Certificate Of Trust Michigan Example With Explanation

Description

Form popularity

FAQ

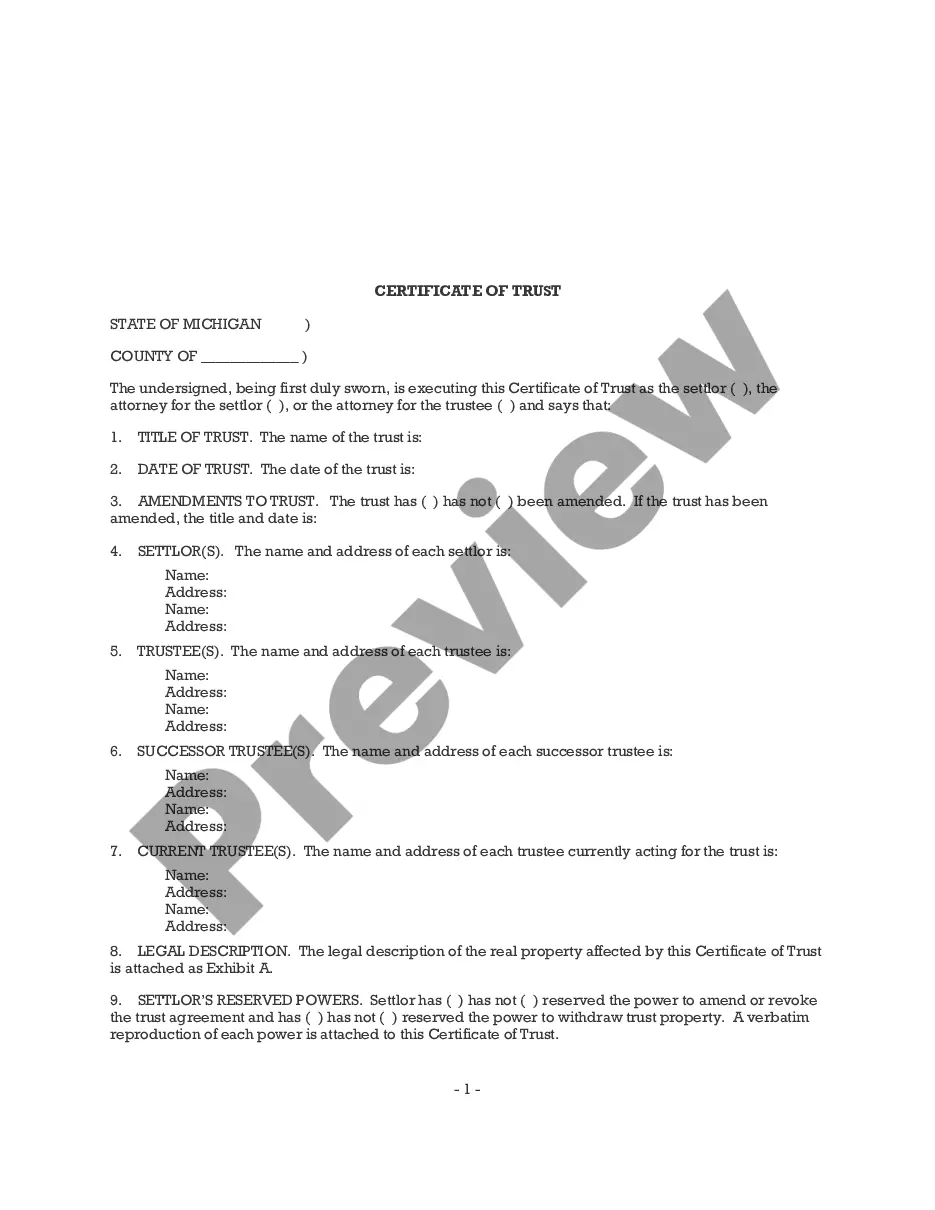

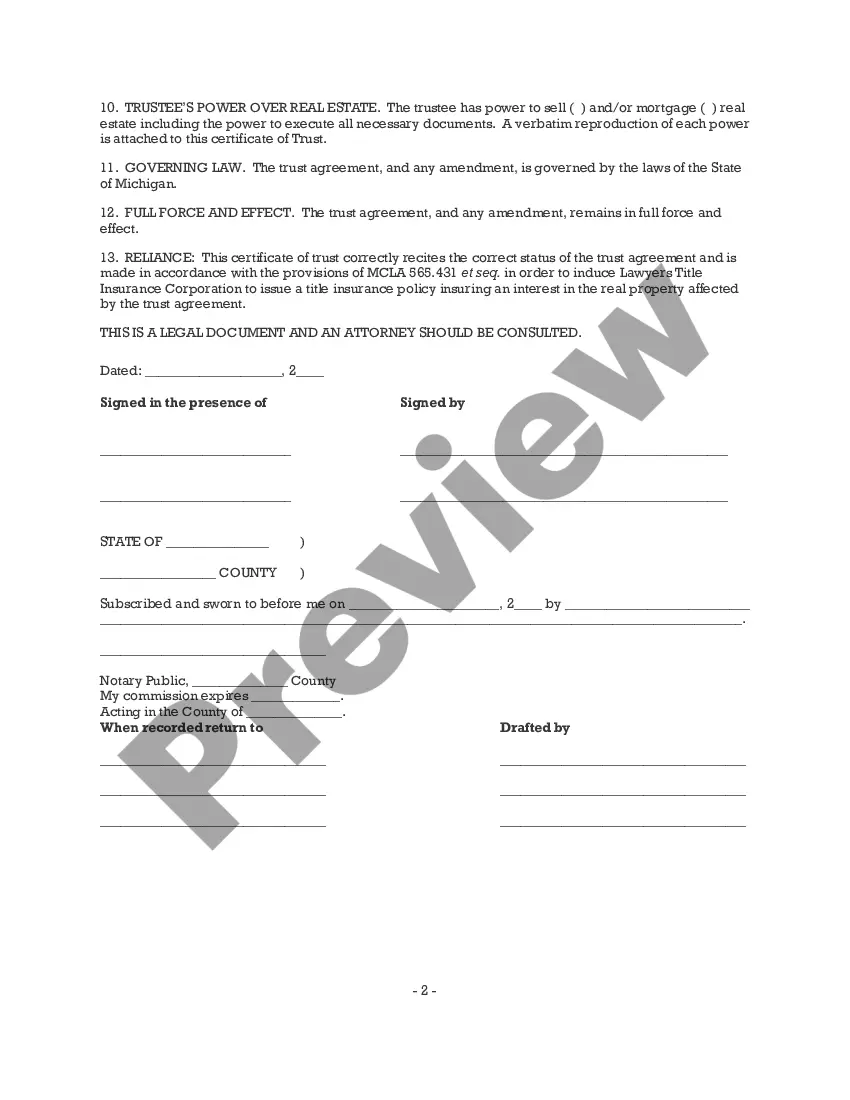

To write a certificate of trust, start by identifying the trust's name and the date it was established. Next, include details about the trustees and their authority, specifying any limitations or powers granted. It can be beneficial to use examples or templates provided by resources like uslegalforms to ensure all necessary information is clearly articulated and compliant with Michigan law.

A certificate of trust serves as a summary of the trust's key elements, allowing the trustee to engage with banks or others without revealing the entire trust document. It simplifies the verification process and grants the trustee authority to act on behalf of the trust. By providing essential information in a straightforward format, it facilitates smoother transactions and interactions concerning the trust's assets.

A certificate of trust in Michigan must include the trust's name, its date of creation, the names and contact information of the current trustees, and the powers granted to them. It is crucial that this document is accurate and complete to be recognized legally. This ensures that third parties, such as banks or other agencies, can rely on it when interacting with the trust.

Completing a certificate of trust involves filling out a form that includes basic trust details, such as the trust name, date of establishment, and trustee information. You may also need to include pertinent provisions that specify the trustee's powers. For an effective example of a certificate of trust in Michigan, consider using tools provided by platforms like uslegalforms, which can guide you in preparing this legal document correctly.

In Michigan, a certificate of trust must include essential information, such as the name of the trust, the date it was created, and the names of the trustees. Moreover, it should state the authority granted to the trustee, allowing them to act on behalf of the trust. This concise document ensures that interested parties can verify trust details without navigating the entire trust document.

