An estoppel certificate for a lease is a legally binding document that provides a detailed description of the current terms and conditions of a lease agreement. It serves as a verification tool for potential buyers, lenders, or investors who require accurate and up-to-date information before entering into any transaction involving the property. Estoppel certificates are commonly used in real estate transactions, particularly when the property is subject to an existing lease agreement. Keywords: estoppel certificate, lease, terms and conditions, verification tool, potential buyers, lenders, investors, accurate information, up-to-date, property, real estate transactions, existing lease agreement. In addition to the general estoppel certificate for leases, there are a few different types that may be issued based on the specific circumstances: 1. Landlord's Estoppel Certificate: This is a document that is completed and signed by the landlord or property owner. It verifies the current lease terms, rental rates, payment history, security deposits, and any other relevant information. 2. Tenant's Estoppel Certificate: Conversely, this certificate is provided by the tenant or leaseholder. It confirms their understanding of the lease terms, including the rental amount, lease duration, options for renewal, any outstanding payments, or any modifications made to the original agreement. 3. Lender's Estoppel Certificate: In situations where the leased property is being financed or mortgaged, the lender may require an estoppel certificate to ensure the lease agreement is in full force and effect. This certificate often includes information on the lease terms, options, rent payments, and any provisions that may affect the lender's interest in the property. 4. Subordination, Non-Disturbance, and Attornment (SODA) Estoppel Certificate: This type of certificate is commonly used in commercial real estate, particularly in situations involving anchor tenants, subtenants, or multiple leases. It addresses the priority of claims between different parties to the lease, such as lenders, landlords, and tenants. It provides assurances to lenders that their interests will be protected, even if there is a change in ownership or default by the borrower. These various types of estoppel certificates play a vital role in real estate transactions, ensuring transparency and clarity in lease agreements for all parties involved. They serve as an essential tool for due diligence and risk assessment before entering into any property-related transactions.

