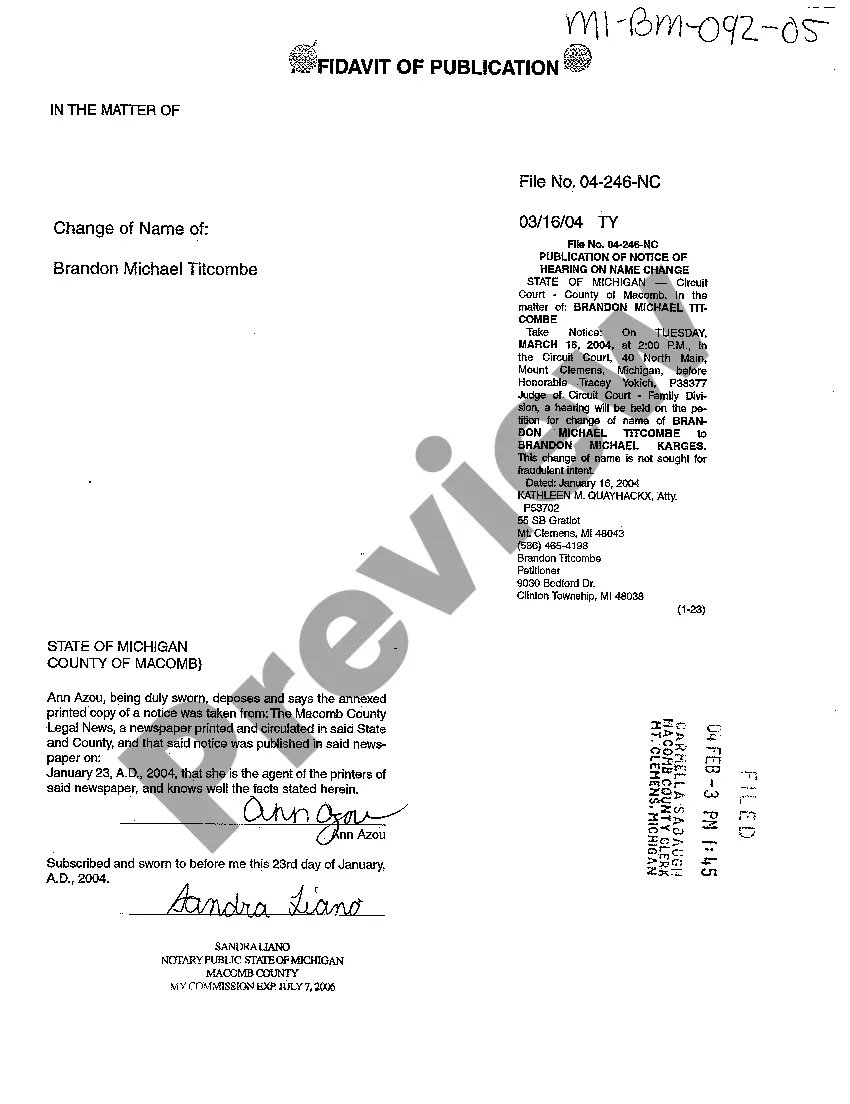

Affidavit Of Publication Michigan For Death

Description

How to fill out Michigan Affidavit Of Publication?

Finding a go-to place to access the most current and appropriate legal samples is half the struggle of handling bureaucracy. Discovering the right legal documents demands precision and attention to detail, which is why it is vital to take samples of Affidavit Of Publication Michigan For Death only from trustworthy sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You can access and see all the details concerning the document’s use and relevance for the circumstances and in your state or region.

Take the listed steps to complete your Affidavit Of Publication Michigan For Death:

- Make use of the library navigation or search field to find your sample.

- View the form’s information to ascertain if it fits the requirements of your state and region.

- View the form preview, if there is one, to make sure the form is the one you are looking for.

- Get back to the search and find the appropriate document if the Affidavit Of Publication Michigan For Death does not fit your requirements.

- When you are positive about the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and gain access to your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Choose the pricing plan that fits your needs.

- Proceed to the registration to finalize your purchase.

- Finalize your purchase by selecting a payment method (bank card or PayPal).

- Choose the file format for downloading Affidavit Of Publication Michigan For Death.

- Once you have the form on your device, you may modify it with the editor or print it and finish it manually.

Get rid of the hassle that accompanies your legal paperwork. Discover the extensive US Legal Forms catalog where you can find legal samples, check their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

Ing to Michigan law, this simplified procedure is available if the value of the estate is less than $15,000 after all funeral and burial costs are paid. Probate can be skipped altogether in cases where the estate is valued as lower than $15,000 and contains no real estate.

MI Form PC 561, which may also referred to as Waiver/consent, is a probate form in Michigan. It is used by executors, personal representatives, trustees, guardians & other related parties during the probate & estate settlement process.

Although Michigan does not stipulate a legal timeframe, filing a probate petition as soon as possible will be in everybody's best interests. The probate process takes a minimum of five months in Michigan, but most probate cases take between six months and a full year. In contested cases, probate may take far longer.

Affidavit of Decedent's Successor for Delivery of Certain Assets Owned by Decedent (PC 598) may be used to affirm the following: More than 28 days have passed since the death of the decedent. The estate does not include real property.

You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee). Then?and this is crucial?you must transfer ownership of your property to yourself as the trustee of the trust.