Authorization For Release Of Employment Information Mn Withholding

Description

How to fill out Minnesota Authorization To Release Employment Information?

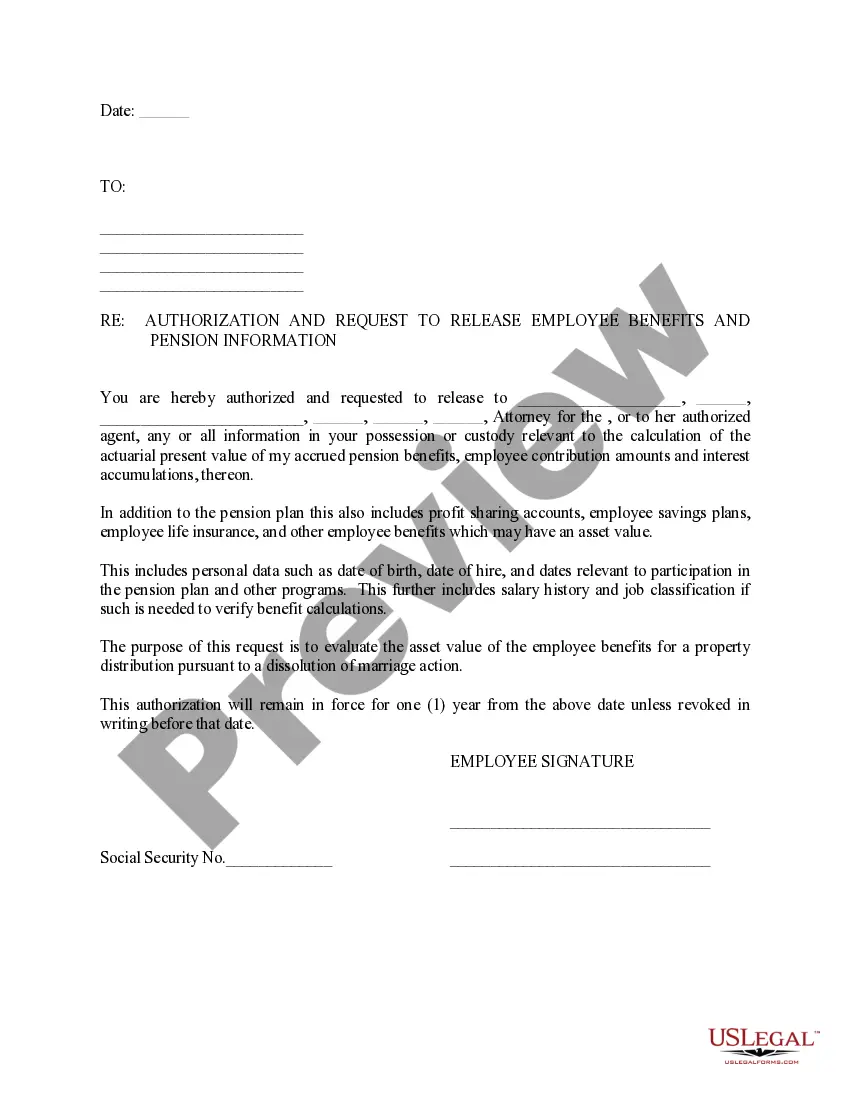

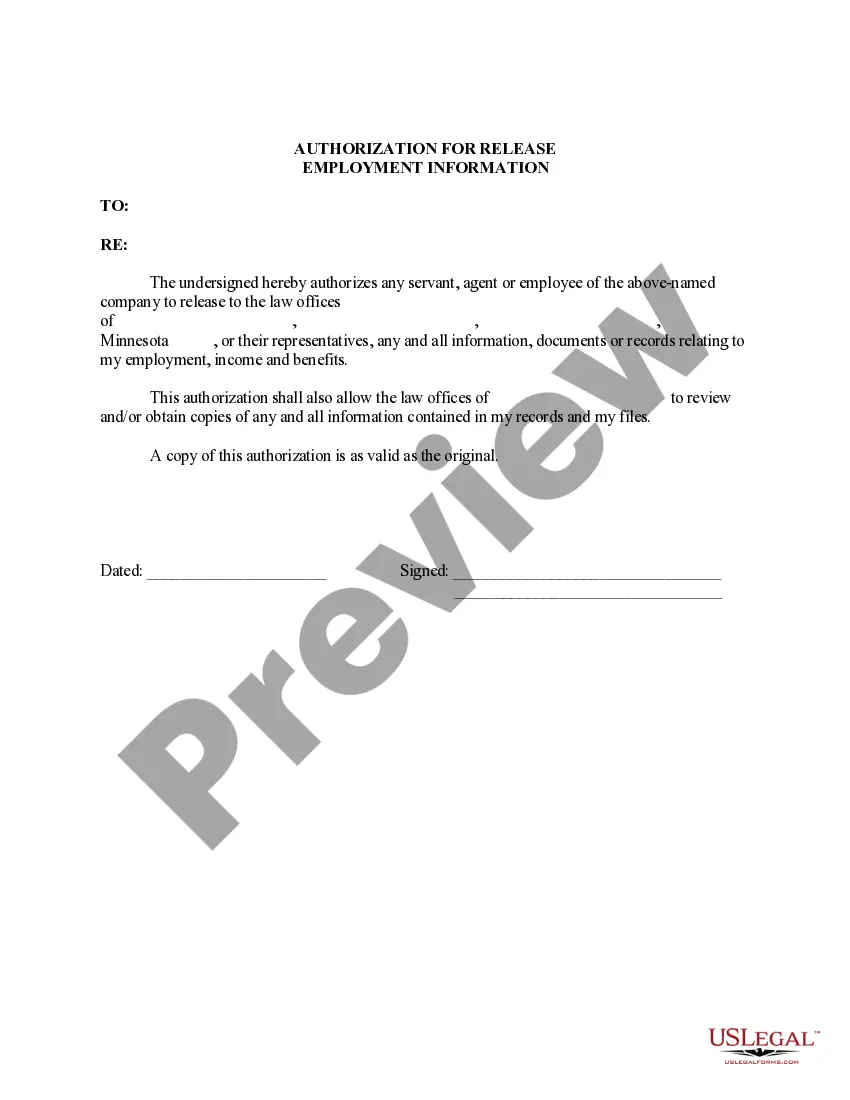

The Authorization For Release Of Employment Information Mn Withholding you see on this page is a multi-usable formal template drafted by professional lawyers in compliance with federal and regional regulations. For more than 25 years, US Legal Forms has provided individuals, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the quickest, most straightforward and most trustworthy way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Getting this Authorization For Release Of Employment Information Mn Withholding will take you just a few simple steps:

- Search for the document you need and check it. Look through the sample you searched and preview it or review the form description to ensure it satisfies your requirements. If it does not, utilize the search option to find the correct one. Click Buy Now once you have located the template you need.

- Subscribe and log in. Select the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Acquire the fillable template. Pick the format you want for your Authorization For Release Of Employment Information Mn Withholding (PDF, Word, RTF) and download the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a eSignature.

