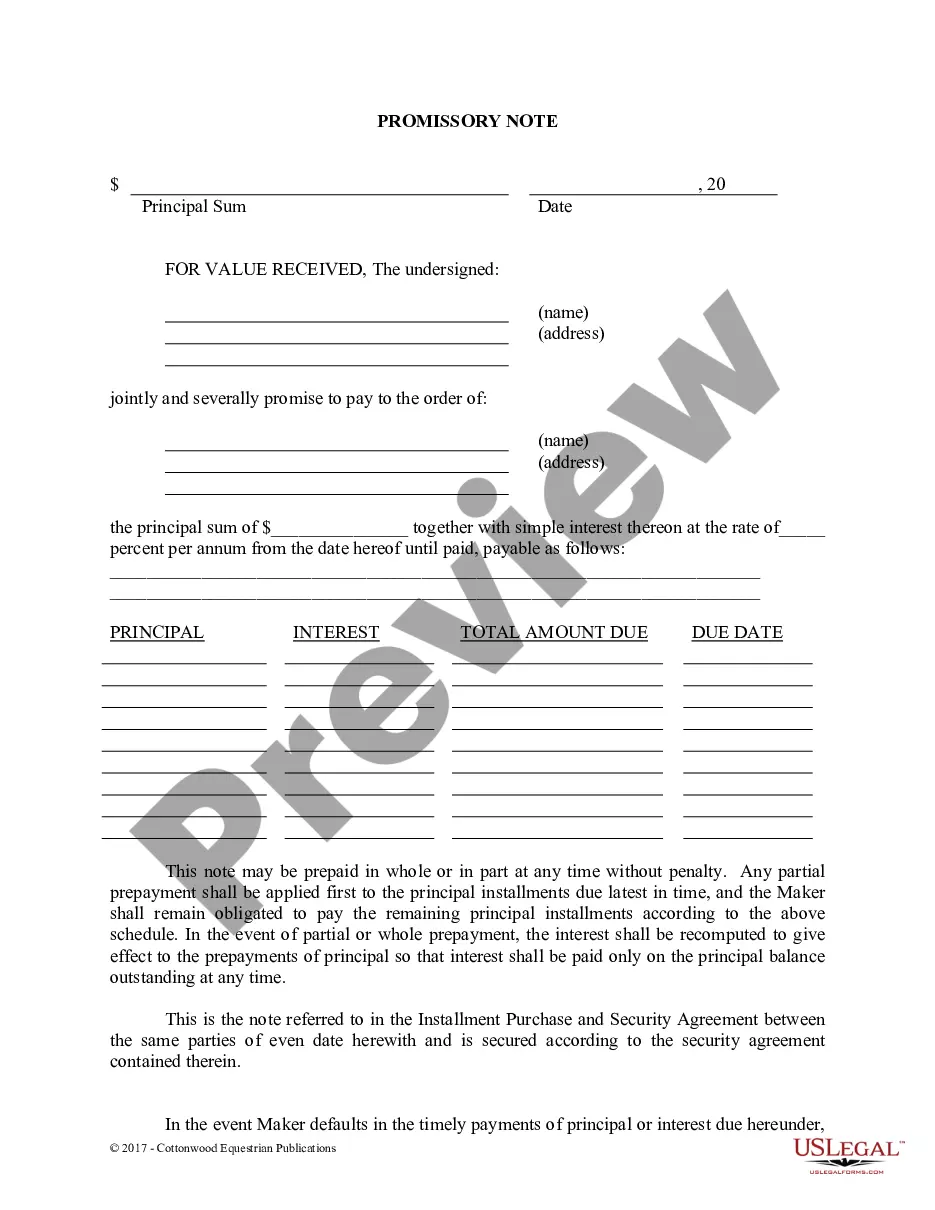

Promissory Note Template Michigan For Real Estate

Description

How to fill out Michigan Promissory Note - Horse Equine Forms?

How to locate professional legal documents that adhere to your state regulations and draft the Promissory Note Template Michigan For Real Estate without consulting a lawyer.

Numerous services online offer templates to address various legal needs and requirements.

However, it may require some time to determine which of the accessible samples fulfill both the intended purpose and legal standards for you.

