Beneficiary Deed Vs Transfer On Death

Description

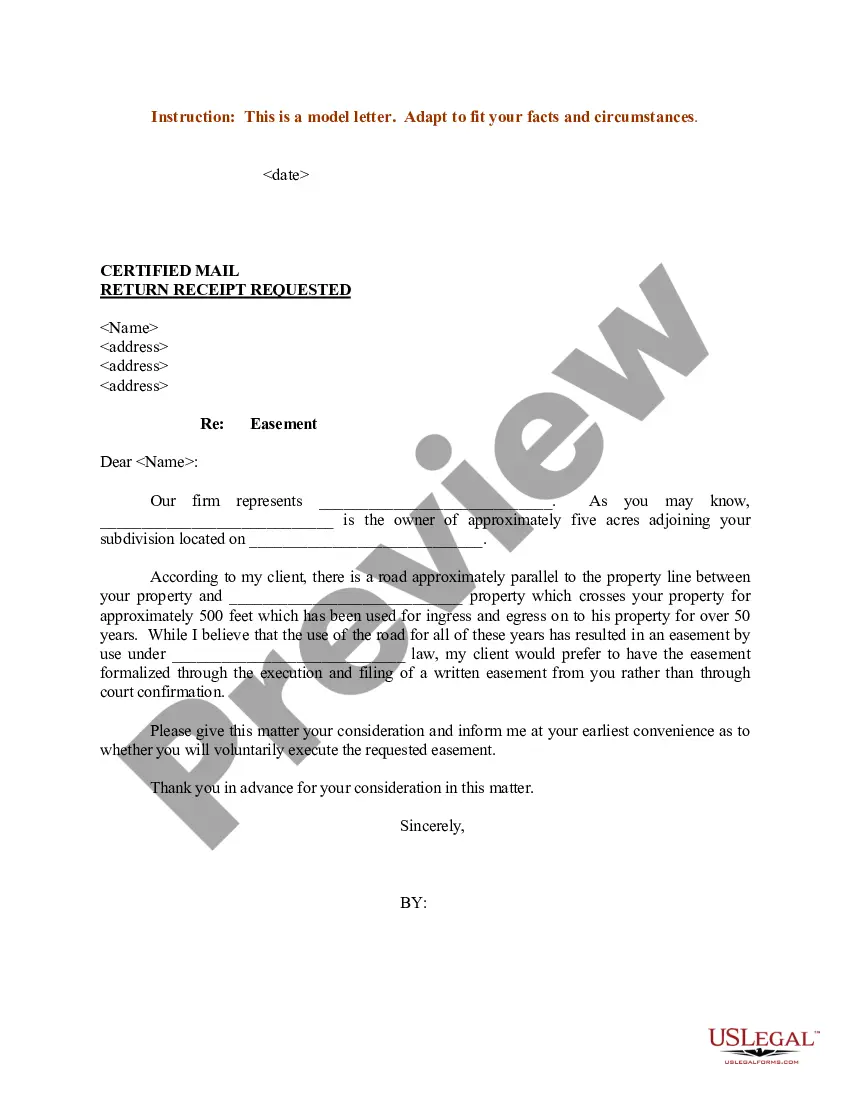

How to fill out Minnesota Transfer On Death Deed - Individual To Individual?

Managing legal documents can be overwhelming, even for experienced professionals.

If you are searching for a Beneficiary Deed Vs Transfer On Death and lack the time to devote to finding the correct and updated version, the process can be taxing.

US Legal Forms addresses all your needs, ranging from personal to business documents, all in one convenient location.

Make use of advanced tools to fill out and manage your Beneficiary Deed Vs Transfer On Death.

Here are the steps to follow after obtaining the form you need: Preview the form to confirm it is the correct one and check its description. Ensure that the template is valid in your state or county. Click Buy Now when you're ready. Choose a subscription plan. Select your desired file format, and Download, complete, eSign, print, and send your documents. Experience the US Legal Forms online library, supported by 25 years of expertise and trustworthiness. Transform your everyday document management into a straightforward and user-friendly experience today.

- Access a valuable collection of articles, guides, and resources pertinent to your situation and requirements.

- Save time and effort searching for the documents you need by utilizing US Legal Forms' sophisticated search and Review feature to find Beneficiary Deed Vs Transfer On Death.

- If you have a subscription, Log Into your US Legal Forms account, search for the document, and obtain it.

- Check your My documents tab to view the documents you have previously downloaded and organize your files as needed.

- If this is your first experience with US Legal Forms, create an account to enjoy unlimited access to all the advantages of the library.

- An extensive online form directory can revolutionize the way anyone handles these matters efficiently.

- US Legal Forms stands as a frontrunner in online legal documentation, offering over 85,000 state-specific legal forms available at your convenience.

- With US Legal Forms, you can access legal and business forms tailored to your state or county.

Form popularity

FAQ

Some potential problems include: Paying estate debt. ... Accidentally disinheriting someone. ... Jeopardizing your beneficiary's government benefits. ... Conflict with your will. ... No plan for incapacity.

Transfer on Death Deeds are used in Estate Planning to avoid probate and simplify the passing of real estate to your loved ones or Beneficiaries. It's also known as a ?Beneficiary Deed? because in essence, you're naming a Beneficiary who will receive the deed to your property after you pass away.

What Is the Difference Between TOD and Beneficiary? A transfer on death is an instrument that transfers ownership of specific accounts and assets to someone. A beneficiary is someone that is named to receive something of value.

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

Transfer-on-Death deeds also do not allow for naming a contingent beneficiary on the deed like a trust document that owns the property does. Secondly, if the intended beneficiary is a minor, the minor would not be able to manage or transfer the property until they reach the age of 18.