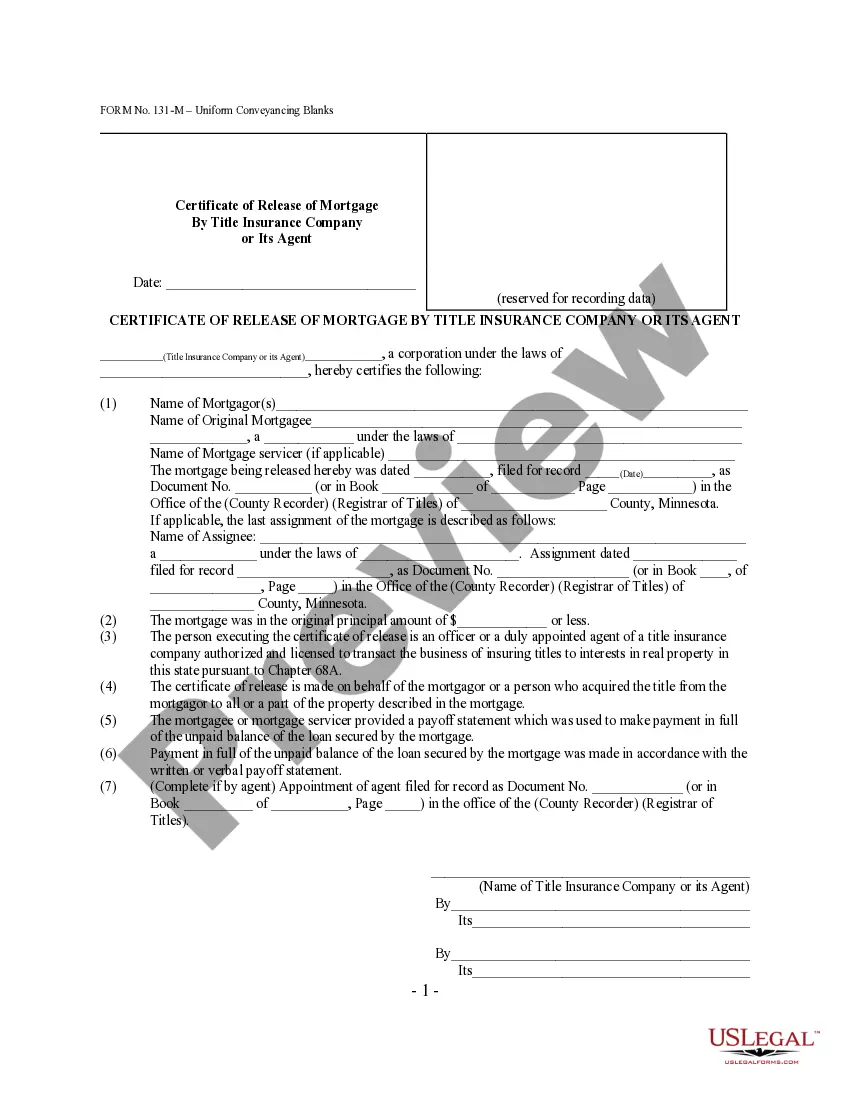

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Partial Release Form Withdrawal

Description

How to fill out Minnesota Certificate Of Partial Release Of Mortgage And Assignment Of Rents And Profits By Title Insurance Company Or Its Agent - Minn. Stat. 507.401 - UCBC Form 20.7.4?

Bureaucracy requires precision and meticulousness.

If you don't handle filling out documents like the Partial Release Form Withdrawal on a daily basis, it might lead to some misunderstanding.

Selecting the correct sample from the outset will ensure that your document submission goes effortlessly and avoid the issues of resubmitting a file or having to redo the entire task from the beginning.

If you are not a member, locating the necessary sample will require a few extra steps: Locate the template using the search bar.

- You can always obtain the appropriate sample for your documentation at US Legal Forms.

- US Legal Forms is the largest online collection of forms, containing over 85 thousand templates across different sectors.

- You can easily find the most recent and suitable version of the Partial Release Form Withdrawal by simply navigating through the website.

- Access, store, and save templates in your account, or refer to the description to ensure you have the correct one available.

- With an account at US Legal Forms, you can compile, store in one place, and browse through the templates you have saved to reach them with a few clicks.

- When on the webpage, click the Log In button to authenticate.

- Next, go to the My documents page, where your documents are listed.

- Review the descriptions of the forms and save the ones you need at any time.

Form popularity

FAQ

The document used to release a lien is Form 668(Z),Certificate of Release of Federal Tax Lien. Servicewide Delegation Order 5-4 lists those employees who have the authority to approve Federal tax lien releases and other lien related certificates.

If there is a federal tax lien on your home, you must satisfy the lien before you can sell or refinance your home.

A partial tax lien release will only apply to a certain piece of property, but it can be useful to help prevent the encumbrance of an asset. One common example of where a partial release of lien is helpful is when the taxpayer is short-selling their residence in order to free up financial flexibility.

If you have failed to pay your tax debt after receiving a Notice and Demand for Payment from the IRS and are now facing a federal tax lien, you may be wondering when the lien will expire. At a minimum, IRS tax liens last for 10 years.

Taxpayers generally request the withdrawal using Form 12277, Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien; however, any written request that provides sufficient information may by used. Requests for withdrawals should be considered regardless of the date the NFTL was filed.