This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantor is an individual and the Grantees are four individuals. It is also known as a "Lady Bird" Deed. Grantor conveys the property to Grantees subject to an enhanced retained life estate. The Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future, without joinder or notice to Grantees, with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

What Is A Lady Bird Deed Michigan

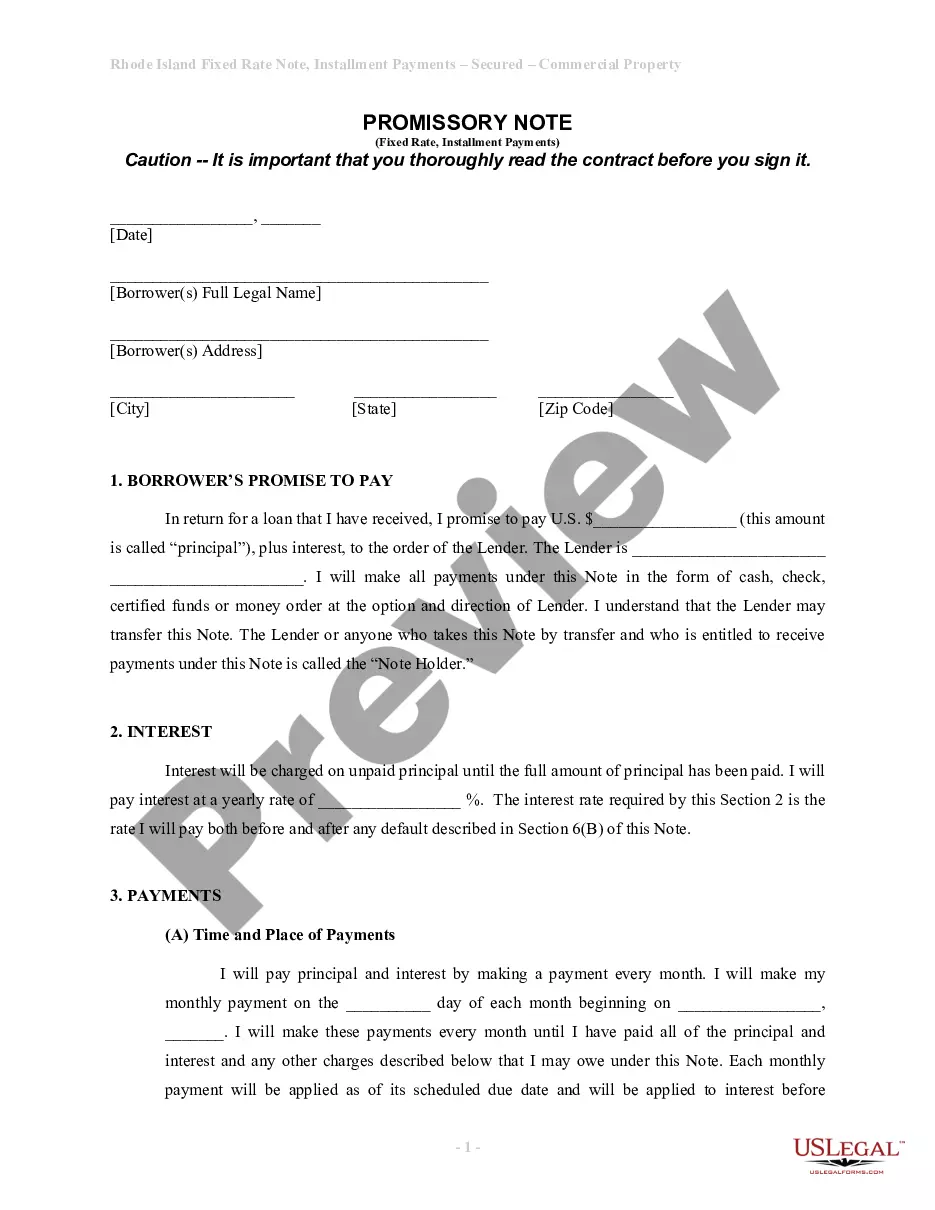

Description

How to fill out Michigan Enhanced Life Estate Or Lady Bird Deed - Individual To Four Individuals?

