117 M Corporation Affidavit Regarding Corporation Withdrawal

Description

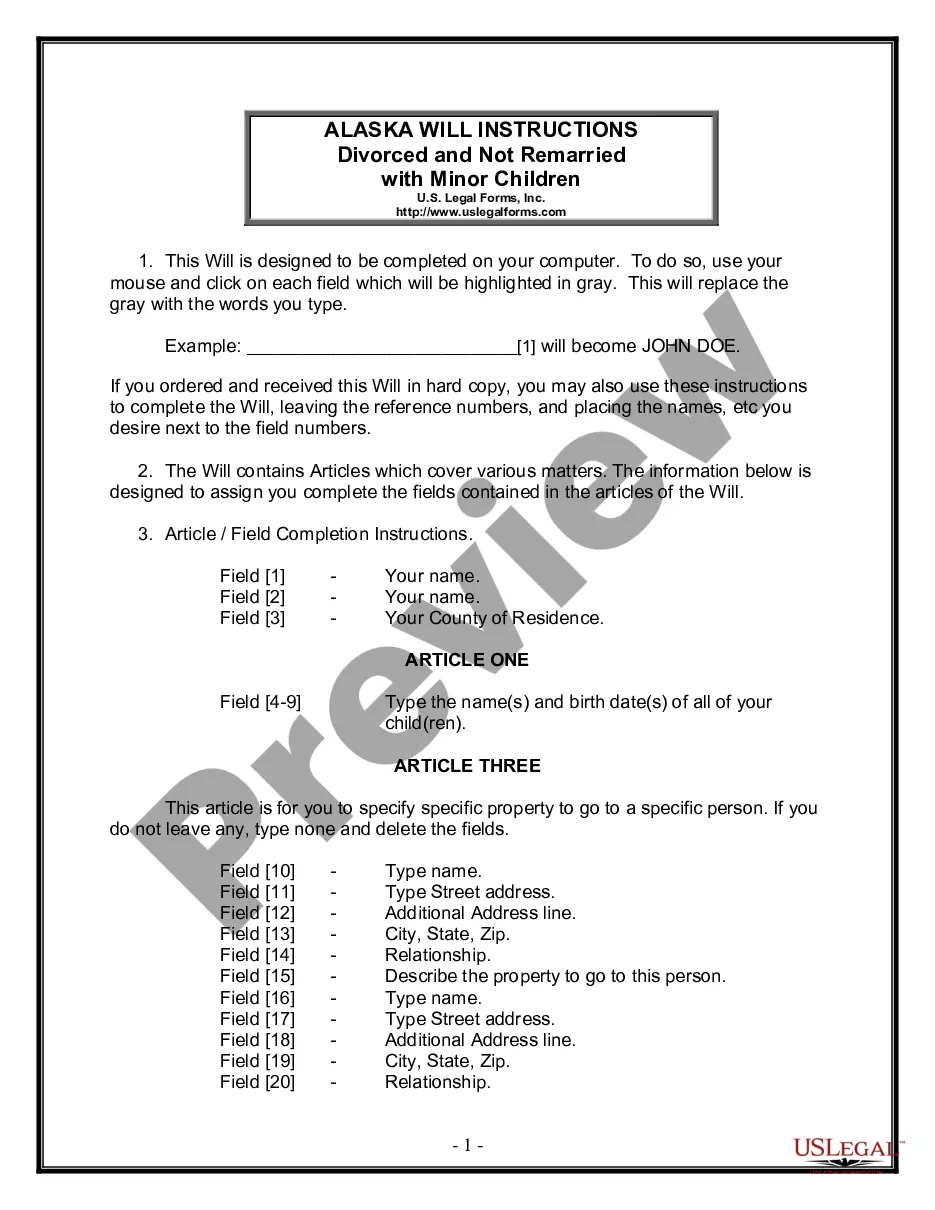

How to fill out Minnesota Affidavit Regarding Corporation - UCBC Form 50.1.3?

There’s no longer justification to waste hours searching for legal documents to adhere to your local state rules. US Legal Forms has gathered all of them in a single location and simplified their availability.

Our platform provides over 85,000 templates for any business and personal legal situations organized by state and category of use. All forms are correctly drafted and validated for authenticity, so you can feel assured in acquiring an up-to-date 117 M Corporation Affidavit Concerning Corporation Withdrawal.

If you're acquainted with our service and already possess an account, you must confirm your subscription is active before accessing any templates. Log In to your account, choose the document, and click Download. You can also return to all stored paperwork whenever necessary by accessing the My documents tab in your profile.

Print your form to fill it in by hand or upload the sample if you prefer to edit it online. Preparing formal documents under federal and state guidelines is quick and easy with our platform. Experience US Legal Forms today to keep your paperwork organized!

- If you’ve never interacted with our service before, the process will require a few more steps to finalize.

- Here’s how new users can locate the 117 M Corporation Affidavit Concerning Corporation Withdrawal in our collection.

- Examine the page content thoroughly to ensure it contains the sample you need.

- To do this, utilize the form description and preview options if available.

- Use the Search bar above to look for another sample if the current one doesn’t meet your needs.

- Click Buy Now adjacent to the template name when you find the right one.

- Select the desired pricing plan and either register for an account or Log In.

- Complete payment for your subscription using a credit card or through PayPal to continue.

- Choose the file format for your 117 M Corporation Affidavit Concerning Corporation Withdrawal and download it onto your device.

Form popularity

FAQ

To withdraw or cancel your Foreign Corporation in Utah, you must provide the completed Application for Withdrawal form, along with a Tax Clearance Certificate from the Utah State Tax Commission, to the Division of Corporations & Commercial Codes by mail, fax or in person.

To withdraw or cancel your Foreign Corporation in Utah, you must provide the completed Application for Withdrawal form, along with a Tax Clearance Certificate from the Utah State Tax Commission, to the Division of Corporations & Commercial Codes by mail, fax or in person.

Corporations ending business in New Jersey can dissolve, cancel, or withdraw online. Go to njportal.com/dor/annualreports and select Close a Business. Businesses that choose to complete a paper application must submit all of the following: Appropriate dissolution/withdrawal/cancellation form.

Certificate of withdrawal of registration must be accompanied by a certificate of account status from the Texas Comptroller of Public Accounts indicating that all taxes administered by the Comptroller under Title 2, Tax Code have been paid and that the entity is in good standing for the purpose of withdrawal.

To cancel a foreign LLC, just submit form L-109, Certificate of Cancellation to the New Jersey Division of Revenue. To withdraw a foreign corporation, file form C-124P, Certificate of Withdrawal with the Division of Revenue.