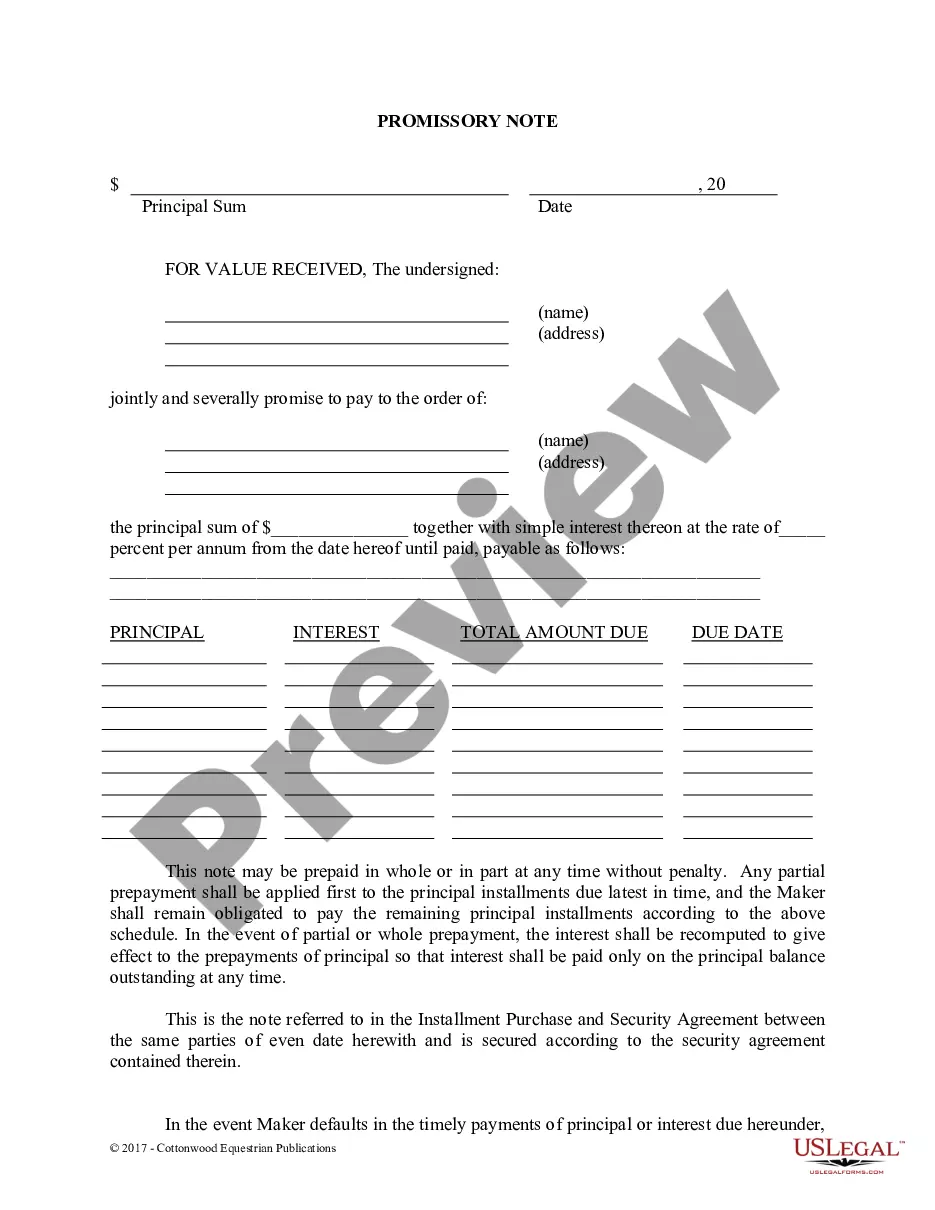

Promissory Note Template Michigan Without Interest

Description

How to fill out Michigan Promissory Note - Horse Equine Forms?

There’s no longer any justification for spending hours searching for legal documents to adhere to your local state requirements.

US Legal Forms has compiled all of them in one location and enhanced their accessibility.

Our platform provides over 85k templates for any business and personal legal matters categorized by state and area of usage.

Filling out formal documents under federal and state laws and guidelines is quick and easy with our platform. Experience US Legal Forms today to keep your paperwork organized!

