Formulário Waiver

Description

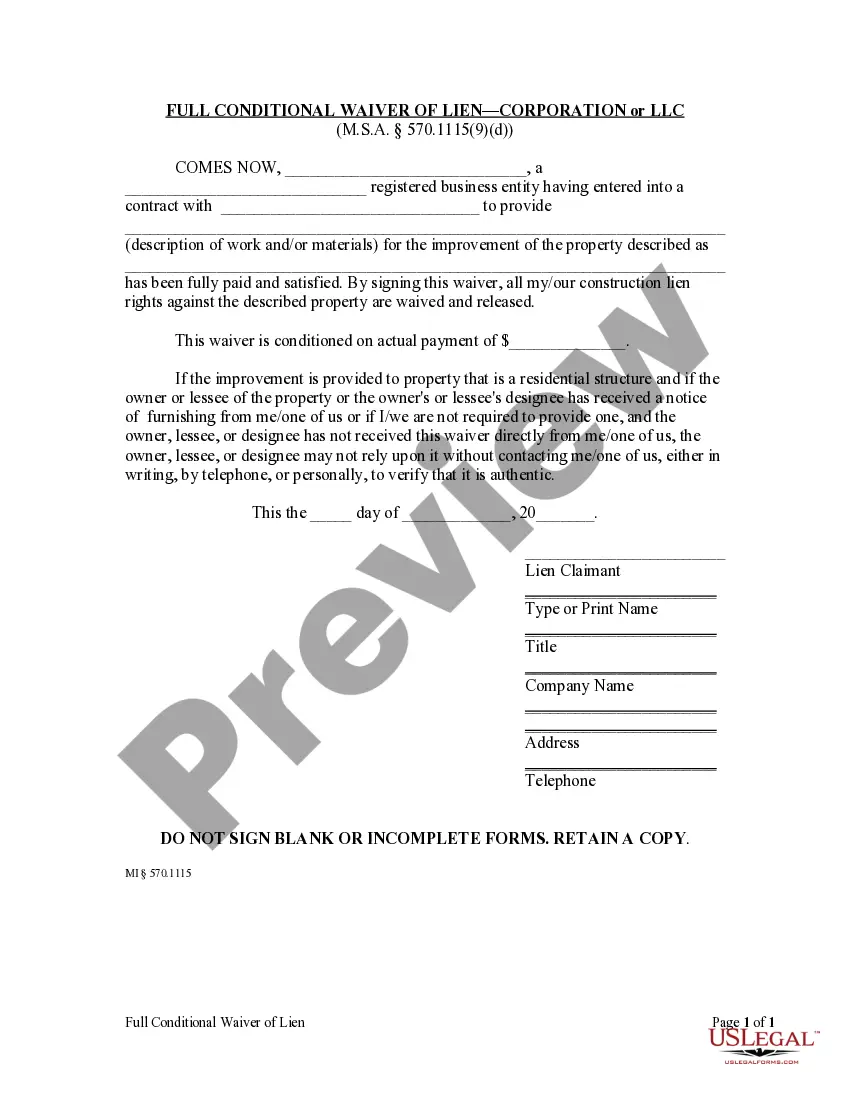

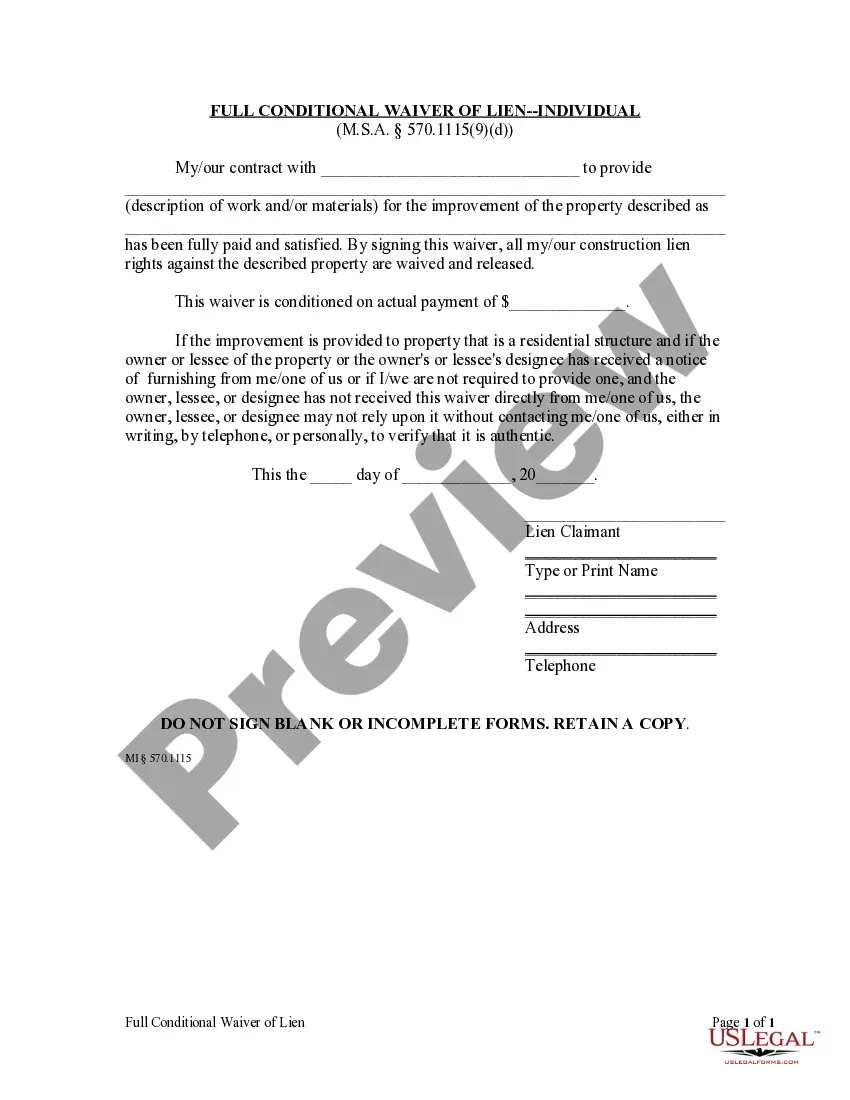

How to fill out Michigan Full Conditional Waiver And Release Of Lien By Contractor - Individual?

- If you are a returning user, log in to your account to access the document. Ensure your subscription is active, and if it has expired, renew it according to your payment plan.

- For first-time users, start by checking the preview mode and form description. Confirm that the selected template meets your needs and complies with local jurisdiction requirements.

- If you don't find the right form, use the Search tab to browse for alternative templates until you locate one that fits your needs.

- Next, click on the Buy Now button to select your preferred subscription plan, which will grant you access to the form library. You'll need to register an account if it's your first time.

- Proceed to make your purchase by entering your payment details, whether through a credit card or PayPal account.

- Finally, download your 'Formulário waiver' and save it on your device. You can always access it later in the My documents section of your profile.

By utilizing US Legal Forms, you gain access to a robust collection of legal documents available at a competitive price. With more than 85,000 forms at your disposal, the platform streamlines the document preparation process, ensuring accuracy and compliance.

In conclusion, acquiring your 'Formulário waiver' has never been easier. Take advantage of US Legal Forms’ vast resources and empower yourself with legal documentation today! Don't hesitate to get started now.

Form popularity

FAQ

When responding to a notice of deficiency, first, read the notice carefully to understand the IRS's position. Prepare a written response addressing each issue outlined in the notice, and be sure to include any evidence supporting your case. Reference your Formulário waiver clearly in your documentation. For a more structured approach, consider using resources from US Legal Forms to ensure you’re submitting the correct forms.

To fill out a notice of deficiency waiver, you should first understand the specific tax details related to your case. Include your personal information, the tax year in question, and reference the Formulário waiver. Be clear and concise in your explanations to facilitate easier processing. If you need guidance, utilizing the US Legal Forms platform can provide you access to templates and resources.

Filling out Form 5564 can be straightforward if you follow each section carefully. Begin by entering your personal information at the top, ensuring you reference the Formulário waiver as needed. Continue by filling in details regarding your tax situation and make sure to double-check for accuracy before submitting. You might consider using the US Legal Forms platform to find resources that simplify this process.

