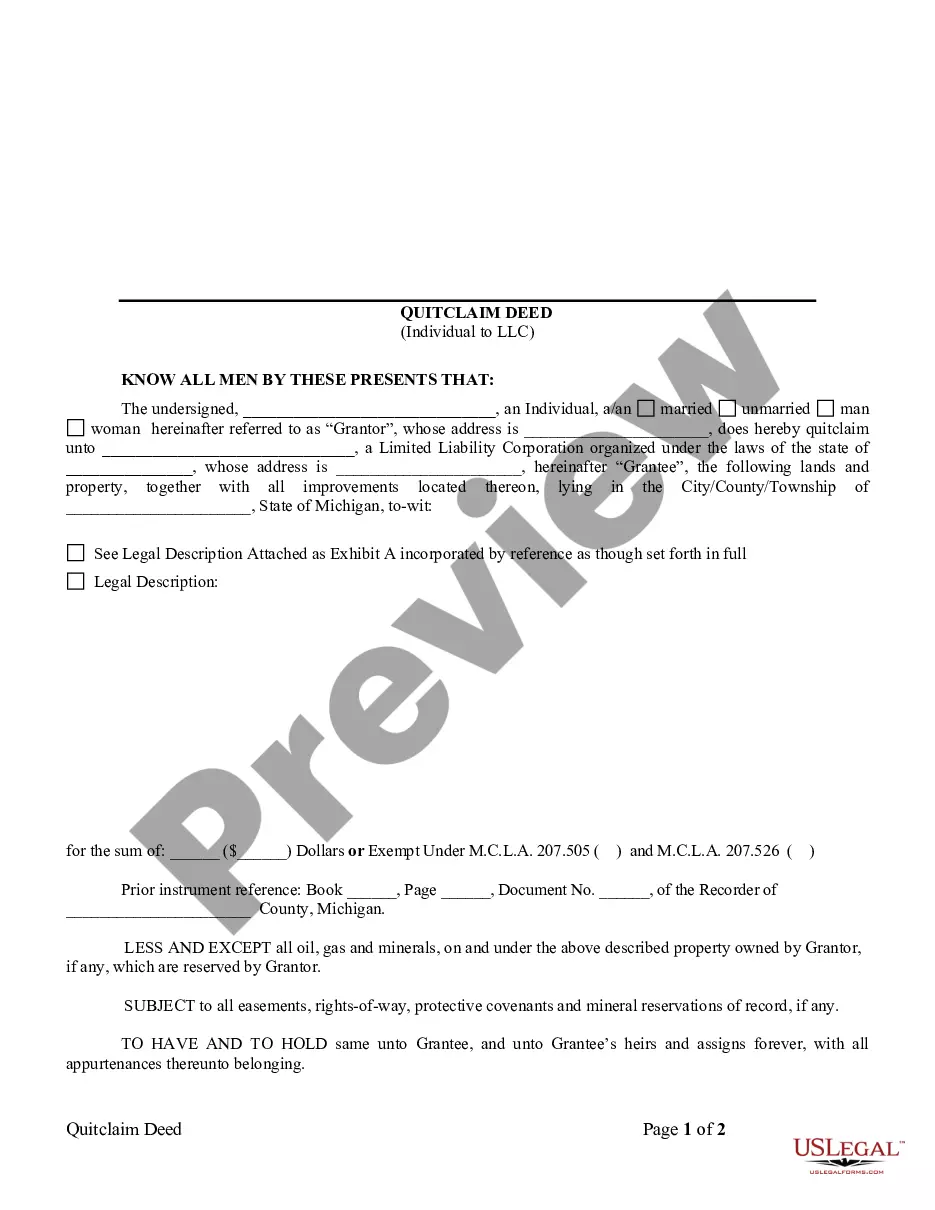

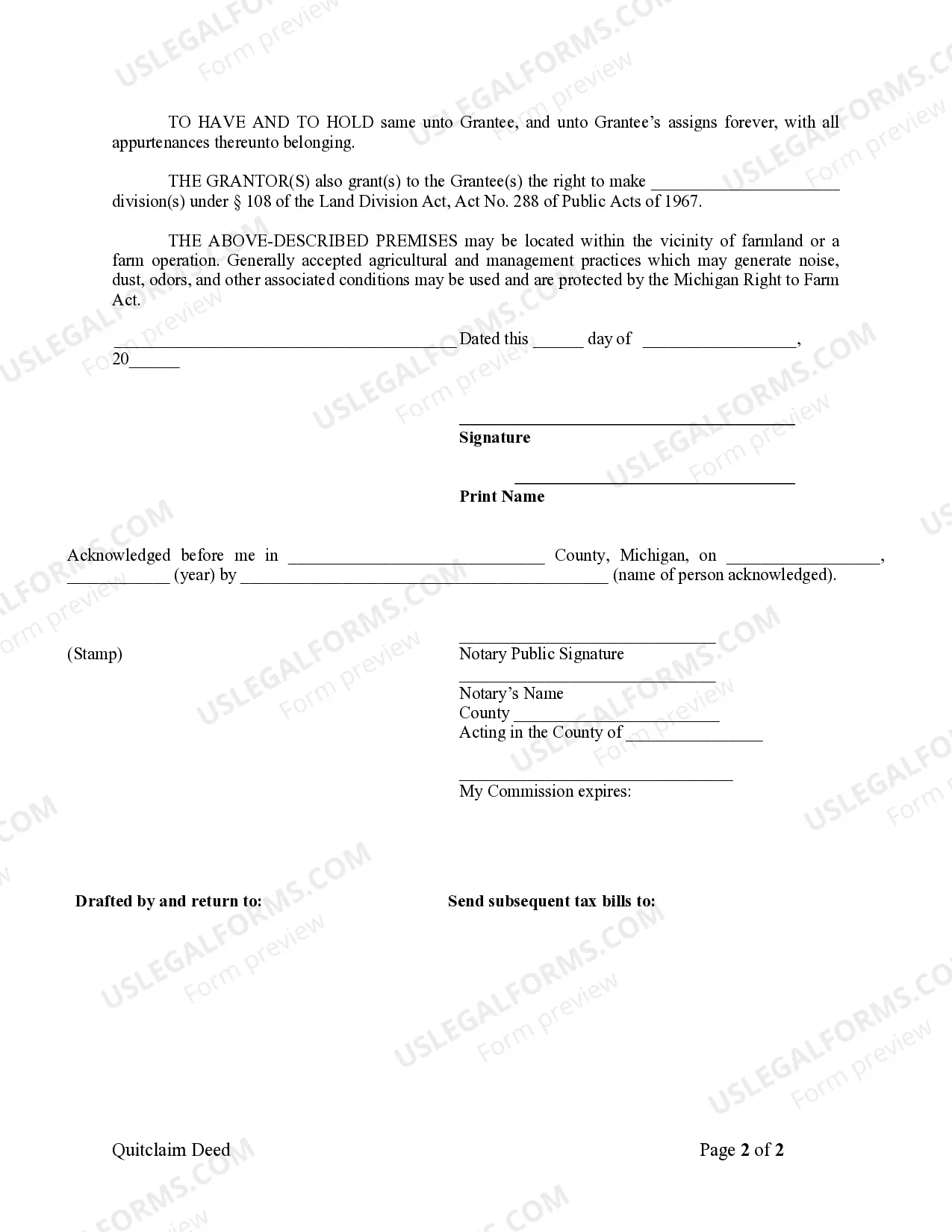

A quitclaim deed without refinancing is a legal document that allows one party to transfer their interest or ownership in a property to another party without the need to go through the process of refinancing the mortgage associated with the property. This type of deed is commonly used in situations where there is no existing mortgage or where the parties involved have agreed that the transfer of property ownership will not impact the existing loan. One of the main advantages of a quitclaim deed without refinancing is that it provides a straightforward and efficient way to transfer property ownership between parties. It is often used in situations such as divorce settlements, gifting of property, changing ownership between family members, or removing a name from the property title. In a quitclaim deed without refinancing, the transferring party, known as the granter, simply signifies their intention to release or quit any claim they have on the property to the recipient, known as the grantee. This type of deed does not provide any guarantees or warranties regarding the property's title, liens, or encumbrances. It essentially transfers whatever interest the granter has to the grantee without assuming any responsibility or liability. It is important to note that quitclaim deeds without refinancing do not require the involvement of a lender, as they do not affect any existing mortgage on the property. However, it is recommended to consult with a real estate attorney or a qualified professional to ensure compliance with local laws and regulations. While the term "quitclaim deed without refinancing" is generally used as a generic term, there may be variations or similar terms used in specific jurisdictions. Some variations of quitclaim deed without refinancing include names such as non-refinance quitclaim deed, quitclaim deed without new financing, or quitclaim deed of release without mortgage modification. However, the fundamental concept remains the same — the transfer of property ownership without the need for mortgage refinancing. In conclusion, a quitclaim deed without refinancing is a legal instrument used to transfer property ownership without the need for mortgage modification. It is an efficient and effective method for transferring property titles when there is no existing mortgage or when the parties involved agree that the transfer will not impact the current loan. Proper legal advice should be sought to ensure adherence to local laws and regulations when utilizing a quitclaim deed without refinancing.