Estoppel Certificate For Lease

Description

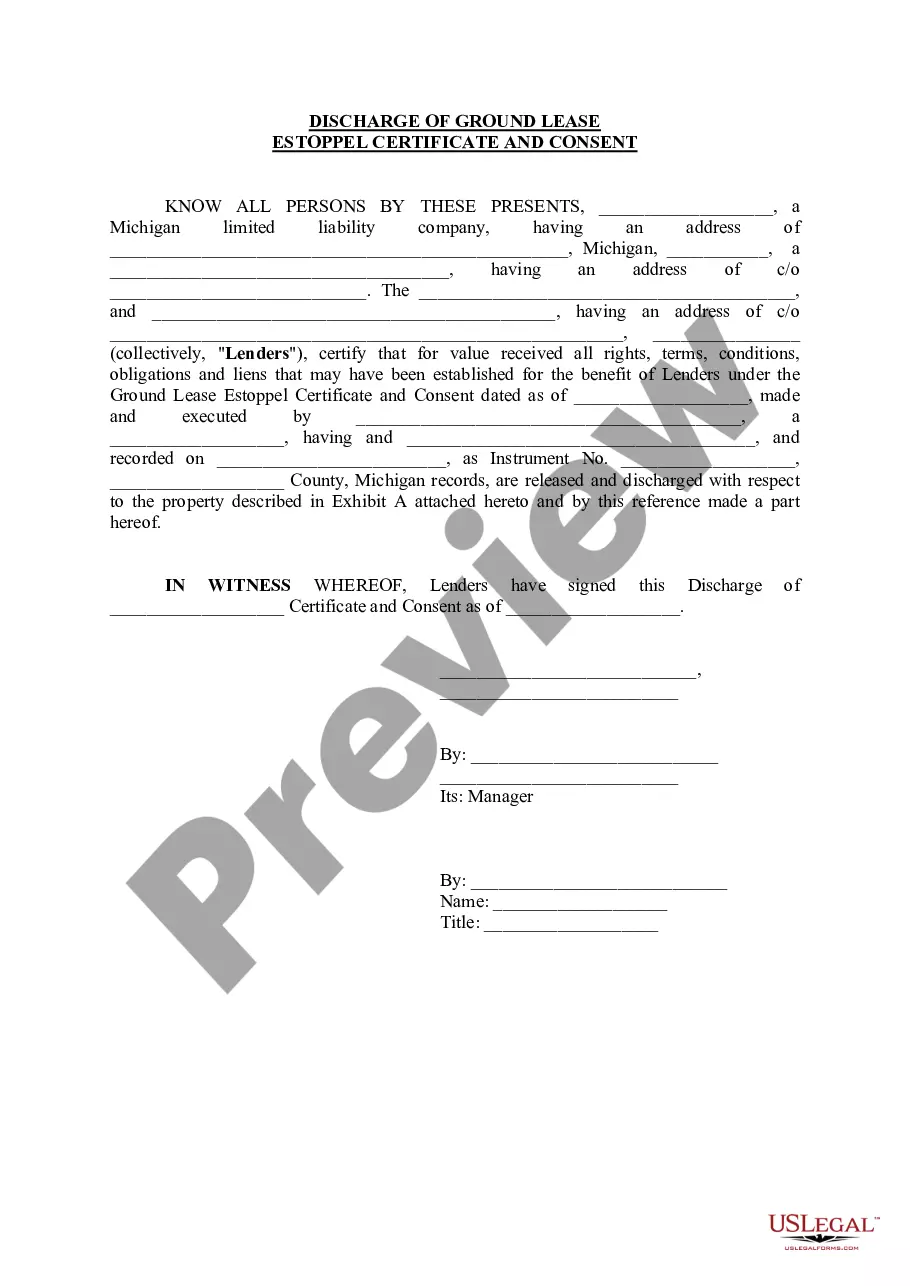

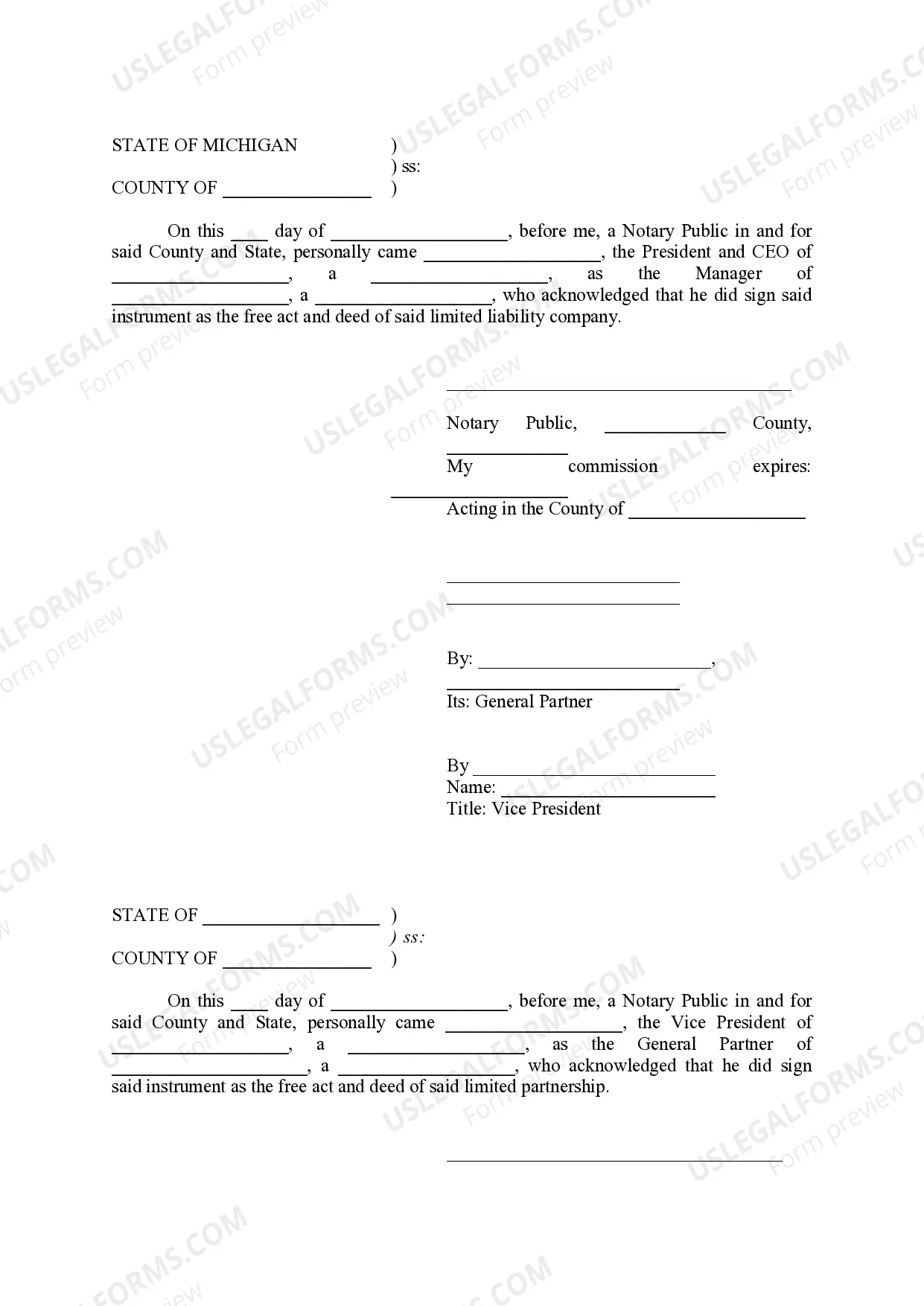

