Operating Agreement Llc Minnesota For Single Member

Description

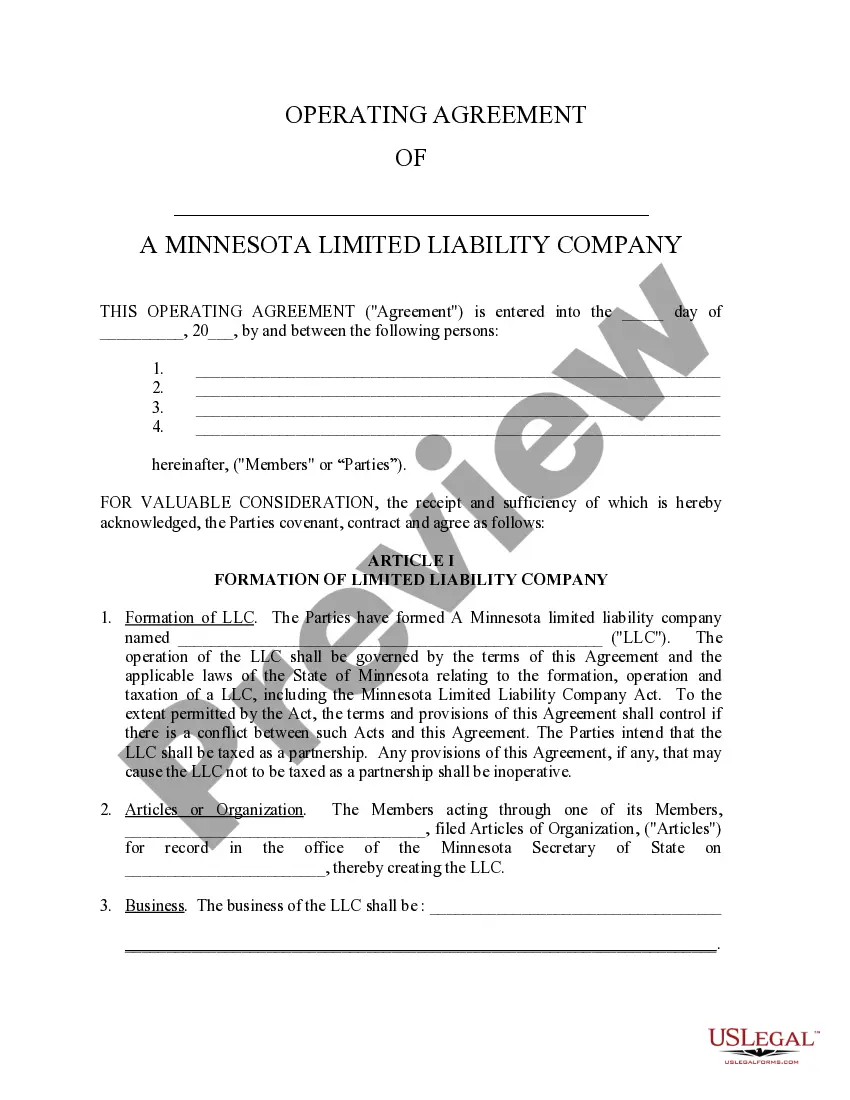

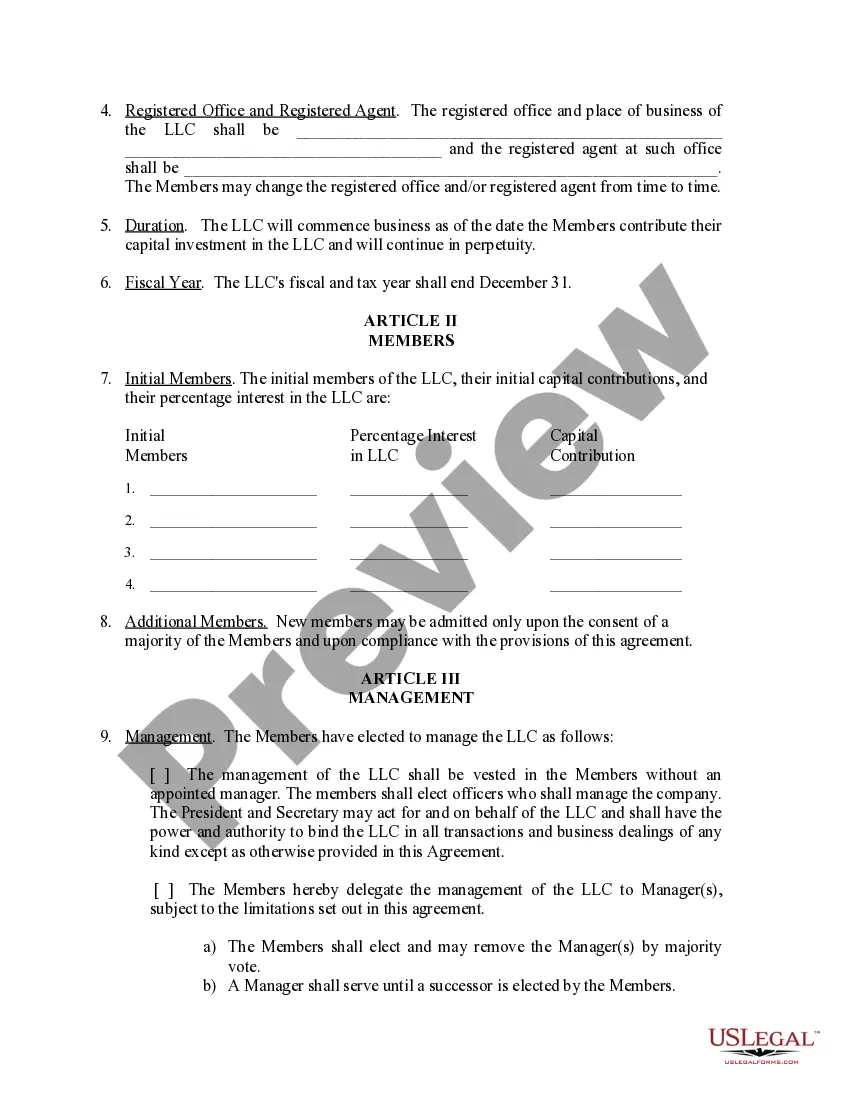

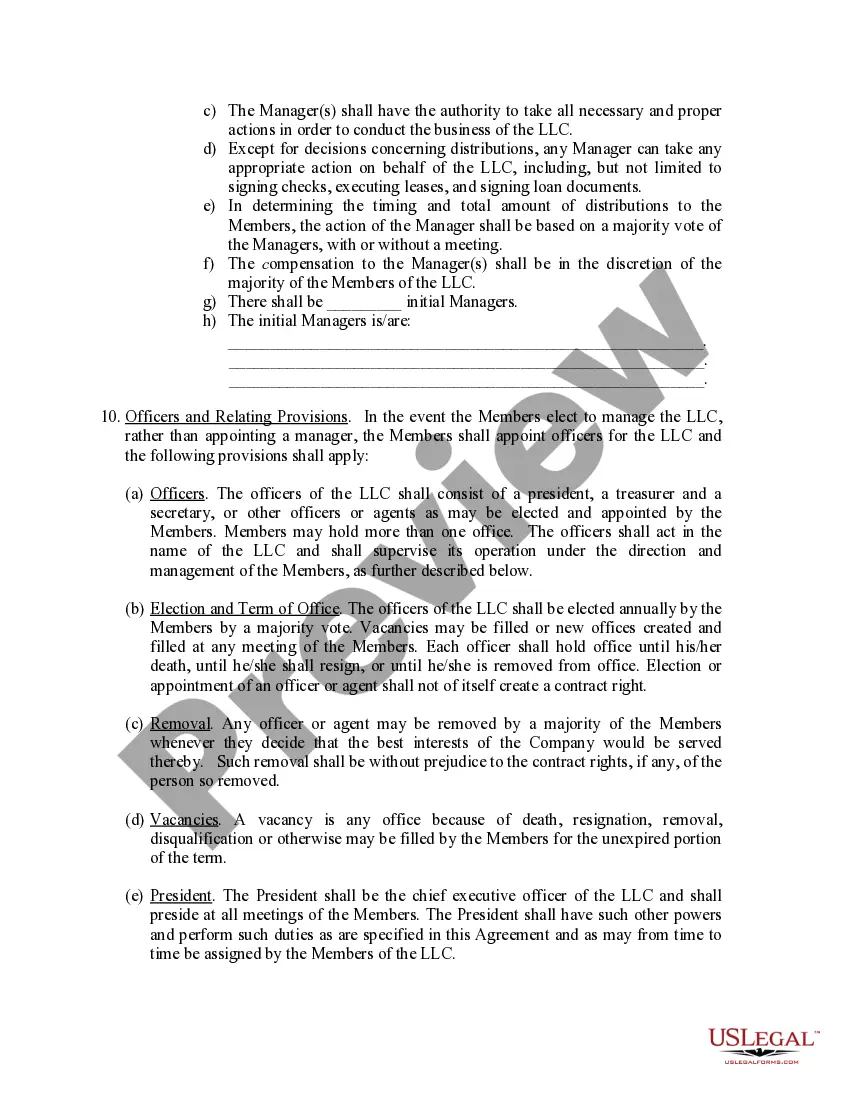

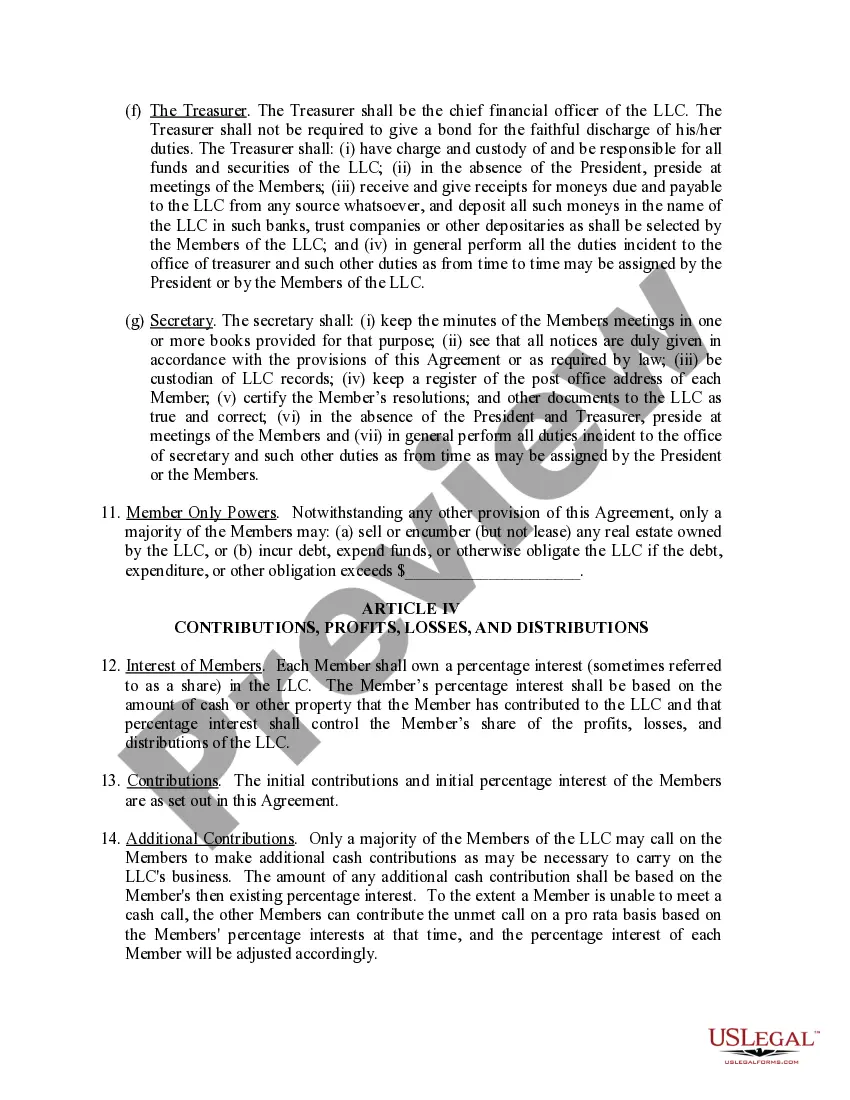

How to fill out Minnesota Limited Liability Company LLC Operating Agreement?

Getting a go-to place to take the most recent and appropriate legal templates is half the struggle of dealing with bureaucracy. Discovering the right legal documents calls for accuracy and attention to detail, which explains why it is vital to take samples of Operating Agreement Llc Minnesota For Single Member only from reliable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have little to be concerned about. You can access and view all the details about the document’s use and relevance for the situation and in your state or region.

Consider the listed steps to complete your Operating Agreement Llc Minnesota For Single Member:

- Utilize the catalog navigation or search field to locate your template.

- Open the form’s description to see if it matches the requirements of your state and region.

- Open the form preview, if available, to ensure the form is definitely the one you are interested in.