Quitclaim Deed Without Refinancing

Description

How to fill out Quitclaim Deed Without Refinancing?

It’s obvious that you can’t become a legal expert overnight, nor can you learn how to quickly prepare Quitclaim Deed Without Refinancing without having a specialized background. Creating legal documents is a long process requiring a certain training and skills. So why not leave the preparation of the Quitclaim Deed Without Refinancing to the specialists?

With US Legal Forms, one of the most comprehensive legal template libraries, you can find anything from court papers to templates for in-office communication. We understand how important compliance and adherence to federal and state laws are. That’s why, on our platform, all forms are location specific and up to date.

Here’s start off with our website and get the document you require in mere minutes:

- Discover the document you need by using the search bar at the top of the page.

- Preview it (if this option available) and check the supporting description to figure out whether Quitclaim Deed Without Refinancing is what you’re searching for.

- Start your search again if you need any other template.

- Register for a free account and choose a subscription option to buy the form.

- Pick Buy now. As soon as the transaction is complete, you can download the Quitclaim Deed Without Refinancing, complete it, print it, and send or send it by post to the designated individuals or organizations.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your documents-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

Obtaining a quitclaim deed without refinancing is generally a straightforward process. You typically need to fill out the appropriate form and have it notarized. While it may sound daunting, many users find that platforms like US Legal Forms provide easy templates that simplify the task. This ensures you can transfer property interest without the complexities often associated with traditional refinancing.

To get your ex off your mortgage without refinancing, a quitclaim deed serves as a valuable tool. You can transfer their interest in your shared property while still maintaining your mortgage. Although this process doesn't eliminate their mortgage responsibility, it clarifies ownership. Consider using USLegalForms to guide you through the documentation and ensure you handle the transfer correctly.

Yes, you can execute a quitclaim deed without the need for refinancing. This deed allows you to transfer ownership interests in a property quickly and efficiently. You can complete this process without the complexities often associated with refinancing, helping streamline your ownership transfer. Make sure to consult the resources available through USLegalForms to get started easily.

To remove someone from a mortgage without refinancing, you can use a quitclaim deed to transfer their interest in the property to yourself. Start by drafting the quitclaim deed, which can be easily accomplished through platforms like USLegalForms. While this document helps remove them from ownership, keep in mind you will still need lender approval to change the mortgage terms. This method allows for a smoother transition in property ownership.

Yes, you can remove your ex-spouse from your mortgage without refinancing by using a quitclaim deed. This legal document allows you to transfer your ex-spouse's share of the property to yourself, thus simplifying the ownership structure. It’s important to note, however, that this does not remove them from the mortgage obligation unless the lender agrees to a modification. However, a quitclaim deed without refinancing serves as a practical step in transitioning ownership.

You do not need to refinance to get someone off the deed. A quitclaim deed allows you to transfer ownership without going through the refinancing process, which can be lengthy and complicated. This option is particularly useful if you want to remove a co-owner from the property. By utilizing a quitclaim deed without refinancing, you simplify the transfer and save time.

Transferring a mortgage to someone else usually requires refinancing, but there are exceptions based on the mortgage terms. Using a Quitclaim deed without refinancing can help simplify the property transfer process. This method allows you to change the property's ownership without altering the mortgage obligations. Always check with your lender and consider using the services of US Legal Forms to help navigate the paperwork.

To remove a person from a mortgage, you typically need to refinance the mortgage or obtain consent from the lender. However, if you're looking for an alternative solution, a Quitclaim deed without refinancing allows you to remove their name from the property's deed. This method won't change the mortgage terms but effectively transfers ownership rights. We recommend working with a professional to handle the legalities involved.

Yes, you can take someone's name off a house using a Quitclaim deed without refinancing. This legal document allows you to transfer ownership rights without needing to modify the existing mortgage. By using this method, you can simplify the process and avoid the costs associated with refinancing. It's essential to consult a legal expert to ensure the process aligns with your specific circumstances.

No, you do not have to refinance when using a quitclaim deed. This type of deed allows for the transfer of property rights without altering your current mortgage. It provides flexibility for changing ownership while keeping your existing financing intact. For guidance on completing this process, US Legal Forms offers tools that can help you prepare the necessary documentation.