Affidavit Of Heirship Minnesota With Will Attached Texas

Description

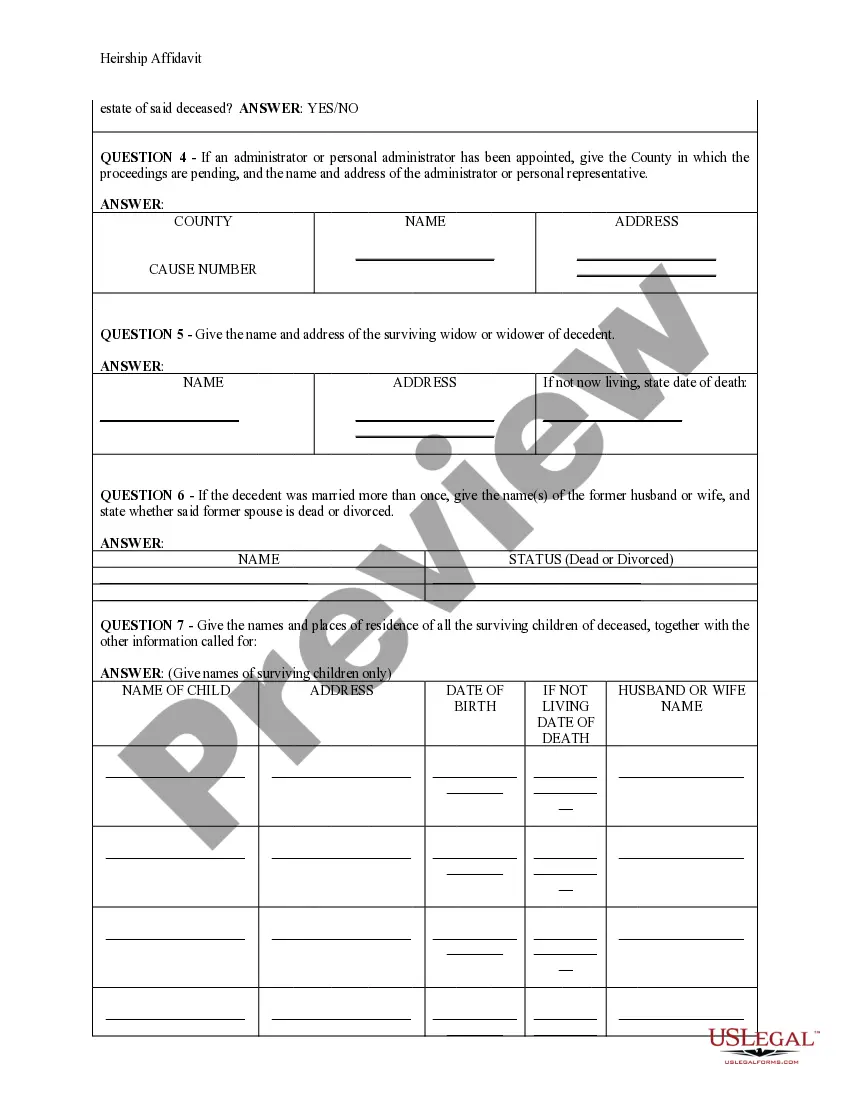

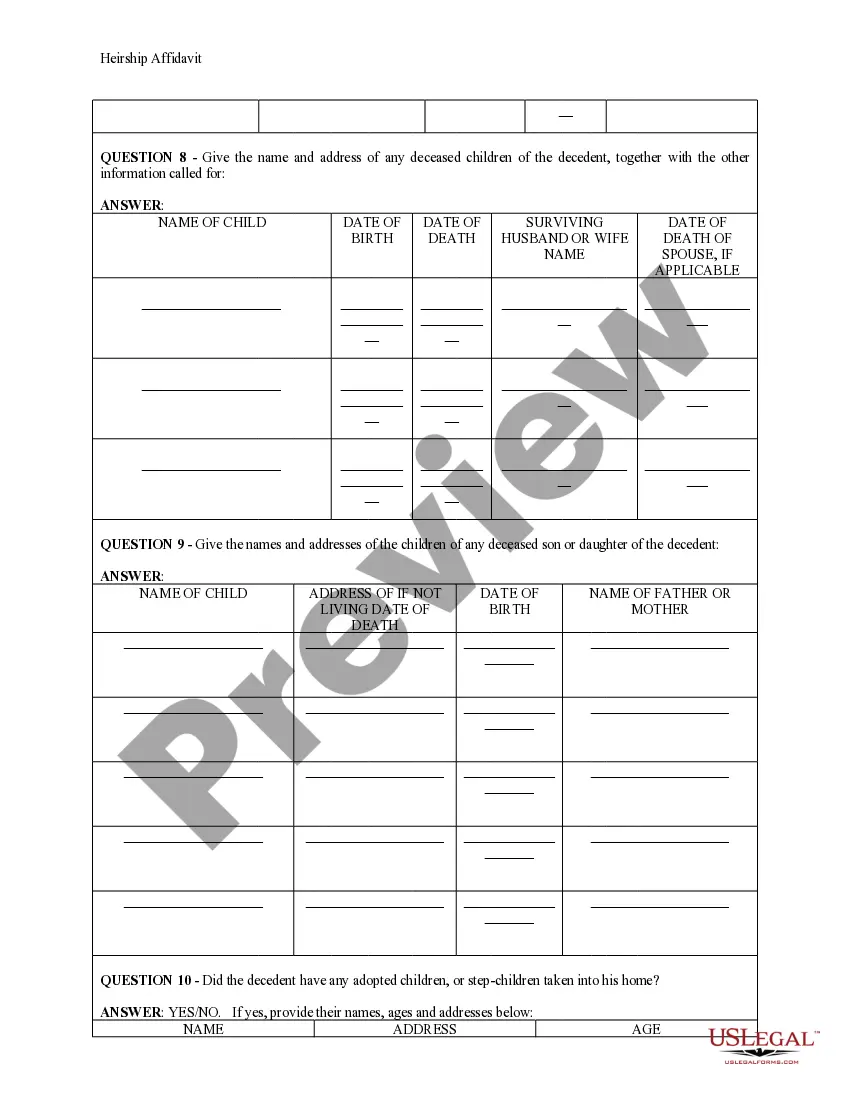

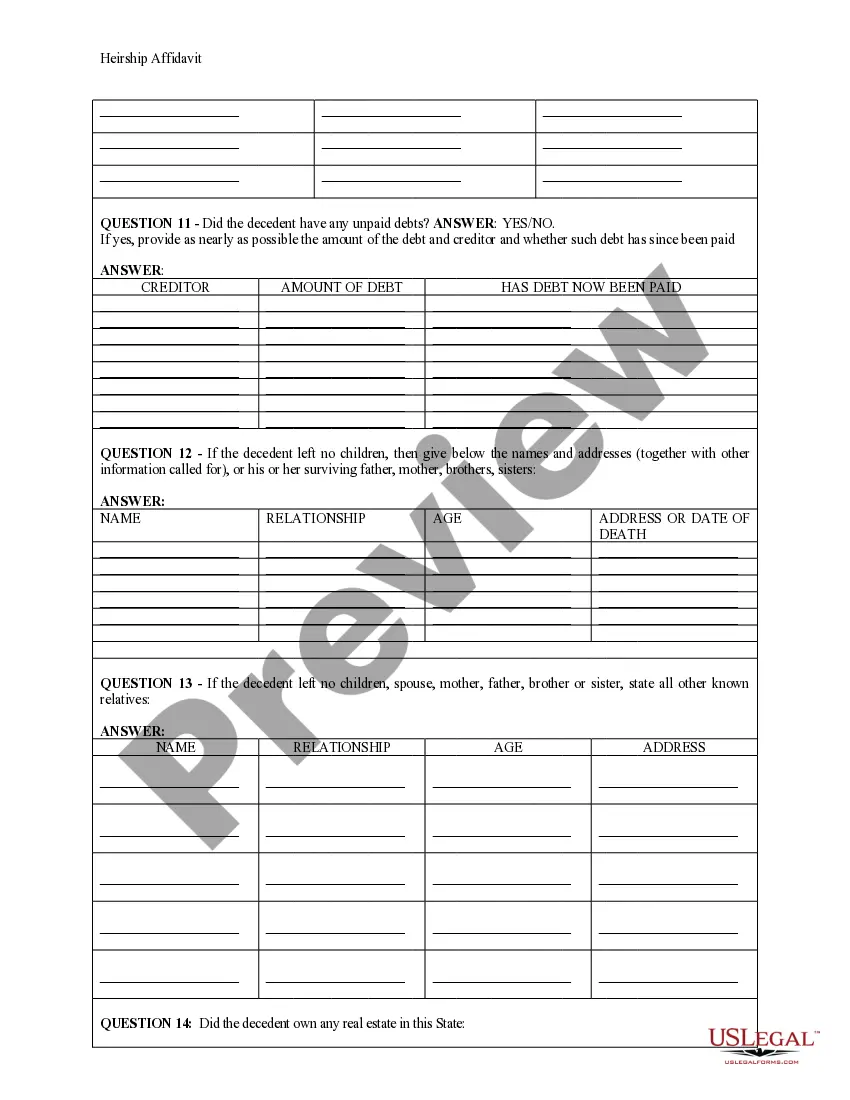

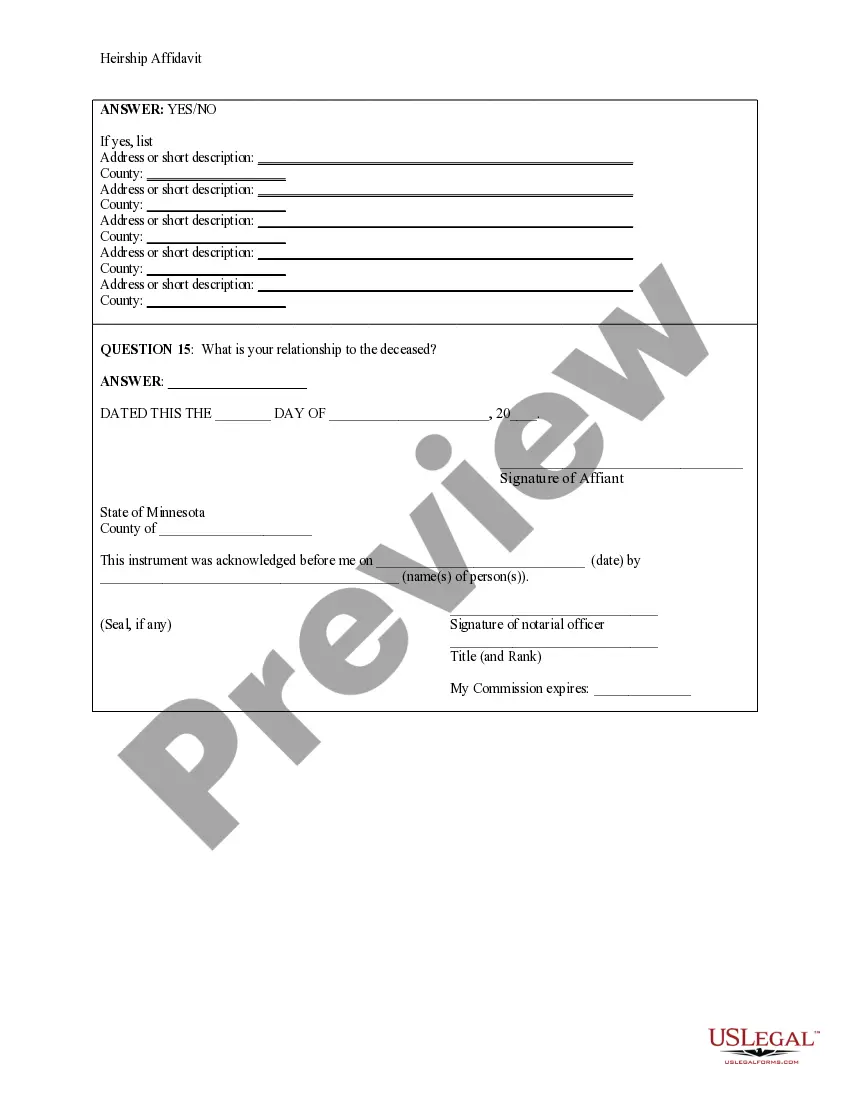

How to fill out Minnesota Heirship Affidavit - Descent?

The Affidavit Of Heirship Minnesota With Will Attached Texas you see on this page is a reusable legal template drafted by professional lawyers in compliance with federal and state laws and regulations. For more than 25 years, US Legal Forms has provided people, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the quickest, easiest and most reliable way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Affidavit Of Heirship Minnesota With Will Attached Texas will take you just a few simple steps:

- Look for the document you need and review it. Look through the sample you searched and preview it or review the form description to ensure it fits your requirements. If it does not, use the search option to find the appropriate one. Click Buy Now once you have found the template you need.