- All forms are expertly drafted and verified for accuracy, allowing you to trust that you're obtaining an up-to-date Promissory Note Template Michigan Without Interest.

- If you are acquainted with our service and already possess an account, ensure that your subscription is active before acquiring any templates.

- Log In to your account, choose the document, and select Download.

- You can also access any obtained documents at any time by visiting the My documents tab in your profile.

- If you have never interacted with our service before, the procedure will involve a few additional steps.

- Here’s the method for new users to acquire the Promissory Note Template Michigan Without Interest from our collection.

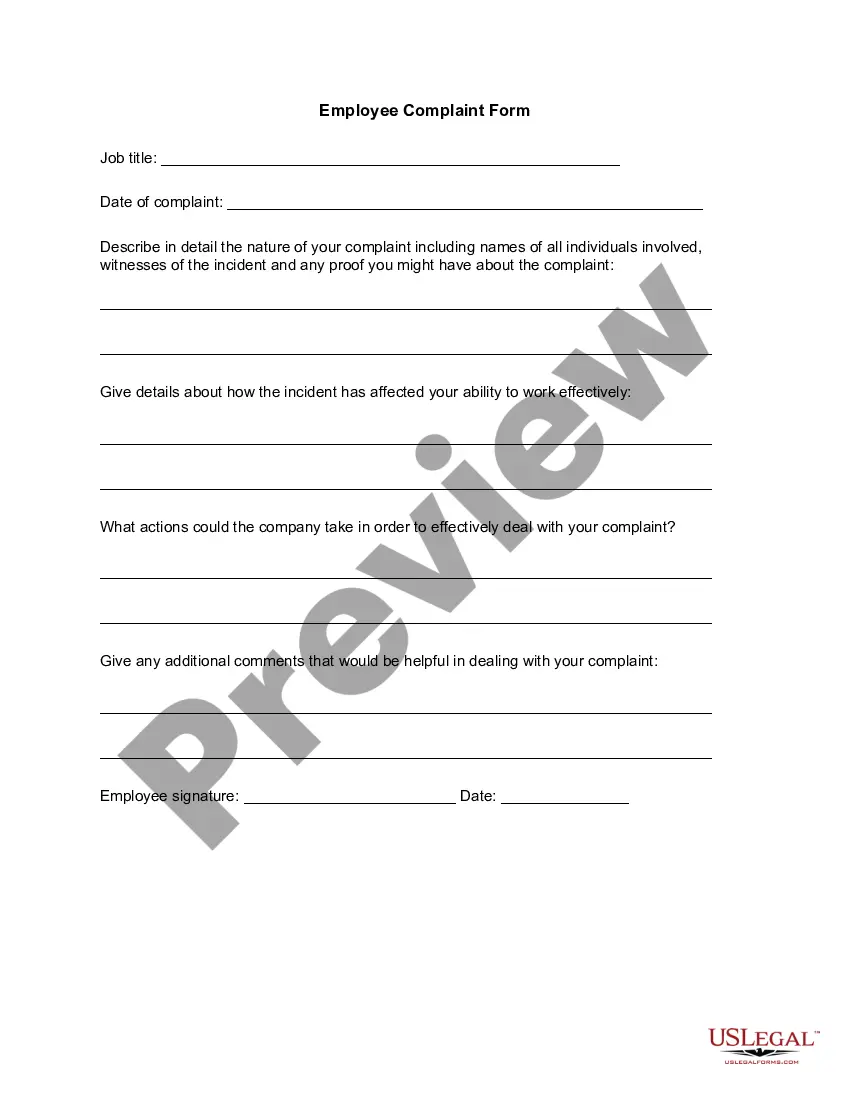

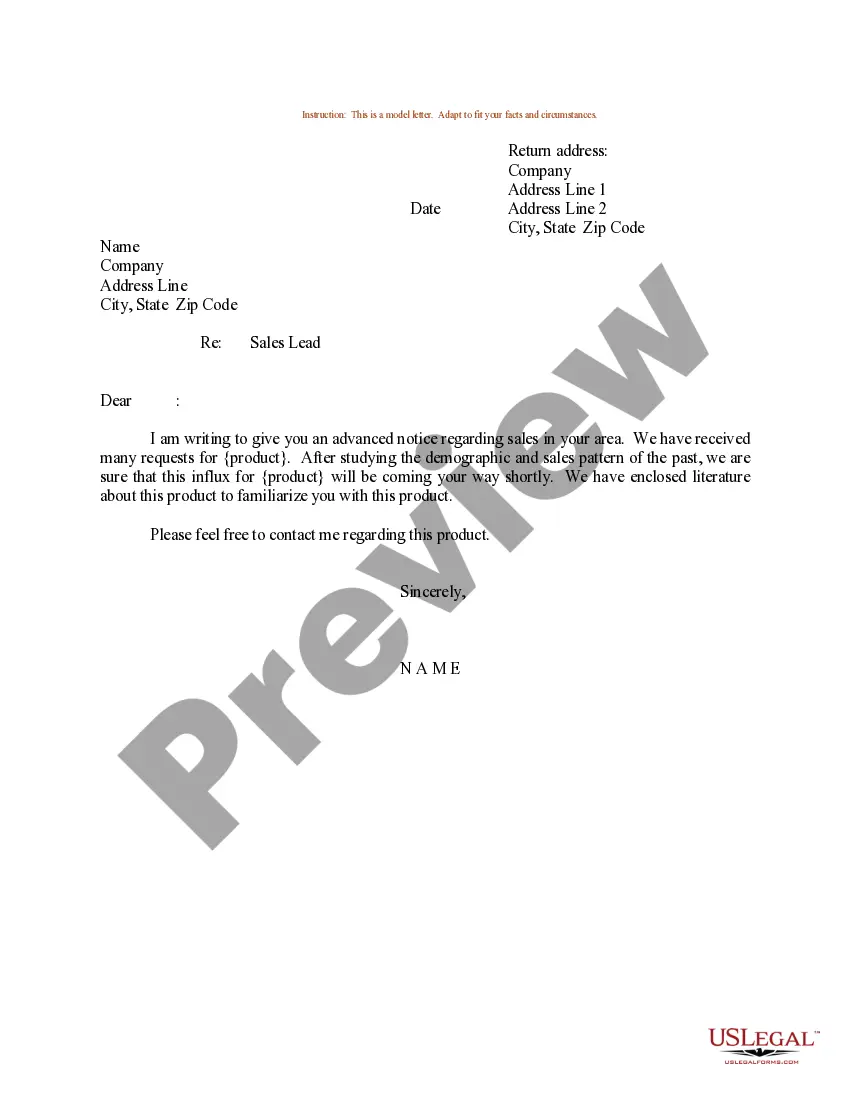

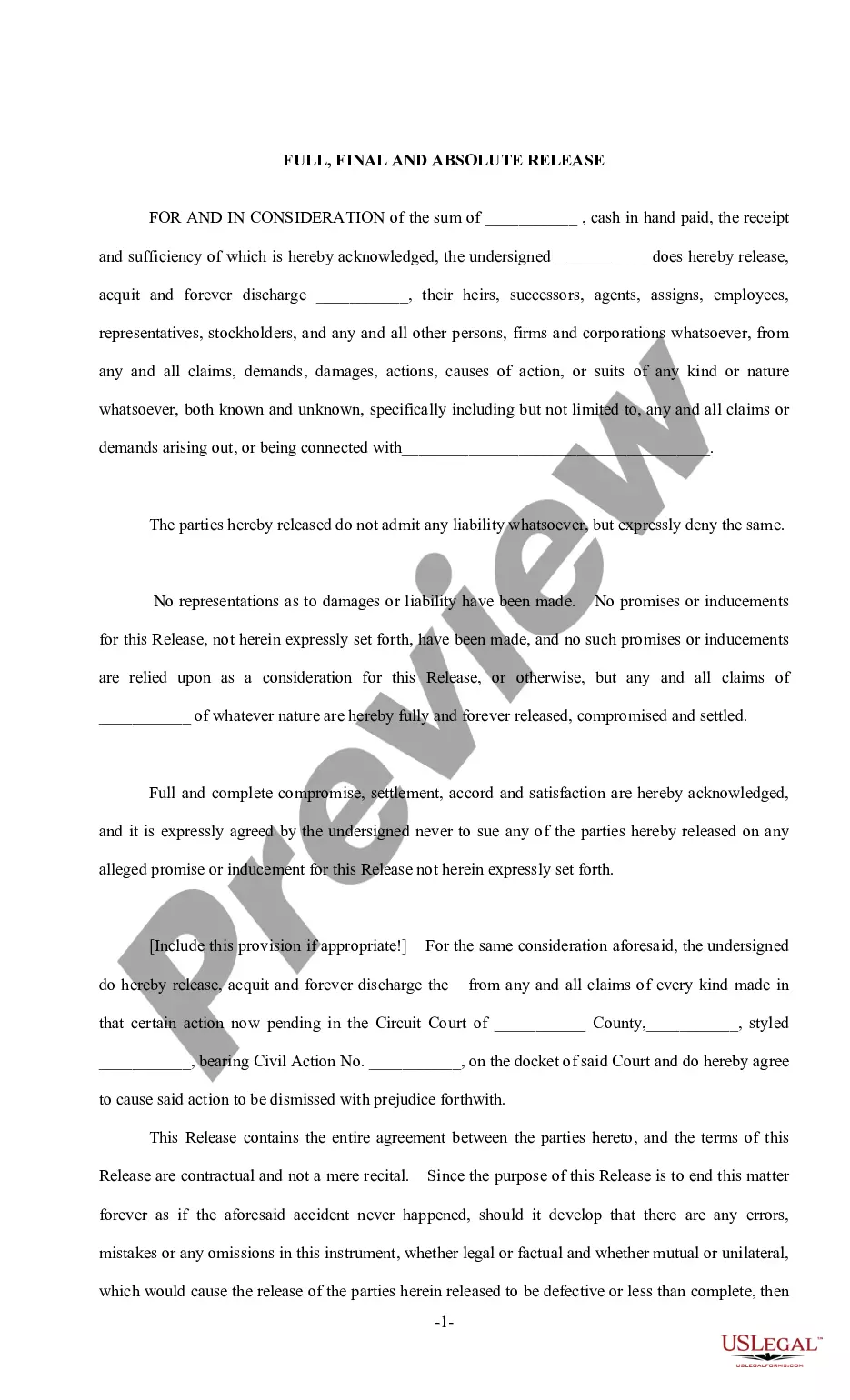

- Thoroughly examine the page content to confirm it includes the sample you need.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

