Owner Corporation Paper With Picture Box

Description

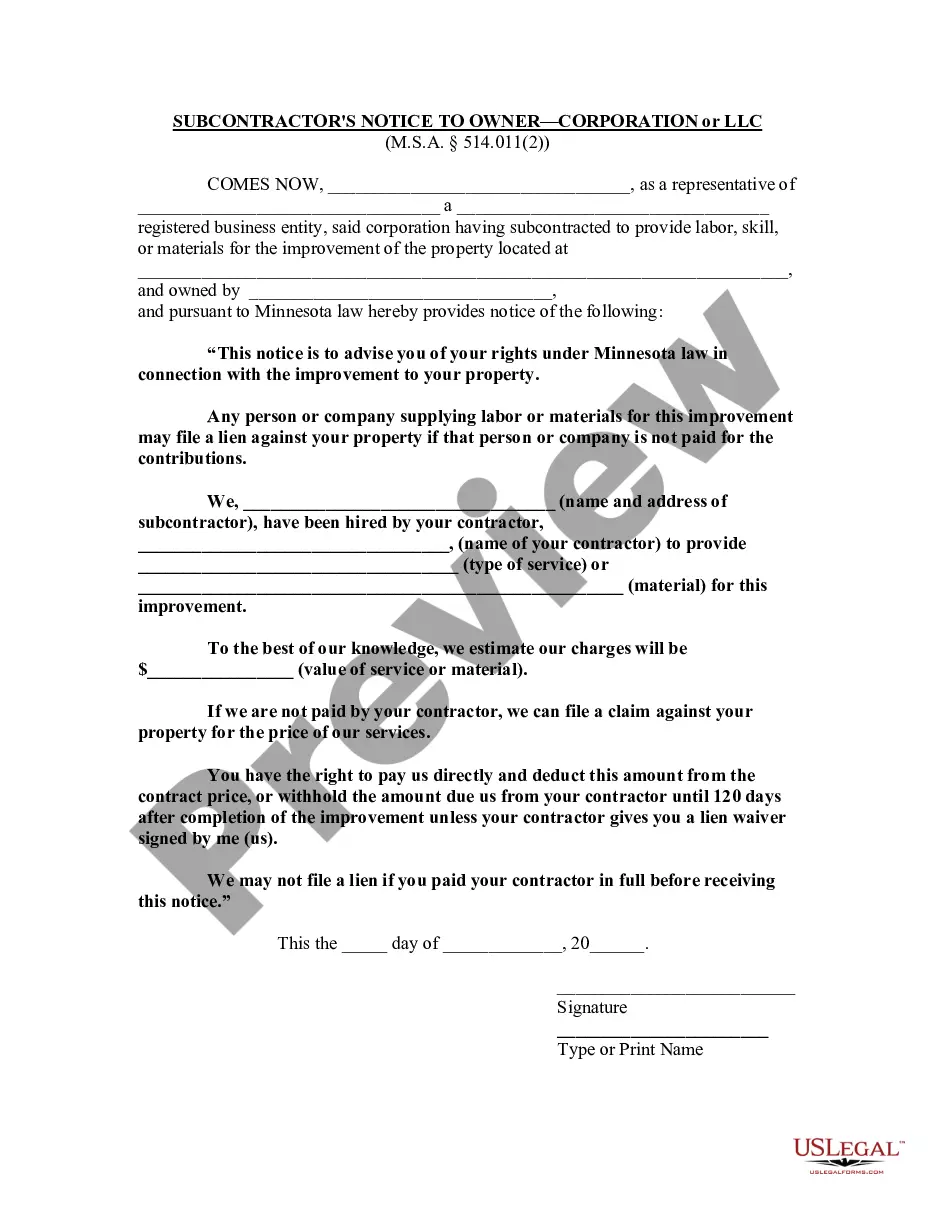

How to fill out Minnesota Contractor's Notice To Owner - Corporation Or LLC?

