Lien Release Michigan Withholding Tax

Description

How to fill out Michigan Order For Release Of Lien?

It’s well known that you cannot transform into a legal expert in a single night, nor can you easily learn how to swiftly create a Lien Release for Michigan Withholding Tax without possessing a specific skill set. Compiling legal paperwork is a lengthy endeavor that necessitates certain training and abilities. So, why not entrust the preparation of the Lien Release for Michigan Withholding Tax to the experts.

With US Legal Forms, one of the largest collections of legal document templates, you can discover everything from court forms to templates for internal company communications. We understand how vital it is to comply with and adhere to federal and state laws and regulations. That’s why, on our platform, all templates are location-specific and current.

Let’s begin with our website and acquire the document you require in just a few minutes.

You can access your forms again from the My documents section at any time. If you’re an existing customer, you can simply Log In, and locate and download the template from the same section.

Regardless of the intent behind your forms—whether it’s financial, legal, or personal—our website has you covered. Give US Legal Forms a try now!

- Find the document you’re searching for by utilizing the search bar at the top of the page.

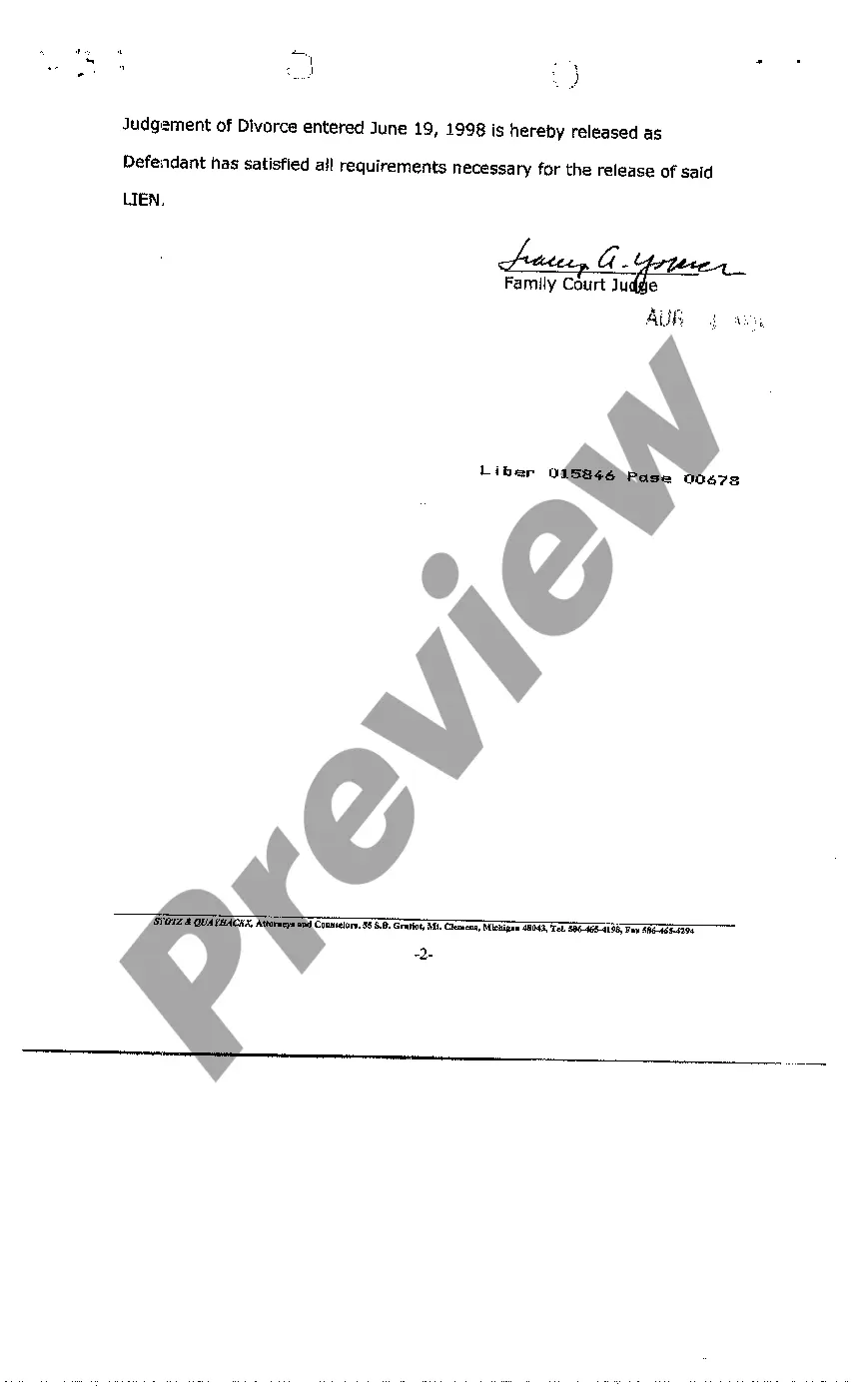

- Preview it (if this feature is available) and review the accompanying description to determine whether Lien Release for Michigan Withholding Tax is what you seek.

- Start your search anew if you need a different document.

- Create a free account and select a subscription plan to purchase the form.

- Click Buy now. After the transaction is finalized, you can obtain the Lien Release for Michigan Withholding Tax, complete it, print it, and send it or forward it by mail to the required individuals or organizations.

Form popularity

FAQ

To close out a withholding account, submit Form D-941 as a ?Final Return.? Check the box in the lower left corner of the form and answer the applicable questions on the reverse side. Within 30 days after filing a ?Final Return,? a DW-3 Annual Reconciliation must be submitted with W-2 forms or accept- able E.D.P.

Michigan law provides for the creation of a lien when a taxpayer owes back taxes to the Michigan Department of Treasury to protect the State's interest in the property because of back taxes ? in other words, to ensure that profit from a sale of property is paid to the Michigan Department of Treasury.

Every employer in Michigan who is required to withhold federal income tax under the Internal Revenue Code, must also be registered for and withhold Michigan income tax.

In order to close your sales tax permit in Michigan, you will need to complete the Michigan Notice of Change or Discontinuance form 163.

With tax return: Make check payable to the ?State of Michigan?. Carefully write the business tax account number, ?SUW?, and the return period on the memo line of the check. Send with the tax return to the address listed on the return form.