To request a waiver from the IRS, begin by gathering necessary documents that support your waiver request. Next, draft a formal letter or use the appropriate IRS form to explain your situation clearly. Make sure to reference your Formulário waiver in your request, as this aids in processing. Finally, send your complete application to the designated IRS address.

In Nevada, an unconditional waiver and release upon final payment is a document that signifies that a contractor or subcontractor accepts payment and agrees to waive future claims related to that payment. This document is crucial for resolving payment disputes. It ensures that the payer receives confirmation that all obligations are met. A Formulário waiver can provide the necessary framework and legal language to create this document correctly.

Unconditional release waivers are legal documents that allow a party to waive any claims against another party upon the receipt of payment. This type of waiver ensures that once the payment is made, the waiving party relinquishes any future rights to dispute or claim any issues related to that payment. Understanding unconditional release waivers is essential for managing financial transactions. A Formulário waiver can help clarify its structure and purpose.

To fill out an unconditional waiver and release upon final payment, start with your personal information and the sum received. State explicitly that the waiver applies upon receipt of the final payment, ensuring no further claims can be made afterward. Don’t forget to date and sign the document to confirm its legitimacy. Using a Formulário waiver can make this process clearer and more straightforward.

The application form for a US waiver typically serves as a legal method to relinquish certain rights or claims. It includes your personal details, the context for the waiver, and any necessary supporting documentation. This form may vary depending on the specific waiver type. A Formulário waiver can provide you with a clear understanding of the requirements.

Filling out a waiver form involves providing basic information, such as your name and the details surrounding the waiver. Clearly explain the purpose of the waiver, indicating whether it is unconditional or conditional. Finally, remember to date and sign the form to make it official. Utilizing a Formulário waiver ensures you have a comprehensive format to follow.

When filling out a conditional waiver and release on final payment, begin by entering your information and the payment specifics. Clearly state that the waiver is conditional based on the receipt of the final payment. Make sure to include the date and your signature at the bottom for authenticity. A Formulário waiver can help guide you through this process effortlessly.