- Visit the US Legal Forms website and log into your account if you're a returning user or create a new account if this is your first visit.

- Browse the extensive library and use the preview feature to find the Lady Bird Deed form. Confirm that it aligns with Michigan's legal requirements.

- If necessary, utilize the search function to locate other relevant documents or templates.

- Once you've found the correct form, click on the 'Buy Now' button to choose your subscription plan that fits your needs.

- Complete your purchase by entering your payment details, either through credit card or PayPal.

- Finally, download the Lady Bird Deed template to your device and manage it from your 'My Forms' account whenever necessary.

In conclusion, US Legal Forms makes obtaining legal documents like a Lady Bird Deed straightforward and efficient. With access to a vast array of legal templates and expert assistance, you'll have the right tools to ensure your estate planning is hassle-free.

Don't wait—visit US Legal Forms today to access the essential documents you need!

Form popularity

FAQ

A lady bird deed in Michigan allows property owners to retain control over their property while designating a beneficiary to receive it after their death. Essentially, the owner can live in the home, sell it, or change the beneficiary anytime without needing consent. This type of deed avoids probate, simplifying the transfer of property and ensuring that your wishes are honored. Understanding what is a lady bird deed Michigan can greatly assist you in making informed estate planning decisions.

A ladybird deed can be an excellent option for property owners in Michigan who want to simplify the transfer of property to their heirs and avoid probate. It offers control during your lifetime while ensuring a smooth transition after death. However, consulting a reliable resource like US Legal Forms can help you understand its suitability for your specific needs and circumstances.

A ladybird deed in Michigan provides benefits regarding capital gains taxes. When the property is transferred to beneficiaries, it typically receives a step-up in basis, which means capital gains taxes may be minimized if the property appreciates. However, due diligence is necessary, and consulting a tax professional can clarify how this could impact your tax situation.

A ladybird deed has its drawbacks, which include limited protection against certain legal claims and the fact that it may complicate the homeowner's relationship with their estate planning. If the homeowner needs to make significant changes to their estate plan, updating the ladybird deed may also be necessary. Therefore, understanding these disadvantages is crucial before utilizing this method.

After the death of the property owner, the ladybird deed automatically transfers ownership to the designated beneficiaries without going through probate. This means beneficiaries can take possession of the property quickly and without the typical costs of probate court. You should ensure the deed is recorded correctly and inform all parties involved, so they understand the property status.

While a ladybird deed offers many benefits, there are some disadvantages to consider. One potential issue is that it may not protect the property from creditors or certain claims, as the owner still retains full control during their lifetime. Additionally, the deed does not eliminate all estate planning needs, so it's important to evaluate whether it meets your entire estate planning strategy.

Using a ladybird deed in Michigan typically does not trigger immediate tax consequences for the property owner. Since the owner retains full control, they remain responsible for paying taxes, and the property value is included in their estate for tax purposes. However, it's beneficial to consult a tax advisor to understand how this could influence your overall financial situation in the long term.

A ladybird deed, often called an enhanced life estate deed, allows property owners in Michigan to maintain full control of their property during their lifetime while ensuring a smooth transfer to designated beneficiaries after death. This means you can sell or mortgage the property without needing consent from the beneficiaries. It simplifies estate planning and avoids the probate process, making it an efficient tool for asset management.

No, a quitclaim deed does not avoid probate in Michigan. When you use a quitclaim deed, the property may still need to go through the probate process upon the owner’s death, which can complicate matters for heirs. Choosing a lady bird deed, on the other hand, can allow for a smoother transfer of ownership without the hassle of probate, making it an attractive option for many property owners.

No, a quitclaim deed is not the same as a lady bird deed in Michigan. While both can transfer property, a quitclaim deed lacks any guarantees regarding the property, whereas a lady bird deed allows you to retain control until death and to transfer the property outside of probate. Understanding these differences is crucial for effective property management and estate planning.