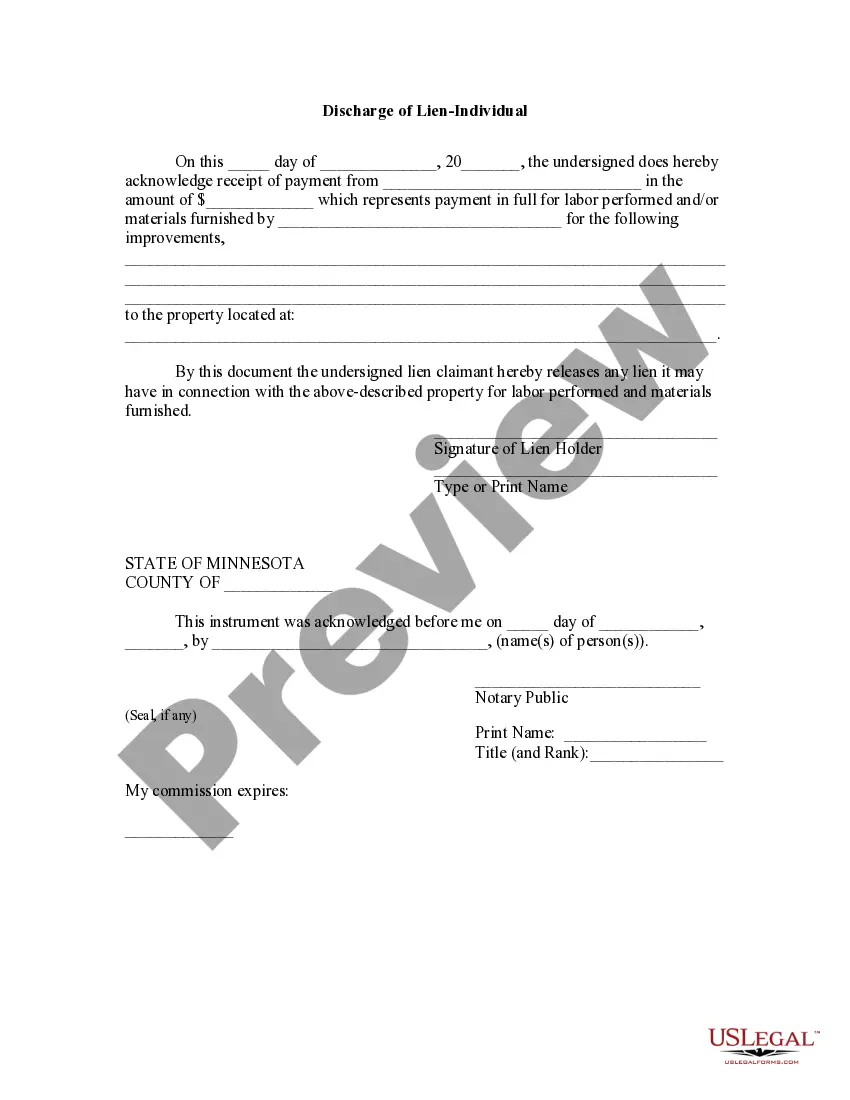

Minnesota law does not have a specific provision for the release of a lien. However, this form is a general use form that would allow a lien holder to provide notice that the lien is released after being paid in full.

Minnesota Pre Lien Forms

Description

Form popularity

FAQ

In Minnesota, lien releases usually need to be notarized to ensure the legitimacy of the document. Notarization adds an essential layer of verification, confirming that the parties involved are who they claim to be. This requirement helps avoid disputes over property ownership and ensures that all parties agree on the release. Using Minnesota pre lien forms from USLegal can help simplify the process and ensure all legal requirements are met.

When you receive a lien release in Minnesota, it is important to take the necessary steps to ensure your property records reflect this change. First, you should file the lien release with your county's recorder office. This action removes the financial claim against your property, making it clear to future creditors that there are no outstanding liens. For added security, consider using Minnesota pre lien forms to streamline the process of document preparation.

Minnesota has specific rules governing the establishment and enforcement of liens. Generally, lien holders must adhere to strict timelines for filing and notifications. Familiarizing yourself with these guidelines ensures compliance and protection of your rights. For more details, exploring Minnesota pre lien forms can provide you with the necessary templates and information to navigate the lien process effectively.

To remove a lien in Minnesota, you typically need to file a release of lien using the proper Minnesota pre lien forms. Gather all necessary documentation proving that the debt or obligation has been settled. Once completed, submit the release form to the county recorder’s office where the lien was originally filed. This action will clear the property of the lien and restore full legal rights.

While the requirements for lien waivers in California can vary, it is generally advisable to have them notarized for added security. However, this practice is not universally required for all lien waivers. To ensure compliance, it’s best to consult the specific rules of your project or seek legal guidance. Stay informed about the implications of using Minnesota pre lien forms and their acceptance in various contexts.

To file a lien on property in Minnesota, you need to complete the appropriate Minnesota pre lien forms. Ensure that you have all necessary details about the property and the parties involved. After filling out the forms, file them with the county recorder in the county where the property is located. This step is crucial to enforce your lien rights.

In Minnesota, you typically have 120 days from the date of last providing labor or materials to file a lien using the Minnesota pre lien forms. It is essential to be aware of this time limit to secure your rights. If you miss this deadline, you may lose your chance to enforce the lien. Using the correct forms is crucial, and you can find the right documents through platforms like US Legal Forms.

Filing a pre-lien in Minnesota involves a few key steps. First, send a pre-lien notice to the property owner within the legal timeframe. Then, fill out the Minnesota pre lien forms and file them with the appropriate county office. This process is essential for protecting your financial interests in construction projects.

To file a lien on a property in Minnesota, start by gathering necessary documentation related to your claim. Complete the Minnesota pre lien forms accurately and submit them to the county recorder's office where the property is located. This formal filing secures your right to seek payment for services or materials provided.

To file a pre-lien in Minnesota, begin by ensuring you send a proper pre-lien notice within the required timeframe. After sending the notice, fill out the appropriate Minnesota pre lien forms and file them with the county recorder's office. This process establishes your rights and interests in the property.