prevent fraud related to vehicle mileage. Additionally, the form must be signed by both parties involved in the transaction for it to be valid.

It is also advisable to have the form notarized to further protect both parties and to ensure that the transaction is legally recognized. Some counties may have additional requirements, so it’s wise to check local laws and regulations.

Common mistakes to avoid when using this form

When completing the Minnesota Bill of Sale with Odometer Disclosure, be cautious of the following common mistakes:

- Incomplete Information: Ensure all required fields are filled out, including odometer readings and vehicle details.

- Incorrect Mileage: Double-check the odometer reading before completion.

- Missing Signatures: Both parties must sign the form for it to be valid.

- Not Notarizing: While it may not be mandatory, notarization adds an extra layer of security and legitimacy to the transaction.

Avoiding these pitfalls helps in making the transaction smooth and legally binding.

What documents you may need alongside this one

Along with the Minnesota Bill of Sale with Odometer Disclosure, consider having the following documents ready:

- Title Certificate: To prove ownership of the vehicle.

- Registration Documents: To verify the vehicle’s registration status.

- Inspection or Emission Test Certificates: If applicable, these documents can help assure the buyer of the vehicle’s condition.

- Proof of Insurance: Although not always necessary for the sale, having insurance details handy can be beneficial.

Proper documentation ensures a more straightforward transaction and peace of mind for both parties.

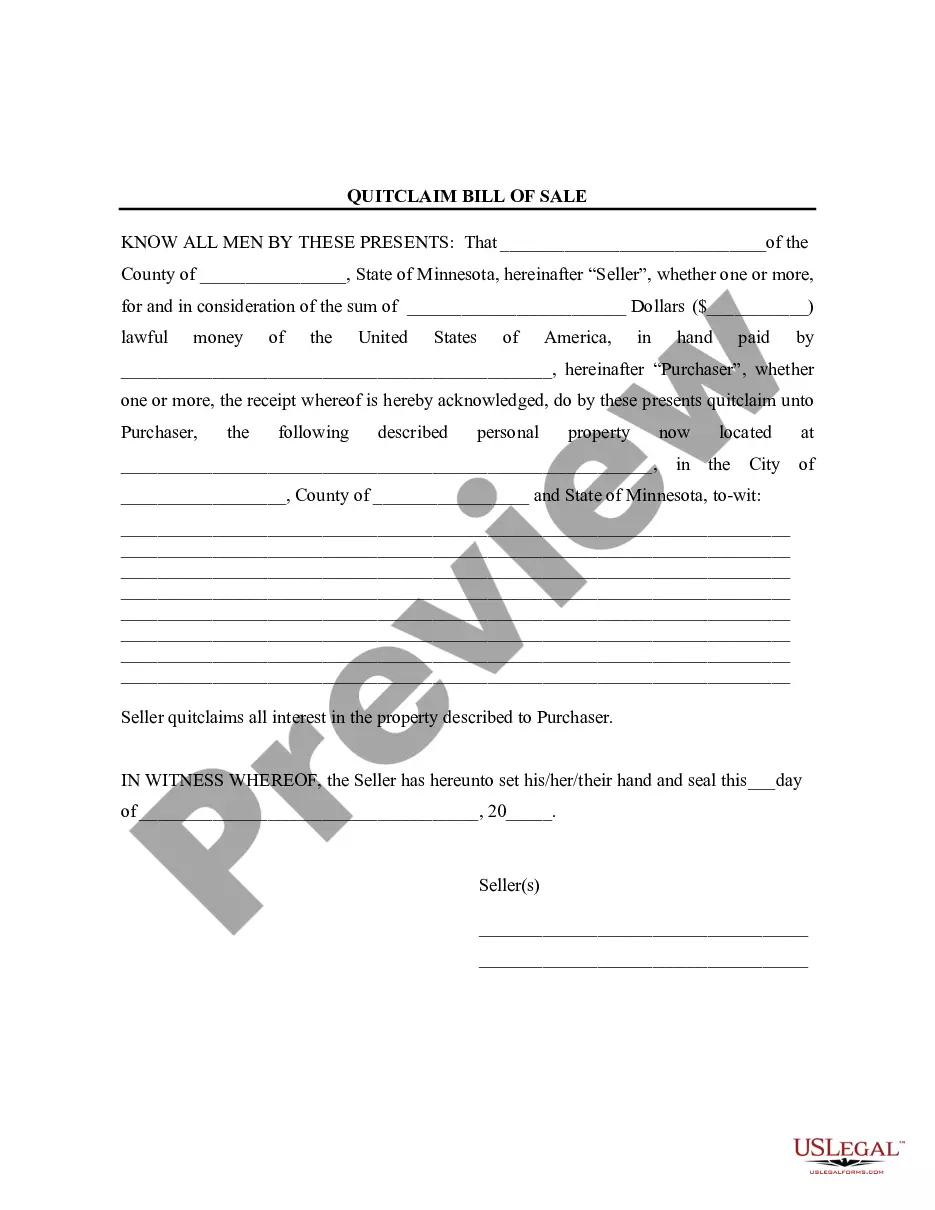

How to fill out Minnesota Bill Of Sale Without Warranty By Individual Seller?

