Durable Power Attorney For Finances

Description

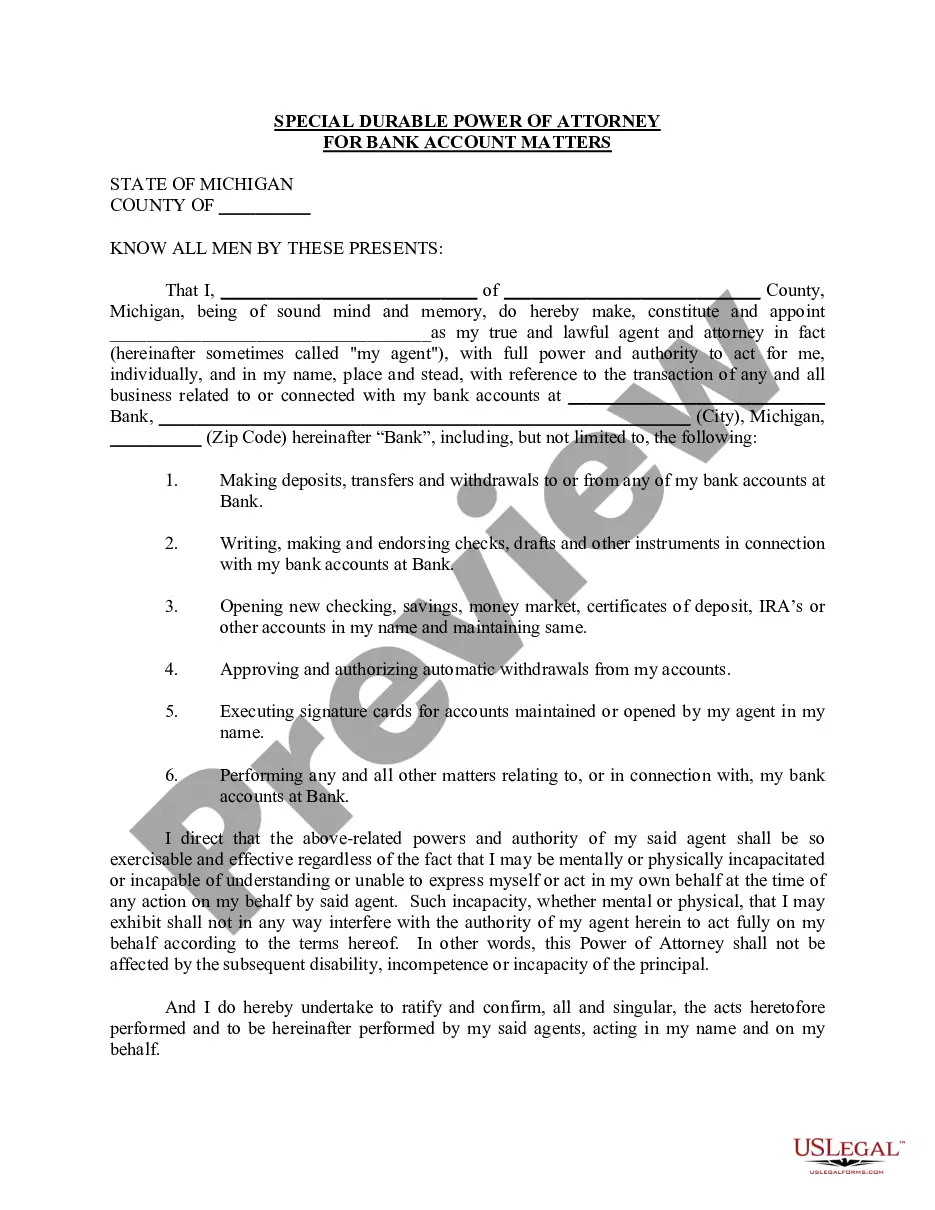

How to fill out Michigan Special Durable Power Of Attorney For Bank Account Matters?

- If you are a returning user, log into your account and locate the durable power of attorney form for finances. Click the Download button to save it on your device.

- For first-time users, start by browsing the extensive library. Check the Preview mode to ensure you've selected the right form that aligns with your specific local regulations.

- Should you need a different document, use the Search feature to find a suitable alternative. If you find the correct template, proceed to the purchase.

- Select the Buy Now option next to the document. Choose a subscription plan that fits your needs and create an account for full access.

