Promissory Note Template Michigan With Collateral Philippines

Description

How to fill out Michigan Promissory Note - Horse Equine Forms?

There's no longer a need to squander time searching for legal documents to comply with your local state laws.

US Legal Forms has gathered all of them in one location and simplified their accessibility.

Our website provides over 85,000 templates for various business and personal legal situations categorized by state and purpose.

Complete official documentation as per federal and state regulations quickly and easily with our platform. Experience US Legal Forms now to maintain your paperwork organized!

- All forms are correctly created and validated for authenticity, ensuring you can confidently access a current Promissory Note Template Michigan With Collateral Philippines.

- If you are familiar with our service and currently possess an account, verify that your subscription is active prior to acquiring any templates.

- Log In to your account, choose the document, and click Download.

- Additionally, you can access all obtained documents whenever necessary by navigating to the My documents section in your profile.

- For first-time users of our service, the procedure will require a few more steps to finalize.

- Here’s how new users can secure the Promissory Note Template Michigan With Collateral Philippines from our collection.

- Review the page content thoroughly to verify it includes the sample you need.

- To do this, use the form description and preview options if available.

Form popularity

FAQ

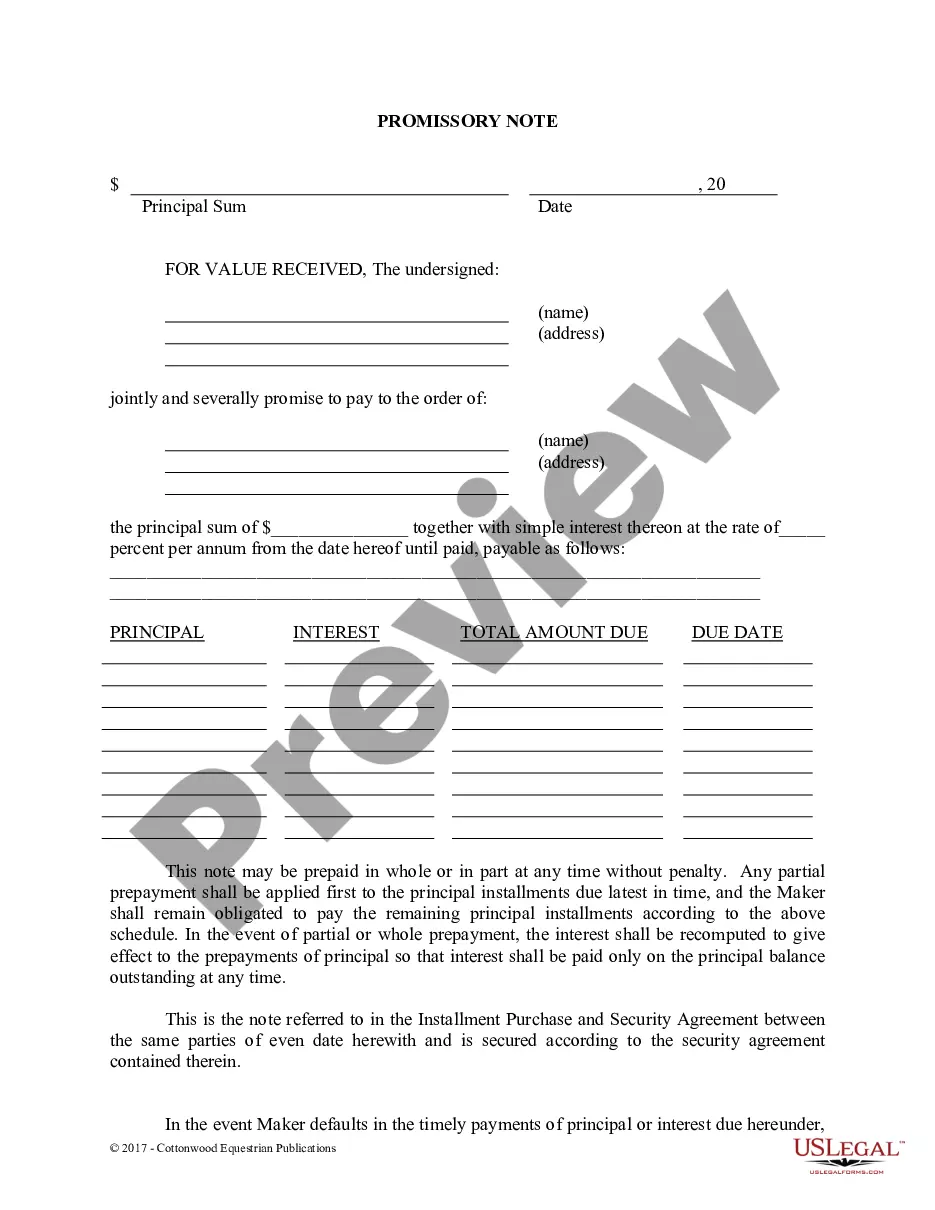

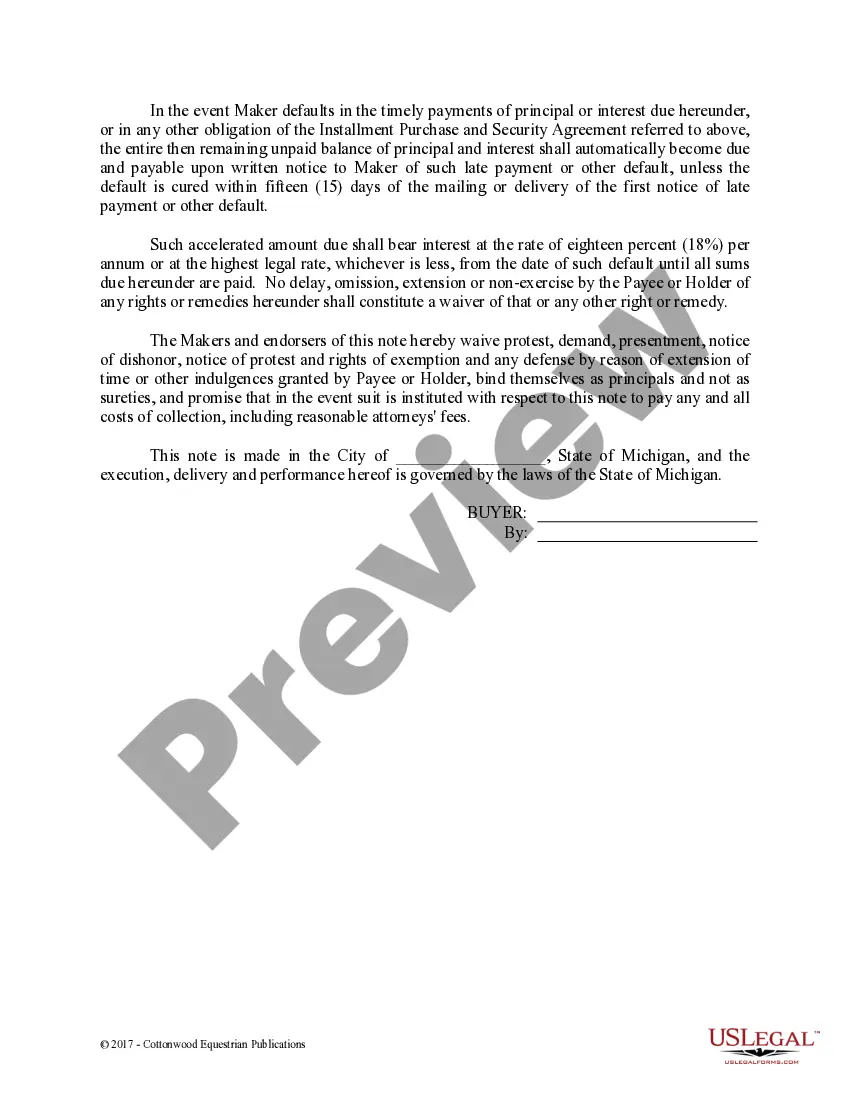

Secured Promissory NotesThe property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

In any event, a promissory note does not have to be notarized to be binding. The private respondents have admitted signing the two notes and they have not succeeded in proving that they did so "under duress, fear and undue influence."