How to acquire professional legal documents that comply with your state laws and create the Minnesota Bill Of Sale With Odometer Disclosure without the need for a lawyer? Numerous online services provide templates for various legal events and formalities. However, it may require time to determine which available samples satisfy both your situation and legal standards.

US Legal Forms is a trustworthy platform that aids in finding official papers crafted according to the latest state legal updates, allowing you to save on legal fees.

US Legal Forms is not just a typical online library. It comprises over 85,000 verified templates for various business and personal situations. All documents are categorized by field and state to enhance your search efficiency and ease.

Search for an alternative template in the header by selecting your state if necessary. Click the Buy Now button when you discover the correct document. Choose the most appropriate pricing plan, then either Log In or register for an account. Select your payment method (by credit card or via PayPal). Change the file format for your Minnesota Bill Of Sale With Odometer Disclosure and click Download. The documents you obtain remain with you: you can always access them in the My documents section of your account. Join our platform and prepare legal documents independently like a seasoned legal expert!

- It also integrates with powerful solutions for PDF editing and eSigning, enabling users with a Premium subscription to swiftly complete their paperwork online.

- Obtaining the necessary documents requires minimal time and effort.

- If you have an account already, Log In and ensure your subscription is active.

- Download the Minnesota Bill Of Sale With Odometer Disclosure using the corresponding button next to the file name.

- If you do not possess an account with US Legal Forms, follow the steps below.

- Examine the webpage you've accessed to verify if the form meets your requirements.

- Utilize the form description and preview options if available.

Form popularity

FAQ

Federal law mandates that vehicle sellers provide an odometer disclosure statement to potential buyers when transferring ownership. This requirement aims to protect consumers from odometer fraud. By including an odometer disclosure in your Minnesota bill of sale, you comply with both state and federal regulations, ensuring a fair transaction for everyone involved.

Yes, you can void a bill of sale under specific circumstances, such as fraud or misrepresentation. If either party did not provide accurate information, the agreement might be considered void. It is crucial to have everything documented correctly in your Minnesota bill of sale with odometer disclosure to minimize the chances of needing to void the agreement.

Texas law requires any transfer of ownership to include an odometer disclosure statement, reflecting the vehicle's mileage at the time of sale. Buyers and sellers need to ensure that this disclosure is accurate to avoid potential legal issues. While this information is crucial in Texas, adhering to similar requirements in Minnesota with a bill of sale with odometer disclosure can help facilitate a smooth transaction.

For a bill of sale to be legally binding, it typically needs to include specific elements such as the identification of both the buyer and seller, a description of the item being sold, and the terms of the sale. In Minnesota, completing a bill of sale with odometer disclosure adds further protection, as it provides essential information about the vehicle's mileage. Make sure all parties sign the document to affirm their agreement.

To certify an odometer reading, both the buyer and seller must sign an odometer disclosure statement. This document clearly states the current mileage of the vehicle at the point of sale. Including this certification in your Minnesota bill of sale with odometer disclosure helps ensure transparency and accountability for both parties involved in the transaction.

An odometer disclosure statement does not need to be notarized in Minnesota. However, notarization can add a layer of protection by verifying the identities of the signers. When you are completing a Minnesota bill of sale with odometer disclosure, ensure that the information is accurate and signed by both parties to avoid future disputes.

A buyer can back out of a bill of sale in certain circumstances, such as if the seller misrepresented the vehicle or failed to provide clear title. However, once a Minnesota bill of sale with odometer disclosure is signed, it generally becomes a binding agreement. It's best for prospective buyers to understand their rights and seek resolution through discussion before making a final decision. Keep in mind that repercussions may apply if you back out without valid reasons.

In Minnesota, an odometer disclosure does not typically need to be notarized to remain valid. However, having it notarized can provide additional assurance of authenticity. When you complete a Minnesota bill of sale with odometer disclosure, it is essential to ensure that both parties sign the document. This helps protect both the buyer and seller in case of any disputes.

Yes, you can obtain a title using a handwritten bill of sale, as long as it meets legal requirements. In Minnesota, a bill of sale including an odometer disclosure can simplify the process of transferring ownership for vehicles. Ensure that the bill of sale is filled out correctly, as this document is often necessary when applying for the title.

To create a handwritten bill of sale, start by including the date of the transaction, the names and addresses of both the buyer and seller, as well as a description of the item being sold. For vehicles, ensure you include the odometer reading to comply with the Minnesota bill of sale with odometer disclosure requirements. You can also add payment details and any warranties or conditions related to the sale.