- Subscribe and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Choose the format you want for your Affidavit Of Heirship Minnesota With Will Attached Texas (PDF, DOCX, RTF) and download the sample on your device.

- Complete and sign the paperwork. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork again. Utilize the same document once again anytime needed. Open the My Forms tab in your profile to redownload any previously downloaded forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

When using an affidavit of heirship in Texas, the witnesses must swear to the following conditions: They knew the decedent. The decedent did not owe any debts. The true identity of the family members and heirs. The person died on a certain date in a certain place. The witness will not gain financially from the estate.

An Affidavit of Survivorship is a sworn statement signed by the surviving owner to verify that the co-owner of the property has passed, and that the property has passed to the surviving owner.

Even if the deceased had a Will, an Heirship Affidavit may be used rather than probating the Will if the Will leaves the property solely to the direct descendants of the deceased. Note: Using this affidavit may be a less expensive and quicker option for title transfer of real property compared to a probate proceeding.

A ballpark fee for preparation of the affidavit is between $750 for a very simple estate with few heirs to several thousand dollars for a more complicated estate with many heirs. The filing fees to record the affidavit in each county where the real property is located usually run about $50 to $75 in Texas.

An affidavit of heirship is easier than going through the court process, but it only applies to land/real estate property. It does not cure or determine beneficiaries to bank accounts or other assets.