Power Of Attorney Form For Texas

Description

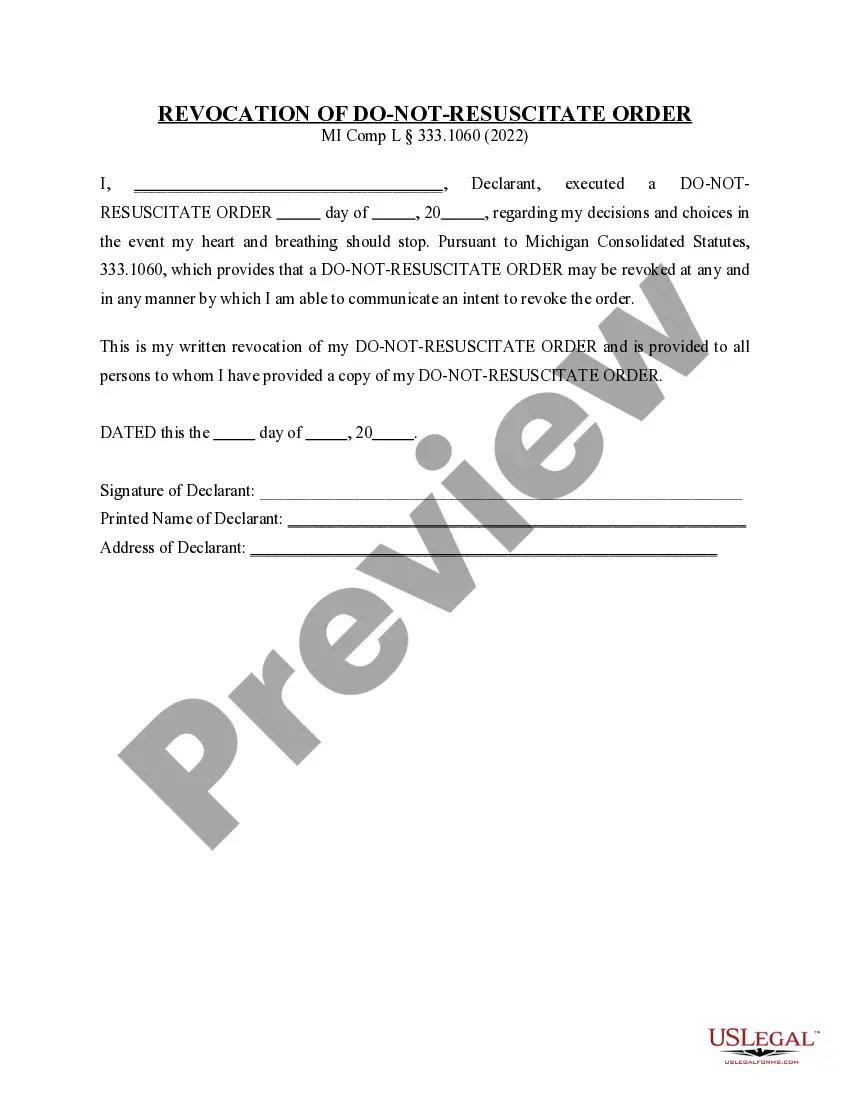

How to fill out Michigan Revocation Of Do Not Resuscitate Order?

It’s no secret that you can’t become a legal expert immediately, nor can you figure out how to quickly draft Power Of Attorney Form For Texas without having a specialized set of skills. Putting together legal documents is a long venture requiring a specific training and skills. So why not leave the preparation of the Power Of Attorney Form For Texas to the specialists?

With US Legal Forms, one of the most extensive legal template libraries, you can access anything from court papers to templates for internal corporate communication. We know how important compliance and adherence to federal and state laws are. That’s why, on our platform, all forms are location specific and up to date.

Here’s start off with our platform and get the document you require in mere minutes:

- Find the form you need with the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to determine whether Power Of Attorney Form For Texas is what you’re looking for.

- Start your search again if you need any other form.

- Register for a free account and choose a subscription plan to purchase the template.

- Pick Buy now. Once the payment is through, you can download the Power Of Attorney Form For Texas, complete it, print it, and send or send it by post to the designated people or entities.

You can re-access your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your documents-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

The POA cannot transfer the responsibility to another Agent at any time. The POA cannot make any legal or financial decisions after the death of the Principal, at which point the Executor of the Estate would take over. The POA cannot distribute inheritances or transfer assets after the death of the Principal.

In order for this power of attorney to be valid it must be notarized, but it doesn't need to be signed by any witnesses like a will does. You do not need to file a power of attorney at the courthouse unless you want your agent to be able to act on your behalf in regards to a real estate transaction.

The POA must be dated and signed by the principal before a notary public or other person authorized in Texas or any other state to "take acknowledgments to deeds of conveyance" and administer oaths.

You can work with an attorney, use estate planning software or download Texas' Statutory Durable Power of Attorney or Medical Power of Attorney Designation of Health Care Agent forms to print and fill out yourself. Choose your agent and detail the authority you'd like them to have.

One major downfall of a POA is the agent may act in ways or do things that the principal had not intended. There is no direct oversight of the agent's activities by anyone other than you, the principal. This can lend a hand to situations such as elder financial abuse and/or fraud.