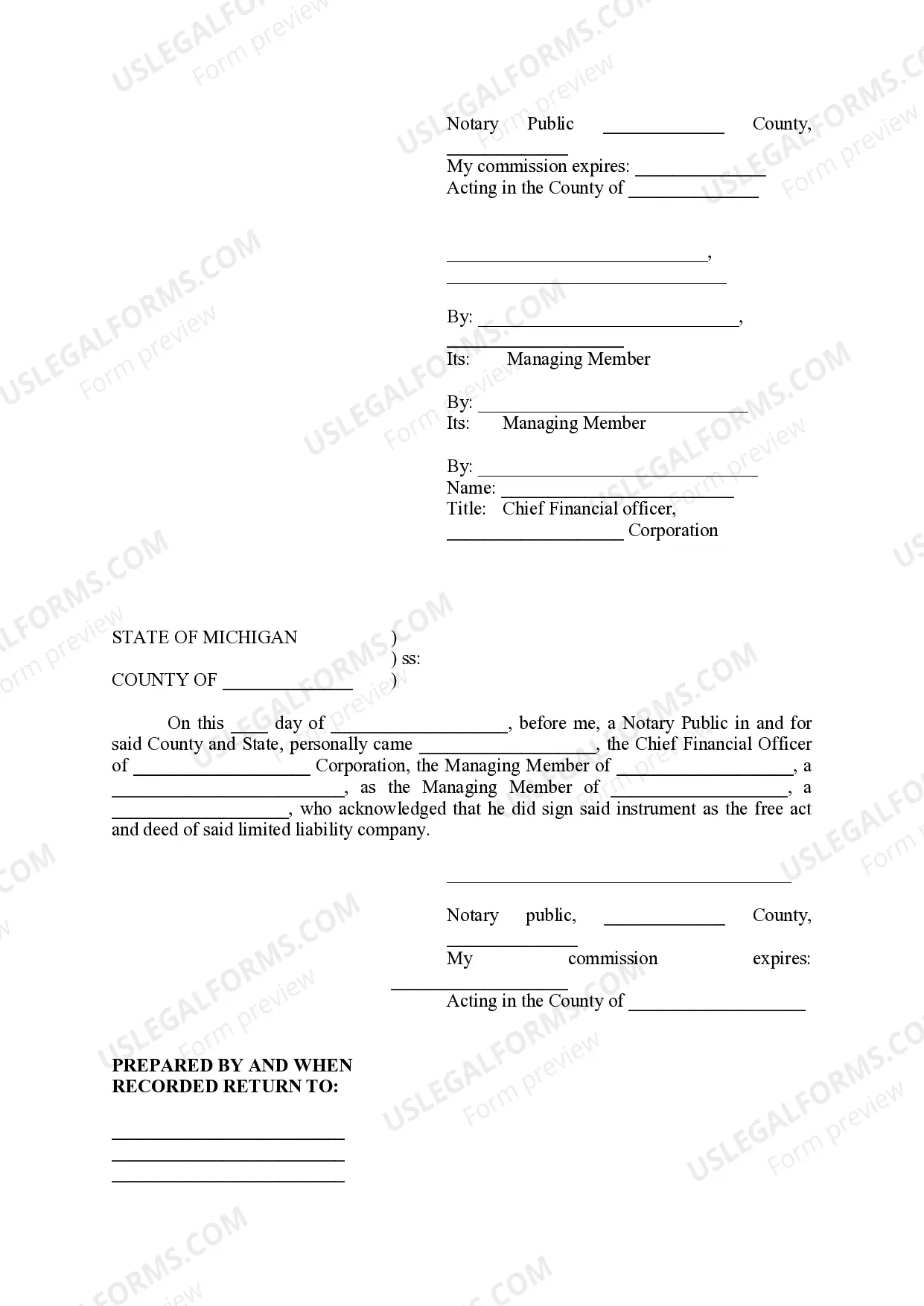

How to fill out Michigan Discharge Of Ground Lease Estoppel Certificate And Consent?

