Promissory Note Template Michigan With Co-maker

Description

How to fill out Michigan Promissory Note - Horse Equine Forms?

Administration necessitates exactness and correctness.

If you do not manage the completion of documents like Promissory Note Template Michigan With Co-maker regularly, it may lead to some misinterpretations.

Choosing the right sample from the beginning will guarantee that your document submission occurs smoothly and avert any troubles of re-sending a file or performing the same task entirely from the beginning.

Discovering the correct and current samples for your documents is a matter of just a few minutes with an account at US Legal Forms. Eliminate the bureaucratic uncertainties and simplify your paperwork process.

- Locate the template by employing the search bar.

- Ensure the Promissory Note Template Michigan With Co-maker you’ve discovered is applicable for your state or area.

- Review the preview or explore the description containing the specifics on the utilization of the template.

- If the outcome matches your inquiry, click the Buy Now button.

- Select the appropriate alternative among the proposed subscription packages.

- Log In to your account or create a new one.

- Complete the transaction using a credit card or PayPal.

- Save the form in your preferred format.

Form popularity

FAQ

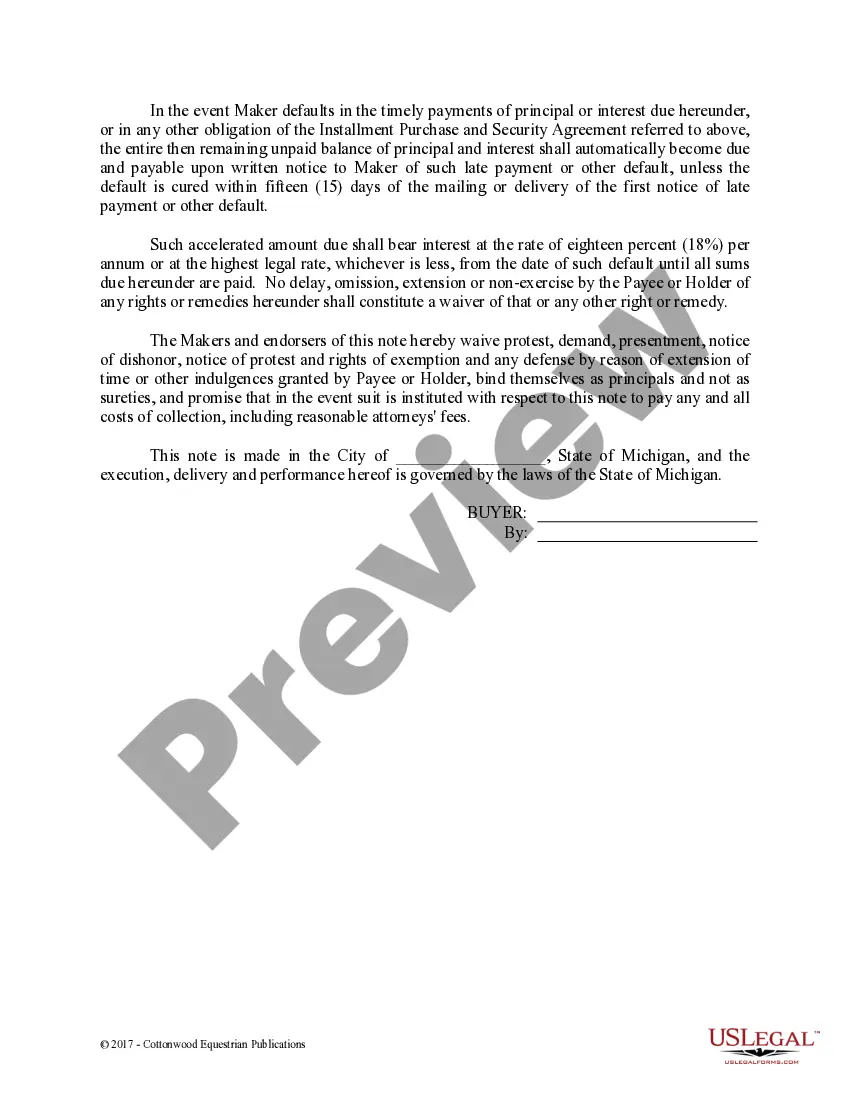

In order for the promissory note to be valid, the borrower needs to sign it. The lender may require the borrower to sign this document in front of a notary to guarantee the signature.

