Mi Attorney Real Withholding

Description

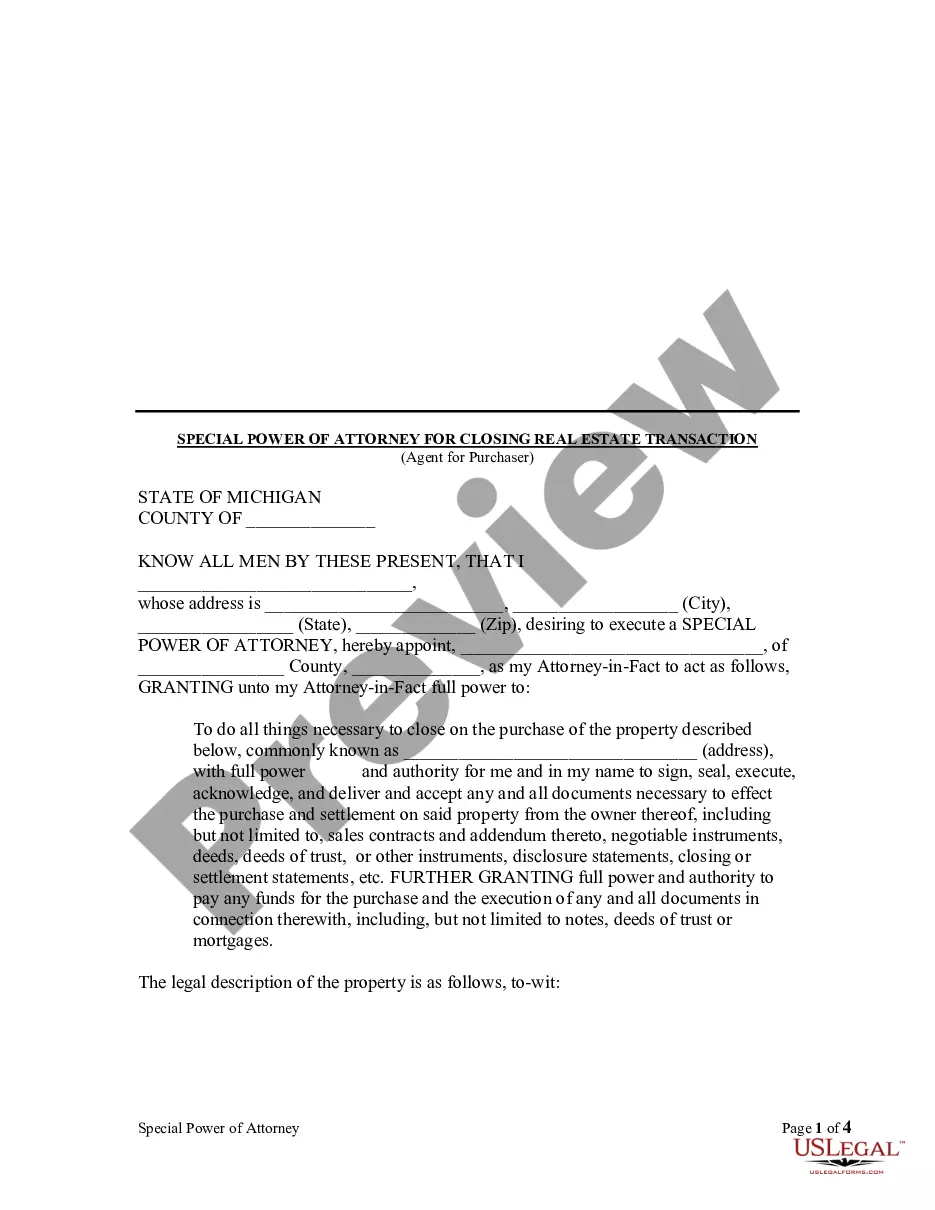

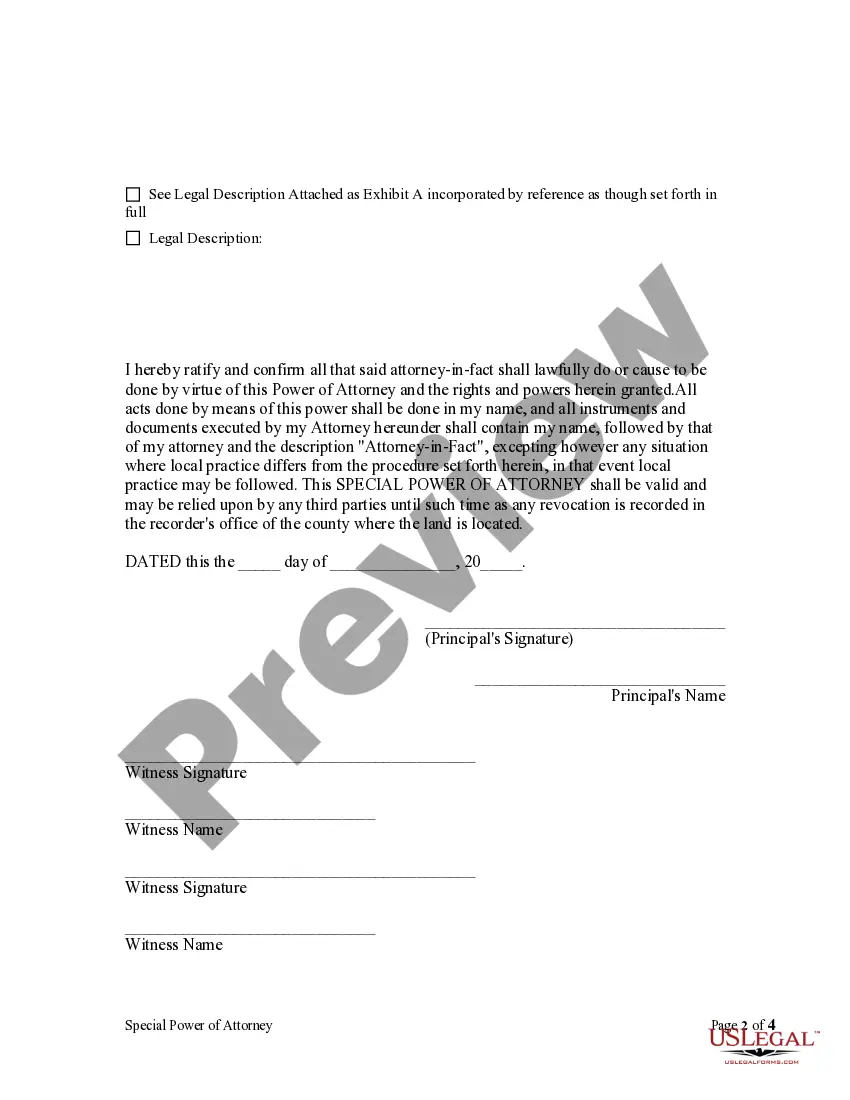

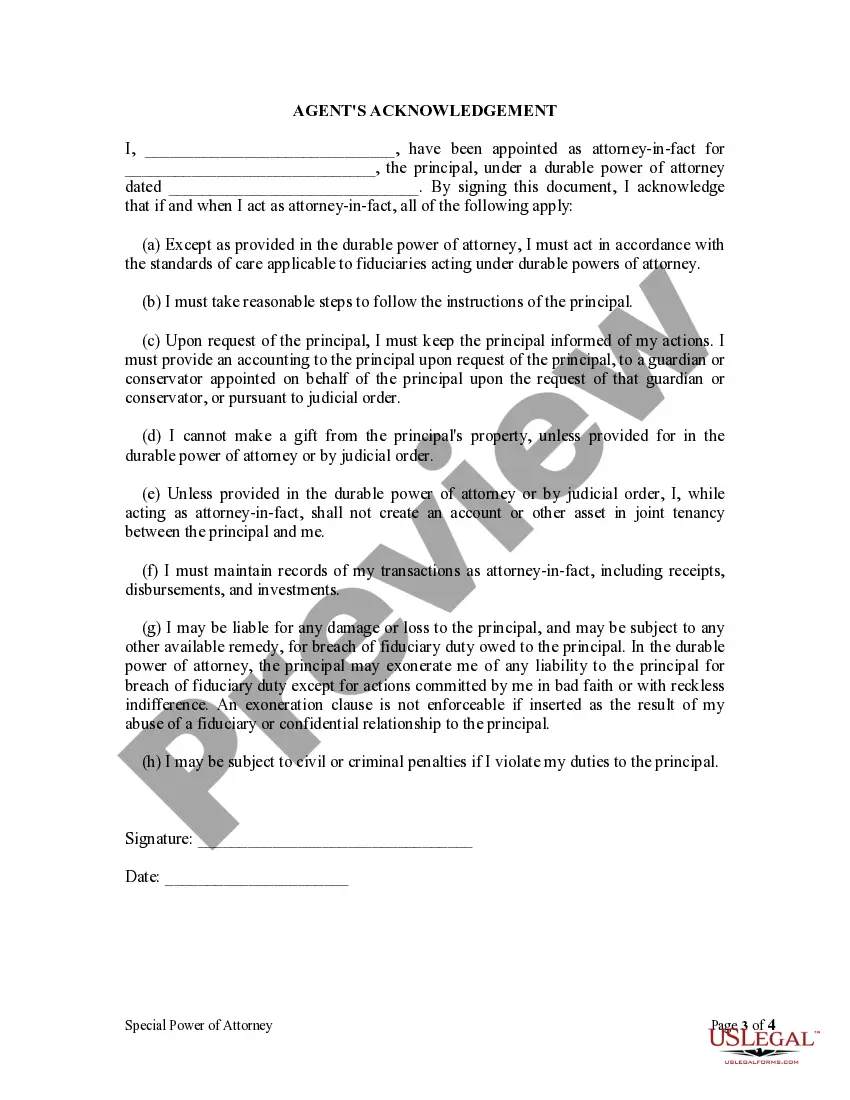

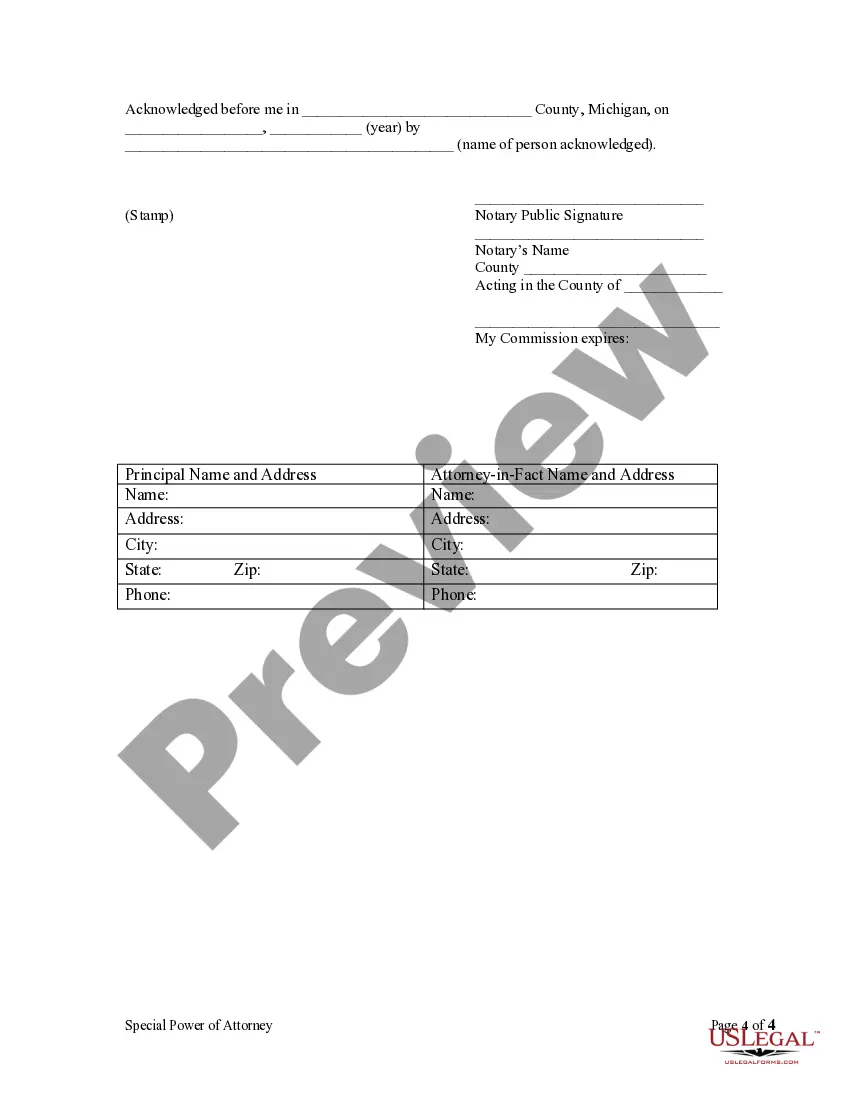

How to fill out Michigan Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

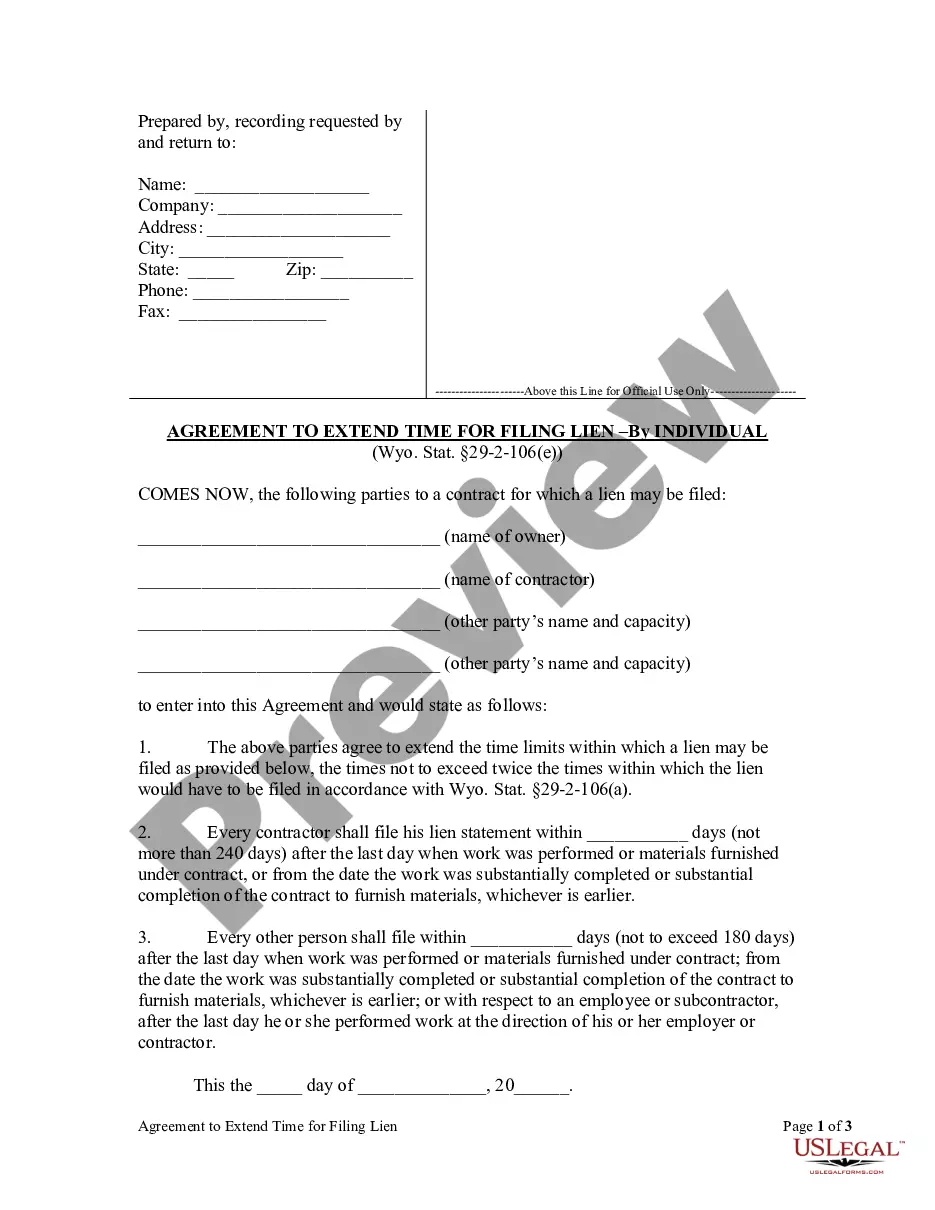

Utilizing legal templates that comply with federal and state laws is essential, and the internet provides numerous choices.

However, why spend time searching for the appropriate Mi Attorney Real Withholding example online when the US Legal Forms digital library already has these templates compiled in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by lawyers for various business and personal situations.

Review the template using the Preview function or through the text outline to verify it meets your requirements.

- They are straightforward to navigate, with all documents categorized by state and intended use.

- Our experts keep up with legislative updates, ensuring that your documentation is current and compliant when obtaining a Mi Attorney Real Withholding from our platform.

- Acquiring a Mi Attorney Real Withholding is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document template you require in the desired format.

- If you are a newcomer to our site, follow the steps outlined below.