The Estoppel Certificate For Lease displayed on this site is a reusable legal document created by experienced lawyers in compliance with federal and local regulations.

For over 25 years, US Legal Forms has offered individuals, organizations, and attorneys access to more than 85,000 confirmed, state-specific forms for various business and personal needs. It’s the quickest, easiest, and most dependable way to acquire the documents you require, as the service guarantees data security at bank-level and protection against malware.

Subscribe to US Legal Forms to access verified legal templates for all of life's scenarios at your convenience.

- Search for the document you require and review it.

- Examine the file you searched and preview it or check the form description to confirm it meets your requirements. If it doesn’t, utilize the search function to find the appropriate one. Click Buy Now once you've located the template you need.

- Subscribe and Log In.

- Choose the pricing plan that fits you and create an account. Execute a quick payment using PayPal or a credit card. If you already have an account, Log In and check your subscription to proceed.

- Obtain the fillable template.

- Select the format you want for your Estoppel Certificate For Lease (PDF, DOCX, RTF) and save the document on your device.

- Complete and sign the document.

- Print out the template to fill it out by hand. Alternatively, use an online versatile PDF editor to quickly and accurately fill out and sign your form with an eSignature.

- Download your documents again.

- Reaccess the same document anytime it is required. Open the My documents tab in your profile to redownload any forms you’ve previously downloaded.

Form popularity

FAQ

To establish an estoppel certificate for lease, certain requirements must be met, including providing accurate and relevant lease information. The tenant must confirm no outstanding claims or disputes concerning the lease. Additionally, both parties need to sign and date the certificate for it to be legally binding. Understanding these requirements can ensure the document serves its purpose effectively.

Requesting an estoppel certificate for lease involves several simple steps. First, identify the appropriate person to contact, typically your landlord or property management. Next, draft a clear request that includes pertinent details such as the date needed and any specific information required. Being concise and professional in your communication can help facilitate a quicker response.

An estoppel certificate for lease is a legal document that outlines specific details of the lease agreement. It serves to confirm important information, such as rent amounts and lease terms, from the tenant's perspective. This documentation protects both parties by providing clarity and preventing future disputes. Understanding this certificate's role is crucial in any leasing context.

To request an estoppel certificate for lease, you should contact your landlord or property manager directly. It's best to put your request in writing, clearly stating your intention and any important deadlines. This approach helps maintain a clear record of your communication and shows your seriousness in the matter. Remember, the sooner you ask, the better your chances of a timely response.

Typically, the landlord or property management company prepares the estoppel certificate for lease. This document requires accurate information regarding the lease terms and the tenant's responsibilities. A legal professional may also draft it to ensure compliance with relevant laws. Having the right person handle this can streamline the process and ensure accuracy.

An estoppel statement, similar to the estoppel certificate for lease, verifies the current status of the lease. This statement confirms details like rent amounts, payment history, and any disputes related to the lease. Its purpose is to provide a snapshot for lenders or buyers, ensuring they understand the lease obligations before proceeding with a transaction. With US Legal Forms, you can efficiently generate an estoppel statement that meets your needs.

Typically, the landlord or their representative prepares the estoppel certificate for lease. However, tenants may also review and sign this document to ensure accuracy. Having both parties involved helps to foster transparency and trust. US Legal Forms offers templates that make this process smoother for everyone.

The estoppel certificate for lease serves to confirm key details about a lease agreement. It protects both landlords and tenants by confirming the lease's validity and terms. This document helps prevent disputes regarding lease obligations and ensures all parties are on the same page. By utilizing US Legal Forms, you can easily create an accurate estoppel certificate.

To write an estoppel certificate for lease, start by gathering all relevant lease details, including tenant obligations and payment history. Clearly format the document to cover essential points such as lease dates, rental amounts, and any modifications to the agreements. You can utilize platforms like US Legal Forms, which provide templates and guidance to ensure the estoppel is standardized and legally sound.

Typically, the property tenant fills out the estoppel certificate for lease, as they possess the most accurate information about their rental situation. Once completed, the certificate is presented to the landlord for their acknowledgment and signature. In many cases, lenders or potential buyers may request these documents to ensure transparency in the leasing situation.