- Resume the search and find the appropriate document if the Operating Agreement Llc Minnesota For Single Member does not suit your requirements.

- If you are positive regarding the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have a profile yet, click Buy now to get the template.

- Pick the pricing plan that suits your requirements.

- Proceed to the registration to finalize your purchase.

- Finalize your purchase by picking a transaction method (credit card or PayPal).

- Pick the file format for downloading Operating Agreement Llc Minnesota For Single Member.

- Once you have the form on your device, you may modify it with the editor or print it and complete it manually.

Remove the hassle that accompanies your legal documentation. Explore the comprehensive US Legal Forms collection to find legal templates, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

How to Start an LLC in Minnesota Choose a Name for Your LLC. ... Appoint a Registered Agent. ... File Articles of Organization. ... Prepare an Operating Agreement. ... Comply With Other Tax and Regulatory Requirements. ... File Annual Renewals.

Here are the steps to forming an LLC in Minnesota Search your LLC Name. Search your Minnesota LLC Name to make sure it's available in the state. ... Choose a Minnesota Registered Agent. ... File Minnesota LLC Articles of Organization. ... Create a Minnesota LLC Operating Agreement. ... Get an EIN for your LLC. ... Get a Minnesota Tax ID Number.

Minnesota LLC Approval Times Mail filings: In total, mail filing approvals for Minnesota LLCs take 3-4 weeks. This accounts for the 11-12 business day processing time (a bit more than 2 weeks), plus the time your documents are in the mail. Online filings: Online filings for Minnesota LLCs are approved immediately.

As per Section 322C. 110 of the Minnesota LLC Act, an Operating Agreement isn't required for an LLC in Minnesota. But while state law doesn't require Operating Agreements to conduct business in Minnesota, we strongly recommend that all Limited Liability Companies have Operating Agreements.

An S corp operating agreement is a business entity managing document. Typically, an operating agreement is a document that defines how a limited liability company will be managed. An S corp actually uses corporate bylaws and articles of incorporation for the purpose of organizing the business operation.