- Complete your transaction by entering your payment details using either a credit card or PayPal.

- After your purchase, download your form and save it on your device. Access it anytime through the My Forms section in your account.

US Legal Forms stands out with a vast collection of legal forms, ensuring you have access to more options than other providers at comparable prices.

With over 85,000 editable forms and expert assistance for form completion, ensuring legally sound documents has never been easier. Get started today and take charge of your financial decisions!

Form popularity

FAQ

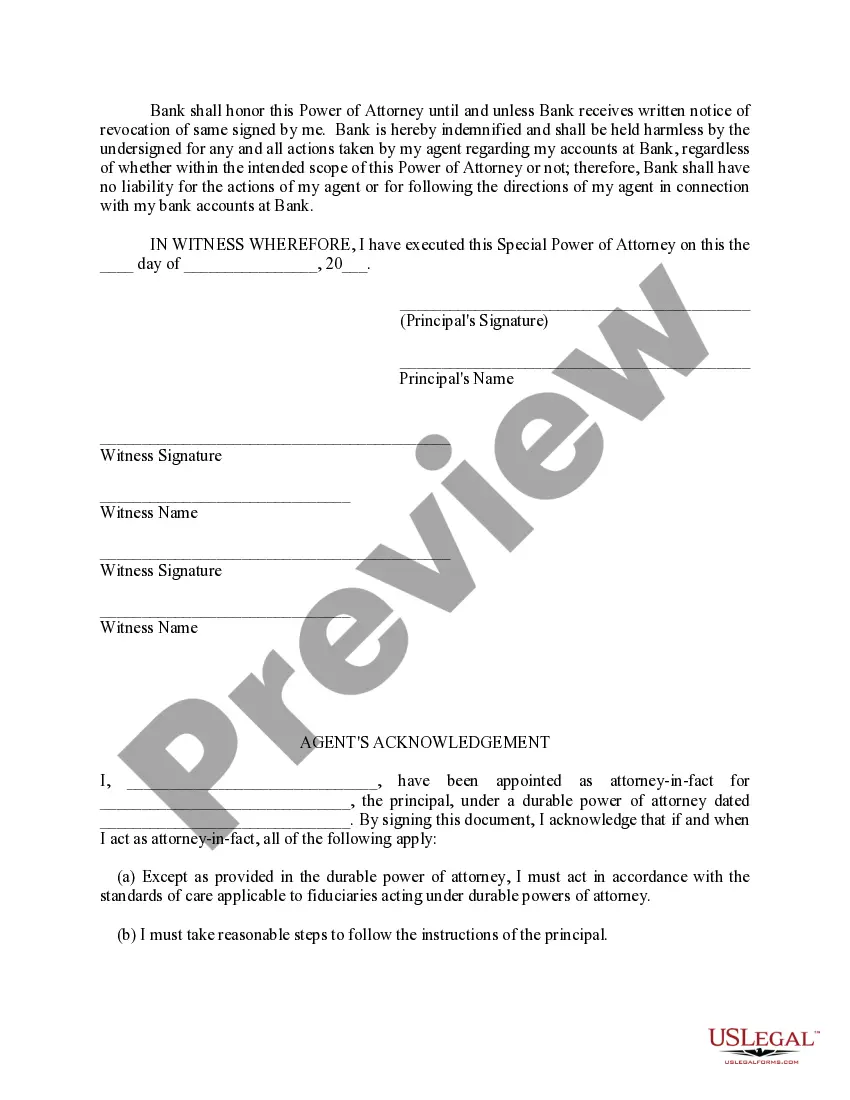

A bank may deny the power of attorney if the document appears to be outdated, incomplete, or does not meet specific requirements. Additionally, if the bank cannot verify the identity of the agent or if the powers granted exceed what they allow, this could lead to denial. To avoid issues, ensure your durable power attorney for finances is compliant with state laws and closely adheres to the bank's policies.

Using a durable power of attorney at a bank involves presenting the original document to the bank's representative. This allows the agent to perform tasks such as accessing accounts, withdrawing funds, or managing investments. It's essential for the agent to clearly explain their authority and provide identification if required. A durable power attorney for finances empowers you to streamline financial management effectively.

