Special Power Of Attorney Coupled With Interest

Description

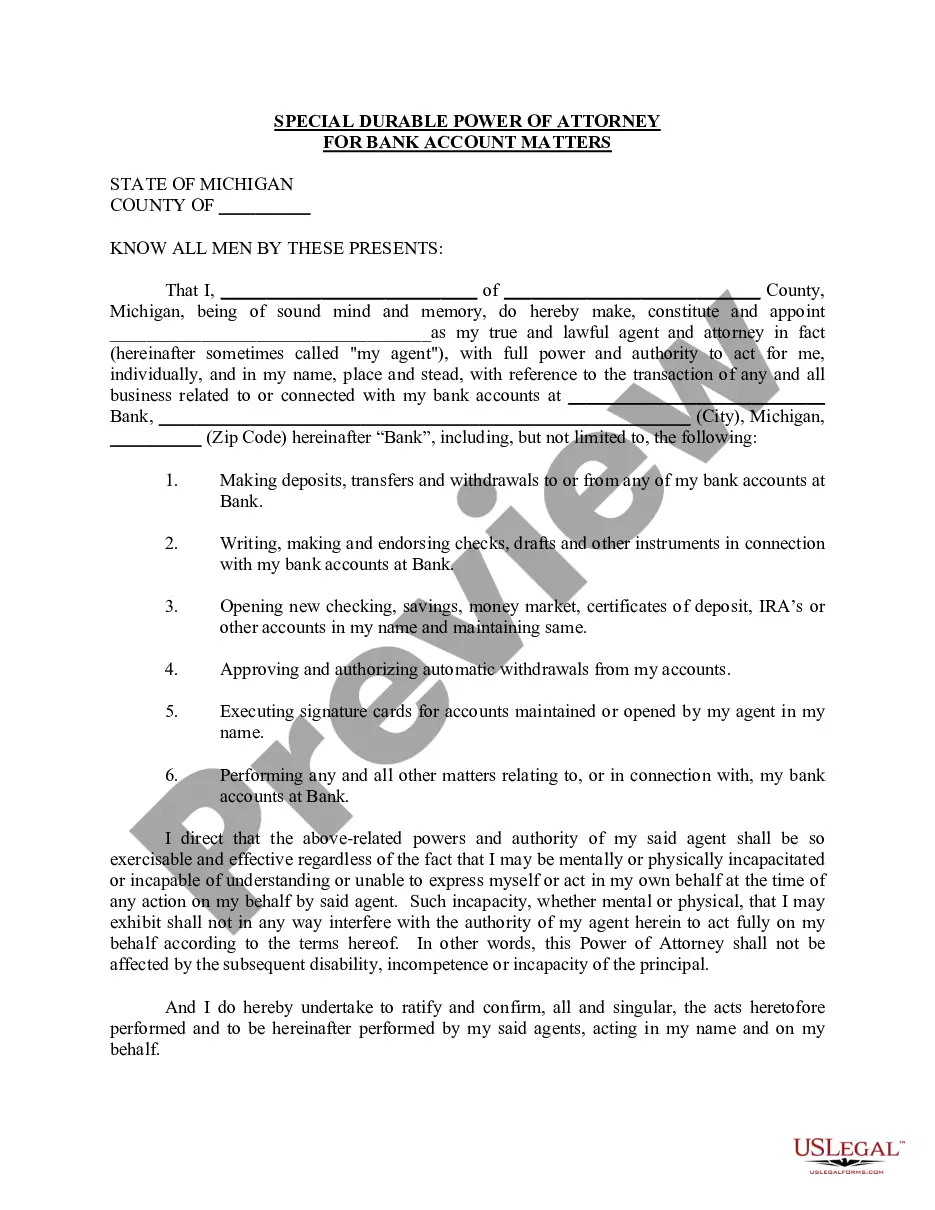

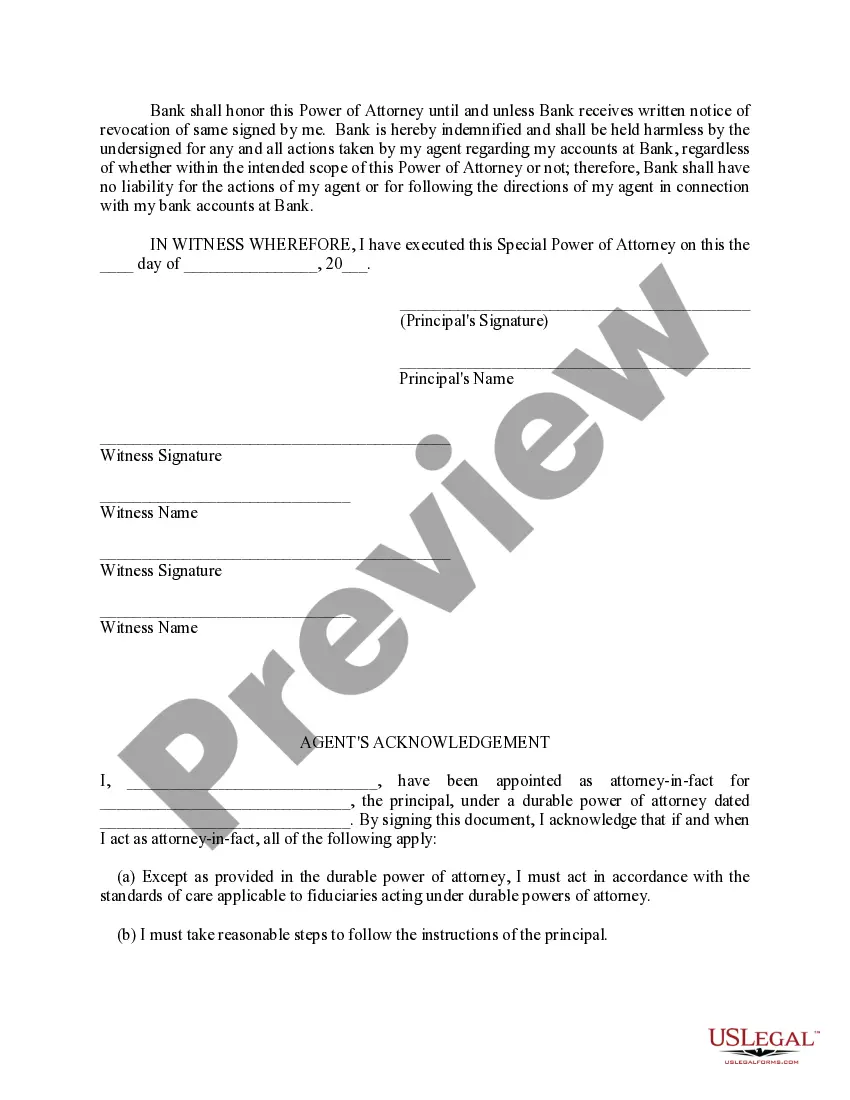