For a trust to be valid in Michigan, it must have specific elements, including a clear intention to create a trust, identifiable assets, designated beneficiaries, and a competent trustee. Additionally, the trust must comply with Michigan law, meaning it should be in writing if it involves real estate. By ensuring these criteria are met, you can create a legal and binding trust document.

A trust is a legal arrangement where one party holds property for the benefit of another, while a certificate of trust is a document that summarizes the trust's essential information. The certificate of trust provides third parties with key details about the trust, such as its title and the authority of the trustee, without disclosing every aspect of the trust. Essentially, the certificate acts as a concise reference for those who need to engage with the trust in Michigan.

A certified trust statement is a formal document that provides evidence of a trust's existence and its terms. It typically includes details about the trust's assets, the trustee, and the beneficiaries. In Michigan, this statement serves as proof when you need to demonstrate the trust's validity to financial institutions or legal entities, making it essential for managing your assets effectively.

The simplest form of a trust is often a bare trust, also known as a passive trust. In this arrangement, the trustee holds the assets for the beneficiary, granting them full rights for control. The beneficiary can instruct the trustee to transfer the trust assets as desired. For insightful examples like a Certificate of trust Michigan example with explanation, uslegalforms can provide comprehensive guidance.

A common simple example of a trust is an irrevocable trust. Once established, the assets placed within the trust cannot be changed or revoked by the person who created it, offering strong protection against creditors. This type of trust is often used for tax benefits and estate planning purposes. To find out how a Certificate of trust Michigan example with explanation can illustrate this concept, uslegalforms offers numerous resources.