Limited Lianility

Description

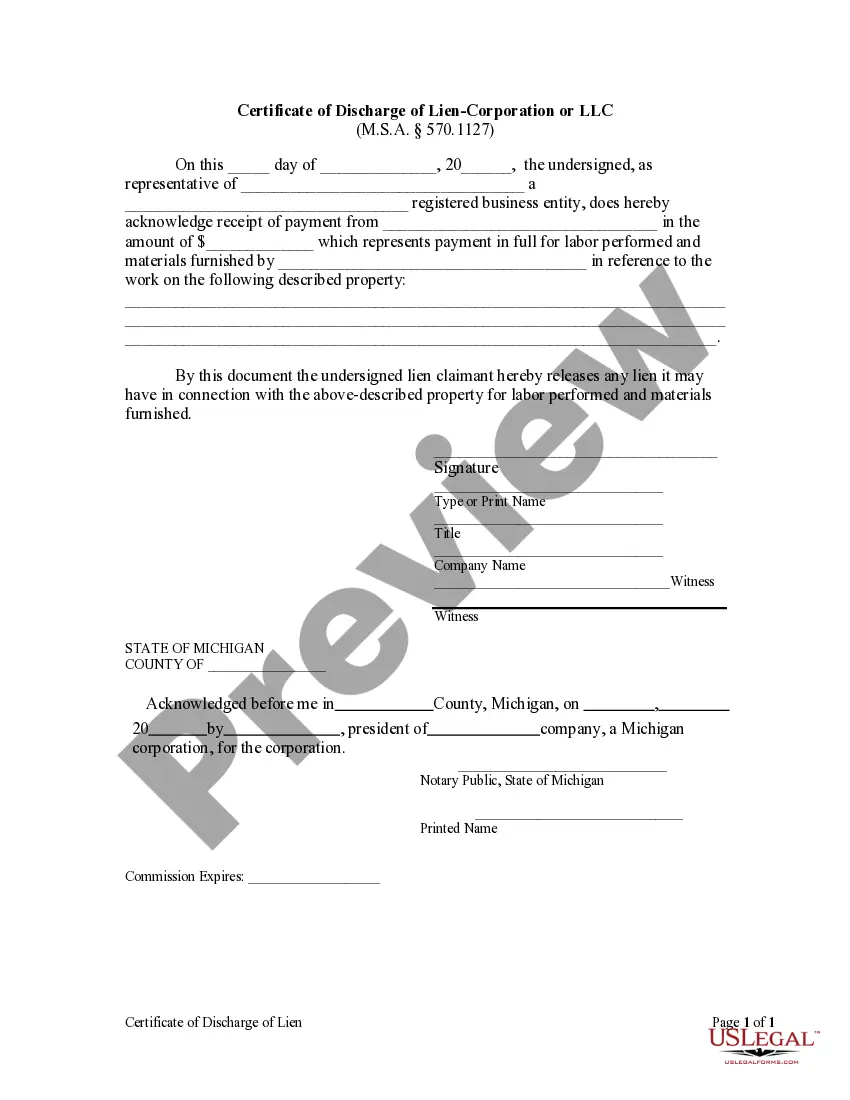

How to fill out Michigan Certificate Of Discharge Of Lien - Corporation Or LLC?

- Log into your US Legal Forms account, ensuring your subscription is active. If not, renew your plan according to your selected payment option.

- Browse the available templates using the Preview mode to find the form that meets your requirements. Pay attention to the descriptions to ensure compliance with your local jurisdiction.

- If necessary, use the Search tab to find alternative templates that better suit your needs.

- Once you find the correct document, click on the Buy Now button and select your preferred subscription plan. You will need to create an account to access the complete library.

- Complete your payment by entering credit card details or selecting your PayPal account.

- Download the completed form onto your device for easy access. You can also retrieve it anytime from the My Forms section in your account.

By following these steps, you can easily access important legal documents that are both accurate and compliant with local laws.

Start navigating your legal needs today with US Legal Forms and ensure that you are protected under limited liability.

Form popularity

FAQ

To write a limited liability company, you typically need to draft the Articles of Organization. This document includes key information such as the LLC’s name, address, and the designated registered agent. Additionally, you may include operating agreements that outline the management and operational procedures of the LLC. Platforms like US Legal Forms offer resources and templates to help you create a compliant and tailored structure for your limited liability company.

world example of limited liability occurs when a business owner faces a lawsuit related to their company's operations. In such cases, the owner's personal assets, like their home or car, remain protected while the business assets may be used to settle claims. This protective feature is a key advantage of limited liability companies. By opting for a limited liability structure, business owners can confidently pursue their ventures without fearing personal financial devastation.

known example of a limited liability company in the US is Tesla, Inc. While it started as a private LLC, it later converted to a corporation while maintaining its limited liability features for investors. Such companies demonstrate how limited liability can attract investments and shield owners from excessive risk. Entrepreneurs often regard the LLC structure as an optimal choice for balancing flexibility with safety.

A limited liability company, often abbreviated as LLC, is a business structure that combines the qualities of both corporations and partnerships. It provides owners, known as members, with limited liability protection from debts and legal actions against the business. This means that members’ personal assets are generally safe from business liabilities. Choosing an LLC structure is a common decision for small business owners seeking both flexibility and protection.

An example of a limited company is a typical corporation or an LLC that limits the personal liability of its owners. For instance, many popular tech startups began as limited companies, protecting their founders’ personal assets. This structure allows owners to engage in business activities without risking their individual finances. Understanding how limited liability works can benefit entrepreneurs looking to establish a secure financial foundation.

Limited liability corporation start-up costs generally include state filing fees, which may vary from state to state, and legal fees if you choose to hire an attorney. You should also consider costs for licenses and permits that might be necessary for your specific business. Furthermore, you may need funds for equipment, inventory, or office space, depending on your industry. Using uslegalforms can simplify your journey by providing resources and templates to help calculate and manage these costs.

To establish a limited liability corporation (LLC), you should first select a business name that complies with state guidelines. Next, file the necessary articles of organization with your state’s business division or Secretary of State. After that, create an operating agreement, although it is not mandatory in every state. Lastly, consider obtaining an Employer Identification Number (EIN) to help manage your taxes and facilitate business operations.

Limited liability refers to a legal structure that shields business owners from being personally responsible for their company's debts. When you operate under limited liability, creditors cannot pursue your personal assets, reducing financial risk and encouraging business growth. This protection is essential for those looking to establish their ventures with confidence.

Limited liability protects personal assets from business-related debts, ensuring owners are only responsible for what they invest in the company. In contrast, unlimited liability exposes personal assets to business risks, meaning owners could lose their home or savings if the business fails. Understanding these concepts can help you make informed choices about your business structure.

A limited liability company (LLC) is a flexible business structure that combines the benefits of both a corporation and a partnership. It provides limited liability protection, ensuring owners are not personally liable for business debts, while allowing for pass-through taxation. This structure is ideal for many entrepreneurs, as it helps protect personal assets and minimize tax burdens.