Liability O Que é

Description

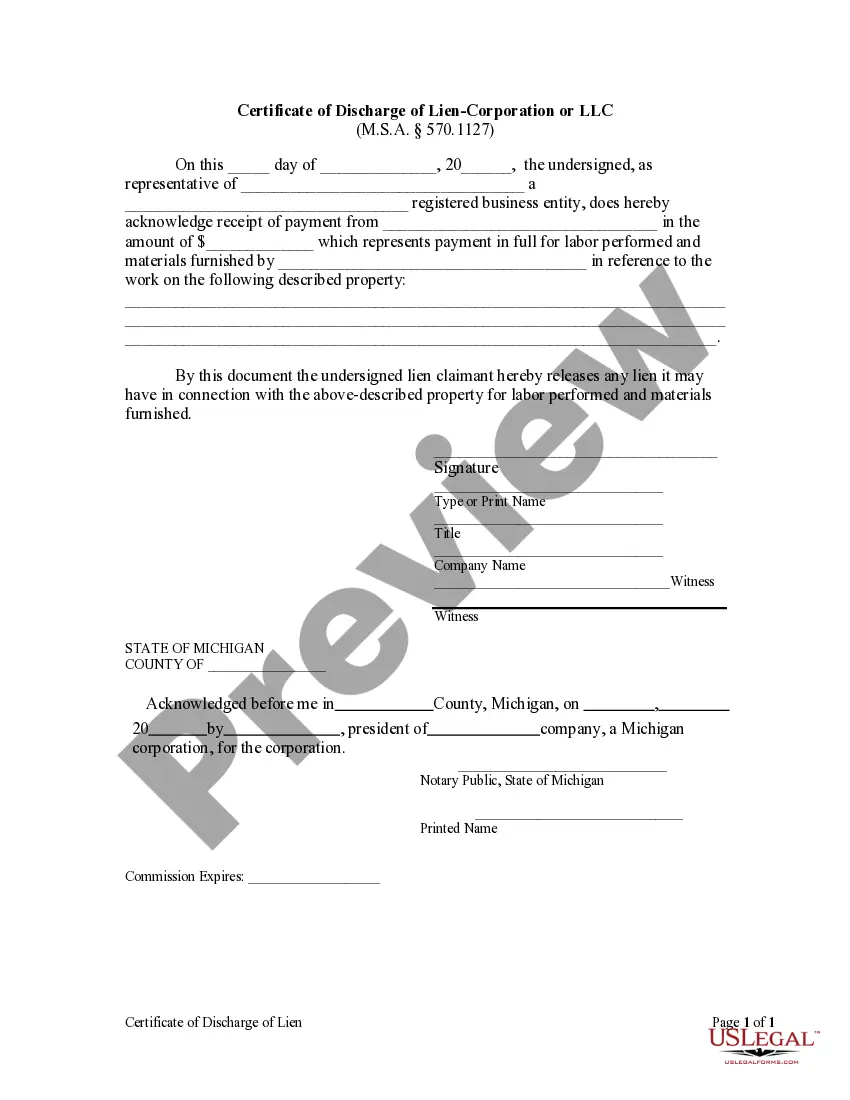

How to fill out Michigan Certificate Of Discharge Of Lien - Corporation Or LLC?

- Log in to your account if you're a returning user, ensuring your subscription is active. If it's expired, renew it according to your payment plan.

- Review the Preview mode and form description closely, making sure you've selected the correct form that fits your needs and adheres to local jurisdiction requirements.

- If necessary, utilize the Search tab to find alternative forms that better suit your situation. Confirm that the new form meets your criteria before proceeding.

- Select the Buy Now button and choose your preferred subscription plan. Register an account to gain full access to the library's offerings.

- Complete your purchase by entering your credit card information or utilizing your PayPal account for secure payment.

- Download your form to save it on your device. Access it later in the My Forms section of your profile whenever needed.

US Legal Forms delivers unparalleled benefits, including a vast form collection that exceeds competitors' offerings. With expert assistance available, users can ensure their documents are completed accurately and comply with legal standards for peace of mind.

Start utilizing US Legal Forms today to simplify your legal needs. Explore the extensive library and experience hassle-free document preparation!

Form popularity

FAQ

The three types of liabilities o que é encompass personal, business, and environmental liabilities. Personal liabilities pertain to individuals being responsible for actions causing harm to others. Business liabilities involve risks associated with company operations, including injuries to employees or consumers. Environmental liabilities relate to damage caused to the environment, for which a company may be accountable, showcasing the diverse range of liabilities one might encounter.

The liability answer essentially refers to the legal responsibility for harm or damages caused by one's actions. When considering the question of liability o que é, it encompasses the understanding of how laws assign fault and dictate consequences. In any legal dispute, determining liability involves evaluating the evidence and circumstances surrounding the case. Knowing the answers to these questions can guide individuals in protecting their rights and fulfilling obligations.

In legal terms, liability o que é categorized into three primary types: personal liability, vicarious liability, and corporate liability. Personal liability refers to an individual's responsibilities for their actions and its consequences. Vicarious liability holds one party legally responsible for the actions of another, typically in employer-employee relationships. Corporate liability involves legal accountability at the company level, where businesses may face consequences for the actions of their employees or products.

Liability o que é broadly classified into three major types: contractual liability, tort liability, and strict liability. Contractual liability arises from agreements between parties, where one party fails to meet their obligations. Tort liability, on the other hand, is based on wrongful acts that cause harm to another person, like negligence or intentional misconduct. Lastly, strict liability applies in situations where a defendant is held responsible regardless of fault, often seen in cases involving defective products.

The provider of a COI is your insurance carrier or your insurance agent. They will prepare this document based on the details of your policy and the coverage you have opted for. Make sure to request the COI from them whenever required, especially in professional or contractual situations. Understanding liability o que é will help you grasp how vital a COI is in demonstrating your liability coverage.

A Certificate of Insurance (COI) is issued by your insurance company or agent. They have the authority to create and provide this document once you have the appropriate liability coverage in place. It serves as proof of your insurance and outlines the specifics of your policy. By learning about liability o que é, you can better appreciate the role and importance of the COI in your insurance strategy.

To create a COI, you should start by contacting your insurance provider. They will guide you through the process, typically requiring you to fill out a form with necessary details about your insurance coverage. Once everything is verified, your insurer will generate the COI for you. Understanding liability o que é ensures you know the significance of having this important document.

When requesting a Certificate of Insurance (COI), you typically need to provide your policy number, the name of the insured, and the effective date of coverage. Additionally, you may need to include the details of the party requesting the COI and any specific coverage limits required. Familiarizing yourself with liability o que é can help you grasp the importance of this information in securing your certificate.

To get proof of liability, you need to request a certificate from your insurance company. This certificate confirms that you have liability coverage in place and details the extent of the protection offered. Be sure to specify your requirements, as different situations may necessitate specific information on the certificate. Being knowledgeable about liability o que é will aid you in communicating effectively with your insurer.

To obtain a liability certificate, you must first ensure that you have the appropriate liability insurance in place. Once your policy is active, simply contact your insurance provider, and they will issue a certificate for you. Applications and requests for certificates can typically be submitted online through platforms like US Legal Forms, streamlining the process for your convenience.