- Log into your account at US Legal Forms if you're a returning user and check your subscription status to ensure it’s active.

- If you're new, start by browsing the extensive legal form library. Preview relevant forms, making sure they align with your local laws.

- If the desired form isn’t found, utilize the search feature to locate the appropriate template that meets your requirements.

- Proceed to purchase the document by clicking the 'Buy Now' button, selecting a subscription plan that suits you, and creating an account if you haven't done so already.

- Complete the transaction by entering your payment details using a credit card or PayPal.

- Finally, download your essential form. It will be saved on your device and accessible via the 'My Forms' menu for future reference.

In conclusion, US Legal Forms provides an efficient way to obtain legal documents like the owner corporation paper with picture box. With its extensive library and easy navigation, you can ensure your paperwork is completed accurately and conveniently. For legal form needs, start your journey with US Legal Forms today!

Don’t hesitate, explore your options now and simplify your legal paperwork process!

Form popularity

FAQ

Your beneficial ownership report should be filed with the appropriate government agency, which is usually the state or federal regulator overseeing corporate disclosures. You can utilize the USLegalForms platform for creating the owner corporation paper with picture box, ensuring you have all the necessary details organized. Check your state laws for specific filing instructions and deadlines to remain compliant.

A CTA file refers to the Corporate Transparency Act filing which contains important details about the beneficial owners of a corporation. By filing this document, you maintain transparency with regulatory bodies and help combat financial crime. Use the USLegalForms platform to generate your owner corporation paper with picture box, ensuring completeness and accuracy in your CTA filing.

You should file your CTA report with the Financial Crimes Enforcement Network (FinCEN) or the equivalent agency in your state. The USLegalForms platform can guide you through this process and help you create the necessary owner corporation paper with picture box for smooth filing. Make sure you check local requirements to confirm the exact location for submitting your paperwork.

Filing the CTA report involves providing detailed information about your corporation's beneficial owners. Start by accessing the appropriate form through the USLegalForms platform, which simplifies the creation of owner corporation papers with picture boxes. After you fill out the form accurately, ensure that you file it with the relevant government entity according to the filing guidelines provided for your location.

To file your beneficial ownership information report, begin by gathering the required information about the owners of your corporation, including their names, addresses, and identification details. You can easily complete this process through the USLegalForms platform, which provides user-friendly templates for the owner corporation paper with picture box. Once you have compiled all the necessary data, submit the report to the designated authority as specified in your jurisdiction.

You need to fill out a W9 for reimbursement because the entity issuing the reimbursement must report the payment to the IRS. By submitting a W9, you provide the necessary information to ensure compliance with tax regulations. This form guarantees that you receive your reimbursement efficiently and correctly. If you’re looking for examples, the owner corporation paper with picture box can provide you with helpful insights on this topic.

When filling out a W9 for a disregarded entity, you will include the owner’s name on the first line and the disregarded entity name on the second line. It’s also necessary to use the owner's Social Security Number or the entity’s Employer Identification Number as applicable. This information is vital for accurate tax reporting. For further clarification, check the owner corporation paper with picture box on uslegalforms.

To fill out a W9 step by step, start by downloading the form and entering your name or business name. Follow by selecting the correct box that describes your tax classification and entering your Tax Identification Number. Lastly, review all information, sign, and date the form. For a clear visual guide, refer to the owner corporation paper with picture box available through uslegalforms.

On a W9 form, you should enter your business name if you are representing an LLC. However, if you operate as a sole proprietor, then your personal name should appear. Make sure to double-check this detail before submission as it impacts tax reporting accuracy. If you're unsure, the owner corporation paper with picture box provides guidance to help you navigate this process.

On a W9 for an LLC, you should check the box labeled 'Limited Liability Company' to identify the type of entity you are filing as. If your LLC has multiple members, you may also need to specify the tax classification as either C-Corporation or S-Corporation. Ensuring this information is accurate helps prevent future tax complications. For additional assistance, consult the owner corporation paper with picture box available on our platform.