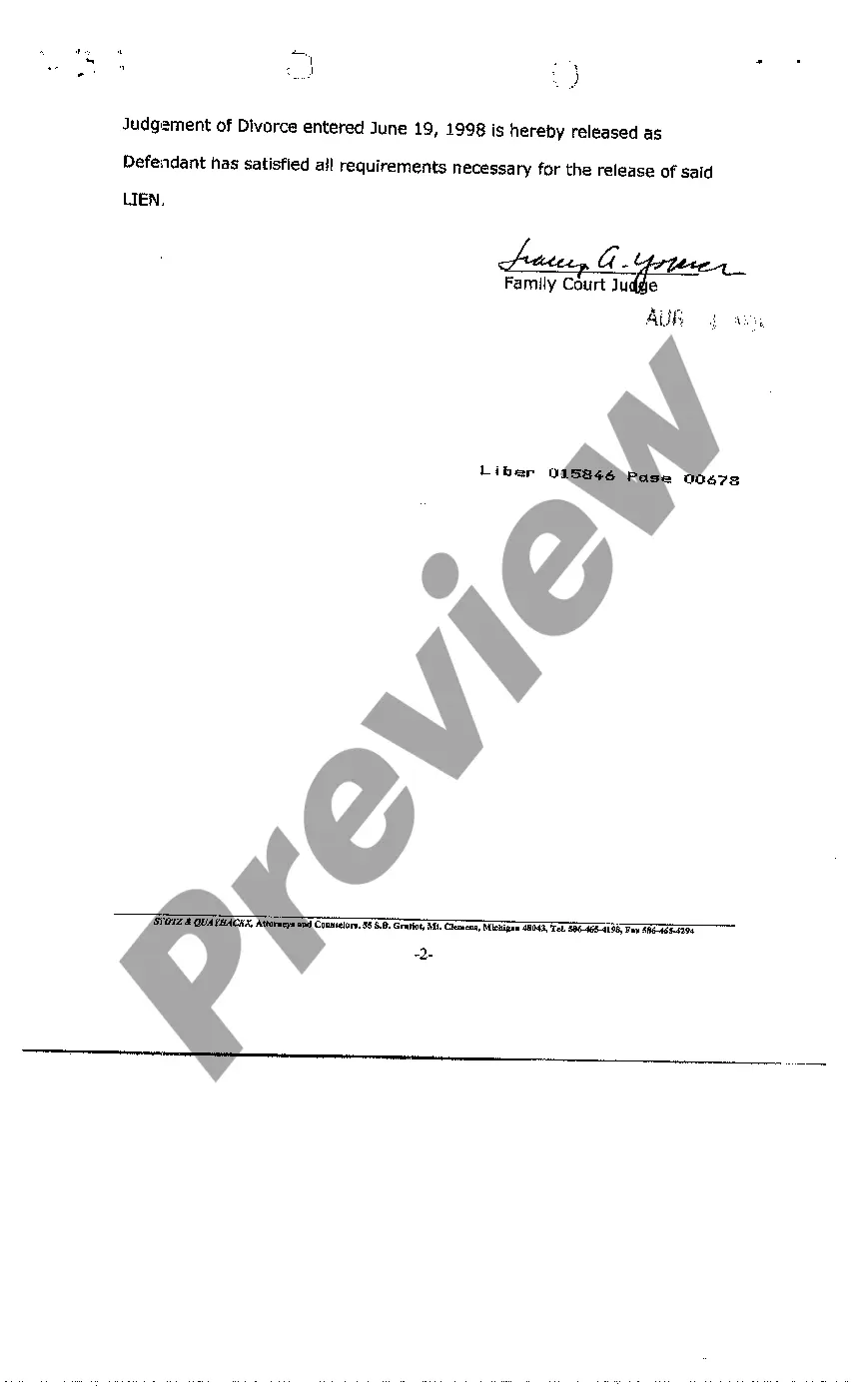

Michigan Vehicle Lien Release Form With Lien

Description

How to fill out Michigan Order For Release Of Lien?

The Michigan Vehicle Lien Release Template With Lien displayed on this webpage is a reusable formal document created by expert attorneys in compliance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with more than 85,000 authenticated, state-specific documents for any professional and personal needs. It’s the fastest, simplest, and most reliable method to acquire the forms you require, as the service ensures bank-grade data protection and anti-malware safeguards.

Subscribe to US Legal Forms to access verified legal templates for every aspect of life.

- Search for the document you require and review it.

- Examine the template you found and preview it or review the description to confirm it meets your needs. If it does not, utilize the search function to locate the appropriate one. Click Buy Now once you have found the form you are looking for.

- Register and Log In to your account.

- Choose the pricing plan that fits you and establish an account. Use PayPal or a credit card to complete a swift payment. If you already possess an account, Log In and verify your subscription to move forward.

- Retrieve the editable document.

- Select your preferred format for the Michigan Vehicle Lien Release Form With Lien (PDF, DOCX, RTF) and download the template onto your device.

- Complete and sign the document.

- Print the form to fill it out manually. Alternatively, use an online multifunctional PDF editor to quickly and accurately complete and sign your form electronically.

- Download your document again.

- You can access the same document again when necessary. Navigate to the My documents tab in your account to redownload any previously purchased templates.

Form popularity

FAQ

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

A Florida Mortgage Instrument and Promissory Note does not need to be notarized to be legally binding. It does however require a witness to the document's signing by both impacted parties, the lender and the borrower.

All parties must sign the promissory note. Florida law does not require that the promissory note be notarized, but parties often take this extra step.

No. Promissory notes do not need to be notarized. The borrower only needs to sign the document to make it legally enforceable. A witness may be helpful if one party contests the note, but a notary is not necessary.

To be legally enforceable, a promissory note must meet multiple legal conditions. Moreover, it must contain both an offer of agreement and an acceptance of agreement. All contracts state the type of services or goods rendered and indicate how much they cost.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

A promissory note Florida requires several terms stated clearly in the written instrument that explain the key rights and obligations for both the lender and borrower. Some of these requirements include: Interest rate and how it accrues (e.g., per annum) Principal sum (i.e., the loan amount)

Incomplete signatures This means both the lender and borrower must sign the original document (plus any amended versions). Without the signatures, the promissory note has no legal leg to stand on.