- Download your paperwork one more time. Make use of the same document again anytime needed. Open the My Forms tab in your profile to redownload any previously downloaded forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

New Hire Paperwork and Compliance for Minnesota W-4. W-4MN. Wage Theft Notice. Notice of Review of Personnel Records. Notice of Drug and Alcohol Policy. I-9. New Hire Reporting. W-2.

Form W-4 tells you the employee's filing status, multiple jobs adjustments, amount of credits, amount of other income, amount of deductions, and any additional amount to withhold from each paycheck to use to compute the amount of federal income tax to deduct and withhold from the employee's pay. Topic No. 753, Form W-4 ? Employee's Withholding Certificate irs.gov ? taxtopics irs.gov ? taxtopics

Form W-4, Employee's Withholding Certificate, is generally completed at the start of any new job. This form tells your employer how much federal income tax withholding to keep from each paycheck. This form is crucial in determining your balance due or refund each tax season.

Requirements for New Employees To know how much federal and state income tax to withhold from employee wages, you will need both a federal Form W-4 and Minnesota Form W-4MN for each employee. Ask all new employees to complete both the federal and state forms before they begin working.

If you are exempt from Minnesota withholding, your employer or payer does not have to withhold Minnesota tax. You may claim exempt from Minnesota withholding if at least one of these apply: You meet the requirements and claim exempt from federal withholding.