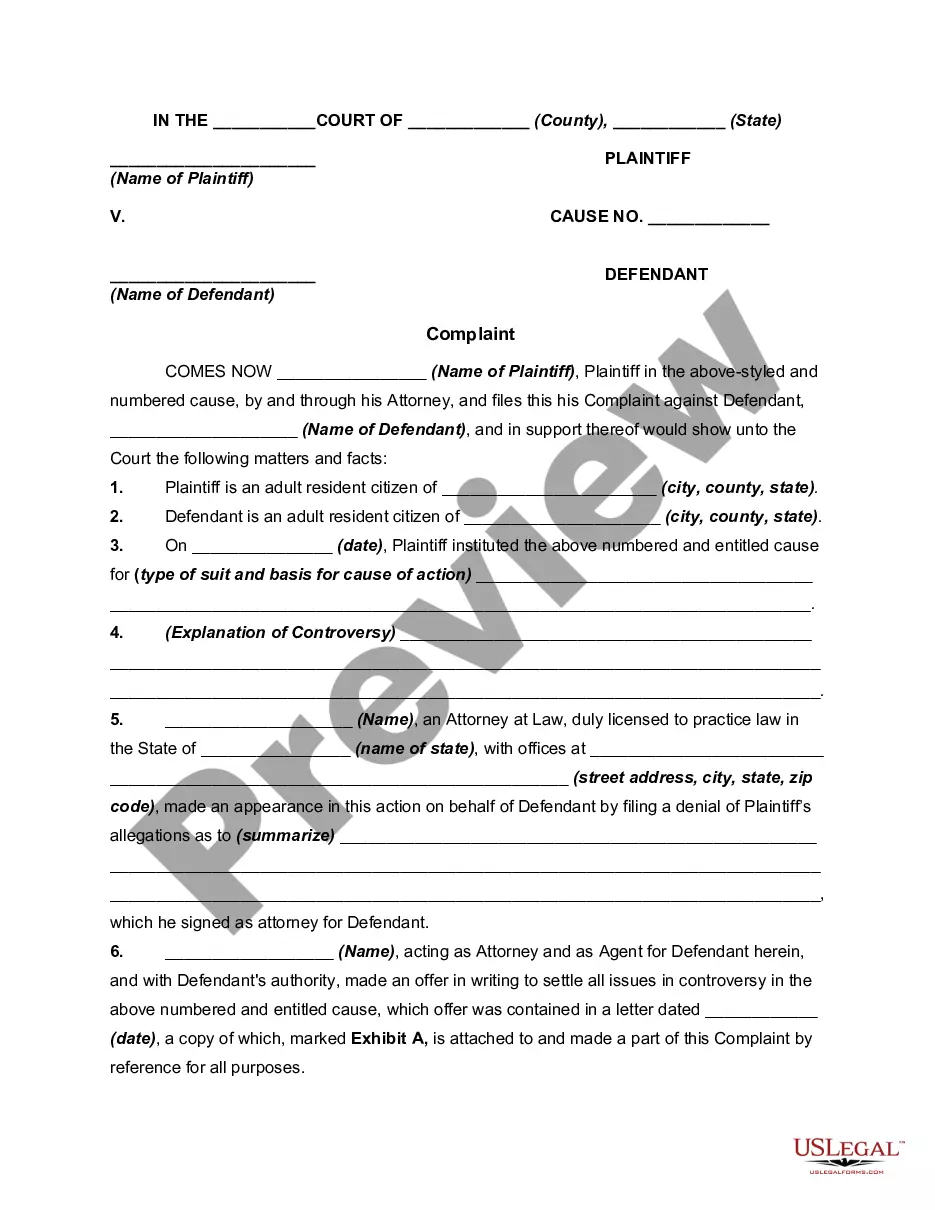

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

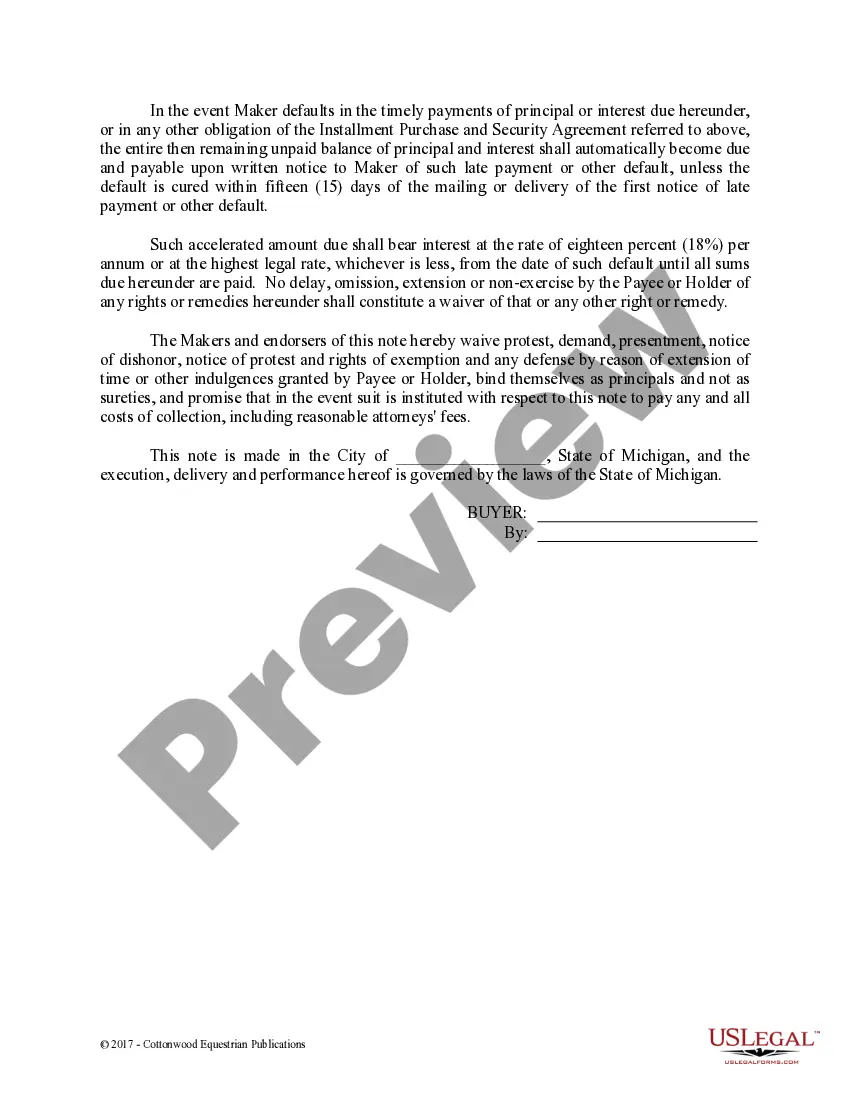

If you decide to give the loan without charging any interest, be prepared to justify it to the IRS, because it literally is a gift in the IRS's eyes. The IRS can "impute" interest on your loan, whether you actually charged any interest or not, and require you to report that imputed interest as income.