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

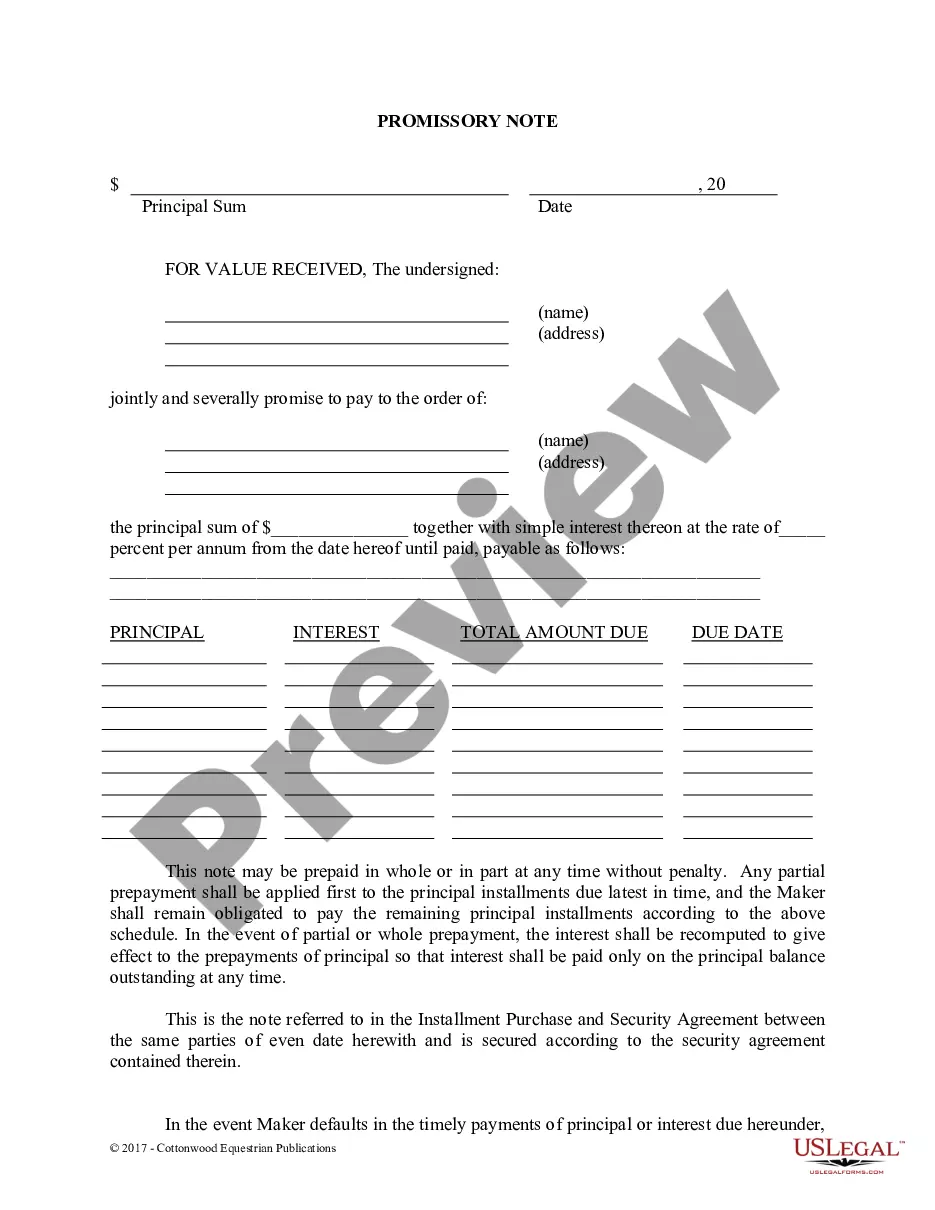

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

The promissory note is commonly only signed by the maker since the holder is not making any commitment under the note. Even in the case of a loan, the transfer of funds is separate from the note itself. It's important to note that a promissory note is not a substitute for a formal contract.