Bill Of Sale Michigan With Deposit

Description

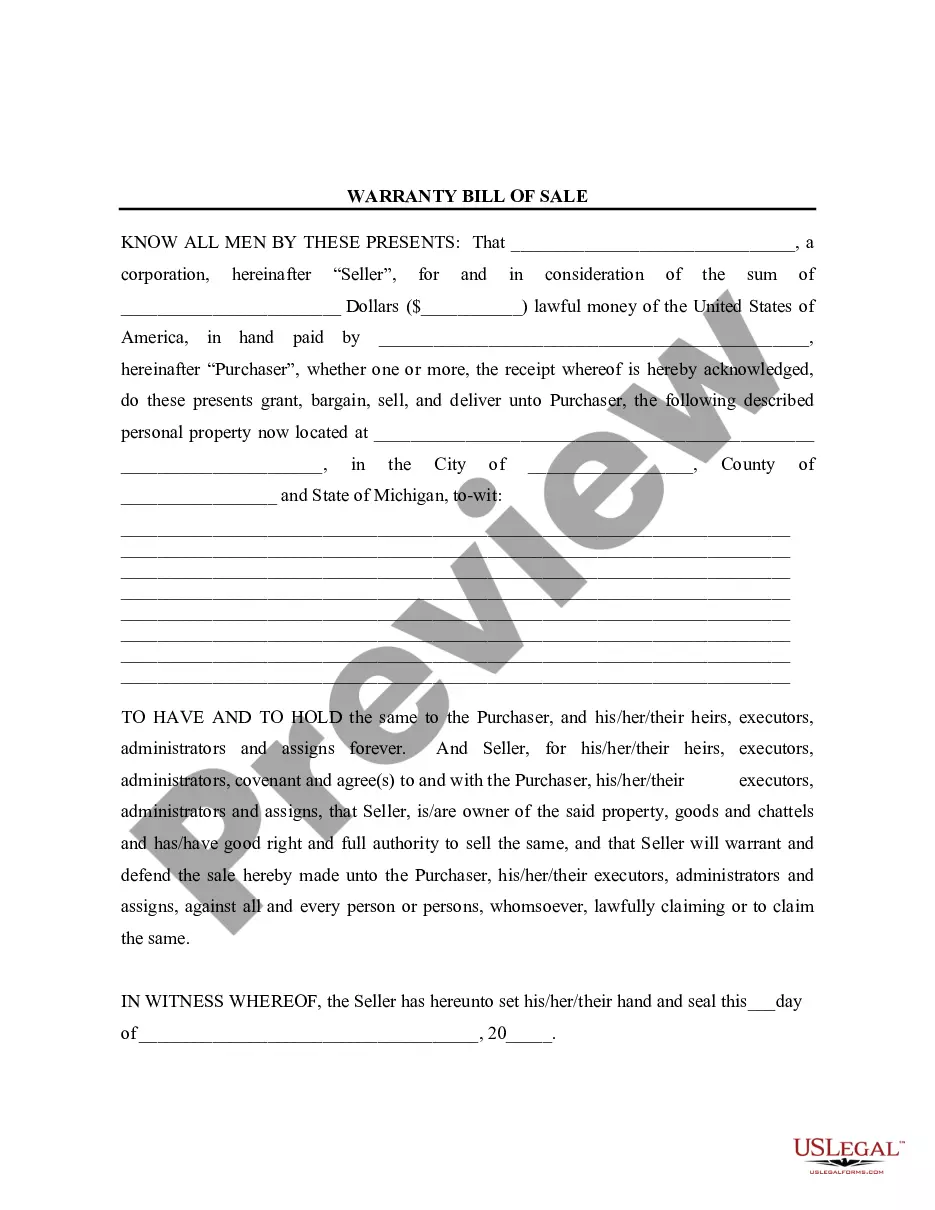

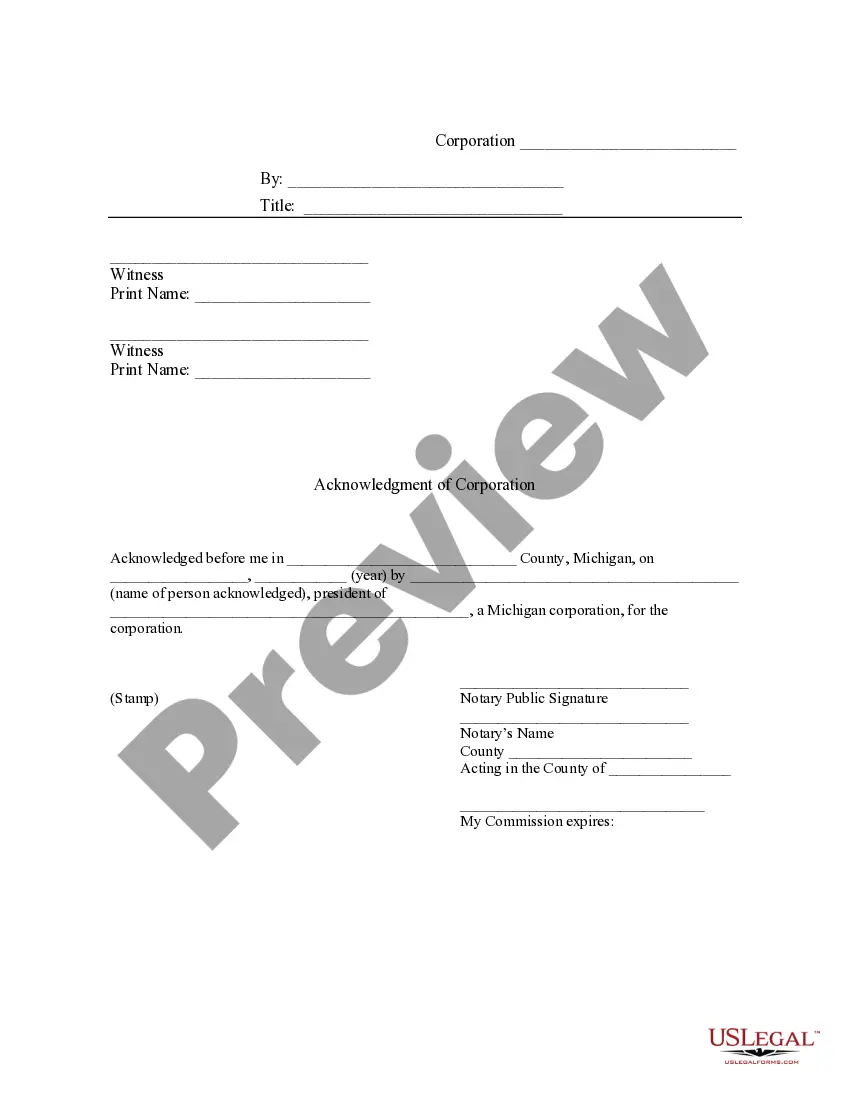

How to fill out Michigan Bill Of Sale With Warranty For Corporate Seller?

When you need to finalize the Bill Of Sale Michigan With Deposit that adheres to your local state’s statutes and regulations, there can be numerous options to select from.

There’s no requirement to examine every document to ensure it fulfills all the legal prerequisites if you are a US Legal Forms member.

It is a reliable service that can assist you in obtaining a reusable and current template on any subject.

Acquiring properly drafted official documentation becomes simple with US Legal Forms. Additionally, Premium users can also take advantage of powerful integrated tools for online PDF editing and signing. Give it a shot today!

- US Legal Forms is the most extensive online directory with a library of over 85k ready-to-use documents for both business and personal legal situations.

- All templates are verified to comply with each state's laws and regulations.

- Consequently, when downloading the Bill Of Sale Michigan With Deposit from our platform, you can be confident that you possess a valid and current document.

- Obtaining the necessary template from our platform is remarkably simple.

- If you already have an account, just Log In to the system, verify that your subscription is active, and save the selected file.

- Subsequently, you can navigate to the My documents tab in your profile and maintain access to the Bill Of Sale Michigan With Deposit at any time.

- If it’s your first time using our library, please follow the guide below.

- Review the suggested page and ensure it meets your needs.

Form popularity

FAQ

The charge for California Redemption Value (CRV) is not a deposit, but a fee imposed on the distributor of the beverage, the state explains. The fee is passed along to the retailer and to you as the consumer. Although separately stated, the fee is subject to tax as part of the taxable selling price of the beverage.

Bottle bills, also known as container deposit return laws, are the practice of adding a small deposit on top of the price of a beverage. This is repaid to the consumer when the empty can or bottle is returned to a retailer or redemption center for recycling.

Michigan has one of the country's largest beverage container deposits at 10 cents for every carbonated or distilled beverage. It covers both cans and bottles. Violators often bring containers purchased out of state into Michigan to collect bottle returns on beverages that were not subject to paying the 10-cent deposit.

A Michigan law passed in 2004 (PA 34 of 2004) makes it illegal to dispose beverage containers in a landfill. Bottles and cans may be recycled or redeemed for deposit. The cardboard cartons are also recyclable.

Under Michigan's current law, distributors must charge a 10-cent deposit per returnable container when they sell their products to retailers. Retailers then pass the charge onto customers and refund it when containers are returned.