Minnesota Tenant With Withholding

Description

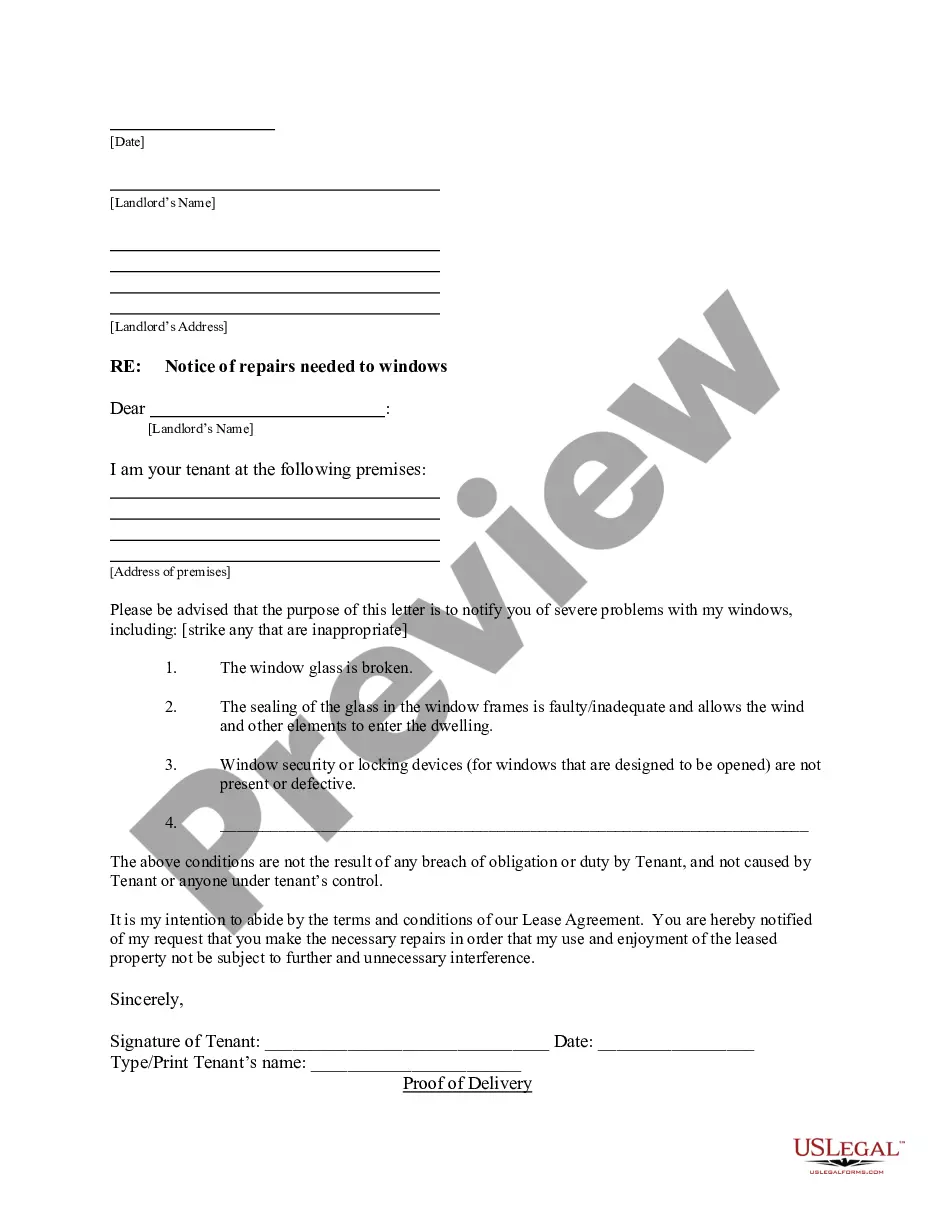

How to fill out Minnesota Letter From Tenant To Landlord With Demand That Landlord Repair Broken Windows?

Getting a go-to place to take the most recent and relevant legal templates is half the struggle of dealing with bureaucracy. Discovering the right legal documents needs accuracy and attention to detail, which is the reason it is crucial to take samples of Minnesota Tenant With Withholding only from reliable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to be concerned about. You can access and check all the details about the document’s use and relevance for the circumstances and in your state or county.

Consider the following steps to complete your Minnesota Tenant With Withholding:

- Utilize the library navigation or search field to find your template.

- View the form’s information to see if it matches the requirements of your state and county.

- View the form preview, if available, to ensure the form is definitely the one you are looking for.

- Get back to the search and find the appropriate document if the Minnesota Tenant With Withholding does not suit your needs.

- If you are positive about the form’s relevance, download it.

- If you are an authorized user, click Log in to authenticate and gain access to your picked forms in My Forms.

- If you do not have a profile yet, click Buy now to get the template.

- Choose the pricing plan that suits your requirements.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by choosing a transaction method (credit card or PayPal).

- Choose the document format for downloading Minnesota Tenant With Withholding.

- Once you have the form on your gadget, you can change it with the editor or print it and complete it manually.

Eliminate the inconvenience that comes with your legal documentation. Check out the extensive US Legal Forms catalog to find legal templates, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

If you are exempt from Minnesota withholding, your employer or payer does not have to withhold Minnesota tax. You may claim exempt from Minnesota withholding if at least one of these apply: You meet the requirements and claim exempt from federal withholding.

Starting January 1, 2024: The MN state tax withholding default will be 6.25%. Benefit recipients may complete a W-4MNP to choose an alternative withholding rate including a specified percentage, dollar amount, or no withholding.

Minnesota Withholding Tax ID Number You can find your Withholding Account ID online or on any notice you have received from the Department of Revenue. If you're unable to locate this, contact the agency at (651) 282-9999.

Form W-4MN, Minnesota Employee Withholding Allowance/Exemption Certificate, is the Minnesota equivalent of federal Form W-4. Your employees must complete Form W-4MN to determine their Minnesota tax withheld. You also may need to submit Forms W-4MN to the Minnesota Department of Revenue.

Minnesota Withholding Tax is state income tax you as an employer take out of your employees' wages. You then send this money as deposits to the Minnesota Department of Revenue and file withholding tax returns. Withholding tax applies to almost all payments made to employees for services they provide for your business.