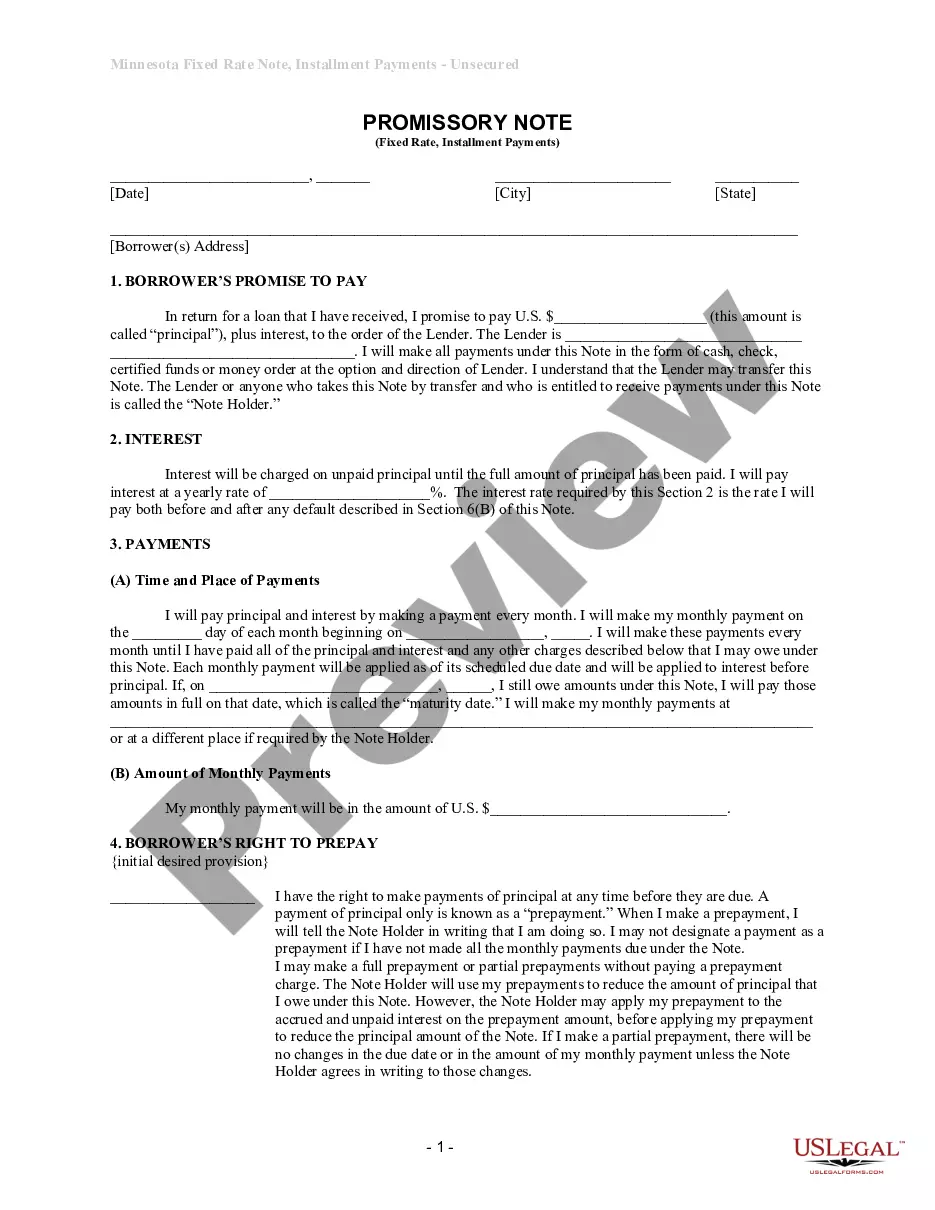

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

However, a promissory note should contain at least the following parts:Title of the document.The statement For value received, to indicate the maker has received the amount borrowed.The name of the maker.The statement of an unconditional promise to pay.The name of the payee.The amount to be paid.More items...?

A secured promissory note should clearly identify the collateral backing the loan. For example, if collateral is being secured by business vehicles, the note should provide their vehicle identification numbers. A small business that is extending credit should also verify collateral is worth enough to cover the debt.