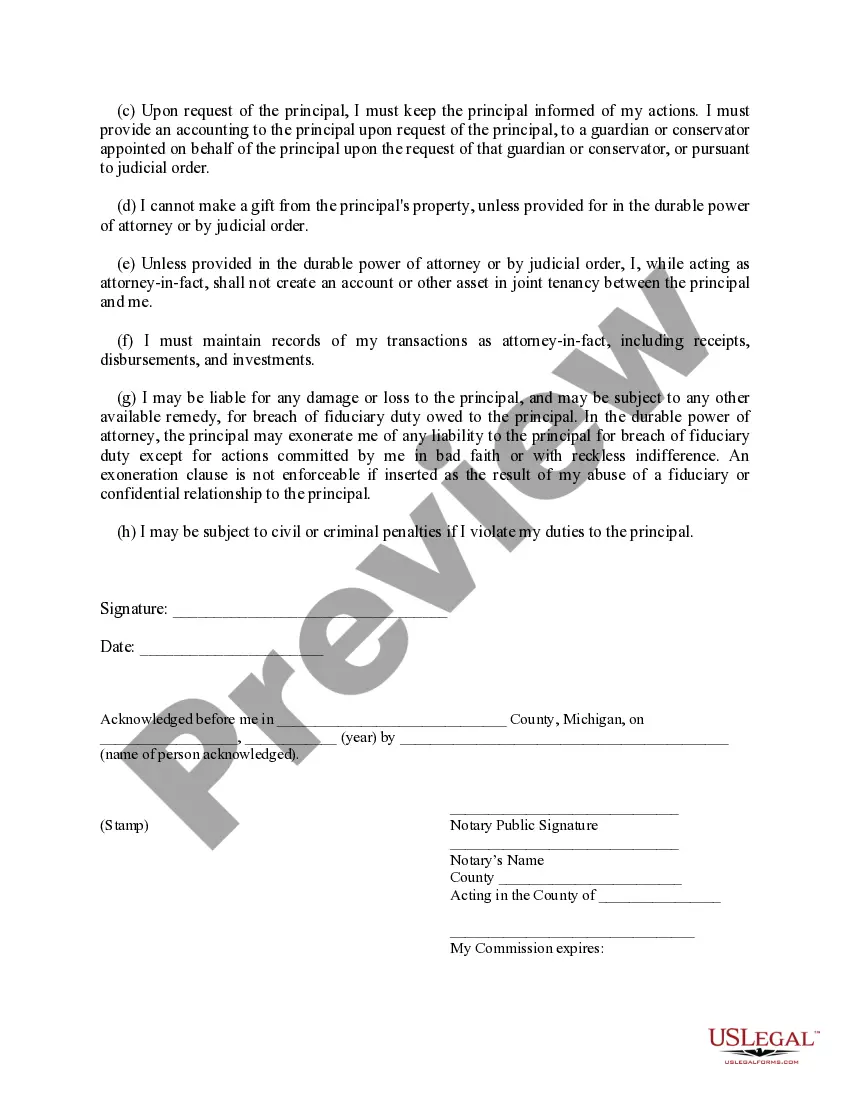

How to fill out Michigan Special Durable Power Of Attorney For Bank Account Matters?