Yes, many banks require you to present the original durable power of attorney for finances when conducting transactions on behalf of someone else. They may not accept a photocopy or electronic version for legal matters. Therefore, always check with your specific bank beforehand to understand their policies. Having the original document ready can help ensure smooth operations.

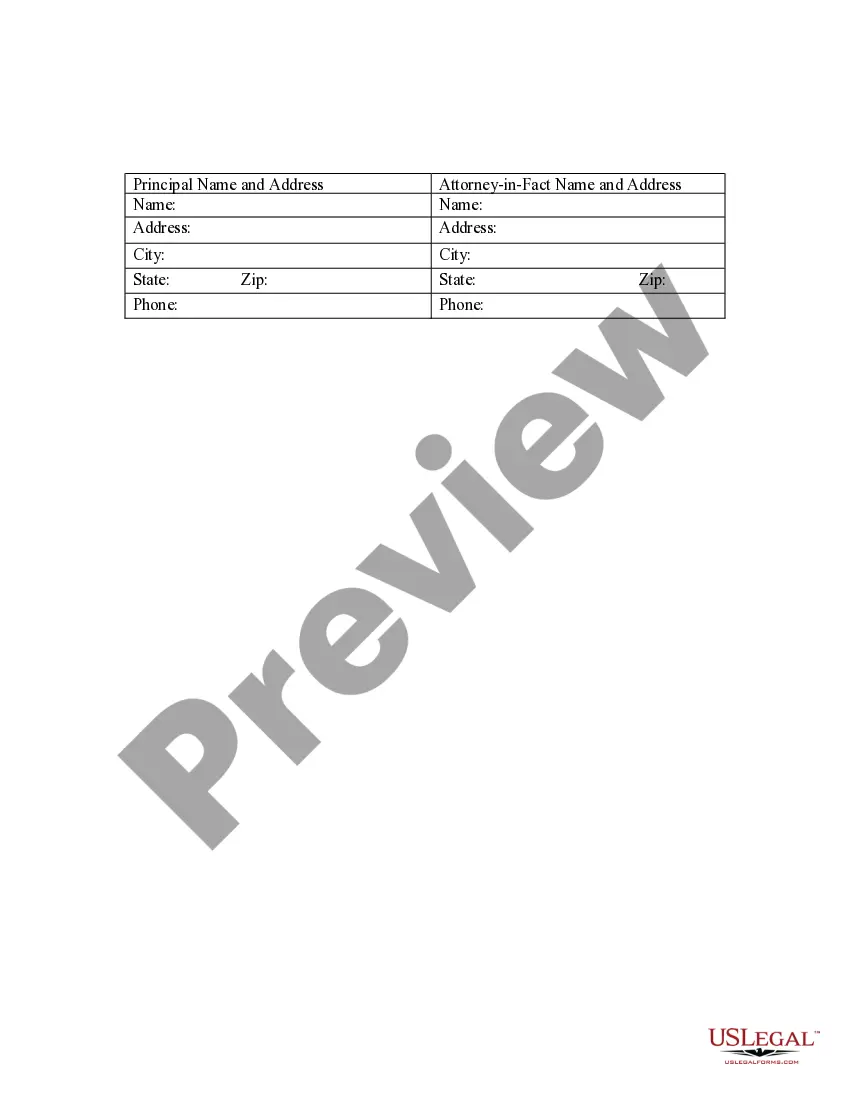

To fill out power of attorney paperwork, begin by selecting the right form for your state, as requirements can vary. Clearly state your name, the name of your agent, and the exact powers you are granting. After completing the forms, make sure to sign them in the presence of a notary or witnesses, depending on your state's rules. Uslegalforms provides easy-to-follow templates to simplify this process.

Yes, banks typically honor a durable power of attorney for finances, as long as it meets specific legal requirements. This document allows you to designate someone to manage your financial matters, ensuring that your financial affairs are handled according to your wishes. To ensure your durable power of attorney is recognized, make sure it is properly executed and includes all necessary information. If you need assistance creating a durable power of attorney for finances, US Legal Forms offers user-friendly templates that can help streamline the process.

