Withdraw Promissory Note

Description

How to fill out Michigan Installments Fixed Rate Promissory Note Secured By Personal Property?

There's no longer a necessity to squander hours hunting for legal documents to comply with your local state requirements.

US Legal Forms has assembled all of them in a single location and enhanced their accessibility.

Our website provides over 85,000 templates for any business and personal legal matters categorized by state and purpose.

Utilize the Search field above to look for another template if the present one does not suit you. Click Buy Now next to the template title once you locate the suitable one. Select the preferred subscription plan and register for an account or Log In. Make payment for your subscription with a card or via PayPal to proceed. Choose the file format for your Withdraw Promissory Note and download it to your device. Print your form to complete it by hand or upload the sample if you prefer to use an online editor. Preparing formal documents according to federal and state regulations is swift and straightforward with our platform. Try US Legal Forms today to keep your documentation organized!

- All forms are properly drafted and validated for accuracy, allowing you to be assured of obtaining a current Withdraw Promissory Note.

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all previously acquired documents whenever necessary by accessing the My documents tab in your profile.

- If you haven't interacted with our platform before, the process will involve a few more steps to finalize.

- Here's how new users can acquire the Withdraw Promissory Note from our inventory.

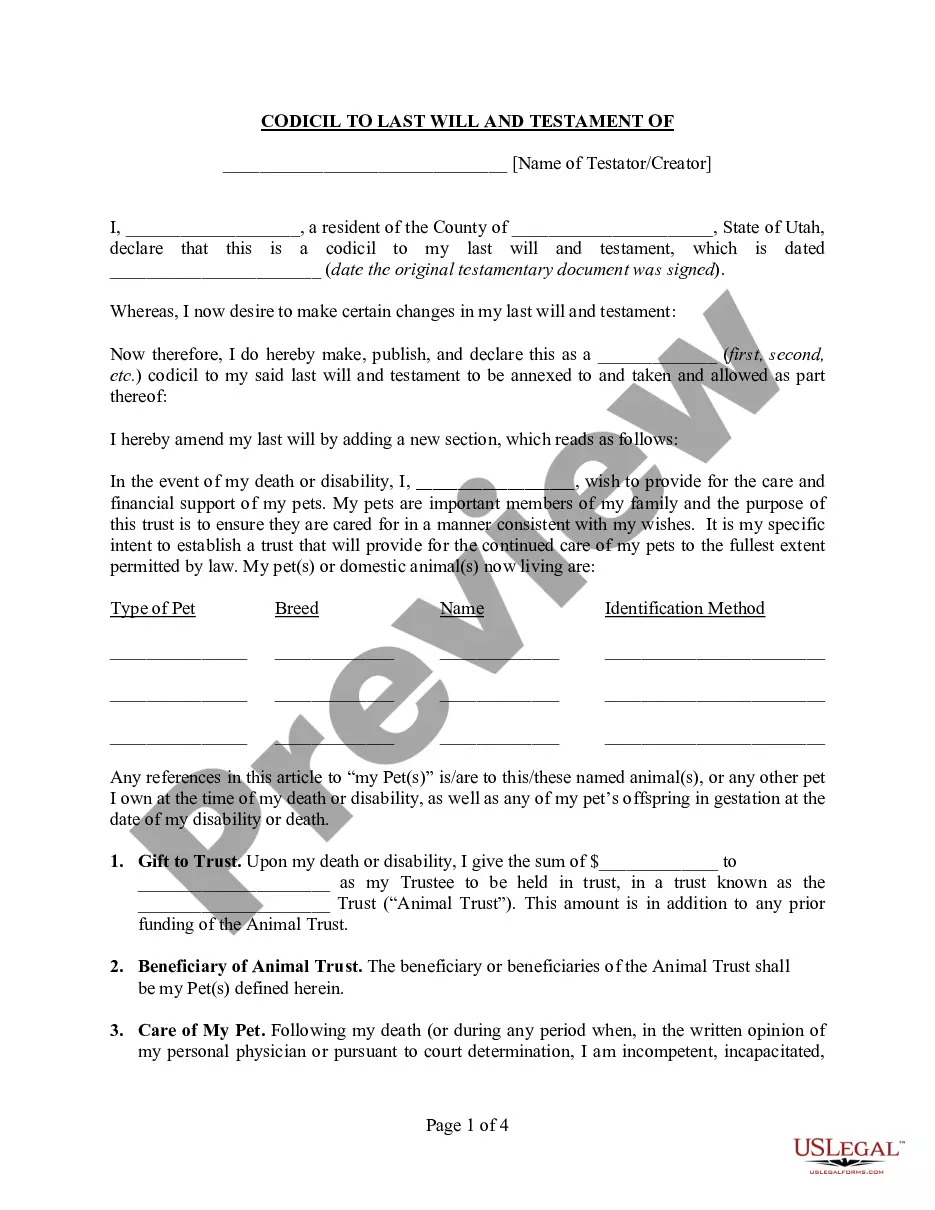

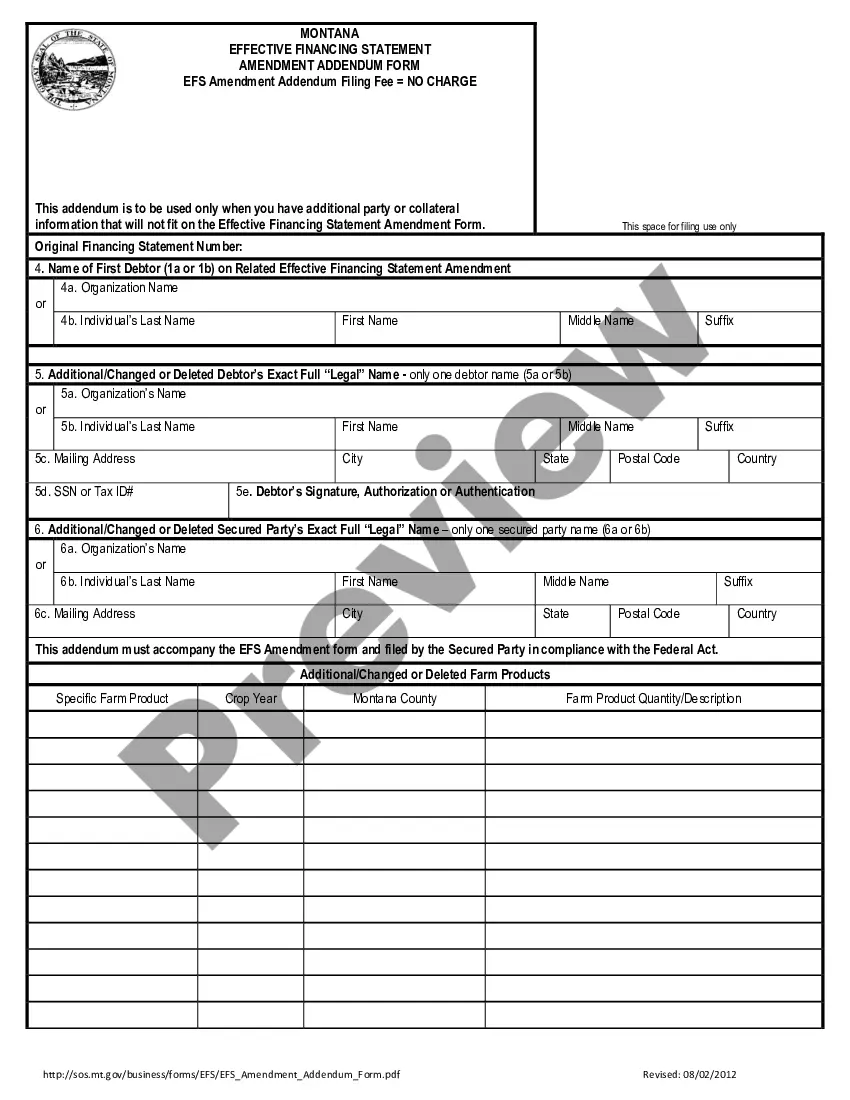

- Examine the page content attentively to verify it includes the sample you need.

- To do so, utilize the form description and preview options if available.

Form popularity

FAQ

The maker/borrower of the note will report interest expense and interest payable. The creditor/lender will report the accrued interest as interest income and interest receivable. A promissory note is created when a company borrows money from its bank.

Follow the steps below to complete the Master Promissory Note:Navigate to the website: "Log In."Enter your FSA ID and Password.Under the "Complete Aid Process" heading, select "Complete Master Promissory Note."Select the appropriate loan type.Enter Your Personal Information.More items...

The borrower records the note by debiting the cash account and crediting the notes payable account. The rest of the notes payable formula includes that interest due to date is accrued at the end of each financial period by debiting the interest expense account and crediting the interest payable liability account.

When the borrower signs the promissory note, the lender records the written promise in a Notes Receivable account, which appears under Assets on the lender's balance sheet. At the same time, the borrower records the obligation in a liabilities account such as Notes Payable, Bank Loans Payable, or something similar.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.