Llc Creation Minnesota

Description

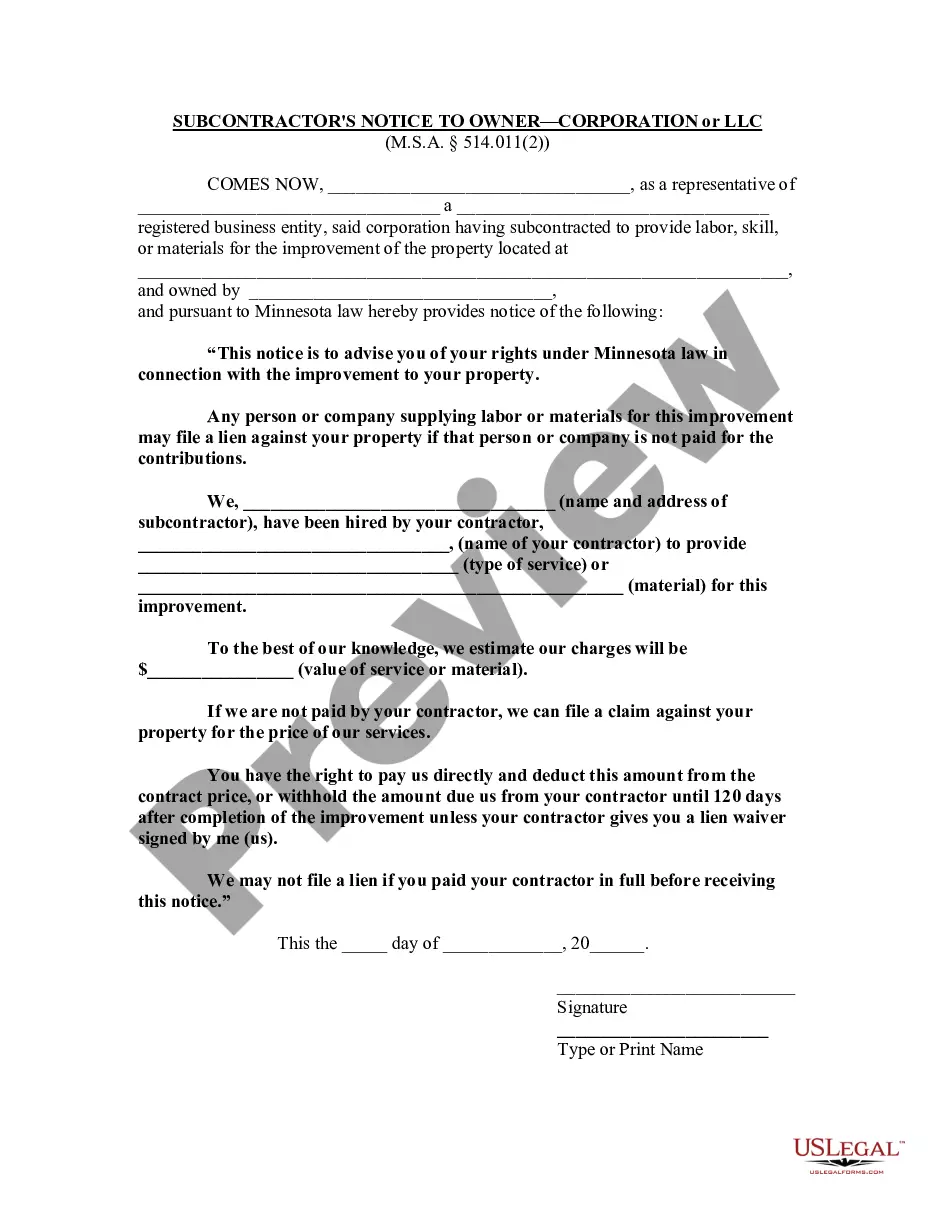

How to fill out Minnesota Contractor's Notice To Owner - Corporation Or LLC?

- Log into your US Legal Forms account. If you're a new user, you'll need to register first.

- Browse the extensive online library. Use the Search tab to find specific forms relevant to LLC creation in Minnesota.

- Preview the form you choose. Ensure it meets your requirements and adheres to Minnesota's regulations.

- Select your preferred subscription plan and click on 'Buy Now' to proceed.

- Complete your purchase. Enter your payment information or opt for PayPal to finalize your subscription.

- Download the completed form to your device. You can also access it anytime from the 'My Forms' section of your profile.

Once you've followed these steps, you're well on your way to establishing your LLC in Minnesota. US Legal Forms not only simplifies the document-filing process but also offers a wealth of resources to help you along the way.

Start your LLC creation journey today with US Legal Forms and ensure your legal documents are handled with expertise and care!

Form popularity

FAQ

Approval times for LLCs in Minnesota depend on your filing method. Online applications typically get approved in just a few days, while mail submissions may take up to two weeks or longer. Regardless of your route, using US Legal Forms can help manage your documentation accurately, enhancing the chances of a swift approval for your LLC creation in Minnesota.

The speed of LLC creation in Minnesota can vary based on how you choose to file. Online submissions can lead to quick approvals, often within days. Conversely, if you submit paper documents, be prepared for longer wait times. Choosing a service like US Legal Forms ensures that you follow all steps properly and can significantly reduce the time needed for LLC formation.

The timeframe for LLC creation in Minnesota typically ranges from a few days to several weeks, depending on the method of submission. If you file online, you may receive your approval within 1 to 3 business days. However, paper filings can take longer, even up to 10-15 business days. To expedite the process, consider using a reliable platform like US Legal Forms for a streamlined experience.

Filing for LLC creation in Minnesota typically takes about 3 to 5 business days if submitted online. If you opt for mail filing, it may take longer, around 5 to 10 business days. Using services like US Legal Forms can expedite the process, as they provide resources and support to ensure your documents are accurate and submitted efficiently.

While it is technically possible for an LLC to operate without an EIN, it is not advisable for most businesses. LLC creation in Minnesota often involves activities that require an EIN, such as hiring employees or opening a business bank account. Additionally, having an EIN simplifies your financial responsibilities and keeps your business more organized.

No, securing an EIN is not automatic when you file for LLC creation in Minnesota. You must apply for an EIN separately through the IRS, either online or by submitting a paper application. This extra step ensures your LLC is recognized for tax purposes and can operate fully within the state.

When starting your business, it is crucial to form your LLC first before obtaining an EIN. The LLC creation in Minnesota defines your business entity and establishes its legal standing. Once your LLC is in place, you can apply for an EIN easily, as the EIN will be specifically assigned to your newly formed entity.

Yes, obtaining an Employer Identification Number (EIN) is often essential for LLC creation in Minnesota. An EIN helps you open a business bank account, file taxes, and hire employees. Without it, managing your LLC can become complicated. Therefore, if you plan to operate your LLC beyond simple ownership, securing an EIN is a wise decision.

Establishing credit for your LLC in Minnesota may take several months, depending on various factors, including your business's financial history and activity. Building a positive credit profile requires you to open business accounts, apply for credit lines, and manage payments responsibly. With US Legal Forms, you can access valuable resources to help navigate establishing your LLC and its credit effectively. This guidance facilitates a smoother process for your business needs.

Yes, your LLC can be denied during the filing process in Minnesota. Common reasons for denial include incomplete applications, insufficient fees, or failure to meet state requirements. By utilizing US Legal Forms, you can ensure that all forms are filled out correctly, reducing the risk of denial. This proactive step can save you time and resources in your LLC creation process.