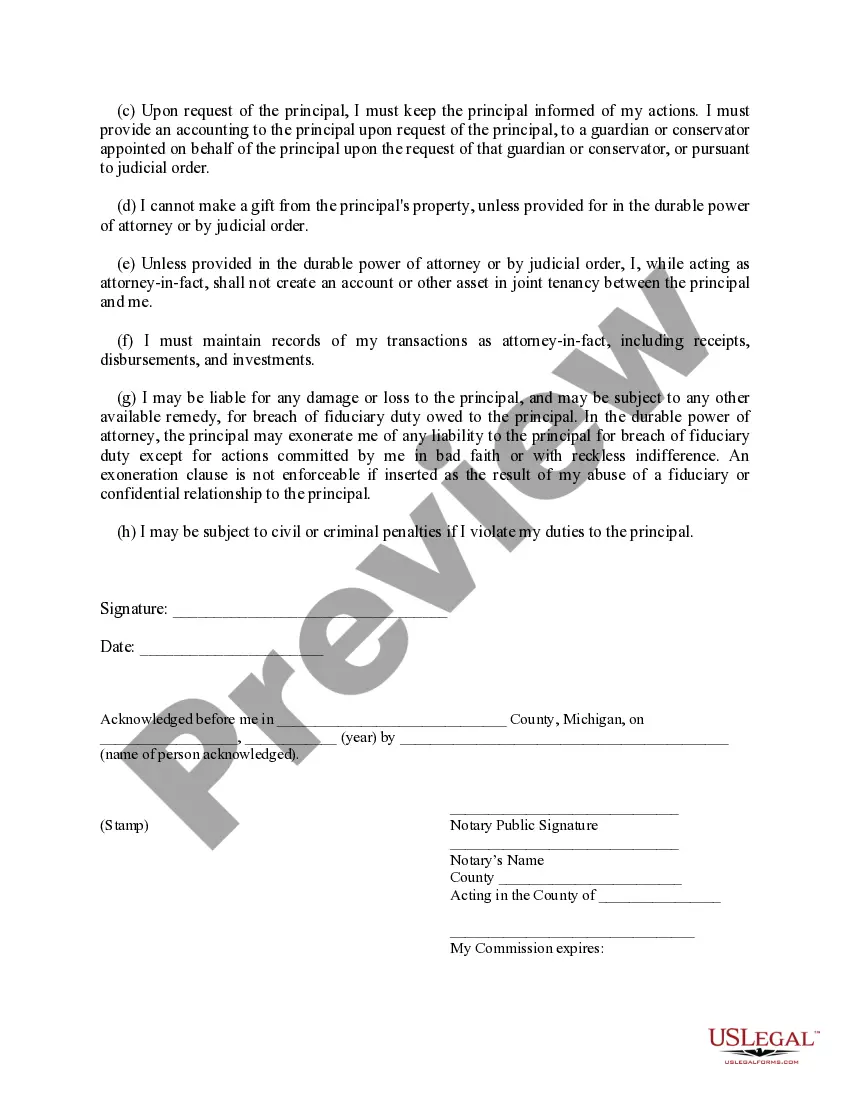

A legal power of attorney typically cannot make decisions about the principal's medical care, create or amend a will, or vote on behalf of the principal. These limitations focus on protecting the personal rights and wishes of the principal. Understanding these restrictions can help you utilize your durable power of attorney for finances more effectively. To ensure clarity and compliance, consider consulting legal resources available on platforms like USLegalForms.

The most powerful form of power of attorney is often recognized as the durable power of attorney for finances. This document remains effective even if the principal becomes incapacitated, allowing their agent to manage financial decisions seamlessly. It provides broad authority to handle financial matters, making it a robust tool for long-term planning. For comprehensive options, you might explore templates from USLegalForms.

A key disadvantage of a durable power of attorney for finances is the potential for abuse. If the appointed agent misuses their authority, it can lead to financial loss for the principal. This highlights the importance of choosing a trustworthy individual as your agent. To safeguard your interests, consider using legal forms like those from USLegalForms to create a durable power of attorney that includes specific guidelines.

A durable financial power of attorney is a legal document that grants someone the authority to manage your financial matters even if you become incapacitated. This ensures that your financial obligations are taken care of without interruption. Engaging with uSlegalforms can help you create a durable power attorney for finances that suits your needs, providing clarity and security in managing your financial future.

While a durable power of attorney for finances has many benefits, it also has potential drawbacks. One disadvantage is the risk of abuse, as the agent has significant power over your financial affairs. Additionally, if not properly drafted, it can lead to confusion regarding the agent's authority, emphasizing the importance of clearly defining the terms within the document.