A promissory note must specify the percentage interest charged on the loan. All loans should carry some interest, even if it is between family members.

Simple Promissory Note SampleInclude the date you are writing or the date you plan to send the note at the top. Write the total amount due in both numeric and long-form. Add a detailed description of the loan or note terms. For example, you'll need to include what the loan or payment is for, who will pay it and how.

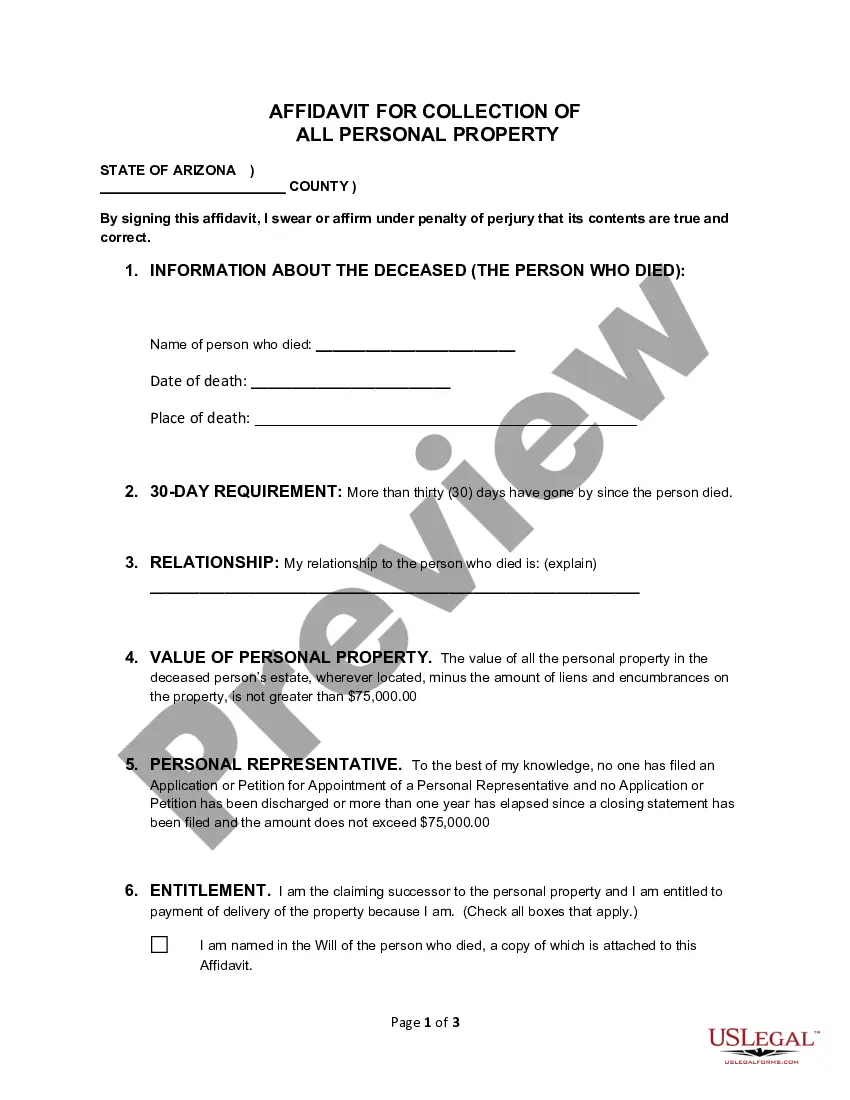

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.