Form popularity

FAQ

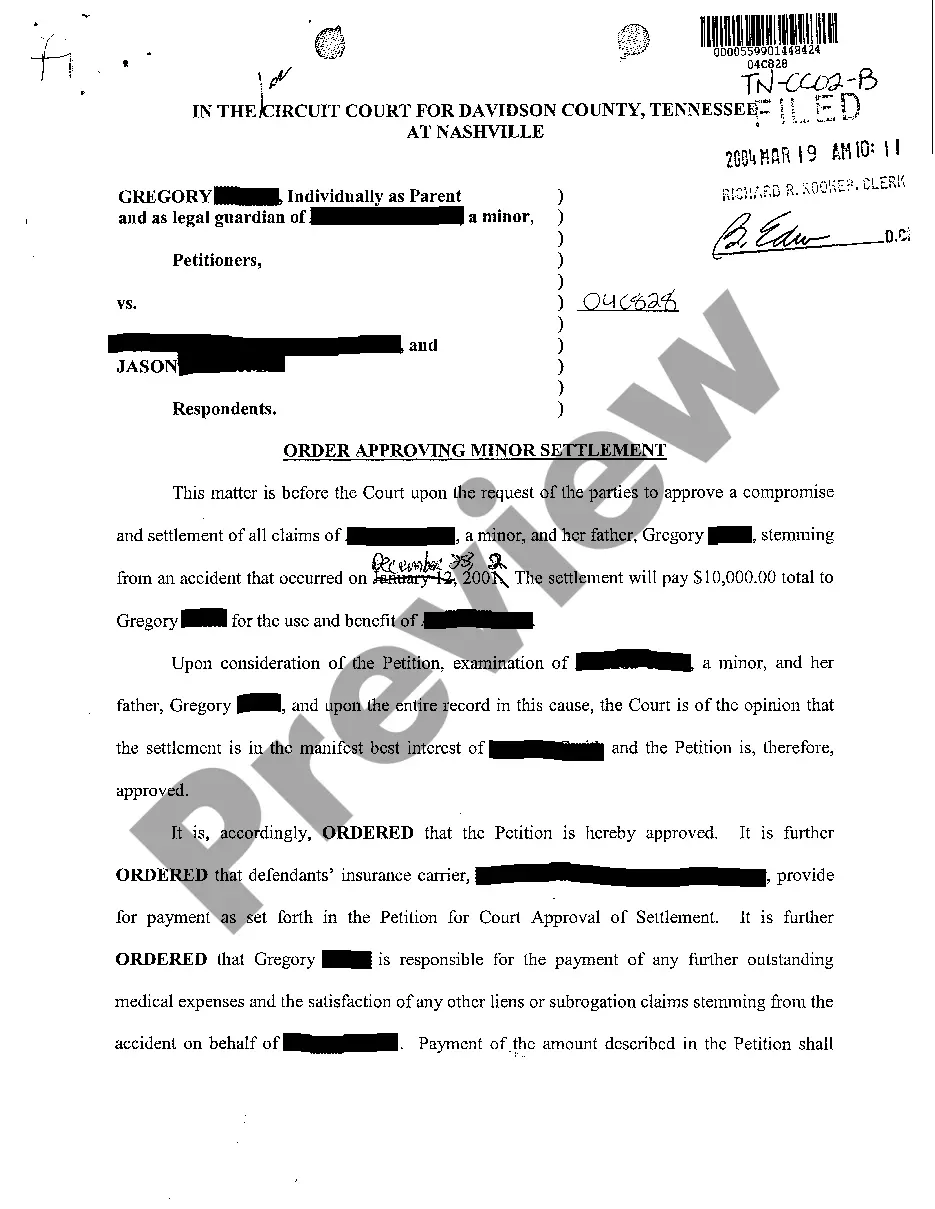

The number of withholding allowances you should claim depends on your personal financial situation, including your marital status and any dependents. Generally, the more allowances you claim, the less tax is withheld from your paycheck. However, be cautious; claiming too many allowances may lead to a tax bill at the end of the year. For clarity on Mi attorney real withholding, uslegalforms offers resources to help you determine the right number.

When claiming withholding exemptions, first determine your eligibility based on your tax situation. You will need to fill out the appropriate section of your tax withholding form, indicating the number of exemptions you believe you qualify for. It is essential to provide accurate information to avoid under- or over-withholding. For detailed guidance, uslegalforms can assist you in navigating the complexities of Mi attorney real withholding.

To fill out your tax withholding form accurately, start by gathering your personal information, including your name, address, and Social Security number. Next, review your income sources and anticipated deductions for the year. This information will help you complete the relevant sections of the form, ensuring you align with the guidelines for Mi attorney real withholding. If you need assistance, consider using platforms like uslegalforms to simplify the process.

To withhold the right amount of tax, first, determine each employee's tax status and income. Use the Michigan withholding tax tables to calculate the correct amount to deduct from their paychecks. Regularly review and adjust these amounts as necessary, especially if there are changes in tax laws. A Mi attorney real withholding service can provide valuable insights and assistance in maintaining accurate withholding practices.