- Start by logging into your US Legal Forms account if you're a returning user or create a new account for first-time users.

- Preview the special power of attorney coupled with interest form and read the description to ensure it meets your needs.

- If adjustments are necessary, use the Search tab to explore alternative templates that fit your requirements more accurately.

- Select the Buy Now button and choose a subscription plan that works best for you, registering your account in the process.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Download the completed form to your device and access it anytime through the My Forms section in your profile.

In conclusion, US Legal Forms offers a user-friendly platform to help you efficiently create legal documents. With numerous templates and expert support, you can ensure that your special power of attorney coupled with interest is executed correctly. Don't miss out on the peace of mind that comes with properly managing your legal affairs.

Visit US Legal Forms today to start your journey towards easy legal document management!

Form popularity

FAQ

An agency coupled with an interest job could be a situation where a real estate agent works on behalf of a property owner but also has a stake in the sales process. For example, an agent might own shares in a real estate investment group while representing a property in that portfolio. This dual experience underscores their commitment to securing the best outcome for everyone involved. When entering such arrangements, using resources such as uslegalforms can provide clarity and structure.

A license coupled with an interest may involve a situation where someone has permission to use a property in a way that benefits them financially, such as operating a business on that property. For instance, if a business owner leases a building they partially own, they hold a license coupled with an interest. This arrangement allows them to generate income while also being invested in the property’s success. Understanding these nuances can be facilitated through legal resources like uslegalforms.

An agency coupled with an interest refers to a situation where an agent holds some vested interest in the subject matter they are authorized to manage. This could include financial stakes, such as owning part of a business or property the agency is assigned to represent. The concept provides an added layer of commitment for the agent, ensuring their actions are in the best interest of both themselves and the principal. Using platforms like uslegalforms can help you create a clear framework for such agreements.

A special power of attorney coupled with interest grants an agent the authority to act on behalf of the principal in specific situations where there is a financial interest involved. This means that the agent's authority is tied to their own rights, providing them a stronger legal basis to act. For instance, if the agent has a financial stake in a property, they can make decisions that align with both their interests and those of the principal. This type of power of attorney ensures that actions taken benefit both parties.

An agency coupled with an interest refers to a relationship where the agent has a personal stake in the authority granted to them. This means that the agent's authority is linked directly to their financial or personal interest in the matter. Such an arrangement adds a layer of security, as it typically ensures the agent will act in a way that benefits both parties. If you’re considering this approach, a special power of attorney coupled with interest could be the right solution for your needs.

When a power of attorney is coupled with an interest, it means that the agent has a stake in the transaction or matter at hand. This type of power of attorney grants the agent the authority to act on your behalf while also allowing them to benefit from the transaction. This arrangement can be advantageous in specific situations, ensuring that the agent's motivations align with your goals. For more clarity, explore how a special power of attorney coupled with interest functions.

A conflict of interest in a power of attorney occurs when the agent's interests may conflict with those of the principal. In such situations, the agent might face a dilemma where personal interests or financial gain could influence their decisions. It's essential to select an agent who can act in your best interest without any conflicting personal stakes. Understanding these dynamics is crucial when using a special power of attorney coupled with interest.

A conflict of interest in a power of attorney arises when the appointed agent's personal interests clash with their fiduciary duties. This situation can lead to decisions that may not be in the best interest of the person granting the power. It is essential to clearly outline the terms of a special power of attorney coupled with interest to minimize potential conflicts and promote trust and transparency between all parties involved.

A license coupled with an interest represents a scenario where the licensee has both permission to engage in a particular activity and an associated financial stake in that activity. This might be seen in real estate transactions, where the licensee earns commissions or profits from the results of their efforts. Understanding the dynamics of a special power of attorney coupled with interest can help clarify rights and responsibilities in such agreements.

An appointment that is coupled with an interest often involves a fiduciary role, where the appointed individual has a financial stake or vested interest in the decisions made on behalf of another. This includes situations such as managing a business or estate, where the agent's potential benefit is directly tied to the success of their actions. Utilizing a special power of attorney coupled with interest can create a clearer alignment of goals between the principal and the agent.