Download the Promissory Note Template Michigan For Real Estate by clicking the appropriate button beside the file name. If you do not have an account with US Legal Forms, please adhere to the instructions below.

- US Legal Forms is a reliable service that assists you in finding official documents created in accordance with the latest updates to state laws and saves you expenses on legal fees.

- US Legal Forms is not just a typical online directory.

- It is a repository of over 85,000 verified templates for different business and personal scenarios.

- All documents are categorized by region and state to simplify your search process.

- It also incorporates powerful tools for PDF editing and eSignature, allowing users with a Premium membership to swiftly finalize their paperwork online.

- Obtaining the necessary documents requires minimal effort and time.

- If you already possess an account, Log In and verify your subscription status.

Form popularity

FAQ

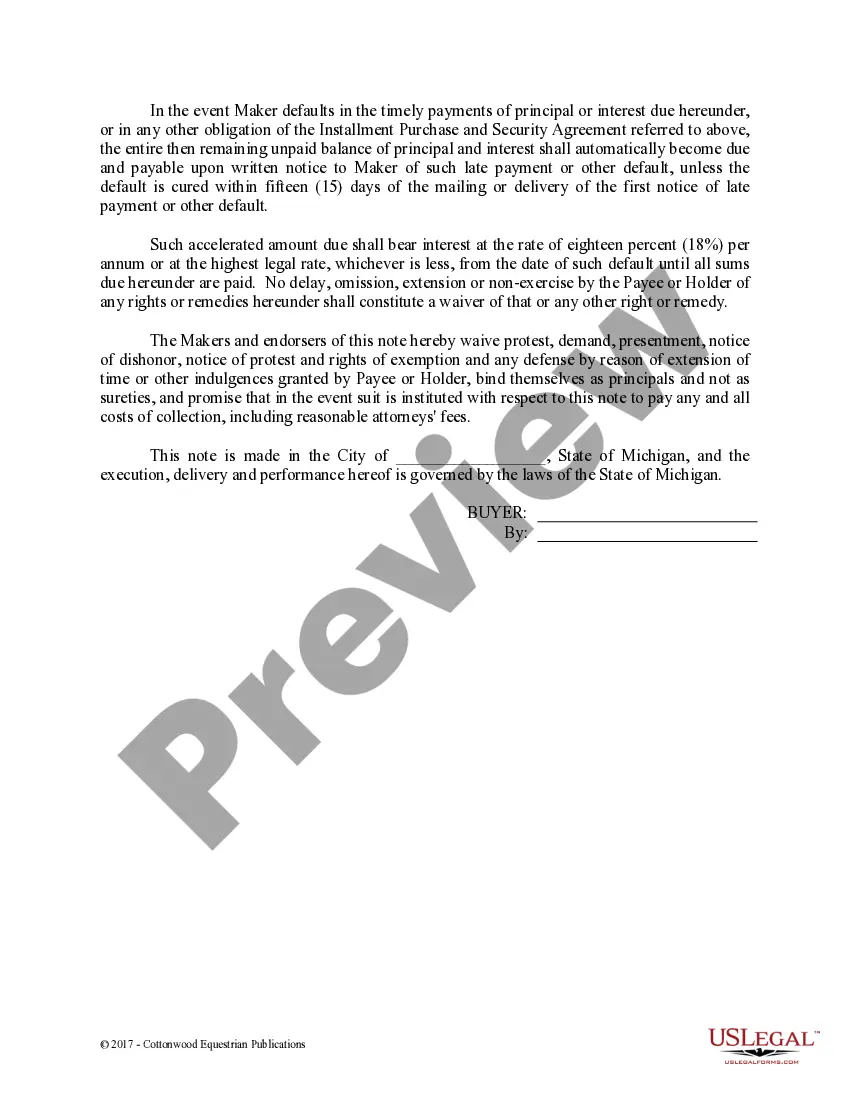

In any event, a promissory note does not have to be notarized to be binding. The private respondents have admitted signing the two notes and they have not succeeded in proving that they did so "under duress, fear and undue influence."

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

There is no legal requirement for most promissory notes to be witnessed or notarized in Michigan (a promissory note for a home loan, however, may need to be notarized). Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.