Michigan Probate With Creditors

Description

How to fill out Michigan Probate With Creditors?

What is the most dependable service to obtain the Michigan Probate With Creditors and other current iterations of legal documents.

US Legal Forms is the solution! It boasts the largest assortment of legal papers for any intended purpose.

If you do not have an account with us yet, here are the steps you need to follow to create one: Form compliance review. Before you purchase any template, ensure that it meets your usage needs and aligns with your state or county's regulations. Review the form description and take advantage of the Preview feature, if available. Alternative document search. If there are discrepancies, use the search bar in the header to locate a different template. Click Buy Now to select the right one. Registration and subscription purchase. Choose the most suitable pricing plan, Log In or register for your account, and proceed with your subscription payment using PayPal or a credit card. Downloading the documentation. Select the format you wish to save the Michigan Probate With Creditors (PDF or DOCX) and click Download to retrieve it. US Legal Forms is a fantastic option for anyone who needs to manage legal documents. Premium users can access additional features since they can complete and authorize previously saved forms electronically at any time using the built-in PDF editing tool. Explore it today!

- Every template is expertly drafted and verified for adherence to federal and local laws.

- They are organized by area and state of application, making it simple to find the one you require.

- Familiar users of the platform simply need to Log In to the system, verify that their subscription is active, and click the Download button next to the Michigan Probate With Creditors to acquire it.

- Once downloaded, the document is accessible for future use within the My documents section of your account.

Form popularity

FAQ

In Michigan, you generally do not inherit your parents' debts unless you co-signed on any loans or accounts. When a parent passes away, their debts are typically settled through the estate during the Michigan probate process. Knowing how Michigan probate with creditors operates will help you understand your responsibilities regarding your parent’s financial legacy.

You can inherit debt in several circumstances, primarily through relationships such as marriage or co-signing loans. In Michigan, when someone dies, their debts do not automatically transfer to their heirs unless they were jointly liable. Understanding how Michigan probate with creditors functions can provide clarity in managing any inherited debts and helping you take the appropriate steps.

In Michigan, a spouse is not automatically responsible for their deceased partner's individual debts. However, joint debts are shared, meaning both partners are liable. If you find yourself dealing with this situation, understanding how Michigan probate with creditors works will be crucial in managing any outstanding obligations.

If your mom has passed away with debt and no will in Michigan, the first step is to assess her financial situation. You will need to gather information about her debts and any assets she may have. The Michigan probate process will address her creditors, and you can seek guidance from a probate attorney to navigate the complexities of Michigan probate with creditors effectively.

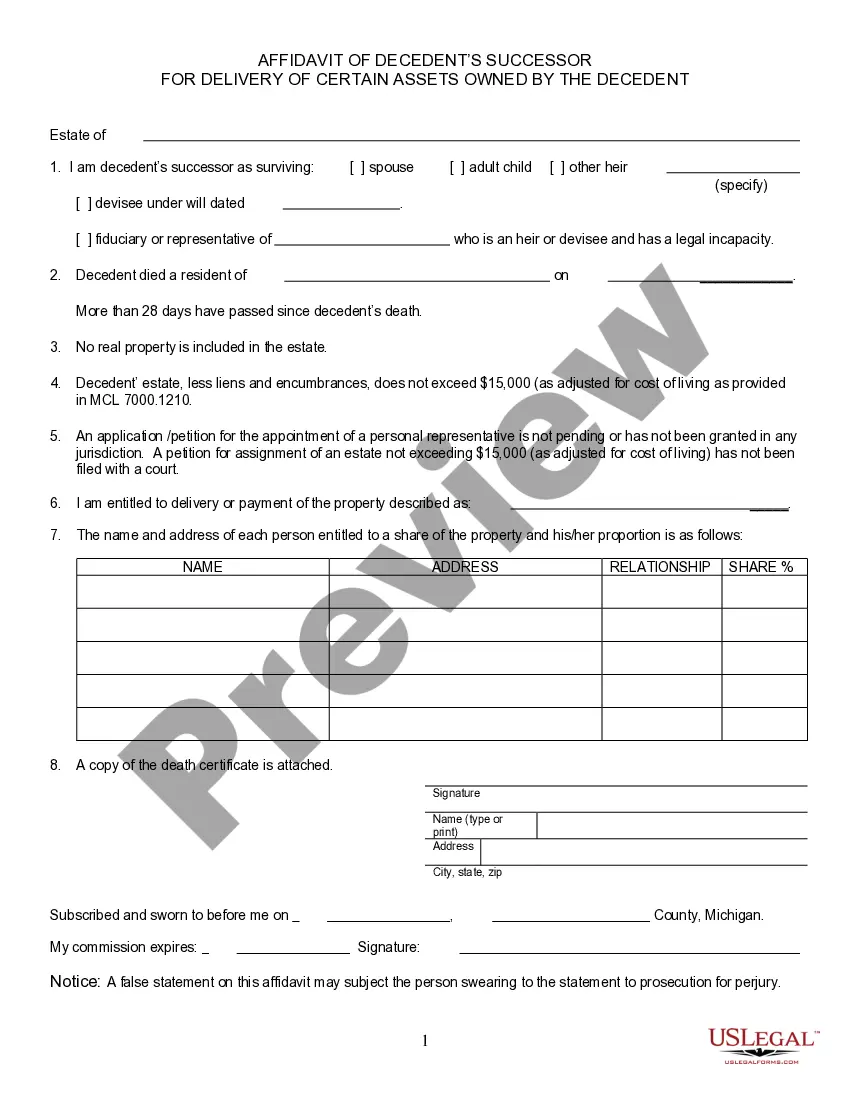

To publish a notice to creditors in Michigan probate with creditors, the personal representative must first prepare the notice, which includes key details about the estate. This notice then needs to be published in a local newspaper for three consecutive weeks. This publishing requirement grants creditors the opportunity to come forward and assert their claims against the estate. Utilizing platforms like US Legal Forms can simplify this process, providing templates and guidelines to ensure compliance.

In Michigan probate with creditors, creditors must file their claims within four months of the date the notice of appointing a personal representative is published. This time frame ensures that claims are addressed promptly, allowing the estate to settle efficiently. It's crucial for creditors to act quickly to protect their rights. Understanding the timeline helps in navigating the Michigan probate process successfully.

In Michigan, there is no minimum value for an estate to go through probate, but generally, small estates under $23,000 can use a simplified process known as 'small estate' probate. Larger estates may face a more complex probate process. Understanding the value thresholds can help you navigate the challenges of Michigan probate with creditors more efficiently.

In Michigan, a car may not necessarily go through probate, depending on how it is titled. If the vehicle is owned jointly or in a trust, it can pass directly to the co-owner or trust beneficiary. However, if it is only in the decedent’s name, it will likely need to be addressed in probate. Being aware of these details can help simplify the process associated with Michigan probate with creditors.

In Michigan, creditors have up to four months after the estate's personal representative is appointed to file a claim against the estate. This means that they need to act quickly to ensure they receive what they are owed. This period provides an opportunity for the estate to settle debts efficiently, tying back to the importance of managing Michigan probate with creditors carefully.

Yes, in Michigan, a will typically must go through probate for the court to validate it. This process ensures the decedent’s wishes are carried out. However, if all assets are non-probate and there are no creditors, the process may be minimal. It’s beneficial to plan for Michigan probate with creditors to avoid unnecessary complexities.