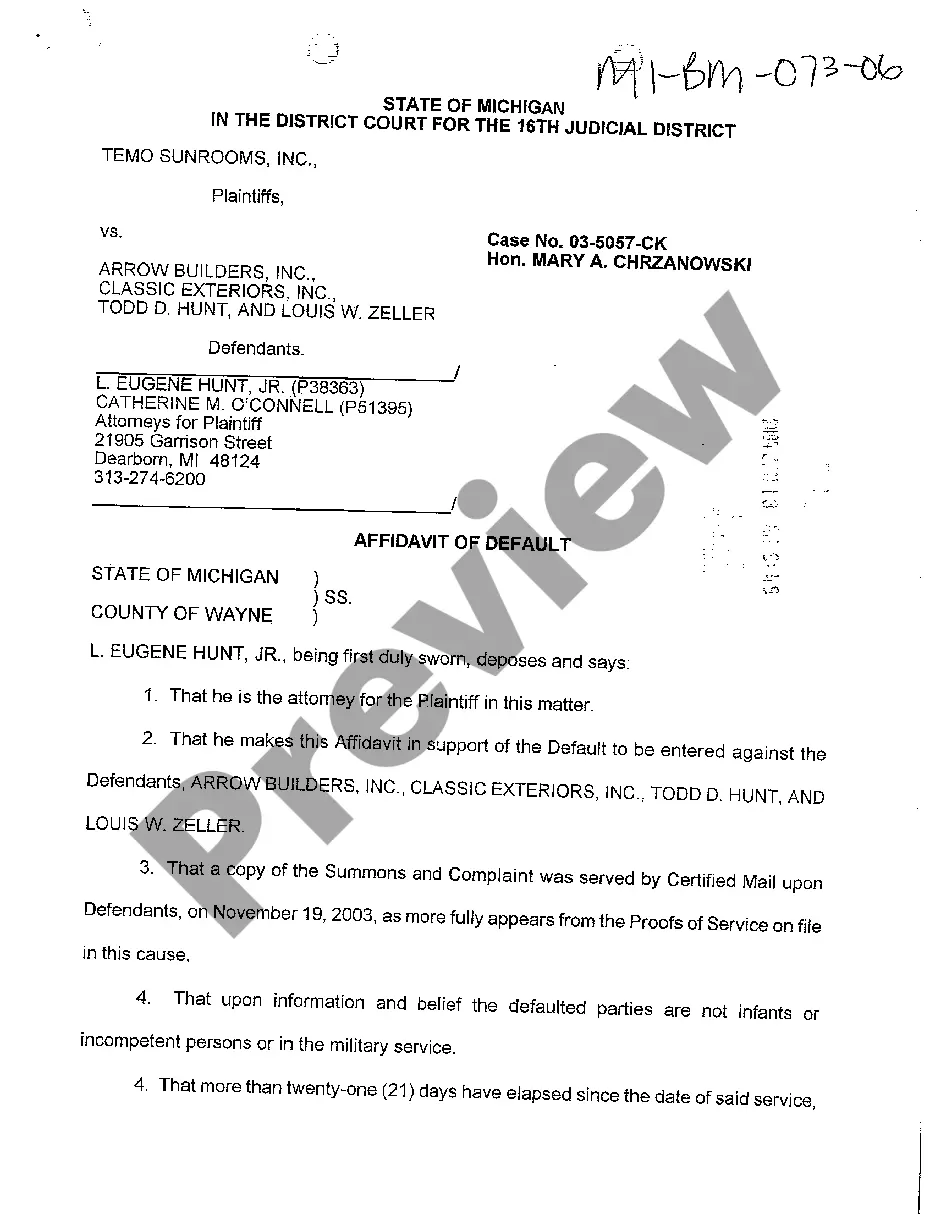

Default Affidavit Michigan Withholding Tax

Description

How to fill out Michigan Affidavit Of Default?

There's no longer a necessity to dedicate hours searching for legal documents to meet your local state obligations.

US Legal Forms has compiled all of them in one location and simplified their availability.

Our platform offers over 85k templates for various business and personal legal situations categorized by state and application area.

Preparing official documents in accordance with federal and state laws and regulations is fast and simple with our platform. Experience US Legal Forms today to keep your paperwork organized!

- All forms are meticulously prepared and verified for accuracy, so you can be confident in obtaining a current Default Affidavit Michigan Withholding Tax.

- If you are acquainted with our service and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also access all previously obtained documents whenever needed by visiting the My documents tab in your profile.

- If you have not used our service before, the process will require a few additional steps.

- Here's how new users can locate the Default Affidavit Michigan Withholding Tax in our collection.

- Examine the page content closely to confirm it contains the sample you need.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

Sec. 2809. (1) Unless subsection (2) or (3) applies, a judgment lien expires 5 years after the date it is recorded. (2) Unless subsection (3) applies, if a judgment lien is rerecorded under subsection (4), the judgment lien expires 5 years after the date it is rerecorded.

Collecting Your JudgmentCollect Before the Judgment Expires.Setting up a Payment Plan.Using Court Processes to Collect the Judgment.Filing a Discovery Subpoena.Serving the Discovery Subpoena.Garnishing the Debtor.Seizing Property.When the Judgment is Paid.

Your judgment might be for money, repossession, eviction, foreclosure, or any number of things. In any case, your rights at this point would be the same as if you had gone to trial and won. A Motion to Vacate is one way by which a defendant can avoid enforcement of a default judgment.

Collecting Your JudgmentCollect Before the Judgment Expires.Setting up a Payment Plan.Using Court Processes to Collect the Judgment.Filing a Discovery Subpoena.Serving the Discovery Subpoena.Garnishing the Debtor.Seizing Property.When the Judgment is Paid.

If the judge grants your motion, the default or default judgment will be set aside, and the case will move forward. You will need to attend all hearings and respond to any documents you get from the court or the other side. If your motion is denied, the default judgment stands and you must pay the judgment.