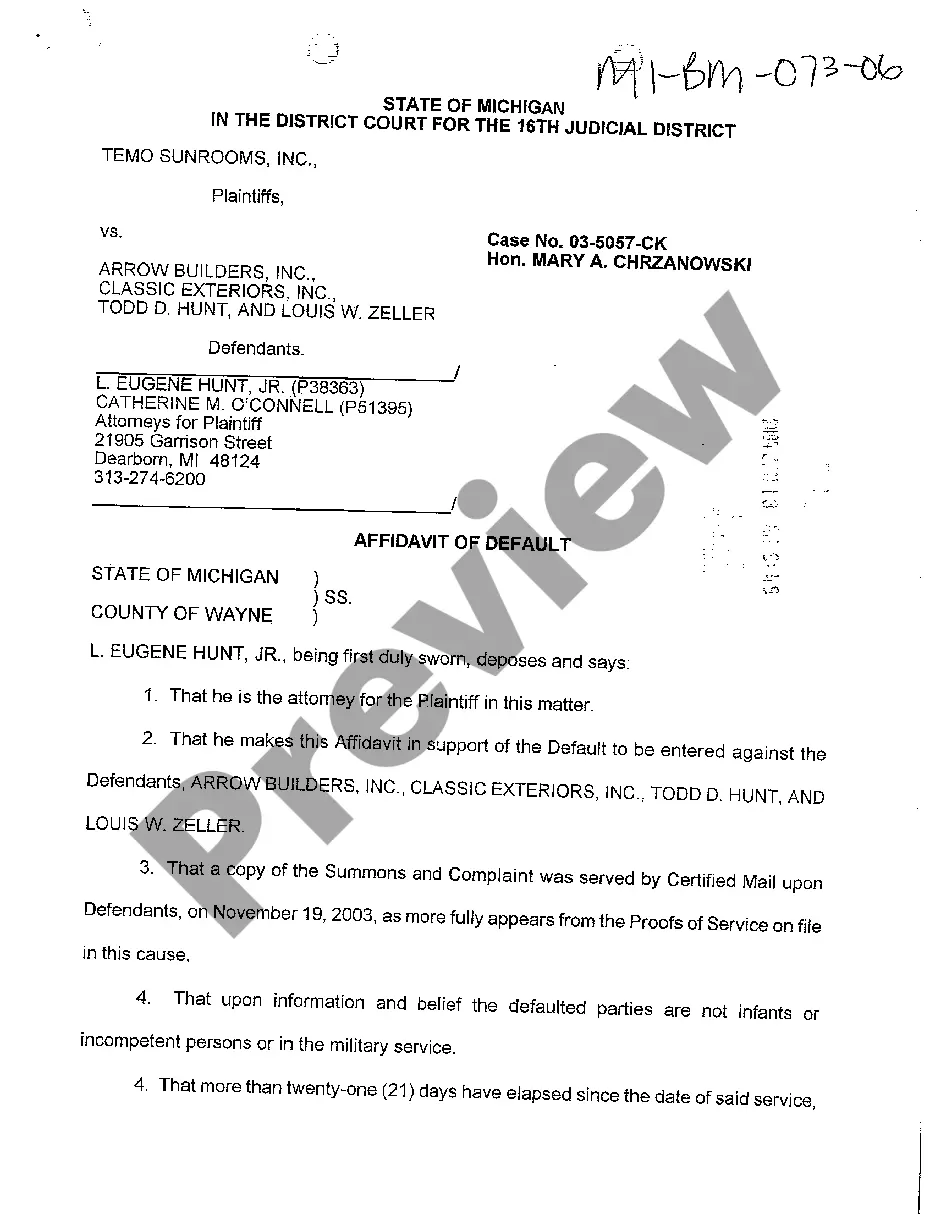

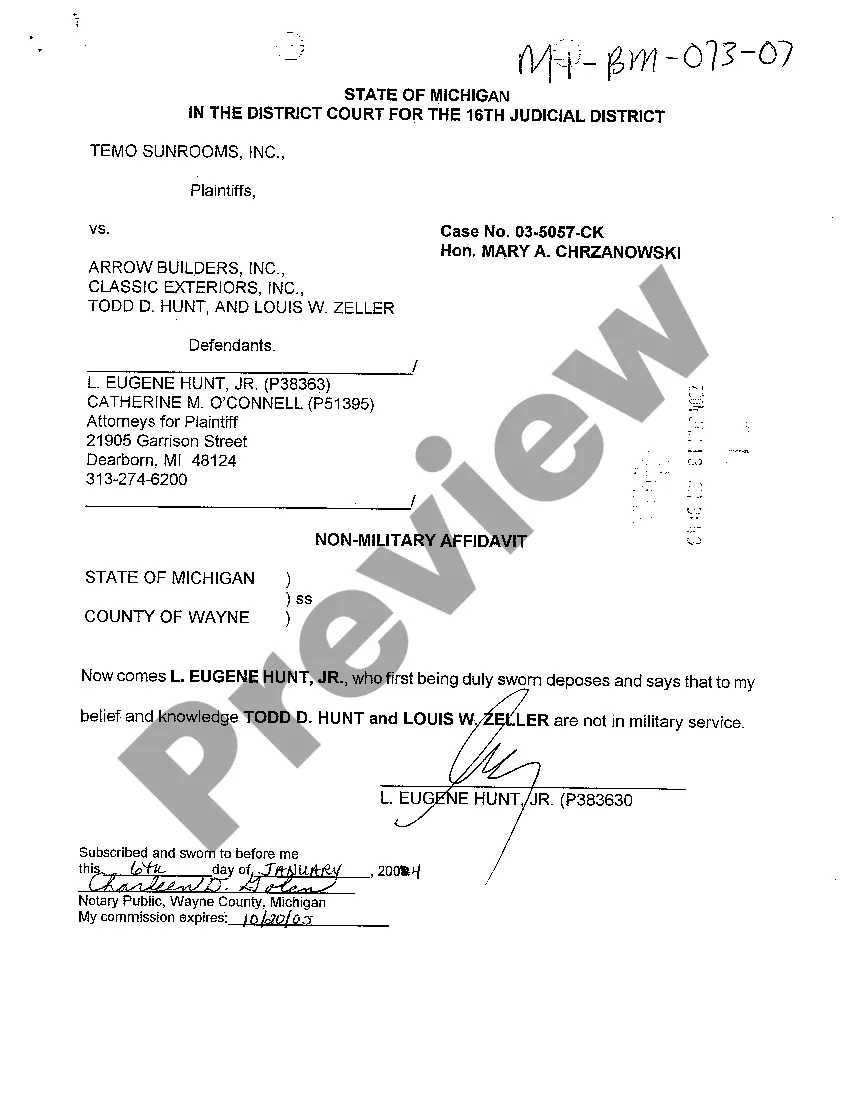

Michigan Non Military Affidavit For Exemption Of Excise Tax

Description

How to fill out Michigan Non-Military Affidavit?

Bureaucracy requires exactness and correctness.

If you don’t handle paperwork such as the Michigan Non Military Affidavit For Exemption Of Excise Tax on a regular basis, it could lead to some misunderstanding.

Selecting the appropriate sample from the outset will guarantee that your document submission will occur smoothly and avert any issues of resubmitting a file or repeating the task from scratch.

Acquiring the right and current samples for your documentation is just a matter of minutes with an account at US Legal Forms. Eliminate the uncertainties of bureaucracy and simplify your form management.

- Access the template by utilizing the search functionality.

- Verify that the Michigan Non Military Affidavit For Exemption Of Excise Tax you found is suitable for your state or county.

- View the preview or examine the description that contains the details regarding the use of the template.

- When the result satisfies your search criteria, click the Buy Now button.

- Choose the appropriate option from the proposed pricing plans.

- Log In to your existing account or create a new one.

- Finalize the purchase using a credit card or PayPal.

- Download the form in your preferred format.

Form popularity

FAQ

Active-duty service members file state income taxes in their state of legal residence. Military service members are not required to change their legal residence when they move to a new state solely because of military orders; they may maintain their legal residence in a state where they have previously established it.

Freedom from Taxes If you serve in a combat zone as an enlisted service member or as a warrant officer for any part of a month, all your income for that month is exempt from federal taxes.

Veterans of the United States Armed Forces or the Virginia National Guard who the U.S. Department of Veteran Affairs determined have a 100% service-connected, permanent, and total disability are eligible for a sales and use tax exemption on the purchase of a vehicle owned and used primarily by or for the qualifying

A property tax exemption is available for disabled veterans. Public Act 161, which went into effect November 12, 2013, applies to a homestead property of a disabled veteran who was discharged from the United States armed forces under honorable conditions.

Sec. 7b. (1) Real property used and owned as a homestead by a disabled veteran who was discharged from the armed forces of the United States under honorable conditions or by an individual described in subsection (2) is exempt from the collection of taxes under this act.