To file withholding tax in Michigan, you need to complete the appropriate state tax forms and submit them to the Michigan Department of Treasury. It's important to keep records of all withheld amounts for your employees. You can also use online resources or platforms like uslegalforms to guide you through the filing process. This ensures you meet your tax obligations efficiently and correctly with a Mi attorney real withholding approach.

In Michigan, withholding rules require employers to deduct state income tax from employee wages. The amount withheld depends on the employee's income level and tax filing status. For accurate calculations, it's essential to refer to the Michigan Department of Treasury guidelines. Utilizing a Mi attorney real withholding service can help ensure compliance and accuracy in your payroll processes.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

INSTRUCTIONS TO EMPLOYER: Keep a copy of this certificate with your records. All new hires must be reported to the State of Michigan. See .mi-newhire.com for information. You must submit a Michigan withholding exemption certificate (form MI-W4) to your employer on or before the date that employment begins.

Thus, claiming "0" results in the smallest paycheck, but a larger tax refund at tax time. The larger the number (i.e. 1, 2, 3, etc...) will result in larger paychecks, but will reduce tax withholdings which may result in a smaller tax refund or owing at tax time.

Employees may claim exemption from withholding only if they do not anticipate a Michigan income tax liability for the current year because their employment is less than full-time and the personal and dependency exemptions exceed their annual compensation. Any changes made to an MI-W4 makes the form invalid.